So much for the worthless EU sanctions. Europe Predicts Full-Blown Stagflationary Shock If Russian Gas Supplies Disrupted, Folds To Russia’s Payment Demands. At Least 20 European Gas Buyers Open ‘Rubles-For-Gas’ Account With Gazprombank, Bloomberg reports. Europe’s anti-Russian virtue signaling and harsh language are nothing more than a facade as the number of European companies opening accounts with Gazprombank JSC has doubled as President Vladimir Putin demands rubles for natural gas.

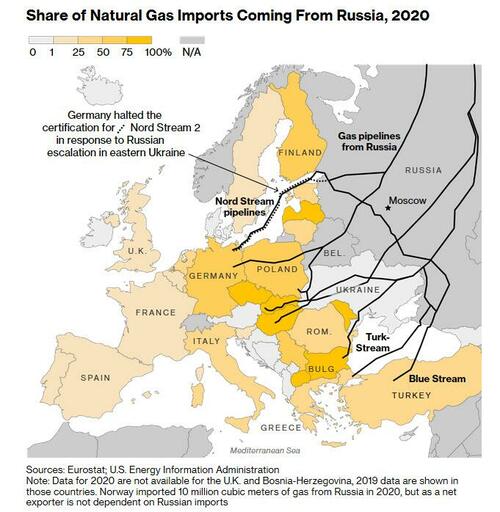

Almost two months after Europe rushed to declare it would impose unprecedented sanctions on Russia in response to Putin’s invasion of Ukraine with no regard for how such sanctions would boomerang and cripple its own economies, the old continent which was and still remains hostage to Russian energy exports, is finally grasping the underlying math which was all too clear to Vladimir Putin long ago.

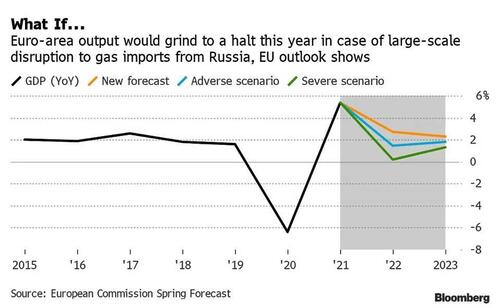

According to new projections from the European Commission, the euro area’s pandemic recovery would grind to a halt, while prices would surge even more quickly if there are serious disruptions to natural-gas supplies from Russia.

Under the severe (i.e., realistic) scenario, the currency bloc’s economy would expand about 0.2% this year, with inflation topping 9%, as governments struggled to replace the imports, the European Union’s executive arm said. After this initial stagflationary period, growth would be one percentage point below the baseline in 2023.

In its first forecasts since Russia invaded Ukraine, the EU also cut its base-case outlook predicting GDP will only grow 2.7% this year and 2.3% in 2023, down from February’s 4% and 2.7%. The revisions suggest Germany, the continent’s biggest economy, won’t reach pre-crisis output until the final quarter of 2022, while Spain must wait until the third quarter of 2023, the commission said.

And while growth slows, inflation is accelerating as stagflation spreads: Euro-zone inflation is seen at 6.1% and 2.7% this year and next, compared with previous projections of 3.5% and 1.7%. The peak is seen sometime this quarter.

Amazingly, the truth is likely even worse: “Russia’s invasion of Ukraine is causing untold suffering and destruction, but is also weighing on Europe’s economic recovery,” Paolo Gentiloni, the EU commissioner for the economy, said Monday in a statement. “Other scenarios are possible under which growth may be lower and inflation higher than we are projecting today.”

Europe’s “sudden realization” of just how destructive pushing through with full-blown sanctions will be, somewhat similar to that of Elon Musk who “learned” about the millions in Twitter spam accounts only after bidding $44 billion – is why over the weekend, Bloomberg reported that the European Union is set to fully water down its so-called sanctions and to offer gas importers a solution to avoid a breach of sanctions when buying fuel from Russia while satisfying President Vladimir Putin’s demands over payment in rubles.

In new guidance on gas payments, the European Commission plans to say that companies should make a clear statement that they consider their obligations fulfilled once they pay in euros or dollars, in line with existing contracts. The EU’s executive arm told the governments that the guidance does not prevent companies from opening an account at Gazprombank and will allow them to purchase gas in accordance with EU sanctions following Russia’s invasion of Ukraine.

Putin’s decree called for companies to open two accounts with Gazprombank – one in euros and one in rubles – and stipulated that gas payments aren’t settled until euros are converted into rubles. Russia clarified its decree earlier this month, stating that payments received in foreign currency would be exchanged to rubles via accounts with Russia’s National Clearing Center, and Gazprom provided buyers with additional assurances that the central bank would not be involved in the conversion process.

As Bloomberg notes, European companies had been scrambling for weeks to figure out how they can meet Moscow’s demand for ruble payment, and keep the crucial gas flowing without violating sanctions on Russia’s central bank. Putin said on March 31 that if payments aren’t made in rubles, gas exports would be halted. Europe depends heavily on the Russian fuel to heat homes and power industry.

Initially, the EU had assessed that the payment mechanism demanded by Putin handed Moscow total control of the process (which it did), breached contracts and violated the bloc’s sanctions. But realizing that a full-blown shutdown of gas shipments would destroy the European economy – i.e., Russia has all the leverage – on Friday, the commission told member states in a closed-door meeting that the updated guidance will clarify that companies can open an account in euros or dollars at Gazprombank as ordered by the Kremlin.

But the EU’s executive arm stopped short of saying whether also having an account in rubles — a step included in the Russian decree — was in line with EU regulations. Previously, officials had indicated, though never in writing, that opening such an account would breach sanctions. The updated guidance, as presented to member states, fails to address this specific point, the Bloomberg sources said.

Another key point in the guidance is that once European companies make a payment in euros or dollars and declare their obligation complete, no further action should be required of them from the Russian side in regard to the payment. The clock is ticking because many firms have payment deadlines falling due later this month – and if they don’t pay, gas flows could be cut off. Poland and Bulgaria already saw their supplies cut after failing to comply with Russia’s requests.

Putin’s demands to pay in rubles divided EU member states, highlighting the dependence of some nations on Russian imports. Confirming that Europe has really fully and completely capitulated to Putin, last week Italian Prime Minister Mario Draghi blew up the impression of European sanctions when he said that European companies will be able to pay for gas in rubles without breaching sanctions.

At the Friday meeting, government representatives were split too, according to one of the people. While Germany, Hungary, Italy and France broadly endorsed the commission’s plan, Poland said it failed to offer legal clarity and called for the matter to be discussed by EU ambassadors. Others were confused by the lack of specific guidance on opening accounts in rubles.

Germany said at the meeting that it consulted its companies on the proposal and got positive feedback, the person added. It also sought to fine-tune the recommendations by clarifying that EU sanctions don’t prohibit opening multiple accounts at Gazprombank.

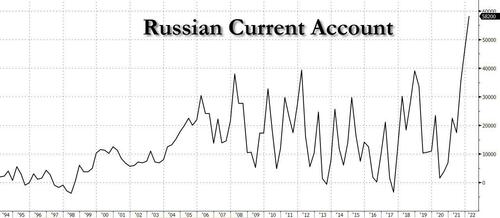

In other words, typical European confusion, where the guidance for companies is one thing while the propaganda disseminated for public consumption totally different, all the while the biggest winner remains Putin and Russia which today reported a new record high in its current account…

… as the Ukraine war remains the greatest thing that happened to the Russian economy in recent years.

Bloomberg reports a person close to Gazprombank said twenty European companies had opened accounts with the private-owned Russian bank to swap euros for rubles to purchase natgas. Another 14 companies are requesting paperwork to facilitate transactions in rubles.

European gas buyers quietly paid for supplies in rubles, and the list continues to grow — despite being in breach of Brussels sanctions.

“Under the new mechanism, clients have to open two accounts: one in foreign currency and one in rubles in Gazprombank,” the person said.

This comes as deadlines for April supplies are near for major European buyers. The person said the payment structure involves European clients paying foreign currency to Gazprombank, then the funds automatically convert to rubles and won’t involve Russia’s central bank, which is under EU sanctions.

Last week, former Goldman partner and ECB head – Italian Prime Minister Mario Draghi – confirmed companies will be able to pay for natgas in rubles without breaking EU sanctions.

“Most of the gas importers have already opened their account in rubles with Gazprom,” Draghi said during a recent press conference. He added that German companies were already paying rubles for natgas as both countries are top importers of Russian fossil fuels.

On April 27, European Commission President Ursula von der Leyen specifically warned companies not to cave to Russia’s demands to pay for gas in rubles: “companies with such contracts should not accede to the Russian demands,” von der Leyen said. “This would be a breach of the sanctions, so a high risk for the companies.”

It should be evident that more and more European companies are going against Brussels’ sanctions. The bloc’s harsh words against Putin are nothing more than fluff.

Putin forcing natgas to be paid in rubles, on top of capital controls, has transformed the ruble into the world’s best-performing currency this year. It’s now up more than 11% against the US Dollar since the start of the year, even outpacing the Real’s 9% increase to become the top mover in 31 major currencies tracked by Bloomberg.

The person close to Gazprom said four clients already are paying in rubles and expects more to come as 20 more opened ruble bank accounts in Russia. So much for the worthless EU sanctions.