EU inflation has skyrocketed to almost 11% last month driven by soaring energy costs, Eurostat reports. Surging food and energy costs have continued to drive prices higher across the bloc, data shows.

Price growth in the EU surged to 10.9% year-on-year in September, marking a new record high across the 27-member bloc, the statistics agency Eurostat reported on Wednesday.

The latest figures show prices having risen from the 10.1% print in August, thus posting a fifth straight month of growth. The rate stood at 3.6% a year earlier.

Meanwhile, the annual inflation rate in the Eurozone, a subset of the EU comprising 19 members that use the euro as their currency, increased to 9.9% in September, a jump from August’s 9.1% and last year’s 3.4%.

The price growth is still being driven by spiraling food and energy costs. Meanwhile, the concerning inflation readings are adding to the urgency for more rate hikes by the European Central Bank (ECB), even after its aggressive moves in July and September.

The European Commission on Tuesday proposed €40 billion ($39.2 billion) in aid to help small and medium-sized businesses and “address energy poverty through support to vulnerable households.” EU leaders will meet on Thursday to discuss the package.

“Europe is facing its week of truth,” Belgian Prime Minister Alexander De Croo was quoted as saying by Deutsche Welle. “This week it is hit or miss,” he stressed.

Germany, which has the EU’s largest economy, has unveiled a €200 billion plan (around $196 billion) to combat the energy crisis and skyrocketing costs. The relief measures include a gas price cap and a tax on windfall profits made by energy firms, RT reports

UK ‘Misery’ Surges As Inflation Unexpectedly Hits 40 Year High

With every development in the political and fiscal basket case that is the UK under the microscope, today’s news that inflation in the United Kingdom unexpectedly hit a fresh 40-year high of 10.10% was not taken too well by markets.

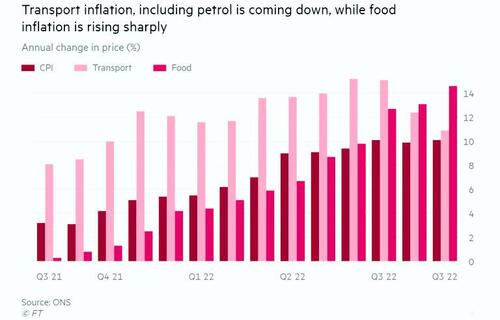

Core CPI inflation in the UK increased from 6.26%yoy in August to 6.54% Y/Y in September, above consensus expectations. But it was headline CPI inflation that stole the show, coming in far above consensus expectations, and increasing from 9.87%yoy in August to 10.10% Y/Y in September, driven by the highest food price increases in decades.

The composition of the strength was broad-based, with the hotel and restaurant category contributing the most to the core inflation increase. Of the non-core components, petrol prices saw a sequential decline in September, while sequential food price inflation slowed slightly yet exploded on an annual basis.

The increase in the year-over-year headline inflation rate was driven primarily by an increase in core inflation. Across core components, the increase was broad-based, with the biggest contribution coming from hotel and restaurant prices. While the ONS notes that the change in this year’s seasonal pattern contributed to the increase, restaurants and hotels are also one of the more labour cost sensitive categories. Of the non-core components, sequential petrol prices fell in September, but this was broadly offset by continued sequential strength in food inflation.

Paul Dales, chief UK economist at Capital Economics, said the rate of inflation would rise to 10.5 per cent in October and to 11 per cent in April once the government’s energy price guarantee expired.

“Today’s release highlights the danger that underlying inflation remains strong even as the economy weakens,” he said.

At more than five times the Bank of England’s 2% target, the double-digit inflation rate will also add to pressure on the central bank for a large interest rate rise on November 3. That said, the BoE will need to weigh the additional price pressures against the government’s U-turns on unfunded tax cuts and less generous relief on household energy costs, which will reduce medium-term pressures on prices.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said the “MPC still is a long way from being able to claim victory” over inflation, but urged the central bank to worry more about “weakening consumer demand and emerging slack in the labour market” than the current high level of inflation.

The resurgence of UK inflation sent the Misery Index back to its highest since 1992…

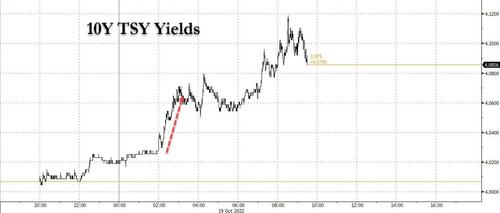

The news sparked a sharp drop in sterling, amid fears that the coming stagflationary recession will be especially painful as the BOE is now forced to keep hiking as it grinds the economy to a halt. It was also bad enough to spark an aggressive selloff in US TSYs, which had been flirting with the 4% level all session, only to break decisively above it after the UK data.