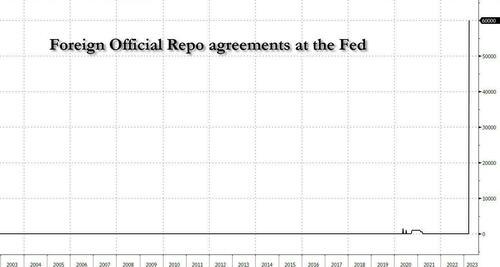

On Friday, amid the US Fed’s H.4.1 report, it was noted an unprecedented surge in foreign official Repo ($60 billion) under the Fed’s new FIMA repo facility, which means that the offshore scramble for dollars was alive and well, and someone really needed access to USD. The assumption was that it was Credit Suisse (or UBS) shoring up some shortfalls, but with the action of the last couple of days, others are worrying that there is more afoot in the EU banking system.

After a brief respite earlier in the week, European bank stocks are cratering once again, now at 3-month lows (catching down to Senior Financial CDS)…

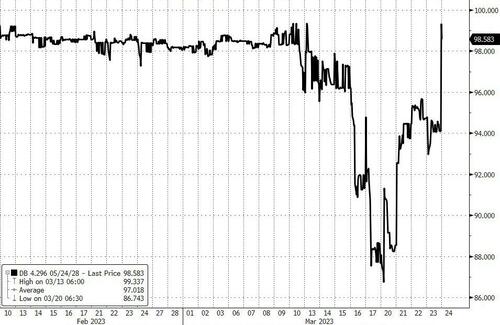

Deutsche Bank stock has crashed to 5-month lows…

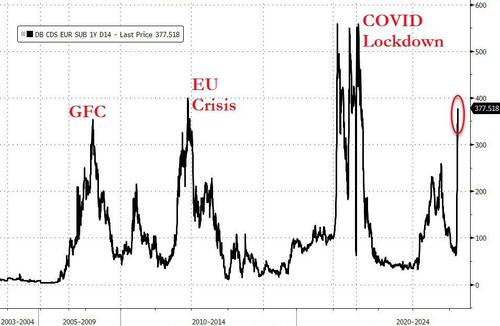

Deutsche Bank CDS is soaring (Commerzbank is also rising rapidly)…

Source: Bloomberg

With the most crucial aspect (short-dated protection mainly used as a counterparty risk by derivatives trading partners) is very aggressively bid…

Source: Bloomberg

Notably, Deutsche unexpectedly announced its decision to redeem a tier 2 subordinated bond on Friday in a reassuring effort.

“Deutsche’s decision to redeem (having received all required regulatory approvals) should be a reassuring signal to credit investors,” Autonomous analyst Stuart Graham wrote in a note on Friday.

But instead, other Deutsche Bank AT1 bonds have plunged in price (with yields soaring above 16%)…

Source: Bloomberg

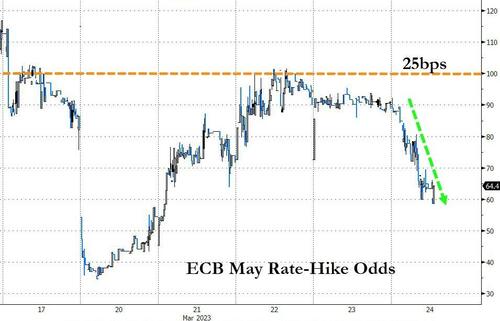

Notably, ECB rate-hike odds have plunged this morning from 25bps in May fully priced-in to just 60% odds now…

Source: Bloomberg

There is no specific news on DB to catalyze these moves but if DB is next, then the world’s financial system has a serious problem that makes CS look like SVB.