European gas prices soared after Russia’s Gazprom announced of further cuts to supplies to EU via Nord Stream pipeline. Prices jumped by nearly 25% after Gazprom cut supplies.

Prices for natural gas in Europe have surged on Wednesday after Russian energy giant Gazprom announced plans for further cuts to supply volumes via the Nord Stream pipeline.

Natural gas futures on the Netherlands-based TTF trading hub climbed over $1,300 per 1,000 cubic meters, marking a surge of nearly 25%.

Earlier this week, gas prices in the region spiked by nearly 11% after Gazprom said that was reducing gas deliveries via the Nord Stream pipeline after German company Siemens failed to return gas pumping units to its compressor station on time.

Overall gas flows via the Nord Stream pipeline will decrease by roughly 60%, from 167 million cubic meters per day to just 67 million cubic meters per day, according to Gazprom.

The Russian energy corporation said it was forced to reduce gas supplies to Germany via the Nord Stream pipeline this week due to the parts shortage. Siemens announced on Wednesday that it was impossible to deliver the gas turbines to Gazprom after they’d been repaired in Canada, due to the sanctions imposed on Russia.

It added that the German and Canadian governments were aware of the problem, and that it was working on a viable solution RT reports.

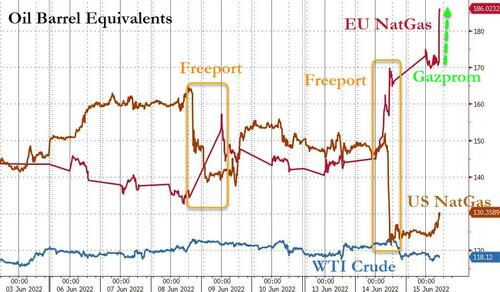

Goldman Sachs commodity analysts Samantha Dart and Damien Courvalin revised their US and European natural gas price targets due to last week’s explosion at the Freeport LNG Terminal in Quintana, Texas.

On Tuesday, Freeport released a statement about how the expected three-week closure at the LNG terminal would only be partially restarted in 90 days (a complete surprise to the energy analysts). This sent US NatGas prices in the US tumbling as much as 25% since the explosion. Inversely, European NatGas has soared by more than 40% because fewer exports from the US will crunch European supplies amid weening attempts from Russian fossil fuels.

EU NatGas is surging even more this morning after Russian natural gas deliveries through Nord Stream to Europe will drop by around 40% this year.

State-controlled energy giant Gazprom said Tuesday that the flow has been restricted after Canadian sanctions over the war in Ukraine prevented German partner Siemens Energy from delivering overhauled equipment.

“Gas supplies to the Nord Stream gas pipeline can currently be provided in the amount of up to 100 million cubic meters per day (compared to) the planned volume of 167 million cubic meters per day,” Gazprom said in a statement.

As AP reports, Siemens Energy said a gas turbine that powers a compressor station on the pipeline had been in service for more than 10 years and had been taken to Montreal for a scheduled overhaul. But because of sanctions imposed by Canada, the company has been unable to return the equipment to the customer, Gazprom.

“Against this background we informed the Canadian and German government and are working on a sustainable solution,” Siemens Energy said in a statement.

It did not provide a timeline for the planned drop in gas flows and that sent EU NatGas prices soaring. (The chart below shows ‘energy equivalent’ comps to enable better comparisons price premia)

The Freeport explosion was a significant enough problem that Goldman’s Dart and Courvalin couldn’t overlook. They readjusted their price targets for US and EU NatGas higher.