A Grim Look At The Exploding US Budget Deficit

Authored by Mike Shedlock via MishTalk,

The non-partisan Congressional Budget Office paints a sorry picture of US government spending.

Debt Will Be Double the Size of the Economy by 2051

The CBO estimates Debt Will Be Double the Size of the Economy by 2051

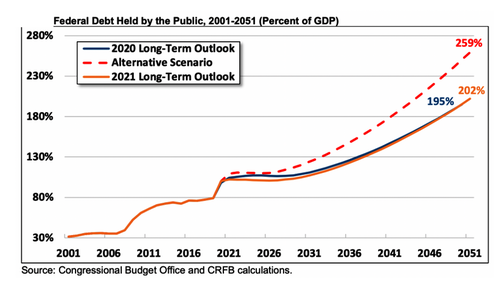

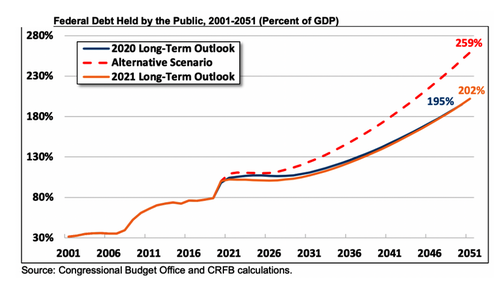

CBO estimates that federal debt held by the public will reach double the size of the economy, rising from 79 percent of Gross Domestic Product (GDP) at the end of 2019 and 100 percent of GDP at the end of Fiscal Year (FY) 2020 to 202 percent of GDP by 2051. Projected debt in 2051 will be over 4.5 times the 50-year average of 44 percent of GDP and will be on track to double the previous record of 106 percent of GDP a few years later. In nominal dollars, debt will grow from $28 trillion today to over $133 trillion by 2051.

Actual debt levels could be higher than CBO projects. Under an alternative scenario that assumes lawmakers enact an additional $2 trillion of fiscal support in response to COVID-19 (similar to the American Rescue Plan), extend most expiring tax cuts, and grow annual appropriations with the economy instead of inflation, debt would total 259 percent of GDP by 2051.

Budget Deficits

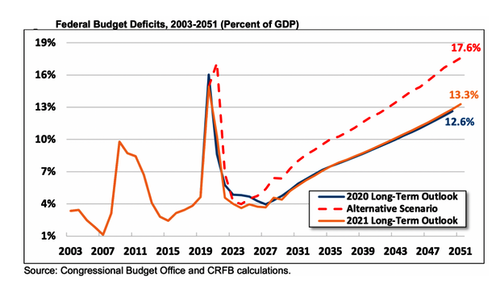

Budget deficits had already risen before the pandemic from 2.4 percent of GDP ($442 billion) in 2015 to 4.6 percent of GDP ($984 billion) in 2019 and set a new record of 14.9 percent of GDP ($3.1 trillion) last year due to the crisis. CBO expects the deficit to fall to $2.3 trillion this year and hit a low of $905 billion in 2024 before resuming its upward trajectory.

The deficit is projected to total 5.7 percent of GDP ($1.9 trillion) in 2031, 9.4 percent of GDP ($4.4 trillion) in 2041, and 13.3 percent of GDP ($8.8 trillion) in 2051.

Rosy Scenario

Those projections constitute rosy scenarios.

Why?

They do not factor in recessions. The prior budget projections did not factor in Covid, the Great Recession, or the DotCom bust.

The CBO does not see and has not factored the next recession into any of these scenarios.

Social Security

CBO also projects that four major trust funds will be insolvent in the next 14 years. The Highway Trust Fund would become insolvent in 2022, the Medicare Hospital Insurance trust fund would run out in 2026, and the Social Security Old Age and Survivors Insurance and Disability Insurance trust funds would run out in 2032 and 2035, respectively. The hypothetical combined Social Security trust fund would run out in 2032, at which point benefits would have to be cut by one-quarter to bring spending in line with revenue.

Spending Projections

The projected long-term growth in spending is largely driven by rising health, interest, and retirement costs. CBO expects spending in these three areas to rise from 12.3 percent of GDP this year to 24.4 percent of GDP by 2051. Interest spending will be the largest federal program by 2045.

Read that last sentence again and again until this sinks in: How the heck is the Fed ever going to hike rates again?

“Existential Threat”

We are on auto-pilot for a global currency crisis because the current path is not remotely sustainable.

But hey, rumor has it that climate change is the “existential threat” of our time, so much so that politicians seek $90 trillion solutions to the problems.

I assure you the world will still be here in 50 years even if the oceans do rise another 3 inches. But what about the value of the US dollar?

For discussion, please see Don’t Accept 100% of the Climate Change Story and You Get Labeled a Racist

Tyler Durden

Thu, 03/11/2021 – 13:07

A Grim Look At The Exploding US Budget Deficit

Authored by Mike Shedlock via MishTalk,

The non-partisan Congressional Budget Office paints a sorry picture of US government spending.

Debt Will Be Double the Size of the Economy by 2051

The CBO estimates Debt Will Be Double the Size of the Economy by 2051

CBO estimates that federal debt held by the public will reach double the size of the economy, rising from 79 percent of Gross Domestic Product (GDP) at the end of 2019 and 100 percent of GDP at the end of Fiscal Year (FY) 2020 to 202 percent of GDP by 2051. Projected debt in 2051 will be over 4.5 times the 50-year average of 44 percent of GDP and will be on track to double the previous record of 106 percent of GDP a few years later. In nominal dollars, debt will grow from $28 trillion today to over $133 trillion by 2051.

Actual debt levels could be higher than CBO projects. Under an alternative scenario that assumes lawmakers enact an additional $2 trillion of fiscal support in response to COVID-19 (similar to the American Rescue Plan), extend most expiring tax cuts, and grow annual appropriations with the economy instead of inflation, debt would total 259 percent of GDP by 2051.

Budget Deficits

Budget deficits had already risen before the pandemic from 2.4 percent of GDP ($442 billion) in 2015 to 4.6 percent of GDP ($984 billion) in 2019 and set a new record of 14.9 percent of GDP ($3.1 trillion) last year due to the crisis. CBO expects the deficit to fall to $2.3 trillion this year and hit a low of $905 billion in 2024 before resuming its upward trajectory.

The deficit is projected to total 5.7 percent of GDP ($1.9 trillion) in 2031, 9.4 percent of GDP ($4.4 trillion) in 2041, and 13.3 percent of GDP ($8.8 trillion) in 2051.

Rosy Scenario

Those projections constitute rosy scenarios.

Why?

They do not factor in recessions. The prior budget projections did not factor in Covid, the Great Recession, or the DotCom bust.

The CBO does not see and has not factored the next recession into any of these scenarios.

Social Security

CBO also projects that four major trust funds will be insolvent in the next 14 years. The Highway Trust Fund would become insolvent in 2022, the Medicare Hospital Insurance trust fund would run out in 2026, and the Social Security Old Age and Survivors Insurance and Disability Insurance trust funds would run out in 2032 and 2035, respectively. The hypothetical combined Social Security trust fund would run out in 2032, at which point benefits would have to be cut by one-quarter to bring spending in line with revenue.

Spending Projections

The projected long-term growth in spending is largely driven by rising health, interest, and retirement costs. CBO expects spending in these three areas to rise from 12.3 percent of GDP this year to 24.4 percent of GDP by 2051. Interest spending will be the largest federal program by 2045.

Read that last sentence again and again until this sinks in: How the heck is the Fed ever going to hike rates again?

“Existential Threat”

We are on auto-pilot for a global currency crisis because the current path is not remotely sustainable.

But hey, rumor has it that climate change is the “existential threat” of our time, so much so that politicians seek $90 trillion solutions to the problems.

I assure you the world will still be here in 50 years even if the oceans do rise another 3 inches. But what about the value of the US dollar?

For discussion, please see Don’t Accept 100% of the Climate Change Story and You Get Labeled a Racist

Tyler Durden

Thu, 03/11/2021 – 13:07

Read More