China’s Industry Ministry Urges Chipmakers To Increase Production Capacity

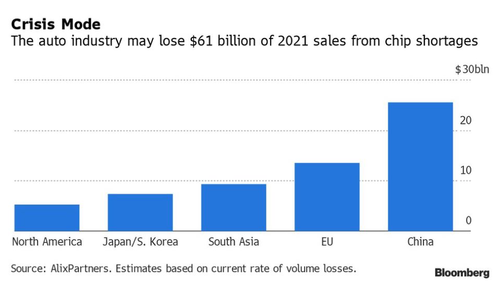

All does not seem to be well in the world’s largest auto market – especially now as the ongoing global semiconductor shortage is hitting the country where it hurts.

China’s industry ministry said this week that it met with automotive and chip manufacturers to try and help ease what is now being called a “crisis” of a shortage in global semiconductors.

The country’s Ministry of Industry and Information Technology has told companies to “place high importance on” and “increase production capacity allocation” for China’s auto market, according to Reuters.

The Ministry also urged companies to improve logistics and supply chain coordination to support China’s auto industry.

As if any of that needed to actually be said at this point…

The auto industry has been struggling with the shortage in semi chips for weeks now, as we have been reporting. Major manufacturers like Toyota, Nissan and GM have all felt the sting of the shortage, with many automakers shutting down shifts and slowing production as a result.

In fact, just yesterday, General Motors noted that the chip shortage was going to cost the company $1 billion to $2 billion in earnings in 2021. And it isn’t just the auto industry that is feeling the pain.

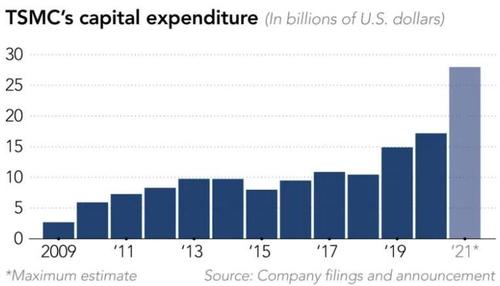

We also wrote that Taiwan Semiconductor was rushing to build infrastructure to try and meet demand. TSMC is one of the biggest suppliers of chips to company like Apple, Google and Qualcomm. As a result of a worldwide shortage in chips that was brought on due to the pandemic, they are now rushing to try and get a new factory in the southern Taiwanese city of Tainan built. It’ll be “the world’s most advanced 3-nanometer chip production plant,” according to Nikkei. The company is also building a research and data center in Hsinchu.

Construction the new facility will take place throughout 2021, with completion expected in 2022.

One executive said of TSMC’s expansion: “We received a notice from TSMC that it is giving 4,000 New Taiwan dollars ($145) a day as an extra bonus for every worker willing to come during the Lunar New Year… that is literally at least double the average daily wage for front line workers. Even if that’s only roughly a few extra days of building time [during the holiday], they don’t want to fully stop at all. That shows their commitment to speed up construction and development and confidence for future demand.”

Recall, we wrote days ago that the shortage is being referred to as the “most serious shortage in years”, with Qualcomm’s CEO saying two weeks ago that there were now shortages “across the board”, according to Bloomberg.

But it isn’t just Qualcomm executives speaking out: other industry leaders have warned in recent weeks that they are susceptible to the shortages. Apple said recently that its new high end iPhones were on hold due to a shortage of components. NXP Semiconductors has also warned that the problems are no longer just confined to the auto industry. Sony also said last week it may not be able to to fully meet demand for its new gaming console in 2021 due to the shortage. Companies like Lenovo have also been feeling the crunch.

Neil Mawston, an analyst with Strategy Analytics, said: “The virus pandemic, social distancing in factories, and soaring competition from tablets, laptops and electric cars are causing some of the toughest conditions for smartphone component supply in many years.”

Mawston says that prices for some smartphone components are up as much as 15% the last 6 months.

To make matters worse, Huawei is being blamed for hoarding components in 2020 (almost as if they knew this was going to happen). This set off other manufacturers to do the same. According to the report:

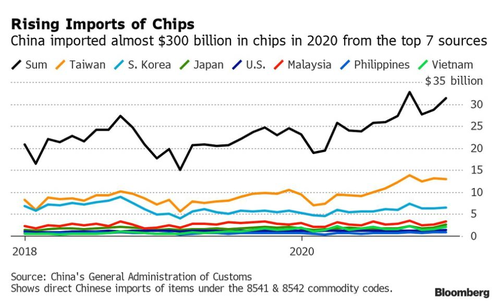

Industry executives also blame excessive stockpiling, which began over the summer when Huawei Technologies Co. — a major smartphone and networking gear maker — began hoarding components to ensure its survival from crippling U.S. sanctions. Led by Huawei, Chinese imports of chips of all kinds climbed to almost $380 billion in 2020 –– making up almost a fifth of the country’s overall imports for the year.

Rivals including Apple, worried about their own caches, responded in kind. At the same time, the stay-at-home era spurred sales of home appliances from the costliest TVs to the lowliest air purifiers, all of which now come with smart, customized chips. TSMC executives said on its two most recent earnings calls that customers have been accumulating more inventory than normal to hedge against uncertainties, a maneuver they see persisting for some time.

“There’s a chip stockpiling arms race,” said Will Bright, co-founder and chief product officer at Drop. Analyst Mario Morales of IDC said: “A lot of it can be traced back to the second quarter of last year, when the whole world basically shut down. Many auto companies shut down manufacturing and their suppliers re-prioritized. Not until the second half will we see relief for some of these markets.

Tyler Durden

Thu, 02/11/2021 – 20:50

China’s Industry Ministry Urges Chipmakers To Increase Production Capacity

All does not seem to be well in the world’s largest auto market – especially now as the ongoing global semiconductor shortage is hitting the country where it hurts.

China’s industry ministry said this week that it met with automotive and chip manufacturers to try and help ease what is now being called a “crisis” of a shortage in global semiconductors.

The country’s Ministry of Industry and Information Technology has told companies to “place high importance on” and “increase production capacity allocation” for China’s auto market, according to Reuters.

The Ministry also urged companies to improve logistics and supply chain coordination to support China’s auto industry.

As if any of that needed to actually be said at this point…

The auto industry has been struggling with the shortage in semi chips for weeks now, as we have been reporting. Major manufacturers like Toyota, Nissan and GM have all felt the sting of the shortage, with many automakers shutting down shifts and slowing production as a result.

In fact, just yesterday, General Motors noted that the chip shortage was going to cost the company $1 billion to $2 billion in earnings in 2021. And it isn’t just the auto industry that is feeling the pain.

We also wrote that Taiwan Semiconductor was rushing to build infrastructure to try and meet demand. TSMC is one of the biggest suppliers of chips to company like Apple, Google and Qualcomm. As a result of a worldwide shortage in chips that was brought on due to the pandemic, they are now rushing to try and get a new factory in the southern Taiwanese city of Tainan built. It’ll be “the world’s most advanced 3-nanometer chip production plant,” according to Nikkei. The company is also building a research and data center in Hsinchu.

Construction the new facility will take place throughout 2021, with completion expected in 2022.

One executive said of TSMC’s expansion: “We received a notice from TSMC that it is giving 4,000 New Taiwan dollars ($145) a day as an extra bonus for every worker willing to come during the Lunar New Year… that is literally at least double the average daily wage for front line workers. Even if that’s only roughly a few extra days of building time [during the holiday], they don’t want to fully stop at all. That shows their commitment to speed up construction and development and confidence for future demand.”

Recall, we wrote days ago that the shortage is being referred to as the “most serious shortage in years”, with Qualcomm’s CEO saying two weeks ago that there were now shortages “across the board”, according to Bloomberg.

But it isn’t just Qualcomm executives speaking out: other industry leaders have warned in recent weeks that they are susceptible to the shortages. Apple said recently that its new high end iPhones were on hold due to a shortage of components. NXP Semiconductors has also warned that the problems are no longer just confined to the auto industry. Sony also said last week it may not be able to to fully meet demand for its new gaming console in 2021 due to the shortage. Companies like Lenovo have also been feeling the crunch.

Neil Mawston, an analyst with Strategy Analytics, said: “The virus pandemic, social distancing in factories, and soaring competition from tablets, laptops and electric cars are causing some of the toughest conditions for smartphone component supply in many years.”

Mawston says that prices for some smartphone components are up as much as 15% the last 6 months.

To make matters worse, Huawei is being blamed for hoarding components in 2020 (almost as if they knew this was going to happen). This set off other manufacturers to do the same. According to the report:

Industry executives also blame excessive stockpiling, which began over the summer when Huawei Technologies Co. — a major smartphone and networking gear maker — began hoarding components to ensure its survival from crippling U.S. sanctions. Led by Huawei, Chinese imports of chips of all kinds climbed to almost $380 billion in 2020 — making up almost a fifth of the country’s overall imports for the year.

Rivals including Apple, worried about their own caches, responded in kind. At the same time, the stay-at-home era spurred sales of home appliances from the costliest TVs to the lowliest air purifiers, all of which now come with smart, customized chips. TSMC executives said on its two most recent earnings calls that customers have been accumulating more inventory than normal to hedge against uncertainties, a maneuver they see persisting for some time.

“There’s a chip stockpiling arms race,” said Will Bright, co-founder and chief product officer at Drop. Analyst Mario Morales of IDC said: “A lot of it can be traced back to the second quarter of last year, when the whole world basically shut down. Many auto companies shut down manufacturing and their suppliers re-prioritized. Not until the second half will we see relief for some of these markets.

Tyler Durden

Thu, 02/11/2021 – 20:50

Read More