We’ve been told inflation is caused by greedy corporations. We’ve been told that inflation is Putin’s fault. Other people just want to blame COVID-19. But are any of these really the root cause of inflation?

Economist Dr. Antony P. Mueller says none of these excuses really account for the rash of rising prices we’ve seen in recent months. At its core, this inflation is caused by a deeply flawed monetary system that allows central banks to create money out of thin air.

![]()

The following article by Dr. Mueller was originally published by the Mises Wire.

A monetary system that allows the creation of money out of thin air is vulnerable to the fits of credit expansion and credit contraction. Periods of credit expansion typically occur over many years and even decades while the phases of credit contraction happen like sudden implosions. The monetary policymakers tend to promote the prolongation of credit expansion because they fear deflation.

By doing this, however, the central banks prevent monetary moderate deflation as it would happen as the natural consequence of rising productivity. This way, an anti-deflationary monetary policy lays the groundwork for an upsurge of price inflation along with augmenting the risk of an abrupt contraction of the financial markets.

Credit Cycles

Financial cycles can extend over long periods of time. In the past decades, there has been a massive global credit expansion, each of which has received new waves of boosts as it happened since the 1980s and as the result of such events like the 2008 financial crisis, the 2020 pandemic policy, and the current policy of sanctions in response to the war in Ukraine.

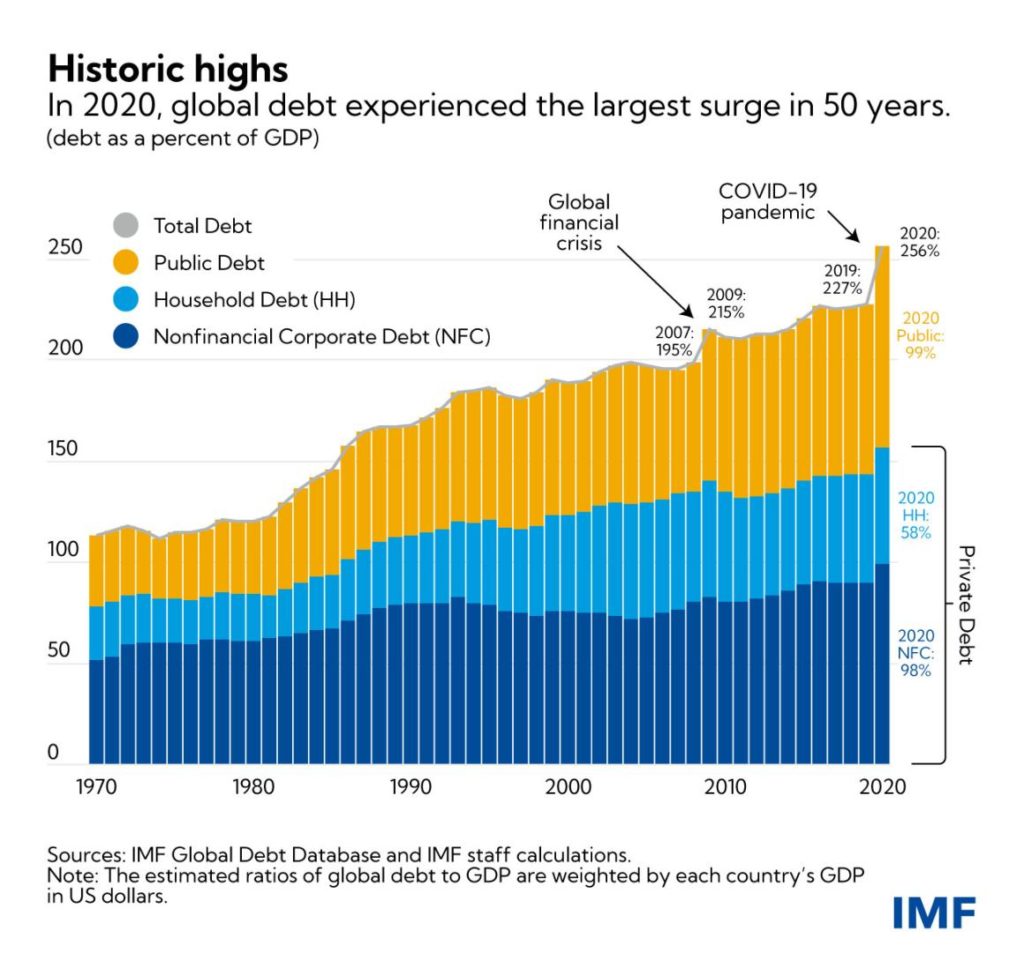

The chart (fig. 1) shows total global debt, public debt, household debt, and non-financial corporate debt as a percentage of the global gross domestic product. Calculated in absolute terms, total global debt is rapidly approaching $300 trillion.

With the end of the US dollar’s link to gold in the 1970s, the international monetary system lost its anchor. Global debt in relation to the world’s gross domestic product has risen from one hundred percent to over two hundred and fifty percent. The attenuation of this credit cycle is long overdue. However, again and again, the major central banks have been fighting any sign of a credit contraction for several decades.

In Japan, the battle against credit consolidation began as early as the 1990s. In the United States, the fight against a perceived threat of deflation began around the turn of the millennium. Since the European debt crisis in 2010, the European Central Bank has also joined the monetary orgy. Obviously, the monetary policy makers ignore the risk that by not letting moderate deflationary contraction happen, they produce a monetary overhang. This in turn, poses the twin risk of higher price inflation along with an uncontrolled collapse of the credit markets.

Central banks are waging a relentless fight against deflation. Being traumatized by the Great Depression, the modern monetary policy makers suffer from the psycho-pathological condition of “apoplithorismosphobia”—the fear of deflation. The battle of the central banks against deflation has created so much liquidity that the earlier deflationary tendency begins now to manifest itself as an upsurge of price inflation that even the official statistics cannot hide anymore.

Having internalized the monetarist lesson about the origin of the Great Depression, central bankers have a deep-seated fear of price deflation, assuming that a fall in the general price level would provoke an economic contraction. However, had central banks left the system alone, deflation would have happened gradually without much turmoil. The economic actors would have had enough room and time to adapt. As such, deflation would not only be harmless but also beneficial. Trapped by their obsession with “stabilization,” central banks have not permitted the economy to move on its natural path. Instead of allowing the self-correcting economic fluctuations, monetary policy has fabricated one artificial expansion after the other.

The conventional monetary theory claims that a growing economy would need an expanding money supply. Even monetarist economists like Milton Friedman supported this idea. Yet Murray Rothbard has shown that there is no need of expanding the money supply to provide more liquidity even when the economy grows. If the money supply remains constant and productivity increases, prices would fall accordingly. This would be a beneficial deflation. Why complain when the goods are getting cheaper for consumers and the real wages rise? The crucial point is whether the price deflation happens due to productivity gains in the economy or abruptly as a sharp decline of the liquidity due to a financial market crisis.

When central banks intervene and expand the money supply, as it happened in the form of the “zero interest rate policy” (ZIRP) or in some cases of a “negative interest rate policy” (NIRP), tensions will arise between the natural tendency of the interest rate to rise and the monetary interest rate that is kept low through the interventions of the central bank. Because of this discrepancy, there will be an additional demand for money. Over time, this monetary overhang promotes financial fragility and lays the foundation for future price inflation.

The massive expansion of the Federal Reserve’s money supply in the form of its monetary base did not immediately lead to price inflation because the velocity of money experienced a sharp fall since 2008. The trend of a falling velocity began to stop in the third quarter of 2020—well before the outbreak of the war in Ukraine. Given that the monetary overhang had persisted, prices began to rise right away, and the official consumer price inflation has accelerated to its highest rate in the past four decades.

Changes in Relative Prices Do Not Cause Price Inflation

The increase in individual prices—for example, crude oil—manifests itself as the change in the relative price. One specific good becomes more expensive in relation to other products. Only if there is a monetary overhang as the result of a previous or ongoing credit expansion, such individual price increases would show up in the so-called price level as an increase of general price inflation.

When the policy makers manipulate the interest rate, they create a discrepancy between human time preference and the monetary interest rate. Stimulus policies push down artificially the monetary rate below the natural interest rate, which would emerge in the unhampered market if there were no central bank intervention. Disproportions occur in the financial markets the same way as they do when the state intervenes in the market for goods. Relative prices then no longer reflect consumer preferences and the marginal cost of production. The consequences are economic disruptions in the supply and demand of these goods.

The monetary system possesses a natural degree of elasticity. Even if the money supply were tied to a fixed supply of central bank money or in a gold standard, there would be expansions and contractions in macroeconomic spending and the nominal national income. With an anchor of the money supply, these variations of economic activity would happen mainly as fluctuations and short-term swings and not as prolonged phases. The whole idea of stabilization stands in contrast to the need for a system in motion to fluctuate.

Money does have loose joints to do its job, yet it should have an anchor to prevent extreme cycles. Under a gold standard, for example, there is an elasticity of money, even if the gold stock is constant. In this respect, the current monetary system is dysfunctional.

The use of money will oscillate naturally also with a fixed quantitative amount of its base. It is wrong to claim that only the artificially created so-called fiat money would offer financial flexibility. Rather, the decisive point is that with an anchored monetary system, the degree of deviation is limited, while under the current fiat money regime, there is no restriction.

Conclusion

A state-sponsored fiat currency system with only a partial reserves coverage of the money in circulation allows the commercial banks to put more money into circulation than they hold in cash. By persistently pursuing an anti-deflationary policy, the central banks have fueled an ongoing credit expansion. They artificially prolonged the cycle of credit expansion. This means that a natural contraction has been prevented. Along with an upsurge of price inflation, this policy has also increased the risk of an uncontrolled implosion of the credit markets. The current outbreak of price inflation does not come by accident or because of external shocks. The foundation for rising prices was laid over a long period of time. As a consequence, another severe financial crisis looms now again on the horizon.

Dr. Antony P. Mueller is a German professor of economics who currently teaches in Brazil.