Cryptocurrency Exchange Binance Banned In The UK

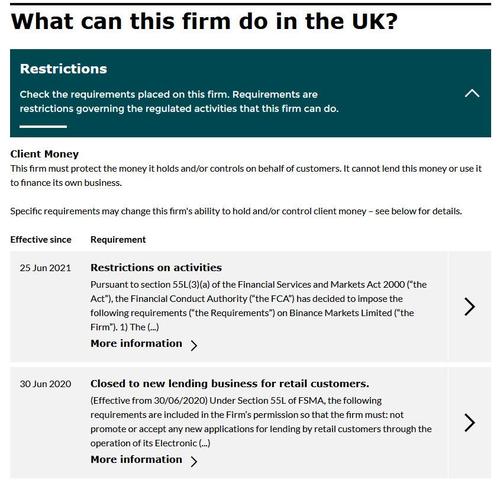

Binance, one of the world’s largest cryptocurrency exchanges, was banned on Sunday from any regulated activities in the UK when Britain’s financial watchdog the Financial Conduct Authority imposed stringent requirements against Binance, a sprawling digital asset firm with subsidiaries around the world. The exchange has until Wednesday evening to confirm it has complied with the watchdog’s demands, including removing all advertising and financial promotions, according to the FCA’s register.

Binance must also make clear on its website, social media channels and all other communications that it is no longer permitted to operate in the U.K.

As part of the FCA’s actions, the regulator ordered Binance to display by next Wednesday on its website that, “BINANCE MARKETS LIMITED IS NOT PERMITTED TO UNDERTAKE ANY REGULATED ACTIVITY IN THE UK.” Binance Markets Limited also must “secure and preserve all records and/or information . . . relating to all UK consumers from its systems” and halt any advertising and financial promotions.

Binance Markets Limited is not approved under the FCA’s cryptocurrency registration regime, which is required for UK groups offering digital asset services. The entity had applied to become a registered cryptocurrency company with the regulator, but pulled that application last month according to two people familiar with the situation. The watchdog confirmed the application had been dropped “following intensive engagement from the FCA”.

The FCA’s focus in deciding whether or not to approve such applications is based on a review of controls and practices to prevent money laundering and the financing of terrorism.

As Bloomberg adds, Binance, which announced the acquisition of an FCA-regulated entity last June along with plans for the launch of Binance.UK, won’t be able to resume U.K. operations without prior written consent. The FCA also issued a consumer warning against both the Cayman Islands-registered Binance holdings company and Binance Markets Limited, a London-based affiliate that is controlled by chief executive Changpeng Zhao and is overseen by the UK regulator.

“A significantly high number of cryptoasset businesses are not meeting the required standards under the money laundering regulations, which has resulted in an unprecedented number of businesses withdrawing their applications,” an FCA spokesperson said. Of the firms assessed, more than 90% have withdrawn applications following the FCA’s intervention.

The move represents the UK’s most substantial regulatory crackdown on the cryptocurrency sector amid concerns about its potential involvement in money laundering and fraud. Binance withdrew an application related to the 5MLD – an anti-laundering directive – on May 17 following “intensive engagement from the FCA,” according to the watchdog, which said the action had been in train for some time.

Binance is one of the most important operators in the fast-emerging crypto market, offering a wide range of services to customers around the world, including trading in dozens of digital coins, futures, options, stock tokens, as well as savings accounts and lending. It recorded crypto trading volumes equivalent to $1.5 trillion last month, according to data from TheBlockCrypto.

Binance Markets Limited was established a year ago as part of a plan by the broader group to launch a UK-focused exchange, Binance UK, which would have been “ring fenced” from the wider global operation, according to public documents and the two people familiar with the matter. Although the FCA has restricted Binance from offering services in the UK, British citizens can still access Binance’s services in other jurisdictions.

London-based Binance Markets Limited had permission from the FCA to provide consumers with investment services in traditional currencies, something Binance achieved by purchasing a financial company that was already registered with the regulator. The transaction was approved by the FCA last June, according to public documents.

The FCA’s decision comes after Japan’s Financial Services Agency warned last week that Binance was conducting unauthorised trade in cryptocurrencies with Japanese citizens. It is the second time the FSA has warned about Binance after publishing an identical notice in 2018.

As the FT reminds us, Germany’s financial watchdog warned investors in April that Binance had probably violated securities rules over its launch of trading in stock tokens, something the exchange tried unsuccessfully to appeal against.

In a comment on twitter on Saturday following news that Binance had banned the use of crypto in Canada’s Ontario province, Binance founder Changpeng Zhao, better known as CZ, said that “new regulations come out all the time in new industries. We always respect them. We will find ways to service regions with clear regulations in (new) compliant ways. It does take time sometimes. Applications processes are often outside of our control.”

New regulations come out all the time in new industries. We always respect them. We will find ways to service regions with clear regulations in (new) compliant ways. It does take time sometimes. Applications processes are often outside of our control.

— CZ 🔶 Binance (@cz_binance) June 26, 2021

The latest regulatory crackdown comes at a time of significant volatility for bitcoin and the broader crypto space: after doubling in April, bitcoin has since erased most of its gains for the year, briefly dripping into the red last week before recovering some of its losses.

Tyler Durden

Sun, 06/27/2021 – 11:30

Cryptocurrency Exchange Binance Banned In The UK

Binance, one of the world’s largest cryptocurrency exchanges, was banned on Sunday from any regulated activities in the UK when Britain’s financial watchdog the Financial Conduct Authority imposed stringent requirements against Binance, a sprawling digital asset firm with subsidiaries around the world. The exchange has until Wednesday evening to confirm it has complied with the watchdog’s demands, including removing all advertising and financial promotions, according to the FCA’s register.

Binance must also make clear on its website, social media channels and all other communications that it is no longer permitted to operate in the U.K.

As part of the FCA’s actions, the regulator ordered Binance to display by next Wednesday on its website that, “BINANCE MARKETS LIMITED IS NOT PERMITTED TO UNDERTAKE ANY REGULATED ACTIVITY IN THE UK.” Binance Markets Limited also must “secure and preserve all records and/or information . . . relating to all UK consumers from its systems” and halt any advertising and financial promotions.

Binance Markets Limited is not approved under the FCA’s cryptocurrency registration regime, which is required for UK groups offering digital asset services. The entity had applied to become a registered cryptocurrency company with the regulator, but pulled that application last month according to two people familiar with the situation. The watchdog confirmed the application had been dropped “following intensive engagement from the FCA”.

The FCA’s focus in deciding whether or not to approve such applications is based on a review of controls and practices to prevent money laundering and the financing of terrorism.

As Bloomberg adds, Binance, which announced the acquisition of an FCA-regulated entity last June along with plans for the launch of Binance.UK, won’t be able to resume U.K. operations without prior written consent. The FCA also issued a consumer warning against both the Cayman Islands-registered Binance holdings company and Binance Markets Limited, a London-based affiliate that is controlled by chief executive Changpeng Zhao and is overseen by the UK regulator.

“A significantly high number of cryptoasset businesses are not meeting the required standards under the money laundering regulations, which has resulted in an unprecedented number of businesses withdrawing their applications,” an FCA spokesperson said. Of the firms assessed, more than 90% have withdrawn applications following the FCA’s intervention.

The move represents the UK’s most substantial regulatory crackdown on the cryptocurrency sector amid concerns about its potential involvement in money laundering and fraud. Binance withdrew an application related to the 5MLD – an anti-laundering directive – on May 17 following “intensive engagement from the FCA,” according to the watchdog, which said the action had been in train for some time.

Binance is one of the most important operators in the fast-emerging crypto market, offering a wide range of services to customers around the world, including trading in dozens of digital coins, futures, options, stock tokens, as well as savings accounts and lending. It recorded crypto trading volumes equivalent to $1.5 trillion last month, according to data from TheBlockCrypto.

Binance Markets Limited was established a year ago as part of a plan by the broader group to launch a UK-focused exchange, Binance UK, which would have been “ring fenced” from the wider global operation, according to public documents and the two people familiar with the matter. Although the FCA has restricted Binance from offering services in the UK, British citizens can still access Binance’s services in other jurisdictions.

London-based Binance Markets Limited had permission from the FCA to provide consumers with investment services in traditional currencies, something Binance achieved by purchasing a financial company that was already registered with the regulator. The transaction was approved by the FCA last June, according to public documents.

The FCA’s decision comes after Japan’s Financial Services Agency warned last week that Binance was conducting unauthorised trade in cryptocurrencies with Japanese citizens. It is the second time the FSA has warned about Binance after publishing an identical notice in 2018.

As the FT reminds us, Germany’s financial watchdog warned investors in April that Binance had probably violated securities rules over its launch of trading in stock tokens, something the exchange tried unsuccessfully to appeal against.

In a comment on twitter on Saturday following news that Binance had banned the use of crypto in Canada’s Ontario province, Binance founder Changpeng Zhao, better known as CZ, said that “new regulations come out all the time in new industries. We always respect them. We will find ways to service regions with clear regulations in (new) compliant ways. It does take time sometimes. Applications processes are often outside of our control.”

New regulations come out all the time in new industries. We always respect them. We will find ways to service regions with clear regulations in (new) compliant ways. It does take time sometimes. Applications processes are often outside of our control.

— CZ 🔶 Binance (@cz_binance) June 26, 2021

The latest regulatory crackdown comes at a time of significant volatility for bitcoin and the broader crypto space: after doubling in April, bitcoin has since erased most of its gains for the year, briefly dripping into the red last week before recovering some of its losses.

Tyler Durden

Sun, 06/27/2021 – 11:30

Read More