British elites should take responsibility for policies on the conflict in Ukraine and the costs of it.

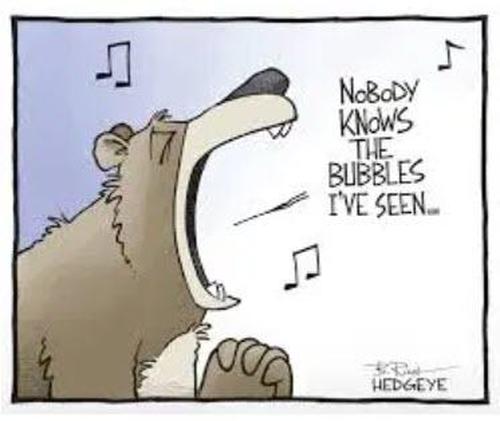

As recession and even depression haunts the EU, in the post-Nord Stream world, the UK in turn has its own problems. Prime minister Liz Truss has said that “Britain’s economy needs a reset”. Supposedly, it all started with the £45bn “mini budget” which was presented last week. The markets did not respond well: investors’ reaction was to sell the pound and to offload government bonds, thereby increasing the interest bill paid by the British Treasury.

All hell has broken loose: the pound fell to a record low against the US dollar, banks unprecedentedly pulled thousands of mortgage products from the shelves (thereby hurting Britain’s housing market), gilts sold off quickly (yields on five-year gilts went up by 50 basis points). The Bank of England in turn even launched an unprecedented £65bn emergency bond-buying programme to stabilize government debt markets and to stop pension funds collapsing.

Meanwhile, markets are betting Britain’s interest rates could peak at 5.8 per cent by next spring, thus creating what some have described in anticipation as an “embarrassment of riches”. Bankers however certainly have not lost sight of the fact that, amid a recession, businesses bust and therefore loan losses go up. Ironically, the rising interest rates are the very thing that in all likelihood shall bring on the British recession. And, according to Tim Worstall (a trader and a Senior Fellow of the Adam Smith Institute), the Bank of England is raising interest rates precisely to bring on a recessionary situation so as to “wring inflation out”.

But has the United Kingdom really collapsed over the new government’s budget? It is in fact the only G7 country with a smaller economy than before the pandemic. Irish economist Philip Pilkington argues that “ridiculous” as the budget may have been (basically an “expansionary package” in an economy already suffering from high inflation and trade deficit), markets and the City of London have been concerned with “out-of-control trade deficit” and “high inflation” for a while. Paraphrasing James Carville, one could very well shout “it’s the energy, stupid!”.

All such imbalances have really been driven by energy costs, as the British import a lot of energy – therefore, when such costs rise, they are passed on to consumers, and thus follows inflation. This is a European crisis, but, according to Pilkington, it only took longer to hit the UK and merely because it does not rely so much on manufacturing like Germany, for instance. Be it as it may, now it is Britain’s turn and Brexit could not avoid it. Phillip Pilkington and other experts now fear the collapse of European economies may have just begun, starting with Europe’s “weakest economic link” – namely, the UK.

High energy costs, finally, have everything to do with a financial warfare against Russia which has backfired. Moreover, Washington has campaigned heavily against Nord Stream 2, the German-Russian project which, truth be told, could have helped to overcome (or at least minimized) Europe’s energy crisis; a crisis that has served American interests well.

After Nord Stream pipelines are gone (in all likelihood as a result of sabotage), there is no going back now on Russian sanctions to solve the situation and energy prices are to remain high. The hard truth is that beneath today’s Europeans and British lies the cost of a war that is taking a heavy toll on Europe.

Notwithstanding any criticism one might make of how and when Moscow decided to conduct its current military operations in Ukraine (after 8 years of Ukrainian offensives against the population of Donbass, in Europe’s “forgotten war”), the fact that the roots of the current conflict lie in NATO enlargement has been acknowledged by different political scientists, and similar Western “containment” policies targeting China over Taiwan risk producing similar disastrous results. However, besides geopolitics, there is also another angle.

I’ve written on how this energy issue is an angle of the geoeconomic dispute between Washington and Moscow which has not received enough attention: US interests in selling its (more expensive) LNG to Europe have driven Washington to adopt over the years a series of legislative measures imposing sanctions on companies involved in Nord Stream – here, as often happens, private interests and government corruption intertwine with US geopolitics.

By embarking on the US-led NATO plans, European powers and Great Britain have put themselves in a situation in which they have much to lose.

Add to this the timing of Queen Elizabeth’s death (and the immense costs all transition procedures will bring) as well as the challenges faced by the new unpopular King to maintain unity, in an already divided United Kingdom, troubled as it is by the post-Brexit Northern Protocol border crisis, and by the reemergence of the Northern Ireland loyalist-republican conflict.

With a coming winter depression, rising interest rates and British banks set to make abundant profits amid a mortgage market freeze, how can the voice of populism possibly not grow louder and louder? The perception that European elites are acting in a Nero-like manner is becoming harder and harder to escape. I’ve also written on how populists and the so-called far-right, such as Marine Le Pen and Viktor Orban, have been capitalizing the growing discontent with NATO and the EU itself – which is in fact a popular phenomenon, although largely politically marginalized in the continent.

To sum it up, it is about time European and British elites take responsibility for their policies pertaining to the conflict in Ukraine and the costs of it. But a way out of the economic and political crisis seems far away.

Uriel Araujo, researcher with a focus on international and ethnic conflicts