American billionaires’ wallets have had a good year, with their fortunes growing by 70%.

That’s according to a new report from the left-leaning Institute for Policy Studies (IPS) and Americans for Tax Fairness, which tracks gains from March 18, 2020 to October 15, 2021. The groups analyzed real time data from Forbes on gains by the ten-figure club to find that billionaires in the US added a cumulative $2.1 trillion to their net worths during the pandemic.

It’s the latest data point showing that the world’s richest grew both in ranks and in fortune. In April, IPS released a report that found the world’s billionaires added $4 trillion to their wealth from March 18, 2020 to March 18, 2021. Research firm Wealth-X found that the number of billionaires in the world rose to over 3,000 in 2020 – a new record. The US alone rose from 614 billionaires in March 2020 to 745 this month.

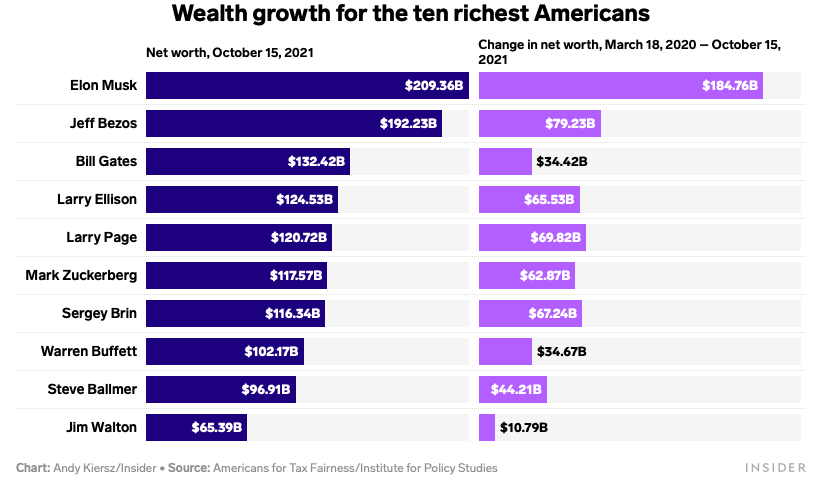

Here’s how much America’s wealthiest added to their collective fortunes, and how their net worths stack up.

Tesla CEO Elon Musk saw the biggest gains by far. He again surpassed former Amazon CEO Jeff Bezos as the richest person in the world in March, a fact he hasn’t been shy about touting. Just this month he tweeted a silver medal at Bezos in response to a tweet from Bezos heralding Amazon’s success.

Meanwhile, the top 1% of Americans just surpassed the entire middle class in how much wealth they hold. That unevenness – alongside continued revelations into how the world’s ultrawealthy weasel out of paying taxes through intricate loopholes and financial structures – have prompted calls for higher taxes on the highest-earners, alongside increased enforcement.

President Joe Biden has proposed tax measures targeted at America’s wealthiest to offset the costs of his party-line infrastructure package. His original plan included an increase in the top individual tax rate, along with a nearly doubled rate for capital gains – the profits from assets like bonds and stacks – although that rate eventually shrunk in Democrats’ proposal. The package would also pour money into the IRS to increase enforcement

A recent study from IRS researchers and academics found that the top 1% of Americans fail to report about a quarter of their income to the IRS. Income underreporting is nearly twice as high for the top 0.1%, which could account for billions in unreported taxes.

The gap between taxes owed and taxes paid could only grow if left without intervention, according to the Department of Treasury. Treasury estimates that Biden’s proposed $80 billion investment in the IRS could bring in an additional $700 billion over 10 years. That’s still with hundreds of billions in taxes going uncollected each year, as Insider’s Ayelet Sheffey reports.

Biden has also backed a proposal from Senate Finance Chair Ron Wyden that would tax unrealized gains from billionaires. Essentially, it would tax the profits that billionaires rake in from those capital gains, even if they’re not selling them off. A report from White House economists – which figured in those gains as income – found that America’s 400 wealthiest families pay just 8.2% in income taxes annually.

However, the fate of tax hikes is currently imperiled. Key moderate senator Kyrsten Sinema opposes raising taxes for both individuals and large corporations, Insider’s Joseph Zeballos-Roig reported. Her support is pivotal in getting a party-line package passed.

*

The original source of this article is Markets Insider