Bitcoin Energy Use Is Far Lower Than Banking System & Gold Industry, Report

Amid all the contention of the last few days, sparked by Elon Musk’s virtue-signaling, the noise-to-signal ratio around the crypto market’s energy use has gone to ’11’ on the Spinal Tap amplifier of social justice.

However, those darn ‘facts’ and ‘science’ keep getting in the way of the ‘bitcoin = bad guy destroying the earth’ narrative and new research by crypto firm Galaxy Digital (founded by former hedge fund manager Michael Novogratz) has shown that both the traditional banking system and the gold industry consume much more energy than the bitcoin network.

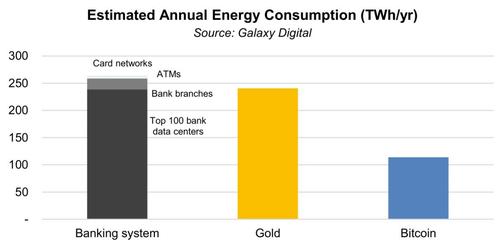

According to the report, compiled by Galaxy’s mining arm, bitcoin’s annual electricity consumption stands at 113.89 TWh (terawatt-hours). That includes energy for miner demand, miner power consumption, pool power consumption, and node power consumption. The amount is at least two times lower than the total energy consumed by the banking system, which is estimated to reach 263.72 TWh per year globally.

Galaxy Digital Mining said that bitcoin’s energy consumption is transparent and easy to track in real time using tools like the Cambridge Bitcoin Electricity Consumption Index, while the evaluation of energy usage of the traditional financial system and the gold industry is not that straightforward.

As Galaxy Digital notes, energy utilization is not necessarily a bad thing. As Vaclav Smil writes, energy is the only universal currency. Humans will continue to find new technologies that require more energy that challenge the status quo. Bitcoin is yet another example.

So, in their view, returning to the defining question of our time (this week): Is the Bitcoin network’s electricity consumption an acceptable use of energy?

Galaxy’s answer is definitive: yes.

As they conclude, subjective views on the Bitcoin network’s importance vary, but Bitcoin’s properties do not. Anyone can use Bitcoin. Anyone can hold bitcoins for themselves. And Bitcoin transactions can provide probabilistically final settlement in an hour, 24 hours a day, 365 days per year.

These features can offer financial freedom to people around the world without the luxury of stable and accessible financial infrastructure. The network can benefit the energy sector by creating perfect use cases for intermittent and excess energy. And the network will only scale further if network adoption warrants it.

Notably this morning, ARK weighed in on the Elon drama, and as Bloomberg’s Eric Balchunas notes, ARK comes down firmly for ‘Team Bitcoin’…

So, the question now is, how long before Elon Musk abandons the energy-sapping traditional banking-system for Tesla payments?

* * *

Read the full report below:

Tyler Durden

Mon, 05/17/2021 – 12:44

Bitcoin Energy Use Is Far Lower Than Banking System & Gold Industry, Report

Amid all the contention of the last few days, sparked by Elon Musk’s virtue-signaling, the noise-to-signal ratio around the crypto market’s energy use has gone to ’11’ on the Spinal Tap amplifier of social justice.

However, those darn ‘facts’ and ‘science’ keep getting in the way of the ‘bitcoin = bad guy destroying the earth’ narrative and new research by crypto firm Galaxy Digital (founded by former hedge fund manager Michael Novogratz) has shown that both the traditional banking system and the gold industry consume much more energy than the bitcoin network.

According to the report, compiled by Galaxy’s mining arm, bitcoin’s annual electricity consumption stands at 113.89 TWh (terawatt-hours). That includes energy for miner demand, miner power consumption, pool power consumption, and node power consumption. The amount is at least two times lower than the total energy consumed by the banking system, which is estimated to reach 263.72 TWh per year globally.

Galaxy Digital Mining said that bitcoin’s energy consumption is transparent and easy to track in real time using tools like the Cambridge Bitcoin Electricity Consumption Index, while the evaluation of energy usage of the traditional financial system and the gold industry is not that straightforward.

As Galaxy Digital notes, energy utilization is not necessarily a bad thing. As Vaclav Smil writes, energy is the only universal currency. Humans will continue to find new technologies that require more energy that challenge the status quo. Bitcoin is yet another example.

So, in their view, returning to the defining question of our time (this week): Is the Bitcoin network’s electricity consumption an acceptable use of energy?

Galaxy’s answer is definitive: yes.

As they conclude, subjective views on the Bitcoin network’s importance vary, but Bitcoin’s properties do not. Anyone can use Bitcoin. Anyone can hold bitcoins for themselves. And Bitcoin transactions can provide probabilistically final settlement in an hour, 24 hours a day, 365 days per year.

These features can offer financial freedom to people around the world without the luxury of stable and accessible financial infrastructure. The network can benefit the energy sector by creating perfect use cases for intermittent and excess energy. And the network will only scale further if network adoption warrants it.

Notably this morning, ARK weighed in on the Elon drama, and as Bloomberg’s Eric Balchunas notes, ARK comes down firmly for ‘Team Bitcoin’…

So, the question now is, how long before Elon Musk abandons the energy-sapping traditional banking-system for Tesla payments?

* * *

Read the full report below:

Tyler Durden

Mon, 05/17/2021 – 12:44

Read More