British bank chief resigns over Farage scandal. The UKIP founder accused the bank of compiling a “Stasi-style surveillance report” on his political views . NatWest’s Alison Rose leaked the Brexit politician’s financial affairs to a BBC journalist

Alison Rose announced on Tuesday that she will step down as CEO of one of Britain’s largest banks, NatWest, after she told a BBC journalist that Brexit leader and UK Independence Party (UKIP) founder Nigel Farage was dropped by one of her bank’s subsidiaries for having insufficient cash. In reality, Farage’s accounts were canceled over his political views.

The politician, now a TV pundit for GB News, revealed last month that he had been refused service by Coutts, a subsidiary of NatWest tailored to wealthy clients. Farage said that he was dropped as a customer over his political opinions, but the BBC reported that Coutts had let him go for “commercial” reasons – meaning he couldn’t reach the £1 million ($1.3 million) wealth requirement set by the bank.

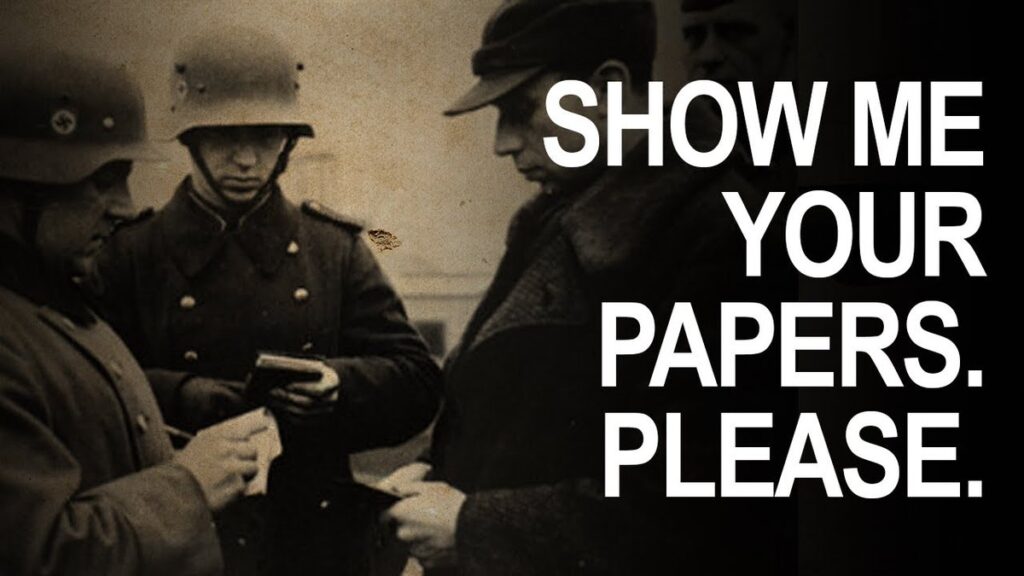

However, Farage obtained an internal document showing that the bank had pored over his political positions – including his opposition to immigration and criticisms of ‘Black Lives Matter’ – and deemed him incompatible with Coutts’ “values.”

Neither NatWest nor Coutts have disputed the authenticity of the document.

Rose was revealed as the BBC’s source in a report by The Telegraph last week, and resigned late on Tuesday night. In a statement, she confirmed that she falsely told BBC Business Editor Simon Jack “that the decision to close Mr Farage’s accounts was solely a commercial one.”

Rose also apologized to Farage for “the deeply inappropriate language” in the paper describing his political outlook. However, she stressed that she was not involved in the decision to close the former UKIP chief’s accounts.

The document described Farage as someone who “is seen as xenophobic and racist” and a “disingenuous grifter.” It stated that his views are “distasteful and appear increasingly out of touch with wider society,” and cited his friendship with former US President Donald Trump as a potential “reputational risk” to the bank.

Farage described the paper as a “Stasi-style surveillance report” that “reads rather like a pre-trial brief drawn up by the prosecution in a case against a career criminal.” Speaking on GB News on Wednesday, Farage described Rose’s resignation as “a start,” and called on the entire NatWest board to resign, as it had approved an earlier statement by Rose in which she claimed not to have revealed any of his “personal financial information.”

“It is right that the NatWest CEO has resigned,” Treasury Minister Andrew Griffith said in a statement on Wednesday. “This would never have happened if NatWest had not taken it upon itself to withdraw a bank account due to someone’s lawful political views. That was and is always unacceptable.”

British Banks That Canceled Conservatives Could Lose Their Licenses – Ethan Huff

A new legislative proposal in the United Kingdom would require banks to treat all of their customers equally, regardless of their political leanings, or else lose their banking licenses.

Following the recent scandal involving Brexit leader Nigel Farage, whose bank account was shuttered by Coutts / NatWest due to his conservative political platform, a number of British MPs (members of parliament) are working on a new law to stop this kind of thing from ever happening again while bolstering and protecting freedom of expression throughout the country.

A related set of newly proposed rules would also force banks to provide customers with at least three months’ notice before closing their accounts. Currently, British banks are only required to give customers a one-month notice before termination, and they are not yet required to provide an “explicit” reason as to why an account is being closed in the first place, which would change under the new rules.

“It would be of serious concern if financial services were being denied to anyone exercising their right to lawful free speech,” said Economic Secretary of the Treasury Andrew Griffith about the matter.

“[T]he privilege of a banking license in a democracy should imply a duty not to ‘debank’ because you disagree with someone’s views.”

Cancel culture in banking must be stopped

In Farage’s case, Coutts / NatWest is, or at least was, run by an anti-Brexit executive who took it upon himself to punish Farage simply for having a different set of political beliefs than himself. The newly proposed rules would make it a crime for the banking sector to discriminate against customers in this way.

It turns out that most British banking executives remain fervently opposed to Great Britain leaving the European Union. This is more than likely because banking in general is controlled by globalists who want their pawn nations to merge and consolidate under one power structure rather than uphold their individual sovereignty.

Here in the United States, the tech giants are known to engage in similar politically driven censorship, and even a few finance platforms like PayPal have been caught engaging in targeted harassment and censorship of accounts with opposing political views. For an actual banking entity to do this kind of thing, however, is relatively new – and is, quite frankly, scary.

It is one thing to get banned from Facebook or Twitter, which in the grander scheme of things is not that big of a deal. But to lose one’s ability to financially transact simply for having the “wrong” set of political beliefs is a whole different animal that, for the sake of freedom and liberty, must be nipped in the bud.

Rules that were implemented in 2015 allow for everyone in the country to hold a basic bank account, no questions asked, facilitating the sending and receiving of payments.

“A credit institution must not discriminate against consumers legally resident in the European Union by reason of their nationality or place of residence or by reason of any other ground referred to in article 21 of the charter of fundamental rights of the European Union when those consumers apply for or access a payment account,” the legislation reads.

The rights charter further states:

“Any discrimination based on any ground such as sex, race, colour, ethnic or social origin, genetic features, language, religion or belief, political or any other opinion, membership of a national minority, property, birth, disability, age or sexual orientation shall be prohibited.”