This week, the largest US producer of aluminum billet used to make automobiles and building supplies told customers and business associates that output capacity might be curtailed in 2022 due to a lack of magnesium supply.

“In the last several weeks, magnesium availability has dried up, and we have not been able to purchase our required magnesium units for all of 2022,” Matalco Inc. President Tom Horter said in the letter obtained by S&P Global Platts.

Difficult-to-source supplies of raw materials and soaring energy prices are adding to the headwinds, Horter said in the letter.

“The purpose of this note is to provide this advanced warning that, if the scarcity continues, and especially if it becomes worse, Matalco may need to curtail production in 2022, resulting in allocations to our customers,” he said.

Horter said his company will source as much magnesium as possible and other raw materials, such as silicon, to maintain its planned production output for 2022. The warning comes as he told customers they should have contingency plans if supplies tighten.

Aluminum billet cannot be produced without magnesium, which is a strengthening agent and allows it to be strong enough to be used in structural applications, such as automobile frames, engine blocks, and body panels.

“We will provide an update in a couple of weeks,” Horter said. “In the meantime, you may want to consider letting your customer base know of this silicon and magnesium availability crisis and also let them know that other products or inputs needed for making billet or slab may also reach a crisis point.”

Horter added other challenges such as the cost of energy, labor, and shipping are increasingly mounting.

Alcoa is another major US aluminum producer that also warned about shortages of magnesium and silicon. Without these two ingredients, both manufacturers cannot produce aluminum billet products. A reduction in US output would tighten global supply even further.

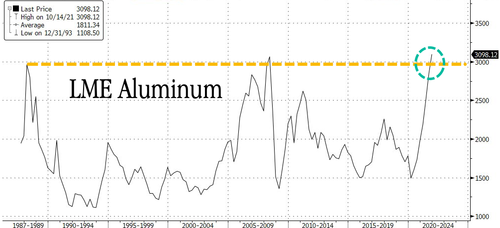

The macro backdrop of the aluminum industry is a complicated one. First, a military coup in Guinea last month stoked concerns over the supply of bauxite, a sedimentary rock with high aluminum content. Then the closure of energy-intensive smelters in Asia and Europe have tightened global supplies and forced LME prices to record highs.

The latest surge in industrial metals will continue to pressure inflation higher.

So much for the Federal Reserve’s “transitory” narrative. Higher costs will push up prices for new cars and other products made of aluminum.