Following the outbreak of conflict in Ukraine almost two years ago, Europeans imposed a limited embargo on Russia, which holds six percent of the world’s oil reserves and a significant 24 percent of global gas reserves.

This strategic decision forced Europe to hurriedly seek out alternative energy sources, including in West Asia and North Africa, regions that collectively contain approximately 57 percent of the world’s oil reserves and 41 percent of the world’s proven gas reserves.

The replacement of Russian natural gas with other, more expensive, and more logistically problematic gas imports came at a high cost for Europeans. But today, even these secondary energy sources may be seriously jeopardized if Israel’s indiscriminate bombing of Palestinians in Gaza escalates further and embroils other countries in the energy-rich region.

Energy in West Asia and North Africa

West Asia and North Africa have long been pivotal players in the global energy scene. According to data released by the International Energy Agency in 2022, this region accounted for roughly 50 percent of global oil exports and 15 percent of natural gas exports.

Consequently, when the European Union resolved to reduce its dependence on Russian gas, it viewed West Asia and North Africa producers as potential saviors in meeting the continent’s energy needs.

In 2021, Saudi Arabia (14.5 percent of global oil exports), Iraq (7.57 percent), the UAE (6.15 percent), and Kuwait (4.21 percent) emerged as the most significant oil exporters in the West Asia-North Africa region. As for natural gas exports in 2022, the top players included Qatar (136.3 BCM/yr), Algeria (38.4 BCM/yr), Iran (17.7 BCM/yr), Oman (11 BCM/yr), and Egypt (8.9 BCM/yr).

The conflict in Ukraine led to a 2 percent increase in Europe’s oil consumption compared to usage in the pre-war period. Data from the EU’s oil imports in the second quarter of 2023 revealed that Saudi Arabia, Libya, Iraq, and Algeria were the leading oil-exporting countries to the European Union, collectively supplying over a quarter of the union’s oil needs.

Conversely, gas consumption in Europe fell by 15 percent in the same period. The figures from the EU’s gas imports in the second quarter of 2023 showed that Algeria, Qatar, Oman, Libya, Turkiye, and Egypt were the primary gas suppliers to the EU, whether in liquid or pipeline form. These countries together accounted for more than a third of the union’s gas needs.

Europe’s vulnerability to war in West Asia

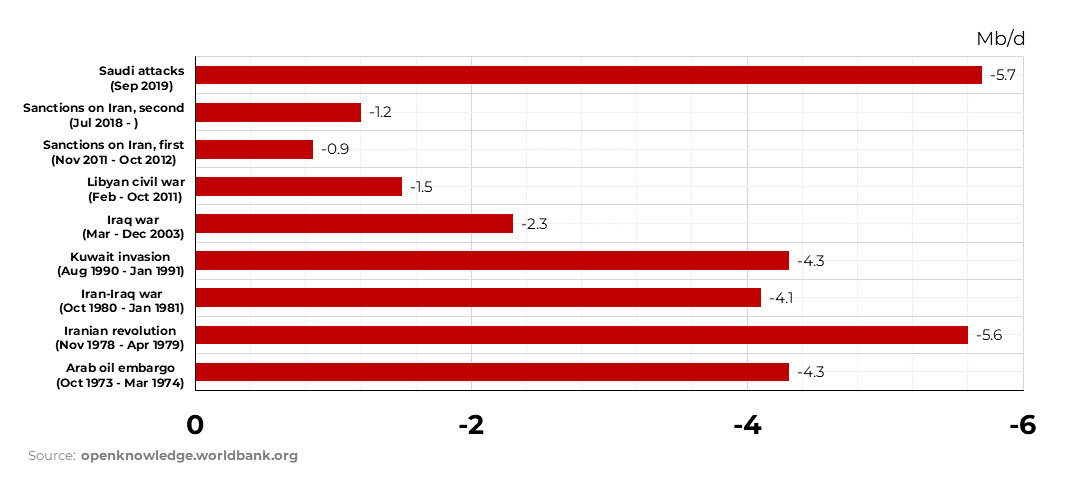

Historically, any significant tension or war in West Asia impacts energy markets by reducing regional oil supply and driving up global energy prices. In 2019, for instance, when Yemen’s Ansarallah-led forces targeted Saudi Arabia’s Aramco facilities, Saudi oil exports plummeted by nearly 5.7 million barrels per day.

Following the launch of the Palestinian resistance’s Al-Aqsa Flood attack on Israel on 7 October, natural gas prices in Europe spiked by 35 percent. This surge was attributed to the closure of a gas field off the occupied-Palestinian coast for security reasons and the explosion of a pipeline in the Baltic Sea. In short, the Ukrainian conflict and the war in Palestine collided, resulting in adverse effects on energy prices in Europe.

In the aftermath of Al-Aqsa Flood, the World Bank conducted a geopolitical risk analysis study to gauge the impact of this Palestine-Israel conflict on global oil prices. The study categorized the escalation of tension into three levels: small, medium, and large.

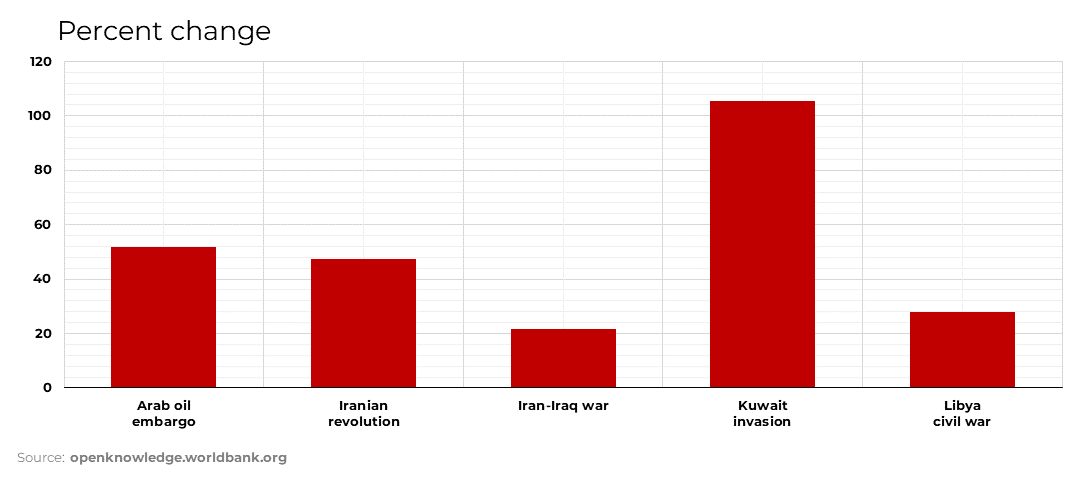

In a “small tension” scenario similar to the 2011 war in Libya, the World Bank projects a global oil supply reduction of 0.5 to 2 million barrels per day, leading to an initial oil price increase of 3 percent to 13 percent – between $93 and $102 per barrel.

In a “medium tension” scenario, akin to the 2003 Iraq war, the World Bank anticipates a global oil supply contraction of 3 to 5 million barrels per day, triggering an initial oil price surge of 21 percent to 35 percent, or costs of between $109 and $121 a barrel.

Finally, in a “high tension” scenario resembling, for instance, the 1973 Arab oil embargo, the World Bank foresees a global oil supply reduction of 6 to 8 million barrels per day, resulting in an initial oil price escalation of 56 percent to 75 percent, with costs skyrocketing to between $140 and $157 a barrel.

Any such increase in oil prices would spell disaster for Europe, which is already grappling with the burden of purchasing energy sources at inflated prices to compensate for its reduced imports from Russia.

While the study did not delve into the impact of escalating tensions on natural gas prices in West Asia, it did underline the interconnected nature of energy sources. As oil supplies decline, the ripple effect extends to other energy sources, with gas prices being particularly affected.

Shifting gas dependency

Europe stands out as the continent most likely to witness a significant rise in gas prices due to its shift away from Russian pipeline gas, leading to considerably increased dependence on liquefied natural gas (LNG) transported by the US.

In addition to the immediate repercussions of escalating tensions and the looming regional war driving up oil and gas prices worldwide, Europe faces a multitude of other factors that could profoundly influence energy exports from the Arab world.

A full-scale regional conflict involving the Axis of Resistance countries, such as Iran, Yemen, Iraq, Syria, and Lebanon, could have dire consequences. These countries, all possessing access to seas and straits, could potentially disrupt trade routes to Europe, including the movement of oil and liquefied gas.

The Strait of Hormuz, situated between Oman and Iran, holds immense significance as the world’s primary energy corridor, with over a fifth of the global oil supply and a third of total LNG supply passing through.

Major oil-exporting countries, including Saudi Arabia, Iran, the UAE, Kuwait, and Iraq, rely on this passage. Additionally, Qatar, the largest LNG exporter worldwide, ships the majority of its LNG exports through the strait. With roughly 20 percent of global LNG flows traversing the strait annually, any closure by Iran or its allies could severely impact Europe’s oil and gas supply.

As Palestine bleeds, Europe will feel the pinch

Another potential scenario involves the closure of the Bab al-Mandab Strait, the strategic passage overlooking Yemen which acts as a linchpin in the maritime trade route connecting the Mediterranean and the Indian Ocean through the Red Sea and the Suez Canal.

Most LNG exports from the Persian Gulf navigate this route, and in 2017, nearly 9 percent of all oil and refined products transported by sea passed through the strait, with over half destined for Europe. A shutdown of the Bab al-Mandab Strait could force tankers from the Persian Gulf to divert around the southern tip of Africa, leading to increased transit times and shipping costs.

Europe would be left with a stark choice: accept exorbitant prices for a continuous flow of oil and gas that causes severe economic strain – or reconsider its stance on Russian gas, which will be viewed internationally as a humiliating backtrack.

The EU initially turned to West Asia to compensate for its dwindling Russian gas supply, even if it meant higher costs. However, the growing prospect of the Palestine war morphing into a region-wide conflict now casts serious doubt on the reliability of West Asian oil and gas deliveries to Europe. Any escalation of the conflict will likely result in skyrocketing energy prices and deal a devastating blow to key sectors of European economies, notably Germany.

In anticipation of the looming crisis, German Chancellor Olaf Scholz quietly began seeking out alternative energy sources: just last week, he visited Ghana and Nigeria in the hope of plumbing new sources of energy for Europe.

As Israel ramps up its bombardment of Gaza with US and European weapons, it risks the emergence of new battlefronts being opened by more militarily sophisticated elements of the region’s Resistance Axis, threatening massive escalations throughout West Asia and potentially plunging Europe into an economic sinkhole.

The days of Europe enjoying continuous prosperity while West Asia suffers the consequences of western-Israeli policies are long gone. The Axis of Resistance – in conjunction with the growing clout of multipolar powers like Russia and China – now possesses the capabilities and options that could challenge the western axis, from Washington to Brussels and Tel Aviv, and fundamentally reshape the global energy market as we know it.

By Mohamad Hasan Sweidan