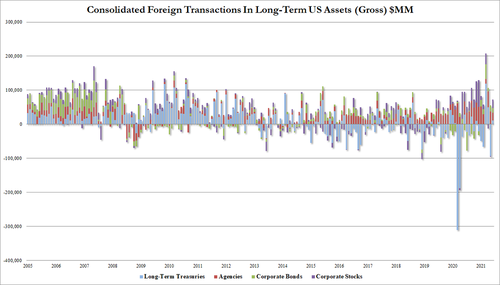

Overall, June was a ‘buy all the US things’ month for foreign investors

- Long-Term Treasurys +$10.9BN

- Agencies +22.7BN

- Corporate Bonds $13.8BN

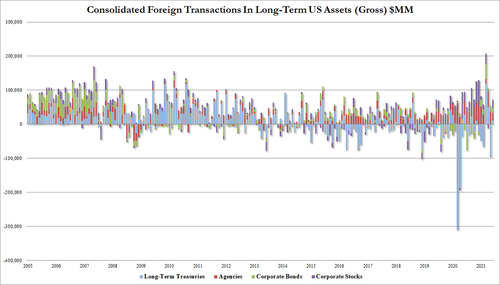

- Corporate Stocks +$25.2BN

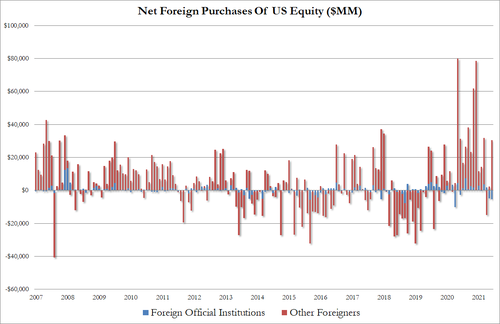

That is the biggest stock buying binge since March, led by non-official source buying (Foreign Official institutions -5.4BN, Other foreign entities: +30.6BN)…

For the 4th straight month, China dumped US Treasuries in June (the latest TIC data). In fact, over the last two months, China sold over $34 billion in Treasuries – the biggest dump since 2016…

Source: Bloomberg

Belgium also saw significant selling (often considered a proxy for China selling via Everclear), now with the lowest holdings since Sept 2020…

Source: Bloomberg

Japan bought Treasuries in June (after selling in May)…

Source: Bloomberg

And finally, hedge funds appear to have been big buyers of bonds in June as Catman Islands added almost $16bn (up for the 3rd month in a row)…

Source: Bloomberg

As a reminder, the benchmark 10-year Treasury yield decreased about 13 basis points in June to 1.47%.

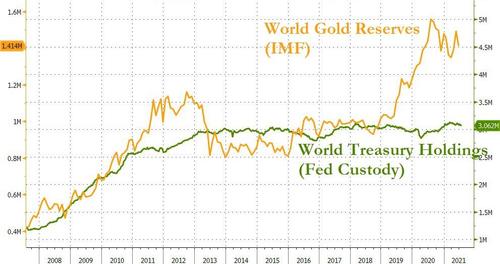

Finally, we note that the shift from Treasuries to Gold among global reserves remains in tact…

Source: Bloomberg