A Market Crash And High Inflation?

Authored by Adam Taggart via PeakProsperity.com,

Imagine for a moment that the price of all your investments – your stocks, your retirement portfolio, your house – suddenly drop in half this year.

Now imagine that on top of that inflation suddenly picks up, making your cost of living skyrocket.

That would be pretty awful, right?

Well, this might not be just some theoretical thought exercise.

Highly respected financial researcher Jesse Felder warns us that these twin dangers of a market crash and higher inflation actually could indeed happen in the near future.

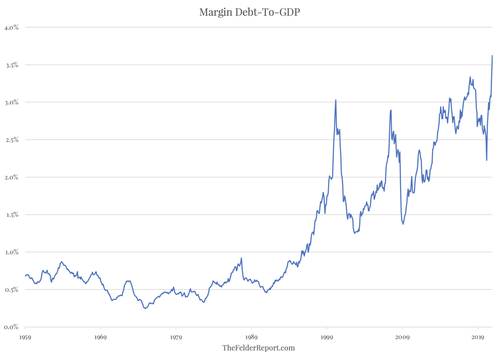

For many months now we’ve been sharing the mounting abundance of data points revealing that today’s markets are historically unprecedented levels of over-valuation. To our list, Jesse adds record margin debt levels, which have NEVER been higher compared to GDP than they are now:

Margin debt is a measure of how speculative the investing environment is: the more margin debt outstanding, the more speculative the time. So we are now living in the most speculative moment EVER.

Like many of our recent past guest experts like Grant Williams, Jim Rogers, Steen Jakobsen and Jim Bianco, Jesse foresees high inflation as the biggest existential threat to markets and the economy going forward. That by itself would puncture the euphoria supporting today’s asset prices.

So, ugly as it is to contemplate, we may be dealing with declining markets and rising inflation as 2021 progresses.

Which is why now, more than ever, is the time to partner with a financial advisor who understands the nature of the risks and opportunities in play, can craft an appropriate portfolio strategy for you given your needs, and apply sound risk management protection where appropriate. Anyone interested in scheduling a free consultation and portfolio review with Mike Preston and John Llodra and their team at New Harbor Financial can do so by clicking here.

Tyler Durden

Mon, 02/15/2021 – 07:00

A Market Crash And High Inflation?

Authored by Adam Taggart via PeakProsperity.com,

Imagine for a moment that the price of all your investments – your stocks, your retirement portfolio, your house – suddenly drop in half this year.

Now imagine that on top of that inflation suddenly picks up, making your cost of living skyrocket.

That would be pretty awful, right?

Well, this might not be just some theoretical thought exercise.

Highly respected financial researcher Jesse Felder warns us that these twin dangers of a market crash and higher inflation actually could indeed happen in the near future.

For many months now we’ve been sharing the mounting abundance of data points revealing that today’s markets are historically unprecedented levels of over-valuation. To our list, Jesse adds record margin debt levels, which have NEVER been higher compared to GDP than they are now:

Margin debt is a measure of how speculative the investing environment is: the more margin debt outstanding, the more speculative the time. So we are now living in the most speculative moment EVER.

Like many of our recent past guest experts like Grant Williams, Jim Rogers, Steen Jakobsen and Jim Bianco, Jesse foresees high inflation as the biggest existential threat to markets and the economy going forward. That by itself would puncture the euphoria supporting today’s asset prices.

So, ugly as it is to contemplate, we may be dealing with declining markets and rising inflation as 2021 progresses.

Which is why now, more than ever, is the time to partner with a financial advisor who understands the nature of the risks and opportunities in play, can craft an appropriate portfolio strategy for you given your needs, and apply sound risk management protection where appropriate. Anyone interested in scheduling a free consultation and portfolio review with Mike Preston and John Llodra and their team at New Harbor Financial can do so by clicking here.

Tyler Durden

Mon, 02/15/2021 – 07:00

Read More