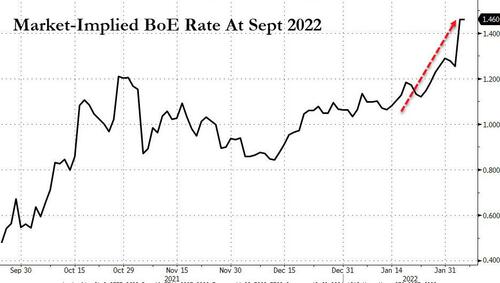

First (among the majors) it was the Bank of England who surprised investors with a rate-hike in mid-December (after promising they wouldn’t), then this morning ending QE and raising rates again (narrowly avoiding by a 5-4 vote a 50bps hike).

Source: Bloomberg

Then it was The Fed’s various group-thinkers doing an extremely rapid volte-face from forever-dovish to the hawkiest hawks in hawk-land, calling for a halt to QE, imminent and rapidly rising rate-hikes, and the start of QT.

US STIRs are now pricing in 5 rate-hikes by year-end (and a 25% chance of a 50bps hike in March)…

Source: Bloomberg

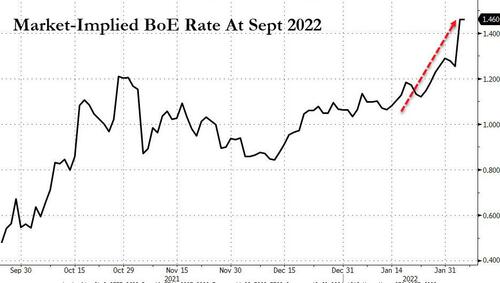

This morning saw Christine Lagarde change her stripes from uber dove to more fence-sitter (and some would say an actual hawkish bias was overheard with Bloomberg reporting that ECB policymakers “see policy change at the March meeting if inflation doesn’t ease.”

Rate-hike expectations are spiking in European bond markets…

Source: Bloomberg

And rates across the curve are flipping back into positive territory…

Source: Bloomberg

All of which leads us to this evening and the open of Japanese markets.

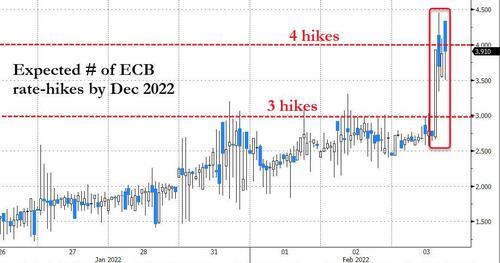

Haruhiko Kuroda has been perhaps the doviest of the dovish central bankers over the years which makes the very recent actions in the Japanese bond markets even more exceptional.

As Bloomberg notes this evening, speculation of monetary policy normalization has reached Japan.

2Y OIS (a proxy for investor expectations of future policy rates) breached zero for the first time since 2016 – the year the Bank of Japan introduced its negative interest rate policy.

Source: Bloomberg

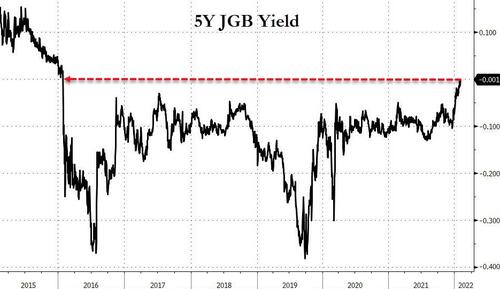

5Y JGB Yields have pushed back above zero for the first time since 2016…

Source: Bloomberg

Of even more note is the fact that the 10Y JGB yield has surged up to the top of its ‘yield curve control’ corridor.

As a reminder, since September 2016, the BoJ has maintained a so-called ‘yield curve control’ policy (allowing 10Y JGB yields to fluctuate within a range regarding of its 0% target – initially +/-10bps but now +/-20bps).

Source: Bloomberg

The last time 10Y yields were at these levels (in Feb 2021), BoJ quickly stepped in, but – for now – this time is different.

“Market participants see an increasing chance that a successor to Kuroda will lift the negative-rate policy,” said Takahide Kiuchi, executive economist at the Nomura Research Institute in Tokyo.

“As the end of his tenure gets closer, the governor’s influence will decrease further.”

Some have argued this pressure is market participants’ desire to test the BOJ’s resolve, and we suspect that if 10-year yields continue to climb well above 0.2% today, BOJ action likely will become a reality.

“The recent rise in the 10-year JGB yield may have gone too far,” Tomonobu Yamashita and Shusuke Yamada, strategists at Bank of America, wrote in a research note.

“Given the BOJ’s dovish stance and leeway for increasing its JGB purchases, this may be an opportunity to buy JGBs cheaply.”

It’s too early to raise interest rates or change the yield curve control program now, Kuroda said last week.

However, once cannot miss the fact that The BoJ has let things get this far without verbal intervention at a minimum. This certainly has the smell of a ‘signal’ that, as Eiichiro Miura, GM of the fixed-income department at Nissay Asset Management notes, the “BOJ may not be seeking to forcibly contain 10-year yield at 0.2% as it may want markets to prepare for a potential change.”

So why are Bailey, Powell, Lagarde, and Kuroda all suddenly shedding their dovish wings?

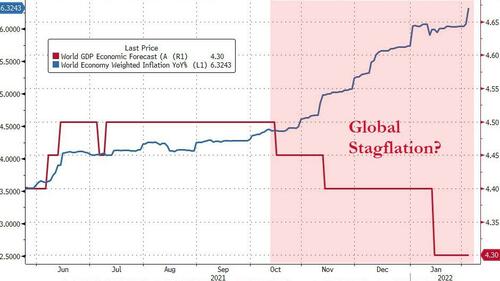

Is this what has the world’s omnipotent puppet-masters panicking?

Source: Bloomberg

Global economic growth expectations are sliding rapidly and inflation (current and forecast) is accelerating.

The Keynesian boogeyman is back – global stagflation! And with global assets at their bubbliest values ever, is it any wonder those-who-shall-not-be-named are panicking?

So action is needed, but what? Hike and kill growth even more (and the wealth creation that’s been coveted for over a decade); don’t hike and spark fiat-credibility crushing inflationary fires worldwide?

One thing is for sure, the market is expecting some action soon (and The Taylor Rule suggests there’s a long way to go)…

Source: Bloomberg

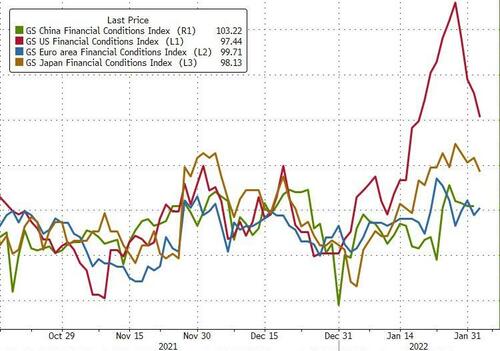

For now, however, only the US appears to be allowing financial conditions to tighten (and perhaps modestly Japan).

Source: Bloomberg

And don’t expect any help from China this time.

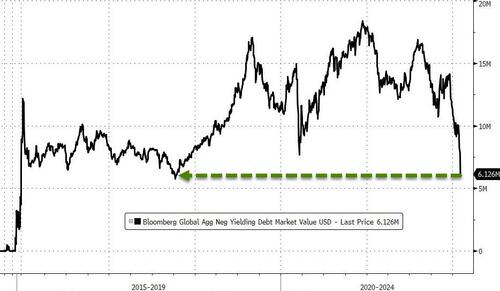

It appears that traders across the world just realized that Central Bankers are serious this time, and as they dump bonds, the global volume of negative-yielding debt has collapsed…

Source: Bloomberg

All of which removes yet another leg from the ‘stool’ of global equity prices. TINA is well and truly dead now.

For a brief explanation of TINA as well as FOMO and BTD acronyms here are the excerpts from an article by Ajay Bodke: How long can FOMO, TINA, BTD help sustain D-Street’s ‘see no evil’ stance?

The three behavioural themes that seem to have cumulatively bewitched equity investors globally can be summed up in three acronyms propounded by the famous investment guru Mohammed A El-Erian:

- TINA or there is no alternative to stocks with bond yields being so low. This is in no small measure due to ‘financial repression towards savers’ unleashed by global central banks through injection of tens of trillions of dollars of bond-buying programs (Quantitative Easing) that has led to ‘manipulation of interest rates’ fueling unprecedented speculative fervour in financial risk-assets like equities.

- FOMO or fear of missing out on yet another rise in stocks.

- And BTD, or buy the dip as a firm belief has taken hold that the torrent of monetary and fiscal deluge inundating the financial markets will continue unabated despite clear signs of build-up of debilitating inflationary pressures, which are being grossly underplayed by central bankers fearful of the wrath of financial markets akin to the mythical demon Bhasmasura threatening to incinerate his own boon-granting benefactor Lord Shiva.

In this article: “Are Global Central Banks (Excluding-China) Suddenly Panicking From Uncontrollable Inflation?”, Posted on : 04/02/2022 is a sentence: “All of which removes yet another leg from the ‘stool’ of global equity prices. TINA is well and truly dead now.”

What does mean TINA ?

Thanks for the comment. The article is updated with a brief explanation by Ajay Bodke of TINA as well as related financial acronyms FOMO, BTD:

The three behavioural themes that seem to have cumulatively bewitched equity investors globally can be summed up in three acronyms:

TINA or there is no alternative to stocks with bond yields being so low. This is in no small measure due to ‘financial repression towards savers’ unleashed by global central banks through injection of tens of trillions of dollars of bond-buying programs (Quantitative Easing) that has led to ‘manipulation of interest rates’ fueling unprecedented speculative fervour in financial risk-assets like equities.

FOMO or fear of missing out on yet another rise in stocks.

And BTD, or buy the dip as a firm belief has taken hold that the torrent of monetary and fiscal deluge inundating the financial markets will continue unabated despite clear signs of build-up of debilitating inflationary pressures, which are being grossly underplayed by central bankers fearful of the wrath of financial markets akin to the mythical demon Bhasmasura threatening to incinerate his own boon-granting benefactor Lord Shiva.