Blistering economic sanctions that threaten to ruin the ruble may leave Putin with little choice but to ally himself further with China and challenge the dollar head-on.

The war being waged by Russia in Ukraine shows no signs of coming to any type of peaceful end.

Meanwhile, it appears to me that a separate war on the U.S. dollar could be “officially” waged at any moment, by Russia and China collectively, as the situation in Ukraine grows more dire, as Russia’s options wane and its ties with China grow closer.

While the hope is still to avoid a World War III type scenario, escalating sanctions from the West are forcing Vladimir Putin to consider his options for pushback.

For example, on Sunday, Putin put nuclear deterrence forces on high alert as a response to increasing pressure from NATO, in a move that the U.S. ambassador to the United Nations said “escalates the conflict unacceptably.”

In the same breath that Putin made this announcement, he continued to push back on economic sanctions being levied against Russia:

“As you can see, not only do Western countries take unfriendly measures against our country in the economic dimension – I mean the illegal sanctions that everyone knows about very well.”

This may be because the bigger story over the weekend was the beginning of removing Russia from the SWIFT intra-bank messaging system, along with sanctions targeting Russia’s Central Bank.

SWIFT helps provide services related to the execution of financial transactions and payments between banks worldwide. Central Bank sanctions from the EU and the Fed instantly make Russia – and its currency, the ruble – pariahs elsewhere in the world.

Russia’s Central Bank reserves are generally controlled by foreign central banks. If those foreign banks decide to freeze access to such reserves, Russia only has its tangible assets (such as oil, and gold reserves) to fall back on.

The ruble is expected to fall as a result of these sanctions.

Said one analyst on Twitter over the weekend, the Kremlin “has no good off-ramps at this point”.

The obvious consequences of these sanctions is a run on Russia’s banks and a crippling of the Russian economy.

The Bank of Russia (Russia’s Central Bank) will now try to prevent a crisis of confidence among the citizens of the country to slow the economic bleeding.

The BBC reported that Russia’s Central Bank has claimed it “has the necessary resources and tools to maintain financial stability and ensure the operational continuity of the financial sector.”

Regardless of whether this is true (the global FX markets will be the judge), it brings up a topic that only “conspiracy theorists” have talked about for decades: the resolve of fiat currencies, and the importance of having tangible bank reserves.

During decades of peace, it’s easy to simply ignore critical questions raised about the backing of fiat currencies while the next trillion dollars casually rolls off the Fed printer and is inequitably distributed through programs like the Paycheck Protection Program. Not unlike equity markets when they’re in a mania, few critical questions are asked while loopholes like money printing are exploited until something eventually gives out.

Now, something is giving out. All those quotes about the “world order” changing as a result of Putin’s recent action? They’re worth paying attention to. They’re the definition of something “giving out”.

When push comes to shove and things get down to brass tacks, people want to know what backs their currency, and it’s not just Russia in this case. While they’re going to be the obvious example, I think economic tensions between Russia and the West are going to stoke a far larger global discussion about the fiat system in general.

After all, heading into this massive conflict, we were already at the precipice of “The Great Reset”, right?

Now, China and Russia may speed that “reset” along much quicker – and in much more volatile fashion – than Klaus Schwab would approve of.

Sorry, Klaus.

The fact is that if Putin has his mind made up to “go the distance” in Ukraine, come hell or high water, he’s going to have to somehow address the crippling of his country’s currency and economy. Left with few “off-ramps”, my guess is that Putin will push back on economic sanctions by allying himself further with China, and even discussing with China the prospects of a monetary system outside of the current global monetary system.

While the idea will likely be written off by economic experts, it’s important to remember that, even if such an idea doesn’t succeed, it could still create chaos for global economic markets and life in the West. We’re already in the midst of a supply chain crisis here in the U.S. – now, add to that the facts that:

- Russia has tangible reserves in the form of oil and gold. Russia is the top supplier of imported gasoline to the United States. “In 2021, Russia accounted for 21% of all U.S. gasoline imports,” Forbes writes.

- China is a major supplier of…basically everything…we use in the West on a daily basis. China was the United States’ largest supplier of goods imports in 2020, according to the USTR. China is currently our largest goods trading partner with $559.2 billion in total (two way) goods trade during 2020, the same report notes.

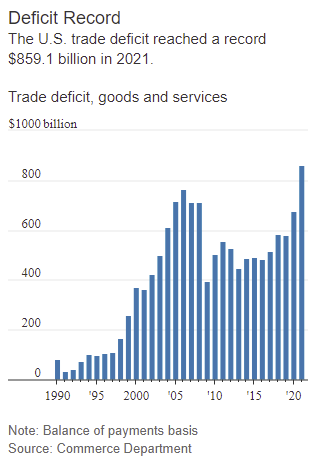

Trade deficits hit further records in 2021, the WSJ reported earlier this month.

In other words, we get tons of stuff – for lack of a better word – from both countries.

This prediction shouldn’t surprise anyone that has been paying attention.

Just one year ago, the idea of Russia and China working together to de-dollarize themselves made headlines. The Washington Post reported on the steps the two countries were collectively taking in April 2021:

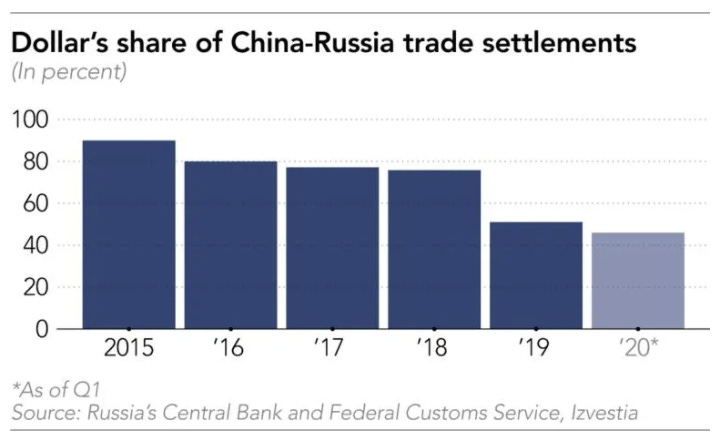

China and Russia have vowed to jointly “de-dollarize,” creating alternatives to the current system with a three-step plan that began a few years ago. First, both countries began to cut back the proportion of their bilateral trade invoiced in dollars, privileging settlement in their own currencies.

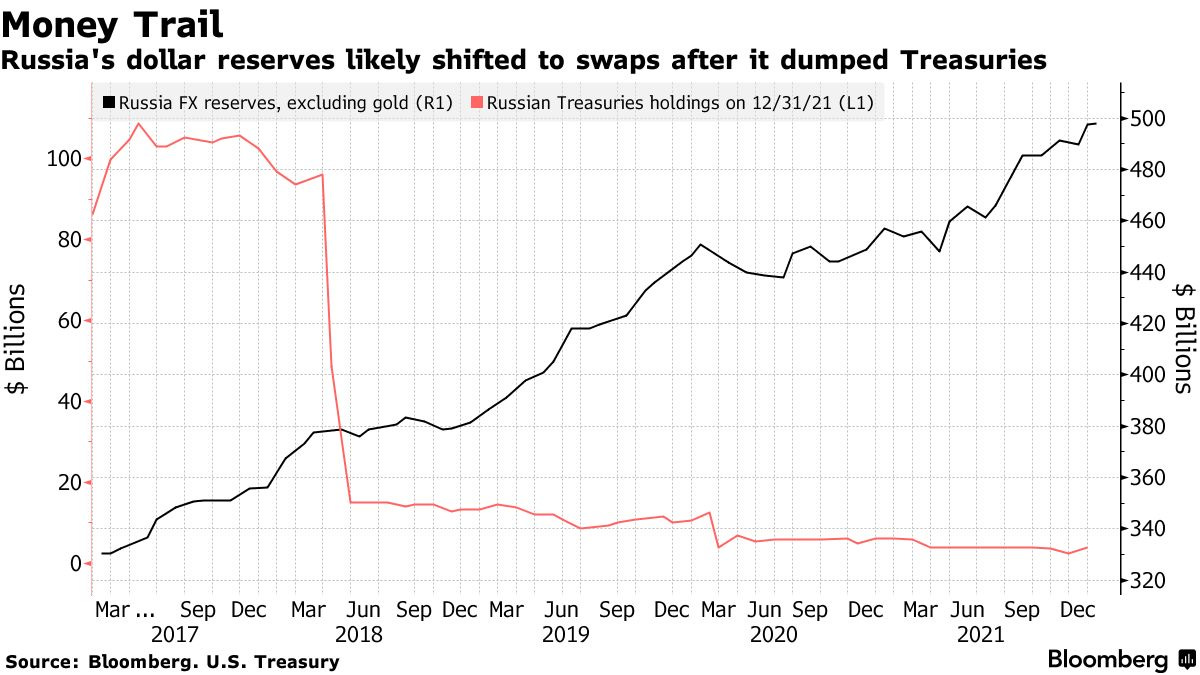

Second, they have sought to boost the renminbi’s role as an international currency for payments and reserves. To encourage wider adoption of its currency, China has given more than 30 countries renminbi access through bilateral swap agreements. China and Russia each scaled back their U.S. Treasury holdings, with Russia channeling cash into renminbi holdings. And China has ramped up the digital currency drive it began in 2014, with the goal of making it easier to hold renminbi.

The third and last leg of these efforts, still underway, aims to create alternative payments and messaging systems allowing countries to use home and partner currencies instead of dollars or euros to settle trade and investment deals.

Far be it for me to agree with the Washington Post, but they were spot on in early 2021 when they concluded that:

“If China and Russia devise successful alternatives to the dollar-centered financial system, and if these alternatives gain significant international traction, we would be witnessing a cataclysmic moment in great power rivalry.”

Meanwhile, we have been standing idly by, watching Russia dump U.S. treasuries while increasing its FX reserves over the last 5 years.

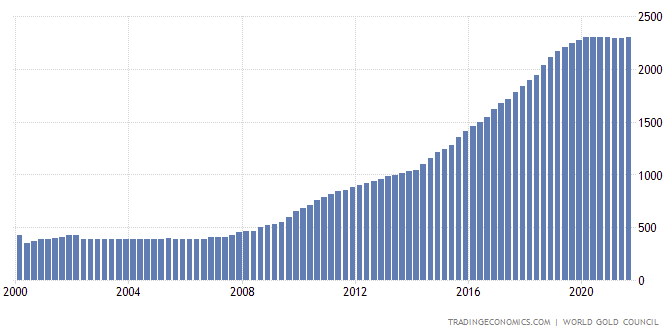

Russia has also been increasing its holdings of gold over the same period:

De-dollarization and a financial alliance between Russia and China was being reported in 2020, as well.

Nikkei wrote at the time:

Dedollarization has been a priority for Russia and China since 2014, when they began expanding economic cooperation following Moscow’s estrangement from the West over its annexation of Crimea. Replacing the dollar in trade settlements became a necessity to sidestep U.S. sanctions against Russia.

The idea of a Russia-China alliance to try and collapse the U.S. economic system isn’t new, either. Russia tried to push China create chaos for the U.S. in the wake of the 2008 financial crisis.

“Russia may have tried to conspire with China in a bid to collapse the U.S. financial system. They were hoping to sell Fannie and Freddie bonds during a time when the U.S. economy was on the ropes,” Insider wrote in 2010, citing Hank Paulson’s memoir about the crisis.

Paulson wrote in his memoir:

“The report was deeply troubling — heavy selling could create a sudden loss of confidence in the GSEs and shake the capital markets. I waited till I was back home and in a secure environment to inform the president.”

Stories like this flew under the radar, anyone who brought up the idea that this could be part of some larger plan was largely ignored, and the story didn’t make waves – at least, not in the way I think it’s going to now.

In a podcast I did with Danielle DiMartino Booth, formerly of the Federal Reserve Bank of Dallas, in 2020, she claimed that a “hot war” could be the only thing that could dethrone the dollar as the world reserve currency.

Now, we are in that situation.

Pieces that I have written in the past, including my prediction that China is going to back its new digital currency with gold – all of a sudden look like discussions that need to take place, post-haste. I wrote last year:

China thinks in terms of generations and centuries. They are officially playing the long game. And don’t let the lack of a hot war fool you, the gears and wheels of trying to advance their country’s interests are there, grinding away slowly behind the scenes, for those who care to peek behind the curtain.

Backing their currency with gold could be seen by Xi as the ultimate “Trump card” of sorts, especially as the U.S. has watched its currency fall into a precarious position over the last 18 months due to unprecedented quantitative easing. It’s the type of revelation that, if done correctly by China, can immediately hoist China’s economic status to the top of the global ladder and can immediately challenge other countries to follow suit.

Except those “other countries” won’t be nearly as prepared to “flip the switch” to a gold-backed currency, because we will not have even considered the idea.

Now, it could be time for China and Russia to collectively “flip the switch”.

The writing has been on the wall for a while: Russia and China “de-dollarizing”, both countries stacking their gold reserves and China quickly looking to implement a digital currency.

Over the last five years, only overtly paranoid people like me looked at these actions and concluded they were the lead up to something much bigger.

Now that Russia has put itself at war with the West, the potential reasons, all of a sudden, become much clearer.

I have long argued that our arrogant treatment of the US dollar and our reliance on being able to print it whenever we want was a fool‘s errand. Austrian economists and conservatives who made these points were written off as conspiracy theorists for making suggestions that our country should shore up its balance sheet and back its currency with something tangible.

Now, in the midst of one of the most consequential wars in decades, our people may be starting to see exactly why having your monetary policy house in order is a good idea. Because the shit, eventually, always hits the fan.

And if the dollar is challenged – even if it holds its place as the world reserve currency – they’re still going to be a lot of uncomfortable questions we’re going to have to ask ourselves about monetary policy afterwards. So far, Tucker Carlson has been the only mainstream news anchor with either the foresight, courage or both to broach the subject, as he did a couple days ago.

Despite his comments, it still doesn’t seem that most people understand that war could be waged not just on Ukraine, but on the dollar.

To me, it only seems like the logical next step. I hope I’m wrong, but it looks as though the unprecedented times we are living through may still get far more unprecedented.