40M Americans Bracing For End Of Student Loan Moratorium As Politicians Acknowledge “Unsustainable” Debt

President Joe Biden is still reportedly mulling whether to cancel up to $10K in student debt per borrower, a plan that, as we have pointed out in the past, would mostly benefit the Democrats’ wealthier, college-educated voters.

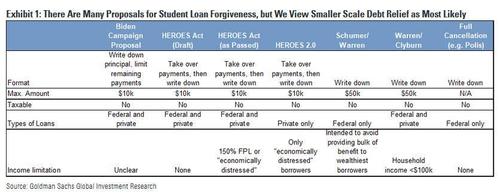

In Congress, several plans were kicked around earlier his year before President Biden’s $1.9 trillion stimulus was ultimately passed. But analysts at Goldman Sachs believe a more scaled-down plan is the most likely. With the moratorium on student loan payments set to expire on Oct. 1, a critical headwind that has allowed (mostly middle-class) Americans to bolster their savings substantially.

According to Bloomberg, “there’s an unwelcome side of the return of business-as-usual after the pandemic: They’ll have to start repaying their student loans again.”

“More than 40 million holders of federal loans are due to start making monthly installments again on Oct. 1, when the freeze imposed as part of Covid-19 relief measures is due to run out. It covered payments worth about $7 billion a month, the Federal Reserve Bank of New York estimated. Their resumption will eat a chunk out of household budgets, in a potential drag on the consumer recovery.”

The problem is that even before the pandemic started, Americans were starting to slack on their student loan payments. In a sense, politicians were fortunate when COVID-19 hit, if only because it gave the government cover to impose the moratorium.

Source: Bloomberg

Politicians already recognize that America’s student debt burden is already unsustainable. Of the government’s $1.7 trillion student loan portfolio, almost one-third is unpaid. That $435 billion is comparable to the $535 billion that private lenders lost on subprime mortgages during the 2008 financial crisis.

Repaying is especially difficult when recent graduates are finding trouble earning high wages in the labor market And with the US economy is still 7.6 million jobs short of pre-pandemic levels, many more of them are likely to be out of work now..

Minority borrowers and older borrowers also struggled to keep up with payments before the pandemic.

Source: Bloomberg

And with today’s desperate drop in bitcoin along with several meme stocks, a critical lifeline for retail traders is now in jeopardy. Young people who are already living with their parents because of their onerous student debt are wondering if they’ll soon need to get a second (or, for some, a first).

The notion that college degrees have become an asset with diminishing returns (given the proliferation of low-value Liberal Arts degrees) has started to spread.

Many Democrats like Senator Elizabeth Warren and Representative Alexandria Ocasio-Cortez have called for write-offs of $50,000 or more per borrower. Local leaders are pressuring the Biden administration to take action. Even some Republicans have joined the cause, including Wayne Johnson, the Trump Administration’s first student-aid chief, who said the student-loan system is fundamentally broken. He proposed not just $50K in debt relief, but also a similar sum in tax credits to those who paid off their loans already.

Source: Bloomberg

Of course, none of this will fix the overall system, and instead could encourage students to irresponsibly pile on more education-related debt.

For this reason, Biden has resisted calls to cancel loans via EO. In early April, he asked Education Secretary Miguel Cardona to prepare a memo on the president’s legal authority to cancel debt.

Still, as millions struggle, a few students who spoke with Bloomberg talked about feeling like they’re “in a relationship” with their student debt.

Other steps the government has taken include allowing employers to contribute toward monthly student loan payments as a tax-free benefit. The pandemic relief bill in March last year allowed firms to reimburse employees up to $5,250 annually.

Malia Rivera, a 46-year old marketing executive with Austin, Texas-based Innovetive Petcare, says her employer has partnered with GiftofCollege.com, a platform that bridges automatic payroll deductions to student loans and college savings accounts.

Rivera says she’s made sure to keep up the payments on her own student loan even through the freeze. She says she’s learned after “racking up late fees over the years and navigating the trials and tribulations of career advancement” that automatic deductions as soon as she gets paid are the best route — and it’s helped lower her balance to about $8,000 from $38,000.

That took time. “I have been in a ‘long-term relationship’ with my student loan,” says Rivera, recalling the initial payment that she made in the first month of her marriage. “My husband is celebrating his 15-year anniversary with me…and my student loan.”

The year-plus loan-payment moratorium was a welcome respite. But the debt for most borrowers is still there. Fortunately, with Dems still in the driver’s seat, it’s likelier than ever a jubilee will arrive eventually – just like reparations – once all the studies have been finished and the reports are in.

Tyler Durden

Tue, 06/08/2021 – 21:45

40M Americans Bracing For End Of Student Loan Moratorium As Politicians Acknowledge “Unsustainable” Debt

President Joe Biden is still reportedly mulling whether to cancel up to $10K in student debt per borrower, a plan that, as we have pointed out in the past, would mostly benefit the Democrats’ wealthier, college-educated voters.

In Congress, several plans were kicked around earlier his year before President Biden’s $1.9 trillion stimulus was ultimately passed. But analysts at Goldman Sachs believe a more scaled-down plan is the most likely. With the moratorium on student loan payments set to expire on Oct. 1, a critical headwind that has allowed (mostly middle-class) Americans to bolster their savings substantially.

According to Bloomberg, “there’s an unwelcome side of the return of business-as-usual after the pandemic: They’ll have to start repaying their student loans again.”

“More than 40 million holders of federal loans are due to start making monthly installments again on Oct. 1, when the freeze imposed as part of Covid-19 relief measures is due to run out. It covered payments worth about $7 billion a month, the Federal Reserve Bank of New York estimated. Their resumption will eat a chunk out of household budgets, in a potential drag on the consumer recovery.”

The problem is that even before the pandemic started, Americans were starting to slack on their student loan payments. In a sense, politicians were fortunate when COVID-19 hit, if only because it gave the government cover to impose the moratorium.

Source: Bloomberg

Politicians already recognize that America’s student debt burden is already unsustainable. Of the government’s $1.7 trillion student loan portfolio, almost one-third is unpaid. That $435 billion is comparable to the $535 billion that private lenders lost on subprime mortgages during the 2008 financial crisis.

Repaying is especially difficult when recent graduates are finding trouble earning high wages in the labor market And with the US economy is still 7.6 million jobs short of pre-pandemic levels, many more of them are likely to be out of work now..

Minority borrowers and older borrowers also struggled to keep up with payments before the pandemic.

Source: Bloomberg

And with today’s desperate drop in bitcoin along with several meme stocks, a critical lifeline for retail traders is now in jeopardy. Young people who are already living with their parents because of their onerous student debt are wondering if they’ll soon need to get a second (or, for some, a first).

The notion that college degrees have become an asset with diminishing returns (given the proliferation of low-value Liberal Arts degrees) has started to spread.

Many Democrats like Senator Elizabeth Warren and Representative Alexandria Ocasio-Cortez have called for write-offs of $50,000 or more per borrower. Local leaders are pressuring the Biden administration to take action. Even some Republicans have joined the cause, including Wayne Johnson, the Trump Administration’s first student-aid chief, who said the student-loan system is fundamentally broken. He proposed not just $50K in debt relief, but also a similar sum in tax credits to those who paid off their loans already.

Source: Bloomberg

Of course, none of this will fix the overall system, and instead could encourage students to irresponsibly pile on more education-related debt.

For this reason, Biden has resisted calls to cancel loans via EO. In early April, he asked Education Secretary Miguel Cardona to prepare a memo on the president’s legal authority to cancel debt.

Still, as millions struggle, a few students who spoke with Bloomberg talked about feeling like they’re “in a relationship” with their student debt.

Other steps the government has taken include allowing employers to contribute toward monthly student loan payments as a tax-free benefit. The pandemic relief bill in March last year allowed firms to reimburse employees up to $5,250 annually.

Malia Rivera, a 46-year old marketing executive with Austin, Texas-based Innovetive Petcare, says her employer has partnered with GiftofCollege.com, a platform that bridges automatic payroll deductions to student loans and college savings accounts.

Rivera says she’s made sure to keep up the payments on her own student loan even through the freeze. She says she’s learned after “racking up late fees over the years and navigating the trials and tribulations of career advancement” that automatic deductions as soon as she gets paid are the best route — and it’s helped lower her balance to about $8,000 from $38,000.

That took time. “I have been in a ‘long-term relationship’ with my student loan,” says Rivera, recalling the initial payment that she made in the first month of her marriage. “My husband is celebrating his 15-year anniversary with me…and my student loan.”

The year-plus loan-payment moratorium was a welcome respite. But the debt for most borrowers is still there. Fortunately, with Dems still in the driver’s seat, it’s likelier than ever a jubilee will arrive eventually – just like reparations – once all the studies have been finished and the reports are in.

Tyler Durden

Tue, 06/08/2021 – 21:45

Read More