If you think the wealth tax is already in the rearview mirror, keep your eyes on the road. The beta test is over, but that was just the nose in the tent phase.

Democrats knowledge of wealth is like the old saying about pornography, they know it when they see it (or in Hunter Biden’s case, when they film it).

But unlike porn, they don’t know where it comes from. Also unlike porn, they know wealth has to be destroyed.

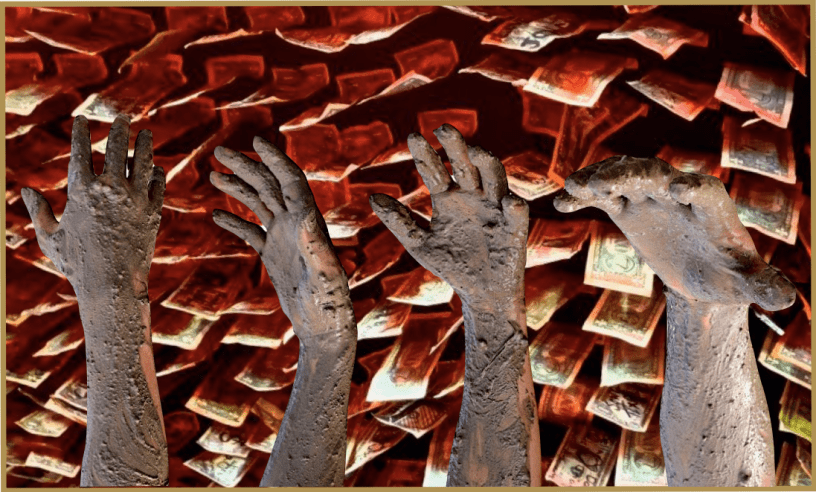

Because wealth is the thing that negates what they call equity. Egalitarianism wasn’t enough. Now we need equal outcomes where each player’s deficits are boosted to make results the same.

What better way to make the rich pay their “fair share” than by seizing the wealth they obviously must have stolen? And using that to even the playing field?

It’s notable that instead of going after the two-and-twenty of the carried interest set, the Democrats sought a mark-to-market tax on equities (a tax on unrealized gains). It was explained as a way to collect capital gains taxes earlier, in order to fund their hyperspend agenda. But it was really a way to collect estate taxes early, as it was structurally designed to force the sale of assets and to destroy wealth.

The wealth tax failed this time because its mechanics were too dumb. That’s what you get when you let Sen. B.S. (obsessed with millionaires and billionaires) and noted Native American Sen. Elizabeth Warren write tax policy.

People asked:

What happens when the market declines? Does the government cut everyone a check?

How is something non-fungible like a piece of real estate valued? Works of art?

What if someone only has one non-financial asset that makes them wealthy?

Do they have to sell it to pay the tax? Take out loans?

This time they couldn’t answer any of those questions. But the details don’t matter, the target does.

Real wealth endures and can maintain itself. It is the essence of capitalism, which is why they hate it. Universal, equitable toil is what the left wants for all of us. Anything that allows someone to sit at home and contemplate the universe is anathema. To the salt mines, comrades!

I jest of course, that’s gross exaggeration. Since they don’t understand biology either, they hate salt too.

Unfocused Rage

The left lives in an 80s teen comedy, where hating Chad & Buffy is just so obvious it never has to be explained. But when you bring that zeitgeist into the policy-making sphere, your laws are still supposed to make (don’t laugh) at least a modicum of sense.

If wealth was just a pile of gold coins, it might make sense to let Fauxcohontas pilfer a few for the common good (you’ve got too many, give me one!). Just to shut her up.

But real wealth has to be evaluated and if the methods to do so are not clear, or even agreed upon, how can the amount of tax be?

Calculating Wealth

Market capitalization is not really the amount of money in a market. It’s an abstract concept that is pretty defective as a calculation of value.

It is the marginal price of a unit of account times the total circulating supply.

That means if we have 1,000 widgetcoins in circulation, and you offer me $2 for one of mine, the current widgetcoin market capitalization is $2,000.

But if I have 700 widgetcoins do I really have $1,400 in wealth?

It depends. If the market is very liquid, and widgetcoins very desirable, maybe. But if I dump 700 out of a total supply of 1,000 on the widgetcoin market, I will likely break that market. The price of widgetcoins will probably approach $1 or lower pretty quick.

But Democrats can’t understand why a 2% tax on my $1,400 widgetcoin fortune is unworkable. For some reason, it’s an unattainable level of knowledge for them and we will have no peace until the average person understands this.

A Class Study in Envy

Ask yourself why you know how much money Bill Gates, Elon Musk or Jeff Bezos have. For years, the “richest person in the US” has been defined using “market cap” style math. This was always so unimaginable numbers could be thrown about in the service of class warfare narratives.

It’s not that these people aren’t rich, it’s that their wealth is almost all in the stock of the companies they founded.

Saying Elon Musk is worth $300B ignores a few things. Democrats think he has $300B in the bank. Whereas in reality, Musk has a lot of Tesla stock.

The fact is Musk’s Tesla shares are not liquid in the same way as 1,000 shares of TSLA is in an average person’s IRA.

As an officer and over 10% holder, there are a variety of SEC and other regulatory issues Musk faces when selling stock. In many companies, operating agreements further restrict how much founder’s stock can be sold in a period. Vesting schedules for early employees add more restrictions.

The Democrats know all this. They figure Musk can just take out loans against his shares and cut the Treasury a check. And Elon Musk or Jeff Bezos can.

But smaller founders who still qualify as “the evil rich” might not have that option. And the more serious issue is that when you sell shares, you lose their votes. And that is something company founders care deeply about, controlling the companies they started.

If you have to sell 2% of your wealth (e.g. shares) every year to pay the Bernie & Lizzie tax, how long before you lose control of your company?

What an added bonus for those who hate the productive.

Fake Voices & Fake Valuations

For a while we were asked to believe fraudster Elizabeth Holmes, of the occasionally mannish voice, was a billionaire. At the time, that was held up as something to be lauded, a great achievement of female entrepreneurship.

But Theranos was never worth $9B, except in the minds of reporters and first year MBA graduates. Serious investors don’t take early stage valuations seriously.

If you raise $10M for 5% of your company, you don’t have $200M in the company treasury. And a founder with 40% of the cap table doesn’t have $80M in the bank.

But this is the type of “wealth” the Democrats want to tax. Because they’re not just insanely jealous, they’re also insanely stupid.

But are they really?

Just Stop Believin’

There has to come a time when we stop believing that no one has thought about the unintended consequences. Their intent is to stop the creation of wealth. And any narrative that serves that goal is on the table.

With every frantic drama the Democrats create, we need to ask: why are they doing this? If they care about the poor, why do they pass policies that create more poverty? If they want to reduce the take of rent-seekers, why protect the tax structures that enrich them? If they are motivated to share the wealth, why do they only seek to destroy that which creates it?

The answer is always they just want to “get something done.” Regardless of the cost.

If you think a wealth tax won’t affect you because it’s only for the rich, don’t be surprised when they lower the bar and call it a savings tax next.

The sad truth is that we live on a farm with people who want to eat the seed corn and if we don’t wake up to it, there’s not going to be a harvest in a couple seasons.