Does The World Need A Gold-Backed Deutsche Mark?

Authored by Patrick Barron via The Mises Institute,

The seeds of sound-money destruction were sown at the 1944 Bretton Woods Conference, which established that US dollars could be held as central bank reserves and were redeemable for gold by the US Treasury at thirty-five dollars an ounce. This was the so-called gold exchange standard, but only foreign central banks and some multinational organizations, such as the International Monetary Fund (IMF), enjoyed this right of redemption. The system depended upon the solemn promise by the US that it would refrain from issuing unbacked dollars. The watershed event that ushered in a new malignant, pure fiat money era occurred on August 15, 1971, when the US abandoned the gold exchange standard in order to stop the drain on the US gold stock.

American money printing had begun in earnest in the previous decade in order to finance Lyndon Johnson’s “guns and butter” policy. The Fed monetized government debt to fund LBJ’s Great Society welfare programs while the government fought a war in Southeast Asia at the same time. Dollar claims in the form of government bills and bonds built up at central banks around the world. At the recommendation of French economic advisor Jacque Rueff, a free market economist and gold standard proponent, French president Charles de Gaulle ordered the Bank of France to redeem 80 percent of its US dollar holdings for gold, per the solemn promise made at Bretton Woods. Thus began a run on the US Treasury’s gold reserves that culminated in President Nixon taking the dishonorable action of abandoning the gold exchange standard. This set the course of unfettered fiat money expansion that has led the world to the precipice of monetary destruction.

This end to the Bretton Woods system—itself already deeply flawed—ushered in the age of competing fiat currencies worldwide. We are now headed toward the chaotic destruction of this system as well.

The Scenario for a Worldwide Currency Collapse

Alasdair Macleod has written exhaustively of the inevitable destructive result of money printing that now has entered hyperinflation in America. Macleod defines hyperinflation not as prices out of control (yet) but as the scenario whereby government spending can be financed only through ever-increasing issues of fiat money. Skyrocketing price inflation, the traditional definition of hyperinflation, follows inevitably from previous acts of excessive and increasing money printing that first reveal their destructive nature in stock market, real estate, and commodity bubbles before emerging as out-of-control consumer price inflation that devastates society, as seen in Weimar Germany in 1923, and more recently in Argentina, Venezuela, Zimbabwe, and elsewhere. The horror stops only when society abandons the hyperinflated money and adopts a new or different currency.

In reality is it is far more difficult to halt hyperinflation events than is supposed. For example, in 1923, Weimar Germany tied its new currency to the dollar, which was still on the gold standard. It was thought this could bring the crisis to an end. But years of economic decline and depression followed. The damage had already been done. As a result, German civil society had been destroyed and its citizens traumatized to the extent that within ten years full-blown totalitarian dictatorship was seen as the only viable solution to internal civil disorder.

Today there is no gold standard currency in the world to which the US and the West could link their hyperinflated currencies. The most likely outcome will be a return to a gold-backed dollar, but only after American civil society has been forever altered for the worse and the American people traumatized as were the Germans during the 1920s.

Could a Revived Deutsche Mark Save Us?

But there is an option still available to the West—a voluntary abandonment of Keynesian economics and other schools of thought that embrace money printing as a solution to economic problems—and the linking of the US dollar to its still substantial gold reserves. But what development could move the US toward strengthening its currency voluntarily? Germany!

Germany is the fourth-largest economy in the world and probably the soundest financially. Germany’s federal government regularly runs budget surpluses, a phenomenon last seen briefly in the US in the 1990s and before that in the Eisenhower presidency of the 1950s. Germany does not rely upon borrowing, much less money printing (called monetization), to balance its books. Prior to Germany joining the eurozone, the Deutsche mark of West Germany was the strongest currency in Europe. For decades it appreciated gradually against all currencies, including the US dollar. As such, it served as a rebuke to the inflationary monetary proclivities of its trading partners. But the DM was more than a rebuke; it was a real market force that prevented its trading partners from debasing their own currencies too rapidly. Prices of highly desirable German goods rose in foreign currency cost even when their prices as denominated in DM remained stable or even fell somewhat. This was especially troubling to France, which feared a resurgence of German economic power in the heart of Europe.

The opportunity for France to eliminate the DM and gain some control over the German economy arose after the fall of the Soviet Union and the government of its puppet state East Germany in the early 1990s. Germans on both sides of the now torn-down Berlin Wall desired to reunite their country politically. Eschewing force majeure, Germany sought the approval of the US, France, and the UK to reunite. In a still controversial and not universally accepted scenario—see this report from Spiegel International—France let it be known that it would give approval to a reunited Germany only if West Germany scrapped the DM and used the euro. German central bankers may actually have thought that they could prevail to make the euro a super-DM. They quickly learned otherwise as they were outvoted at key policy debates, and they watched helplessly as the European Central Bank violated the terms of its charter not to inflate the euro or to support the debt obligations of its members.

Reinstating the Deutsche Mark Would Be Good for Both Germany and the World

The decision to leave the inflationist eurozone is a political decision only. There is nothing in economic science that would prevent Germany from doing so and even adopting a gold standard. As explained by Ludwig von Mises in chapter eleven of Omnipotent Government:

No international agreements or international planning is needed if a government wants to return to the gold standard. Every nation, whether rich or poor, powerful or feeble, can at any hour once again adopt the gold standard. The only condition required is the abandonment of an easy money policy and of the endeavors to combat imports by devaluation.

The question involved here is not whether a nation should return to the particular gold parity that it had once established and has long since abandoned. Such a policy would of course now mean deflation. But every government is free to stabilize the existing exchange ratio between its national currency unit and gold, and to keep this ratio stable. If there is no further credit expansion and no further inflation, the mechanism of the gold standard or of the gold exchange standard will work again.

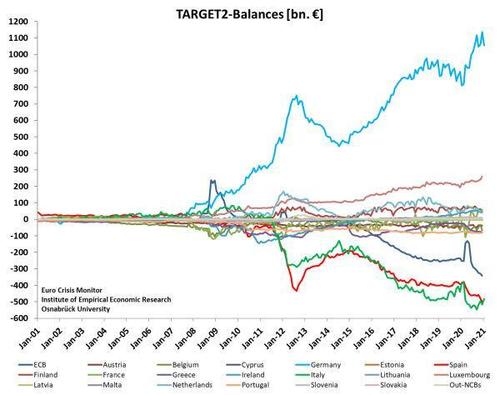

Germany is being plundered economically and financially by mostly southern European countries, as we can see in this time series of the Trans-European Automated Real-Time Gross Settlement Express Transfer System (TARGET2). TARGET2 records the claims and liabilities of the ECB and national central banks against the Eurosystem. A country’s TARGET2 balance is affected by its surpluses/deficits in (i) the current account, (ii) the financial account, and/or (iii) the capital account. It is reminiscent of a swap line operation or a change in foreign reserves under a fixed exchange rate arrangement:

In essence, Germany is building high-quality goods that are being purchased by other eurozone countries with money printed out of thin air by the European Central Bank. Currently Germany’s TARGET2 balance at the European Central Bank is in excess of €1 trillion. The quality of Germany’s TARGET2 credit is suspect, to say the least, as explained here by Macleod. National central banks in highly TARGET2-deficit countries have been declaring nonperforming loans as suitable collateral to obtain loans from the European Central Bank. This dumping of problem loans into TARGET2 will reduce the Bundesbank’s assets in an inevitable banking crisis. The process of capital confiscation is increasing as the European Central Bank expands its so-called quantitative easing program.

The simple answer is for Germany to leave the eurozone and reinstate the Deusche mark. Doing so would be a benign act of rational self-interest by a sovereign nation. Most probably many current eurozone countries would leave, too. Without Germany to fund the budget deficits of the mostly southern members of the eurozone, the European Central Bank would shift its mechanism of plunder—the TARGET2 system—to the few remaining semiresponsible but much smaller nations. To avoid this fate, these more responsible nations would either adopt the DM themselves or reinstate their former local currencies and link them to the DM. This would leave the profligate nations of the former eurozone with no host to plunder. Reinstating their own currencies would probably be short lived, as no one would buy their bonds. The eurozone will collapse, leaving the only option, eventually—for all of Europe to become a DM zone, either adopting the DM themselves, as they adopted the euro decades ago, or through direct linkage of local currencies to the DM. A sound DM would force these former eurozone nations to adopt more responsible spending and regulatory regimes.

A Cascade of Benevolent Reform around the World

Reinstating the DM, a peaceful act by a sovereign country, would create a cascade of monetary reform throughout the world. Europe’s trading partners would find the cost of necessary imports rising in terms of their local currencies, forcing them to adopt fiscal and monetary responsibility. Gresham’s law—that overvalued money drives out undervalued money—would work in reverse in international finance, because there is nothing to force foreigners to settle trade accounts with the dollar. Governments certainly can use legal tender laws to force their citizens to use “bad” money within their borders, but they cannot force sovereign nations to do so for very long. Just as superior automobiles from Japan and South Korea forced US automakers to up their game, a strong DM will force the US to strengthen the dollar. If it does not, the world will abandon the dollar for international trade. All that is required for this process to begin is for Germany, a sovereign nation, to leave the eurozone and reinstate the Deutsche mark. No treaties are required. Germany needs no one’s permission to leave the euro zone. The sooner it does so, the better for itself and for the world.

Tyler Durden

Mon, 02/15/2021 – 06:00

Does The World Need A Gold-Backed Deutsche Mark?

Authored by Patrick Barron via The Mises Institute,

The seeds of sound-money destruction were sown at the 1944 Bretton Woods Conference, which established that US dollars could be held as central bank reserves and were redeemable for gold by the US Treasury at thirty-five dollars an ounce. This was the so-called gold exchange standard, but only foreign central banks and some multinational organizations, such as the International Monetary Fund (IMF), enjoyed this right of redemption. The system depended upon the solemn promise by the US that it would refrain from issuing unbacked dollars. The watershed event that ushered in a new malignant, pure fiat money era occurred on August 15, 1971, when the US abandoned the gold exchange standard in order to stop the drain on the US gold stock.

American money printing had begun in earnest in the previous decade in order to finance Lyndon Johnson’s “guns and butter” policy. The Fed monetized government debt to fund LBJ’s Great Society welfare programs while the government fought a war in Southeast Asia at the same time. Dollar claims in the form of government bills and bonds built up at central banks around the world. At the recommendation of French economic advisor Jacque Rueff, a free market economist and gold standard proponent, French president Charles de Gaulle ordered the Bank of France to redeem 80 percent of its US dollar holdings for gold, per the solemn promise made at Bretton Woods. Thus began a run on the US Treasury’s gold reserves that culminated in President Nixon taking the dishonorable action of abandoning the gold exchange standard. This set the course of unfettered fiat money expansion that has led the world to the precipice of monetary destruction.

This end to the Bretton Woods system—itself already deeply flawed—ushered in the age of competing fiat currencies worldwide. We are now headed toward the chaotic destruction of this system as well.

The Scenario for a Worldwide Currency Collapse

Alasdair Macleod has written exhaustively of the inevitable destructive result of money printing that now has entered hyperinflation in America. Macleod defines hyperinflation not as prices out of control (yet) but as the scenario whereby government spending can be financed only through ever-increasing issues of fiat money. Skyrocketing price inflation, the traditional definition of hyperinflation, follows inevitably from previous acts of excessive and increasing money printing that first reveal their destructive nature in stock market, real estate, and commodity bubbles before emerging as out-of-control consumer price inflation that devastates society, as seen in Weimar Germany in 1923, and more recently in Argentina, Venezuela, Zimbabwe, and elsewhere. The horror stops only when society abandons the hyperinflated money and adopts a new or different currency.

In reality is it is far more difficult to halt hyperinflation events than is supposed. For example, in 1923, Weimar Germany tied its new currency to the dollar, which was still on the gold standard. It was thought this could bring the crisis to an end. But years of economic decline and depression followed. The damage had already been done. As a result, German civil society had been destroyed and its citizens traumatized to the extent that within ten years full-blown totalitarian dictatorship was seen as the only viable solution to internal civil disorder.

Today there is no gold standard currency in the world to which the US and the West could link their hyperinflated currencies. The most likely outcome will be a return to a gold-backed dollar, but only after American civil society has been forever altered for the worse and the American people traumatized as were the Germans during the 1920s.

Could a Revived Deutsche Mark Save Us?

But there is an option still available to the West—a voluntary abandonment of Keynesian economics and other schools of thought that embrace money printing as a solution to economic problems—and the linking of the US dollar to its still substantial gold reserves. But what development could move the US toward strengthening its currency voluntarily? Germany!

Germany is the fourth-largest economy in the world and probably the soundest financially. Germany’s federal government regularly runs budget surpluses, a phenomenon last seen briefly in the US in the 1990s and before that in the Eisenhower presidency of the 1950s. Germany does not rely upon borrowing, much less money printing (called monetization), to balance its books. Prior to Germany joining the eurozone, the Deutsche mark of West Germany was the strongest currency in Europe. For decades it appreciated gradually against all currencies, including the US dollar. As such, it served as a rebuke to the inflationary monetary proclivities of its trading partners. But the DM was more than a rebuke; it was a real market force that prevented its trading partners from debasing their own currencies too rapidly. Prices of highly desirable German goods rose in foreign currency cost even when their prices as denominated in DM remained stable or even fell somewhat. This was especially troubling to France, which feared a resurgence of German economic power in the heart of Europe.

The opportunity for France to eliminate the DM and gain some control over the German economy arose after the fall of the Soviet Union and the government of its puppet state East Germany in the early 1990s. Germans on both sides of the now torn-down Berlin Wall desired to reunite their country politically. Eschewing force majeure, Germany sought the approval of the US, France, and the UK to reunite. In a still controversial and not universally accepted scenario—see this report from Spiegel International—France let it be known that it would give approval to a reunited Germany only if West Germany scrapped the DM and used the euro. German central bankers may actually have thought that they could prevail to make the euro a super-DM. They quickly learned otherwise as they were outvoted at key policy debates, and they watched helplessly as the European Central Bank violated the terms of its charter not to inflate the euro or to support the debt obligations of its members.

Reinstating the Deutsche Mark Would Be Good for Both Germany and the World

The decision to leave the inflationist eurozone is a political decision only. There is nothing in economic science that would prevent Germany from doing so and even adopting a gold standard. As explained by Ludwig von Mises in chapter eleven of Omnipotent Government:

No international agreements or international planning is needed if a government wants to return to the gold standard. Every nation, whether rich or poor, powerful or feeble, can at any hour once again adopt the gold standard. The only condition required is the abandonment of an easy money policy and of the endeavors to combat imports by devaluation.

The question involved here is not whether a nation should return to the particular gold parity that it had once established and has long since abandoned. Such a policy would of course now mean deflation. But every government is free to stabilize the existing exchange ratio between its national currency unit and gold, and to keep this ratio stable. If there is no further credit expansion and no further inflation, the mechanism of the gold standard or of the gold exchange standard will work again.

Germany is being plundered economically and financially by mostly southern European countries, as we can see in this time series of the Trans-European Automated Real-Time Gross Settlement Express Transfer System (TARGET2). TARGET2 records the claims and liabilities of the ECB and national central banks against the Eurosystem. A country’s TARGET2 balance is affected by its surpluses/deficits in (i) the current account, (ii) the financial account, and/or (iii) the capital account. It is reminiscent of a swap line operation or a change in foreign reserves under a fixed exchange rate arrangement:

In essence, Germany is building high-quality goods that are being purchased by other eurozone countries with money printed out of thin air by the European Central Bank. Currently Germany’s TARGET2 balance at the European Central Bank is in excess of €1 trillion. The quality of Germany’s TARGET2 credit is suspect, to say the least, as explained here by Macleod. National central banks in highly TARGET2-deficit countries have been declaring nonperforming loans as suitable collateral to obtain loans from the European Central Bank. This dumping of problem loans into TARGET2 will reduce the Bundesbank’s assets in an inevitable banking crisis. The process of capital confiscation is increasing as the European Central Bank expands its so-called quantitative easing program.

The simple answer is for Germany to leave the eurozone and reinstate the Deusche mark. Doing so would be a benign act of rational self-interest by a sovereign nation. Most probably many current eurozone countries would leave, too. Without Germany to fund the budget deficits of the mostly southern members of the eurozone, the European Central Bank would shift its mechanism of plunder—the TARGET2 system—to the few remaining semiresponsible but much smaller nations. To avoid this fate, these more responsible nations would either adopt the DM themselves or reinstate their former local currencies and link them to the DM. This would leave the profligate nations of the former eurozone with no host to plunder. Reinstating their own currencies would probably be short lived, as no one would buy their bonds. The eurozone will collapse, leaving the only option, eventually—for all of Europe to become a DM zone, either adopting the DM themselves, as they adopted the euro decades ago, or through direct linkage of local currencies to the DM. A sound DM would force these former eurozone nations to adopt more responsible spending and regulatory regimes.

A Cascade of Benevolent Reform around the World

Reinstating the DM, a peaceful act by a sovereign country, would create a cascade of monetary reform throughout the world. Europe’s trading partners would find the cost of necessary imports rising in terms of their local currencies, forcing them to adopt fiscal and monetary responsibility. Gresham’s law—that overvalued money drives out undervalued money—would work in reverse in international finance, because there is nothing to force foreigners to settle trade accounts with the dollar. Governments certainly can use legal tender laws to force their citizens to use “bad” money within their borders, but they cannot force sovereign nations to do so for very long. Just as superior automobiles from Japan and South Korea forced US automakers to up their game, a strong DM will force the US to strengthen the dollar. If it does not, the world will abandon the dollar for international trade. All that is required for this process to begin is for Germany, a sovereign nation, to leave the eurozone and reinstate the Deutsche mark. No treaties are required. Germany needs no one’s permission to leave the euro zone. The sooner it does so, the better for itself and for the world.

Tyler Durden

Mon, 02/15/2021 – 06:00

Read More