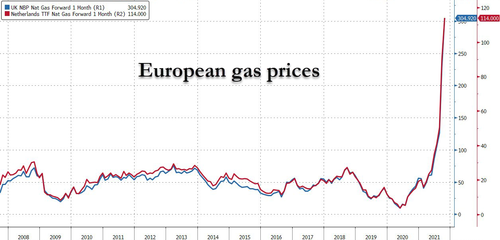

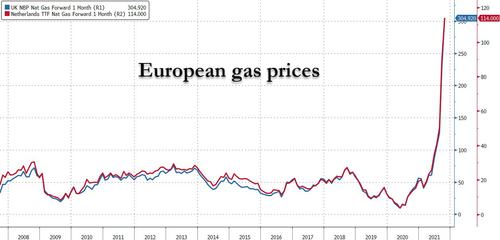

Europe’s power crunch is roiling energy markets Wednesday as Dutch and U.K. natural gas futures jumped 60% in just two days, hitting record highs along with soaring power prices.

Front-month Dutch natgas futures rose an astonishing 40% today to a record 162.125 euros per megawatt-hour after a 20% move higher on Tuesday. U.K. natgas futures surged 39% today, hitting 40 dollars.

For context, the EU NatGas prices are equivalent to $250 oil…

“This is just ridiculous,” Tom Marzec-Manser, an analyst at ICIS, told Bloomberg.

“Almost impossible to even justify or qualify how and why it’s moving so fast and so high.”

E.U. politicians are in panic mode to protect consumers and businesses from rising natgas and power prices. The European Union’s energy chief Kadri Simson said a revision on energy regulations could happen by the end of the year to prevent soaring energy costs from derailing the economic recovery. As we’ve already seen, soaring natgas prices have resulted in fertilizer manufacturers limiting or halt operations from the U.K. to Germany, which has disrupted food supply chains.

Ahead of winter, E.U.’s natgas stockpiles are at their lowest seasonal levels in more than a decade. The continent is super reliant on Russian natgas, which flows have declined in recent months. It’s also unclear when new supplies through Nord Stream 2, the new controversial pipeline from Russia, may begin – at this point, it’s too late for fresh supplies as the restocking period was a month ago. There are discussions E.U. politicians may certify the Russian pipeline early next year. Again, that would be during the winter season and too late to alleviate shortages and higher prices. Europe is in for one harsh winter. But don’t worry. Governments are likely to subsidize energy costs for households and even businesses to thwart a winter of discontent. After all, politicians only have one job: Get re-elected.

Meanwhile, the electricity crisis continues to roil Asian markets as Chinese buyers are paying top dollar for natgas as Beijing ordered energy firms to secure supplies at all costs.

“We are currently living exceptional circumstances,” analysts at consultant Engie EnergyScan told clients.

“The world gas market has never been in a situation where Asia and Europe were obliged to compete fiercely for the marginal LNG cargo available — as the latter was supposed to benefit from comfortable pipeline supply.”

Global natgas and even coal markets have significantly tightened ahead of the northern hemisphere winter. Fall has already begun, temperatures are dipping, and many of these regions are caught with below-average energy supplies. The chaos abroad has even boosted U.S. natgas prices to the highest level in 12 years to $6.466 per million British thermal units in New York.

The astronomical rise in natgas futures makes one wonder if the move is now being driven by the world’s top commodity trading houses, who have all been crushed by a spread (or arbitrage trade) gone wrong. The strategy backfired, and many small-to-mid-sized trading firms are likely facing margin calls on a scale not seen before.

And don’t expect it to stop anytime soon…

Spot on — but don't worry, Brussels will discuss the situation at a later date. And London, well, we are building back butter, apparently. https://t.co/nKPfNutYjB

— Javier Blas (@JavierBlas) October 6, 2021