Brace For A Huge Retail Sales Miss: BofA Card Data Shows Collapse In February Spending

One month ago, ahead of the record-breaking February retail sales report which smashed expectations in a 5-sigma beat to consensus and saw a record jump in core retail sales…

… we cautioned readers that “A Blockbuster Retail Sales Report” was coming, citing BofA’s latest credit and debit card data which showed a surge In spending, and more importantly, found that actual spending was coming in about 5-10x hotter than consensus.

Well, what a difference a month makes, because one month after what BofA (correctly) warned would be a blockbuster beat, the bank now expects a crushing plunge in retail sales.

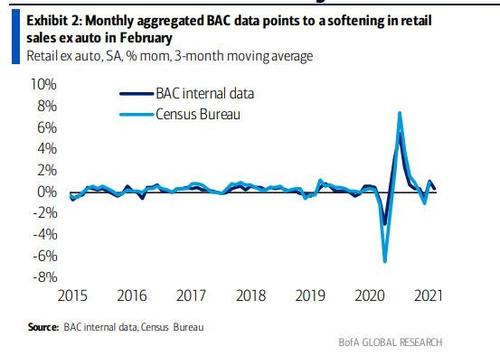

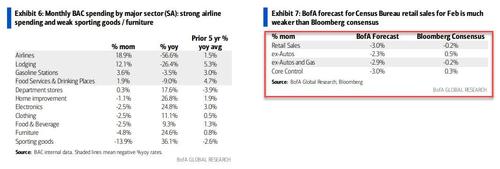

Looking at its latest aggregated monthly credit and debit card data, BAC finds a 2.3% M/M decline in core retail sales (ex-autos) in February, a drop which reflects three main factors:

- payback from the stimulus-induced gain in January;

- delayed tax refunds;

- Winter blizzard.

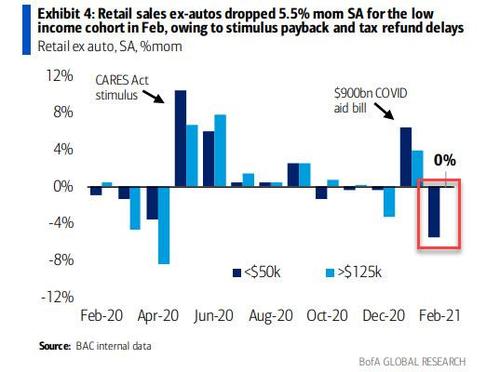

The first two factors led lower income spending to be particularly weak, declining 5.5% mom SA for the lowest income cohort.

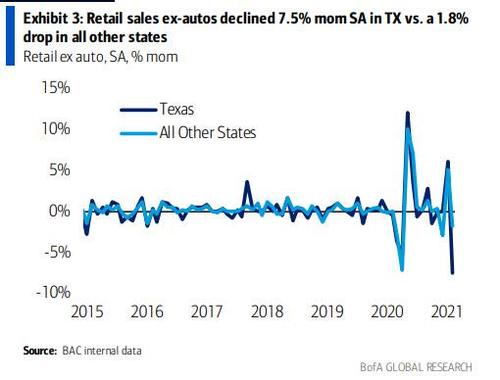

Additionally, the catastrophic winter blizzard curtailed activity in Texas where retail sales ex-autos declined 7.5% mom SA.

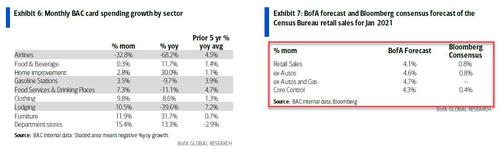

On a sector level, BofA saw strength in spending at restaurants and weakness in goods. As such, the bank’s measure of “core control retail sales”, which nets out autos, gas, building materials and restaurants is down 3.0% mom SA, and means that consensus will be woefully wrong with the real data coming in far below expectations (appropriately enough, one week after blowing out consensus).

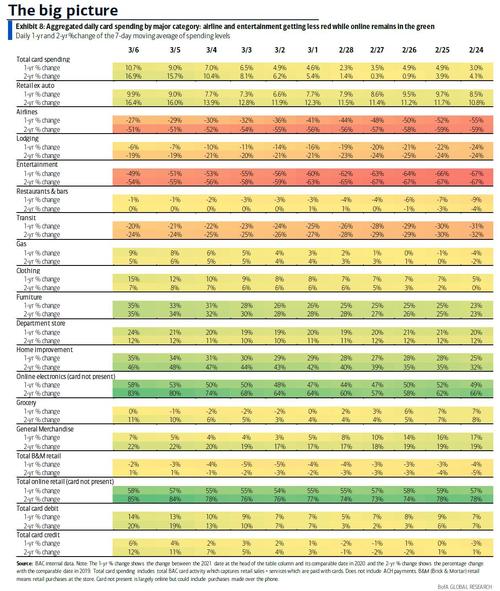

Needless to say, this suggests a very weak February Census Bureau report. But there is good news: the latest weekly data shows another sharp rebound at the start of March. As BofA notes, total card spending jumped 10.7% yoy for the week ending March 6th…

… reflecting the pay period at the beginning of the month which jolted spending.

Furthermore, BofA’s chief economist Michelle Meyer says that she is seeing – and expects to continue to observe – “a decisive improvement in spending in March after the weakness at the end of February” which leads it to conclude that the drop is transitory given the strong data in the first week of March, the likely distribution of stimulus checks before month end and delayed tax refunds.

Tyler Durden

Mon, 03/15/2021 – 12:00

Brace For A Huge Retail Sales Miss: BofA Card Data Shows Collapse In February Spending

One month ago, ahead of the record-breaking February retail sales report which smashed expectations in a 5-sigma beat to consensus and saw a record jump in core retail sales…

… we cautioned readers that “A Blockbuster Retail Sales Report” was coming, citing BofA’s latest credit and debit card data which showed a surge In spending, and more importantly, found that actual spending was coming in about 5-10x hotter than consensus.

Well, what a difference a month makes, because one month after what BofA (correctly) warned would be a blockbuster beat, the bank now expects a crushing plunge in retail sales.

Looking at its latest aggregated monthly credit and debit card data, BAC finds a 2.3% M/M decline in core retail sales (ex-autos) in February, a drop which reflects three main factors:

payback from the stimulus-induced gain in January;

delayed tax refunds;

Winter blizzard.

The first two factors led lower income spending to be particularly weak, declining 5.5% mom SA for the lowest income cohort.

Additionally, the catastrophic winter blizzard curtailed activity in Texas where retail sales ex-autos declined 7.5% mom SA.

On a sector level, BofA saw strength in spending at restaurants and weakness in goods. As such, the bank’s measure of “core control retail sales”, which nets out autos, gas, building materials and restaurants is down 3.0% mom SA, and means that consensus will be woefully wrong with the real data coming in far below expectations (appropriately enough, one week after blowing out consensus).

Needless to say, this suggests a very weak February Census Bureau report. But there is good news: the latest weekly data shows another sharp rebound at the start of March. As BofA notes, total card spending jumped 10.7% yoy for the week ending March 6th…

… reflecting the pay period at the beginning of the month which jolted spending.

Furthermore, BofA’s chief economist Michelle Meyer says that she is seeing – and expects to continue to observe – “a decisive improvement in spending in March after the weakness at the end of February” which leads it to conclude that the drop is transitory given the strong data in the first week of March, the likely distribution of stimulus checks before month end and delayed tax refunds.

Tyler Durden

Mon, 03/15/2021 – 12:00

Read More