By Cyril Widdershoven via OilPrice.com.

A diplomatic crisis between Morocco and Algeria threatens gas supply to Spain

Spain considers importing more (expensive) LNG

Algeria faces a number of problems in expanding its gas market share in Europe

European natural gas supplies are not only waning because of lower Russian supply. Brussels, Berlin and even the Hague are keeping a keen eye on the statements made by Russian President Vladimir Putin and market reports about reduced flows through the Yamal pipeline and Ukraine. At the same time, it seems that Fort Europe is being besieged from all sides. The market is also being confronted by the negative implications of a political crisis between Morocco and Algeria, negatively impacting the latter’s gas supplies to the Iberian Peninsula.

For a few weeks a full-out political, economic and possibly security crisis has been building up between Algeria and Morocco, mainly caused by the still continuing Western Sahara-Mauritania conflict. For decades, Morocco has exerted control over the Western Sahara, fighting a military conflict with rebel movement Polisario, which is backed by Algiers. Until now, Morocco has controlled most of the Western Sahara territory, considering it to be Moroccan. And since August 2021, when Algeria severed its diplomatic relations with Morocco, the conflict has spread to gas pipeline politics too.

Algeria is facing a struggling economy, which has been hit hard by COVID-19, endemic corruption, mismanagement and internal political strive. Algeria’s leaders are also increasingly worried about Morocco’s growing political influence in the region, and even its improving relations with Israel. Internal instability, especially after the death of its former leader Bouteflika, has caused economic mayhem, and has led its oil and gas sector, the major source of income, to decline.

The last decade, both countries also have been in an arms race, which Algeria due to higher oil and gas prices has been winning, but in which Morocco is returning to take the lead. The arms race, combined with a regional power strive between Morocco and Algeria, even into the Gulf region, has caused immense friction. Until now, the strife between the two North-Afican nations, has not had a major impact on Europe. While Brussels, Madrid and other European powers, have been keeping an eye on the conflict and internal developments, the rift was regarded as an insignificant power struggle. This has, however, changed dramatically since Algeria decided to close the Maghreb-Europe gas pipeline on November 1st.

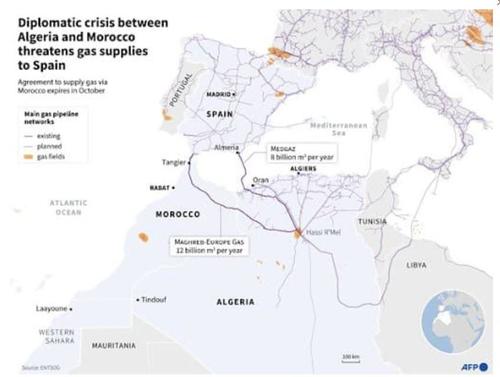

Algiers decided to close down the conduit after Morocco refused to invest in its own part of the gas export pipeline, while still taking a part of the gas in the pipeline as payment for the transfer rights. Morocco used the gas to produce around 12% of the country’s electricity. Due to the closure, Spain is directly affected. In the heads of Algerian leaders, the Medgaz pipeline is seen as a replacement, which would allow Algeria to get rid of intermediaries and to cut Morocco out.

The closure was expected, after that Algerian President Abdelmadjid Tebboune issued an order to Sonatrach, Algeria’s state energy firm, to stop supplying export gas to Spain through the Maghreb pipeline on October 31. Even though Spain has been known as a major renewable energy proponent, mainly wind and solar, the country still relies on natural gas for almost 50% of its energy needs, most of it is being supplied via the Maghreb pipeline.

Knowing that Algeria refuses to renew the contract with Morocco, Spain has been left scrambling for whatever gas supply it can get hold of. Increasing LNG imports is the first option that comes to mind, but buying spot cargoes on the market isn’t going to be easy. Madrid will have to compete with various other European and Asian buyers, which are already paying top-dollar for extra cargoes. As the Iberian Peninsula is not strongly connected to the European gas grid, importing gas from other European nations is also going to be challenging in the short term. Algerian natural gas supplies are still the main and at present the only real option. As the Magrheb-Europe gas pipeline delivered around 6 BCM per year, the gap is immense.

The only other solution is to increase the Medgaz pipeline flows. Medgaz was inaugurated a decade ago and it is controlled jointly by the Algerian state (51%) and by the Spanish energy company Naturgy, formerly known as Gas Natural Fenosa (49%). Normally it provides around 25% of natural gas that reaches Spain. Algeria has pledged to raise its capacity from eight bcm to 10 bcm a year, but Spain would still need around four bcm more to cover its needs. Some Algerian LNG could also be heading to Spain, but the price for these spot cargoes will undoubtedly be high as other countries are also bidding for the same cargoes.

The overall impact on Spain could be significant. Natural gas is not only used for heating or industry use, but also for combined cycle power plants, which are generating around 30-33% of total electricity consumed. When looking at the available strategic gas reserves, the options are limited. Spanish minister of energy Teresa Ribera reported yesterday that the country has only natural gas reserves equivalent to 43 days of consumption. She however also reiterated that Algeria has offered to send higher volumes to Spain if needed.

Algeria’s strategy is very diffuse at present. The lack of transparency in its oil and gas sector is extreme, while overall production capacity is under pressure. Some are even stating that the current crisis could be a way of hiding ongoing supply constraints or outright lack of export volumes.

At the same time, Algeria stated bluntly today that it targets a 30% gas market share in Europe. On October 2nd, Algerian Energy Minister Mohamed Arkab stated that his country was seeking to increase its share of the European gas market to over the current 30%. Algerian press agency APS said that “the minister reiterated the country’s ambition to further strengthen its presence on this market by suggesting additional quantities”. Markets are however very doubtful this will happen in the next 2-5 years. Algeria is currently producing 1.2 million oil barrels per day and 130 billion cubic meters of natural gas annually, making it Africa’s largest gas exporter.