Bitcoin Crashes As Much As 15% Amid Unsubstantiated Report Of Money Laundering Crackdown

In a crash that started late on Saturday evening and accelerated throughout the night, Bitcoin and the entire cryptocurrency space plunged the most in more than seven weeks, just days after hitting a new all time high ahead of the Coinbase IPO.

Bitcoin fell 12% to $53,400 as of 8:0 a.m. in New York on Sunday, after plunging as much as 15.1% to $51,707.51 in the Asian day. Ethereum, the second-largest token, dropped almost 18% before paring losses.

The market-wide crash has in $1.72 billion worth of long positions liquidated in just one hour alone. Expanding this range to 24-hours shows that 927,000 traders’ positions worth nearly $10 billion were wiped off, with $68.73 million being the largest liquidation so far according to FX street.

The crash appeared to coincide with an unconfirmed twitter report from a supposedly credible source that the Treasury could crack down on money laundering using cryptocurrencies.

U.S. TREASURY TO CHARGE SEVERAL FINANCIAL INSTITUTIONS FOR MONEY LAUNDERING USING CRYPTOCURRENCIES -SOURCES

— FXHedge (@Fxhedgers) April 18, 2021

Whereas this account traditionally blasts Reuters or Bloomberg headlines, in this case there was no such underlying report from either Reuters or Bloomberg, and Bloomberg even said that “several online reports attributed the plunge to speculation the U.S. Treasury may crack down on money laundering that’s carried out through digital assets.”

Furthermore, in comments just earlier this week, regulators refused to take a position on bitcoin either way, even as speculation of a crackdown against bitcoin by the US government is ever present – indeed, the rumor of a “crackdown” against money laundering has always been present, which is why said tweet merely poured gasoline on an already jittery market.

In other words this was a case of “goalseeking a narrative” and framing it as a rumor to justify a prior action.

A more likely explanation is the the profit-taking in dogecoin led to some margin calls which quickly spilled over to selling the broader, illiquid crypto space. Dogecoin, a token created as a joke and which has been boosted by the likes of Elon Musk and Mark Cuban, rallied more than 110% Friday before tumbling the next day. Demand was so brisk for the token that investors trying to trade it on Robinhood crashed the site, the online exchange said in a blog post Friday.

“The crypto world is waking up with a bit of a sore head today,” Antoni Trenchev, co-founder of crypto lender Nexo, told Bloomberg. “Dogecoin’s 100% Friday rally was ‘peak party,’ after the Bitcoin record and Coinbase listing earlier in the week. Euphoria was in the air. And usually in the crypto world, there’s a price to pay when that happens.”

Besides the “unsubstantiated” report of a U.S. Treasury crackdown, Trenchev said factors for the declines may have included “excess leverage, Coinbase insiders dumping equity after the direct listing and a mass outage in China’s Xinjiang province hitting Bitcoin miners.”

Last week, Fed Chairman Powell directly addressed Bitcoin saying “is a little bit like gold” in that it’s more a vehicle for speculation than making payments. European Central Bank President Christine Lagarde in January took aim at Bitcoin’s role in facilitating criminal activity, saying the cryptocurrency has been enabling “funny business.”

While both top regulators had an opportunity to preview any coming “crackdown”, they both failed to do so suggesting that contrary to rumors none is coming. In fact, the only place that did lash out against Bitcoin is Turkey, whose central bank banned the use of cryptocurrencies as a form of payment from April 30, saying the level of anonymity behind the digital tokens brings the risk of “non-recoverable” losses. This however only led to further loss of faith in the Turkish lira which is the year’s worst performing currency. As such any more official action against crypto will be viewed as merely confirming that fiat is losing the war against crypto.

As a reminder, while the establishment (Yellen, Lagarde, Powell, and various elected officials) continue to push the “illicit use” fearmongering, Michael Morell, a 33-year veteran of the agency, published an independent paper commissioned by the newly formed lobbying group Crypto Council for Innovation (whose founding members include Coinbase, Fidelity Digital Assets, and Square) directly refuting this well-traveled narrative. In an expansive study, Morell came to two key conclusions:

-

The broad generalizations about the use of bitcoin in illicit finance are significantly overstated.

-

Blockchain analysis is a highly effective crime fighting and intelligence gathering tool.

But that is not all. In speaking with Forbes before the paper’s release, Morell made it clear that there will also be severe geopolitical repercussions for the U.S. vis-a-vis China if it wastes energy and resources chasing a ghost as opposed to leveraging blockchain, and fintech more generally, to build the country’s technological and economic base.

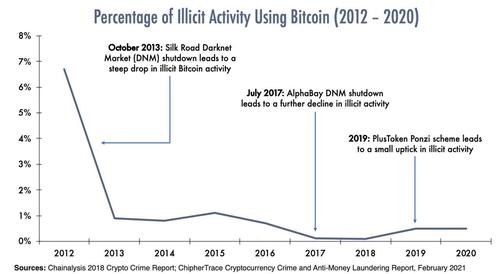

Simply put, the percentage of illicit transactions in crypto is minimal (less than 1% according to one report from Chainalysis), and falling. For additional context, he notes that estimates of illicit activity conducted through traditional intermediaries range between 2-4 percent of global GDP.

Percentage of Illicit Activity Using Bitcoin (2012-2020)

These findings will not surprise readers who have been following this industry for a long time and have encountered this narrative before, but they have never been refuted so directly by such an authoritative figure.

Meanwhile, a buy the dip moment is coming. Not only have some of the biggest crypto bulls expressed their interest in bidding up bitcoin…

Bought the dip. Sorry not sorry.

— Pomp 🌪 (@APompliano) April 18, 2021

…. in a note published on Friday, JPMorgan’s Nick Panagirtzoglou pointed to the “hefty” futures carry over spot of around 4% over two months in both bitcoin and ethereum which “is likely to help the ethereum CME futures contract to continue to grow rapidly over the coming months as it incentivizes institutional market participants to enter the futures market in order to play the carry trade i.e. by selling the futures and buying the spot to capture the spread between the two with an annualized return of more than 20%.” Indeed, most of the previous growth of the CME bitcoin futures contract started taking place from 2019 onwards once the futures to spot spread reached significant positive territory.

As the JPM strategist continues, this high futures to spot spread is likely a function of the high “risk-free” rate or opportunity cost implicit in crypto markets: “Lending USD in crypto markets attracts annual interest rates of 8-10% and this high “risk-free” rate is a common component in the futures vs. spot arbitrage trade across both bitcoin and ethereum futures.” This high “risk-free” rate or opportunity cost is likely a reflection of how “crypto-rich” and “cash-poor” crypto markets still are.

Curiously, and as a post-script to a note we wrote last weekend discussing the steep bitcoin curve, in the case of bitcoin, neither the introduction of ETFs nor the greater institutional participation in the futures market have managed to change the “cash-poor” nature of crypto markets and cause a normalization of the futures to spot spread. Adding to this elevated “risk-free” rate storage costs of around 2% per annum and transaction costs, as a result of relative more fragmented crypto markets, “one can easily see why futures to spot spreads of around 15% per annum could be justified.”

Translation: as soon as the profit-taking turmoil is over, watch as institutions flood to bid up Bitcoin and Ethereum spot while shorting 2M futures to pick up what is literally a risk-free 20% annualized carry.

Tyler Durden

Sun, 04/18/2021 – 08:21

Bitcoin Crashes As Much As 15% Amid Unsubstantiated Report Of Money Laundering Crackdown

In a crash that started late on Saturday evening and accelerated throughout the night, Bitcoin and the entire cryptocurrency space plunged the most in more than seven weeks, just days after hitting a new all time high ahead of the Coinbase IPO.

Bitcoin fell 12% to $53,400 as of 8:0 a.m. in New York on Sunday, after plunging as much as 15.1% to $51,707.51 in the Asian day. Ethereum, the second-largest token, dropped almost 18% before paring losses.

The market-wide crash has in $1.72 billion worth of long positions liquidated in just one hour alone. Expanding this range to 24-hours shows that 927,000 traders’ positions worth nearly $10 billion were wiped off, with $68.73 million being the largest liquidation so far according to FX street.

The crash appeared to coincide with an unconfirmed twitter report from a supposedly credible source that the Treasury could crack down on money laundering using cryptocurrencies.

U.S. TREASURY TO CHARGE SEVERAL FINANCIAL INSTITUTIONS FOR MONEY LAUNDERING USING CRYPTOCURRENCIES -SOURCES

— FXHedge (@Fxhedgers) April 18, 2021

Whereas this account traditionally blasts Reuters or Bloomberg headlines, in this case there was no such underlying report from either Reuters or Bloomberg, and Bloomberg even said that “several online reports attributed the plunge to speculation the U.S. Treasury may crack down on money laundering that’s carried out through digital assets.”

Furthermore, in comments just earlier this week, regulators refused to take a position on bitcoin either way, even as speculation of a crackdown against bitcoin by the US government is ever present – indeed, the rumor of a “crackdown” against money laundering has always been present, which is why said tweet merely poured gasoline on an already jittery market.

In other words this was a case of “goalseeking a narrative” and framing it as a rumor to justify a prior action.

A more likely explanation is the the profit-taking in dogecoin led to some margin calls which quickly spilled over to selling the broader, illiquid crypto space. Dogecoin, a token created as a joke and which has been boosted by the likes of Elon Musk and Mark Cuban, rallied more than 110% Friday before tumbling the next day. Demand was so brisk for the token that investors trying to trade it on Robinhood crashed the site, the online exchange said in a blog post Friday.

“The crypto world is waking up with a bit of a sore head today,” Antoni Trenchev, co-founder of crypto lender Nexo, told Bloomberg. “Dogecoin’s 100% Friday rally was ‘peak party,’ after the Bitcoin record and Coinbase listing earlier in the week. Euphoria was in the air. And usually in the crypto world, there’s a price to pay when that happens.”

Besides the “unsubstantiated” report of a U.S. Treasury crackdown, Trenchev said factors for the declines may have included “excess leverage, Coinbase insiders dumping equity after the direct listing and a mass outage in China’s Xinjiang province hitting Bitcoin miners.”

Last week, Fed Chairman Powell directly addressed Bitcoin saying “is a little bit like gold” in that it’s more a vehicle for speculation than making payments. European Central Bank President Christine Lagarde in January took aim at Bitcoin’s role in facilitating criminal activity, saying the cryptocurrency has been enabling “funny business.”

While both top regulators had an opportunity to preview any coming “crackdown”, they both failed to do so suggesting that contrary to rumors none is coming. In fact, the only place that did lash out against Bitcoin is Turkey, whose central bank banned the use of cryptocurrencies as a form of payment from April 30, saying the level of anonymity behind the digital tokens brings the risk of “non-recoverable” losses. This however only led to further loss of faith in the Turkish lira which is the year’s worst performing currency. As such any more official action against crypto will be viewed as merely confirming that fiat is losing the war against crypto.

As a reminder, while the establishment (Yellen, Lagarde, Powell, and various elected officials) continue to push the “illicit use” fearmongering, Michael Morell, a 33-year veteran of the agency, published an independent paper commissioned by the newly formed lobbying group Crypto Council for Innovation (whose founding members include Coinbase, Fidelity Digital Assets, and Square) directly refuting this well-traveled narrative. In an expansive study, Morell came to two key conclusions:

The broad generalizations about the use of bitcoin in illicit finance are significantly overstated.

Blockchain analysis is a highly effective crime fighting and intelligence gathering tool.

But that is not all. In speaking with Forbes before the paper’s release, Morell made it clear that there will also be severe geopolitical repercussions for the U.S. vis-a-vis China if it wastes energy and resources chasing a ghost as opposed to leveraging blockchain, and fintech more generally, to build the country’s technological and economic base.

Simply put, the percentage of illicit transactions in crypto is minimal (less than 1% according to one report from Chainalysis), and falling. For additional context, he notes that estimates of illicit activity conducted through traditional intermediaries range between 2-4 percent of global GDP.

Percentage of Illicit Activity Using Bitcoin (2012-2020)

These findings will not surprise readers who have been following this industry for a long time and have encountered this narrative before, but they have never been refuted so directly by such an authoritative figure.

Meanwhile, a buy the dip moment is coming. Not only have some of the biggest crypto bulls expressed their interest in bidding up bitcoin…

Bought the dip. Sorry not sorry.

— Pomp 🌪 (@APompliano) April 18, 2021

…. in a note published on Friday, JPMorgan’s Nick Panagirtzoglou pointed to the “hefty” futures carry over spot of around 4% over two months in both bitcoin and ethereum which “is likely to help the ethereum CME futures contract to continue to grow rapidly over the coming months as it incentivizes institutional market participants to enter the futures market in order to play the carry trade i.e. by selling the futures and buying the spot to capture the spread between the two with an annualized return of more than 20%.” Indeed, most of the previous growth of the CME bitcoin futures contract started taking place from 2019 onwards once the futures to spot spread reached significant positive territory.

As the JPM strategist continues, this high futures to spot spread is likely a function of the high “risk-free” rate or opportunity cost implicit in crypto markets: “Lending USD in crypto markets attracts annual interest rates of 8-10% and this high “risk-free” rate is a common component in the futures vs. spot arbitrage trade across both bitcoin and ethereum futures.” This high “risk-free” rate or opportunity cost is likely a reflection of how “crypto-rich” and “cash-poor” crypto markets still are.

Curiously, and as a post-script to a note we wrote last weekend discussing the steep bitcoin curve, in the case of bitcoin, neither the introduction of ETFs nor the greater institutional participation in the futures market have managed to change the “cash-poor” nature of crypto markets and cause a normalization of the futures to spot spread. Adding to this elevated “risk-free” rate storage costs of around 2% per annum and transaction costs, as a result of relative more fragmented crypto markets, “one can easily see why futures to spot spreads of around 15% per annum could be justified.”

Translation: as soon as the profit-taking turmoil is over, watch as institutions flood to bid up Bitcoin and Ethereum spot while shorting 2M futures to pick up what is literally a risk-free 20% annualized carry.

Tyler Durden

Sun, 04/18/2021 – 08:21

Read More