A Third Of All US Homeowners Own Property Worth Double The Underlying Mortgage

In the midst of a virus pandemic, with millions of Americans out of work facing housing and food insecurities, the Federal Reserve has managed to keep interest rates near zero, unleashing a real estate boom, the likes of which hasn’t been seen in years.

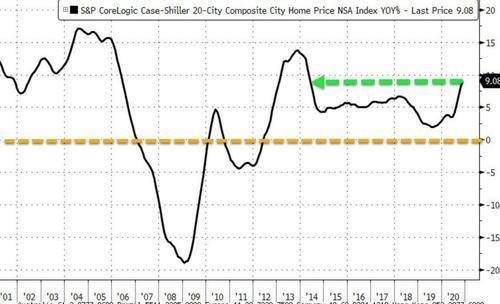

The central-planning mega brains at the Marriner Eccles building in Washington, D.C., have managed to boost home prices almost everywhere. The latest S&P CoreLogic Case-Shiller index of property values is accelerating at the fastest pace since May 2014.

Although the full history of the pandemic’s impact on the housing market is yet to be determined, housing data from ATTOM Data Solutions for 4Q20 shows low-interest rates boosted the number of equity-rich properties.

ATTOM showed at least 30% of U.S. homeowners were equity rich, which means their property was worth twice as much as their mortgage. Last quarter’s equity-rich properties were about 30.2%, or about one in three, of the 59 million mortgaged U.S. homes. The figure was up from 28.3% in the third quarter, 27.5% in the second quarter, and 26.7% in the fourth quarter of 2019.

Despite the virus pandemic crushing the working-poor and devastating tens of millions of American households, the central planners in the Eccles building decided to inflate the housing market with low-interest rates. The federal government also played its part by initiating forbearance programs to keep homeowners from panic selling properties they could no longer afford.

“The housing market kept booming despite the damage caused by the virus pandemic to the broader economy,” said Todd Teta, ATTOM’s chief product officer.

“Homeowners are sitting pretty on a growing reserve of personal wealth.”

Why does this matter? Simple: The Fed is creating a wealth effect with rising home values to make people feel more wealthy, so they spend more. Though the wealth effect benefits certain homeowners and others who own assets have created a failed recovery, known as a “K-shape,” where the working-poor (tens of millions of folks) are left behind.

Bloomberg notes the increase in property values has helped reduce the number of underwater properties. These homes have mortgages worth at least 25% more than the market value, have dropped by a full percentage point over the past year, and only account for 5.4% of all mortgaged U.S. properties.

However, there were six states (Louisiana, Mississippi, West Virginia, Iowa, Arkansas, and Illinois) where the percentage of underwater homes remains above 10%. In Vermont and California, the gap between equity-rich homes and those that are underwater is at 44.7% and 43.6%, respectively. Homes in Baton Rouge, Louisiana, have a larger percentage of underwater homes than equity-rich ones.

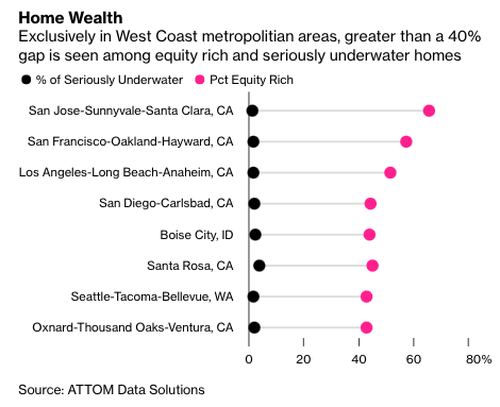

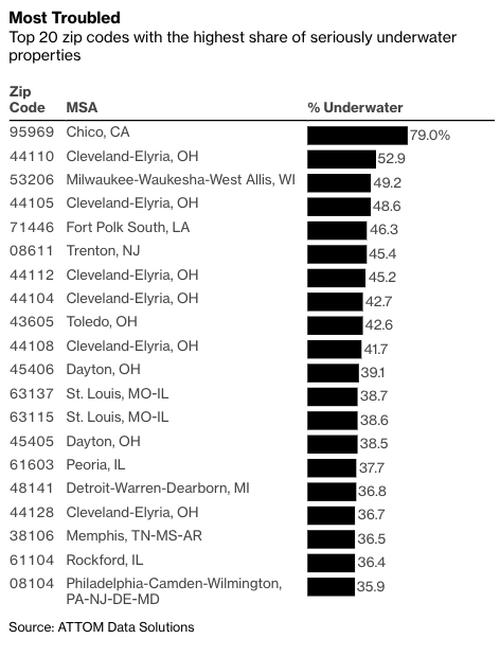

Out of the 107 metropolitan areas with a population over 500k examined by ATTOM, the ten largest equity-rich areas last quarter were in the western part of the country, five of which were in California. The report also showed the top zip codes with the highest share of underwater properties.

Despite the Fed buying tens of billions of dollars in mortgage-backed securities every month, allowing rates to stay low to continue its circus act of bubble blowing, Fed Chairman Jerome Powell recently suggested that the housing market boom was unsustainable and likely to end soon.

“Some of the tightness in housing markets, which has led to the significant price increases this year, we think is a passing phenomenon,” Powell said.

Quoting Powell, the American Enterprise Institute Housing Center warned that “the housing sector has more than fully recovered from the downturn,” adding that “there is no justification for continuing or increasing investment in agency mortgage-backed securities.”

With the labor market deteriorating and the economy stalling, the Fed will have no other choice but to continue inflating the housing bubble until it bursts.

Powell and the rest of the central-planners better wake up to the reality that their so-called ‘recovery’ has left tens of millions of people behind. Simply put, trillions in stimulus aren’t working… and if the delusion of printed-money-driven home equity sparks a consumer re-leveraging (which, it would appear, is the only reason for The Fed to be enabling this farce), then we all know how that ends (or did we all forget 2008?)… Except this time it’s everything!

Tyler Durden

Wed, 02/10/2021 – 21:25

A Third Of All US Homeowners Own Property Worth Double The Underlying Mortgage

In the midst of a virus pandemic, with millions of Americans out of work facing housing and food insecurities, the Federal Reserve has managed to keep interest rates near zero, unleashing a real estate boom, the likes of which hasn’t been seen in years.

The central-planning mega brains at the Marriner Eccles building in Washington, D.C., have managed to boost home prices almost everywhere. The latest S&P CoreLogic Case-Shiller index of property values is accelerating at the fastest pace since May 2014.

Although the full history of the pandemic’s impact on the housing market is yet to be determined, housing data from ATTOM Data Solutions for 4Q20 shows low-interest rates boosted the number of equity-rich properties.

ATTOM showed at least 30% of U.S. homeowners were equity rich, which means their property was worth twice as much as their mortgage. Last quarter’s equity-rich properties were about 30.2%, or about one in three, of the 59 million mortgaged U.S. homes. The figure was up from 28.3% in the third quarter, 27.5% in the second quarter, and 26.7% in the fourth quarter of 2019.

Despite the virus pandemic crushing the working-poor and devastating tens of millions of American households, the central planners in the Eccles building decided to inflate the housing market with low-interest rates. The federal government also played its part by initiating forbearance programs to keep homeowners from panic selling properties they could no longer afford.

“The housing market kept booming despite the damage caused by the virus pandemic to the broader economy,” said Todd Teta, ATTOM’s chief product officer.

“Homeowners are sitting pretty on a growing reserve of personal wealth.”

Why does this matter? Simple: The Fed is creating a wealth effect with rising home values to make people feel more wealthy, so they spend more. Though the wealth effect benefits certain homeowners and others who own assets have created a failed recovery, known as a “K-shape,” where the working-poor (tens of millions of folks) are left behind.

Bloomberg notes the increase in property values has helped reduce the number of underwater properties. These homes have mortgages worth at least 25% more than the market value, have dropped by a full percentage point over the past year, and only account for 5.4% of all mortgaged U.S. properties.

However, there were six states (Louisiana, Mississippi, West Virginia, Iowa, Arkansas, and Illinois) where the percentage of underwater homes remains above 10%. In Vermont and California, the gap between equity-rich homes and those that are underwater is at 44.7% and 43.6%, respectively. Homes in Baton Rouge, Louisiana, have a larger percentage of underwater homes than equity-rich ones.

Source: Bloomberg

Out of the 107 metropolitan areas with a population over 500k examined by ATTOM, the ten largest equity-rich areas last quarter were in the western part of the country, five of which were in California. The report also showed the top zip codes with the highest share of underwater properties.

Source: Bloomberg

Despite the Fed buying tens of billions of dollars in mortgage-backed securities every month, allowing rates to stay low to continue its circus act of bubble blowing, Fed Chairman Jerome Powell recently suggested that the housing market boom was unsustainable and likely to end soon.

“Some of the tightness in housing markets, which has led to the significant price increases this year, we think is a passing phenomenon,” Powell said.

Quoting Powell, the American Enterprise Institute Housing Center warned that “the housing sector has more than fully recovered from the downturn,” adding that “there is no justification for continuing or increasing investment in agency mortgage-backed securities.”

With the labor market deteriorating and the economy stalling, the Fed will have no other choice but to continue inflating the housing bubble until it bursts.

Powell and the rest of the central-planners better wake up to the reality that their so-called ‘recovery’ has left tens of millions of people behind. Simply put, trillions in stimulus aren’t working… and if the delusion of printed-money-driven home equity sparks a consumer re-leveraging (which, it would appear, is the only reason for The Fed to be enabling this farce), then we all know how that ends (or did we all forget 2008?)… Except this time it’s everything!

Tyler Durden

Wed, 02/10/2021 – 21:25

Read More