CPI Jumps In Feb, BLS Admits It’s Making Most Of It Up

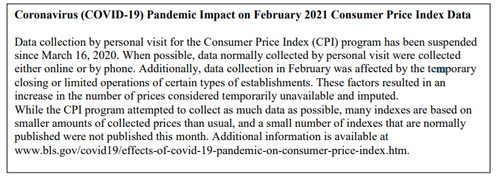

Update: The BLS is basically just admitted it is all BS…“data collection in February was affected by the temporary closing or limited operations of certain types of establishments. These factors resulted in an increase in the number of prices considered temporarily available and imputed”

So take the following data with a pinch of salt (and no there’s no conspiracy cover-up here at all to hide the pernicious effects of massive money-printing… that would be crazy talk).

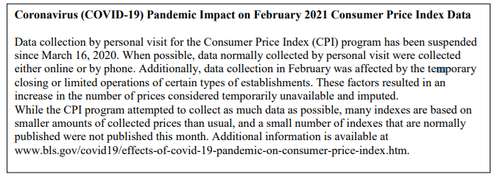

And while you’re ignoring the fact the BLS made all this data up, ignore this chart too…

* * *

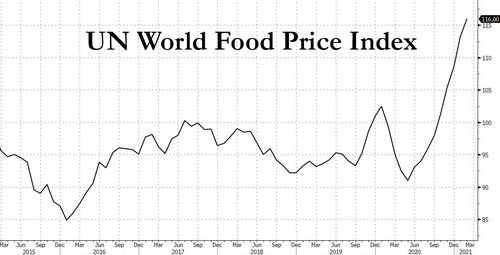

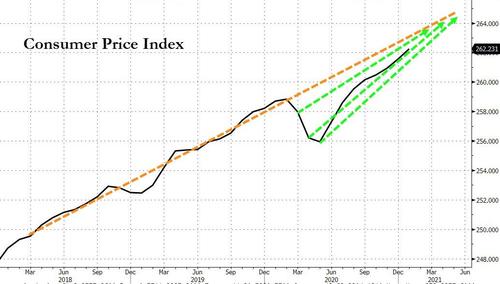

All eyes this morning are on consumer prices as we near the precipice of last year’s collapse and the (artificial) explosion in year over year comps that the short-term collapse will create (temporarily, if The Fed is to be believed). February consumer prices rose at 0.4% MoM – the fastest pace since July, lifting the year-over-year price rise to 1.7% – the highest since Feb 2020…

Source: Bloomberg

This is the ninth straight monthly advance in consumer prices.

However, core CPI disappointed, rising 1.3% YoY vs 1.4% expected as Used Car prices remain a big driver of YoY changes while Apparel and transportation services costs slide…

The index for all items less food and energy rose 0.1 percent in February. The shelter index rose 0.2 percent in February, with the index for owners’ equivalent rent increasing 0.3 percent and the index for rent increasing 0.2 percent. The recreation index increased 0.6 percent in February after decreasing 0.6 percent in January. The motor vehicle insurance index also increased, rising 0.7 percent in February.

The index for airline fares continued to decline in February, falling 5.1 percent following a 3.2-percent decrease in January. The used cars and trucks index fell 0.9 percent over the month, as it did in the 2 previous months. The index for apparel declined 0.7 percent in February after increasing 2.2 percent in January.

The index for all items less food and energy rose 1.3 percent over the past 12 months. Among the indexes rising more quickly were those for used cars and trucks (+9.3 percent), medical care (+2.0 percent), and shelter (+1.5 percent). Indexes that declined over the last 12 months include airline fares (-25.6 percent), apparel (-3.6 percent), and motor vehicle insurance (-2.8 percent).

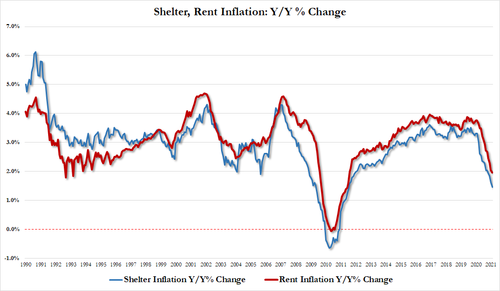

A silver lining – for some – is that Shelter Inflation dropped to 1.47%, from 1.62% in Jan, the lowest since June 2011 and Rent inflation dropped to 1.96% from 2.05% in Jan, the lowest since Aug 2011

So, to summarize:

Case Shiller says home prices as 10 year high

but…

CPI says home price inflation at 10 year low

The big question is – what happens in March, April, and May?

Source: Bloomberg

Which will all be transitory if The Fed is to be believed.

Tyler Durden

Wed, 03/10/2021 – 08:37

CPI Jumps In Feb, BLS Admits It’s Making Most Of It Up

Update: The BLS is basically just admitted it is all BS…”data collection in February was affected by the temporary closing or limited operations of certain types of establishments. These factors resulted in an increase in the number of prices considered temporarily available and imputed”

So take the following data with a pinch of salt (and no there’s no conspiracy cover-up here at all to hide the pernicious effects of massive money-printing… that would be crazy talk).

And while you’re ignoring the fact the BLS made all this data up, ignore this chart too…

* * *

All eyes this morning are on consumer prices as we near the precipice of last year’s collapse and the (artificial) explosion in year over year comps that the short-term collapse will create (temporarily, if The Fed is to be believed). February consumer prices rose at 0.4% MoM – the fastest pace since July, lifting the year-over-year price rise to 1.7% – the highest since Feb 2020…

Source: Bloomberg

This is the ninth straight monthly advance in consumer prices.

However, core CPI disappointed, rising 1.3% YoY vs 1.4% expected as Used Car prices remain a big driver of YoY changes while Apparel and transportation services costs slide…

The index for all items less food and energy rose 0.1 percent in February. The shelter index rose 0.2 percent in February, with the index for owners’ equivalent rent increasing 0.3 percent and the index for rent increasing 0.2 percent. The recreation index increased 0.6 percent in February after decreasing 0.6 percent in January. The motor vehicle insurance index also increased, rising 0.7 percent in February.

The index for airline fares continued to decline in February, falling 5.1 percent following a 3.2-percent decrease in January. The used cars and trucks index fell 0.9 percent over the month, as it did in the 2 previous months. The index for apparel declined 0.7 percent in February after increasing 2.2 percent in January.

The index for all items less food and energy rose 1.3 percent over the past 12 months. Among the indexes rising more quickly were those for used cars and trucks (+9.3 percent), medical care (+2.0 percent), and shelter (+1.5 percent). Indexes that declined over the last 12 months include airline fares (-25.6 percent), apparel (-3.6 percent), and motor vehicle insurance (-2.8 percent).

A silver lining – for some – is that Shelter Inflation dropped to 1.47%, from 1.62% in Jan, the lowest since June 2011 and Rent inflation dropped to 1.96% from 2.05% in Jan, the lowest since Aug 2011

So, to summarize:

Case Shiller says home prices as 10 year high

but…

CPI says home price inflation at 10 year low

The big question is – what happens in March, April, and May?

Source: Bloomberg

Which will all be transitory if The Fed is to be believed.

Tyler Durden

Wed, 03/10/2021 – 08:37

Read More