Evergrande’s Liquidity Crisis Becomes Ever Grander

Evergrande’s existential challenges are becoming ever grander by the day.

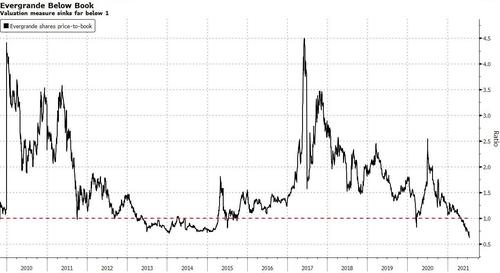

While we have long profiled the growing troubles facing China’s largest and the world’s most indebted property developer, which at the end of 2020 boasted more than $300 billion in total liabilities and which has tried to quell mounting concerns over its financial health since May – the melting ice cube that is Evergrande (which just one year ago vowed it would magically pivot into electric cars and would become China’s “Largest, Most Powerful” EV maker in a few years) had a close encounter with a blowtorch earlier this week when as we noted, the company’s shares crashed below liquidation level (i.e., the value of its standalone assets), trading at just 62% of book value following Monday’s plunge, the lowest ever value.

Meanwhile, its Hong Kong-traded shares which trade under the (not so) lucky ticker 3333.HK, have lost more than half their value from YTD highs, The wide deviation from its market value suggests shareholders are pricing in a significant decline in the assets’ earnings power. In terms of dollar amounts, its shares have lost $15 billion in value since this year’s January high.

As we noted a few days ago, the collapse in the valuation of the shares is a problem for a heavily indebted company with narrowing options for raising funds. It’s not just its own shares: subsidiary Evergrande Property Services has lost about $17 billion in value since its February high, while Evergrande New Energy Vehicle is down more than $60 billion in the period. Evergrande controls more than 60% of both firms. The value of Hengten Networks – a Hong Kong-listed internet services provider in which Evergrande has a 38% stake – has dropped about $15 billion.

Some of its affiliates missed payments earlier this year, and Caixin said authorities are probing Evergrande founder Hui Ka Yan’s relationship with Shengjing Bank. Evergrande holds a 36% stake in the bank, and Caixin said the bank lent up to $20 billion to Evergrande via direct and indirect channels.

The reason why the company has been hammered is simple: as a result of Beijing’s strict deleveraging demands targeting the housing developer sector (hoping to prevent a housing bubble), Evergrande’s cash has been shrinking fast, and it’s getting worse by the day as the company has entered a classical liquidity run (amid ongoing confusion whether Beijing will bail out the company in a worst case scenario).

After the shares plunged 16% on Monday a Chinese court froze a $20 million bank deposit, a city in Hunan province halted sales at two of the company’s residential projects, alleging the developer didn’t properly handle funds. The suspension will last until Oct. 13 and Evergrande can’t use funds currently deposited in supervised bank accounts, according to a statement.

To raise the funds, Evergrande has resorted to heavy discounts on its newly built properties to boost sales. In addition, between March and December 2020, the company raised almost $11.5 billion by selling its own equity as well as stakes in its property services, electric vehicle and other units. In March, Evergrande raised $2.1 billion from the sale of a 10% stake in its online home and car sales unit ahead of a planned listing. Last month, the company agreed to sell holdings worth $570 million in its internet unit HengTen Networks and $386 million in property unit China Calxon Group.

Things went from bad to worse on Wednesday, when four of Hong Kong’s top banks – HSBC Holdings Plc, Bank of China’s Hong Kong unit, Standard Chartered and Bank of East Asia – stopped providing mortgages to buyers of China Evergrande Group’s unfinished residential properties in Hong Kong, the latest sign of dwindling confidence in the developer’s financial strength.

The mortgage halt “could be a fresh sign banks are protecting themselves as they’re increasingly worried about Evergrande,” Bloomberg Intelligence analysts Daniel Fan and William Hau wrote in a note on Wednesday. The development may push Evergrande toward more “radical action,” such as selling a stake in itself to a state-owned Chinese company or pursuing more wide-ranging asset sales, the analysts wrote.

Evergrande, in a statement, glossed over the dismal development, saying that projects in Hong Kong are progressing as “originally planned.”

“There are still other banks maintaining a positive attitude towards mortgages on uncompleted properties, so the impact is believed to be relatively mild,” the company said, adding that it would consider letting buyers delay transactions by 60 days if they are impacted.

The report sparked fresh worries over the company’s ability to pull off a plan to cut debt by half before the end of 2022. Under its turnaround plan dubbed “high growth, scale control and debt reduction,” Evergrande cut total borrowings to 716.5 billion yuan ($110 billion) by the end of last year from a peak of 875 billion yuan in March 2020, according to the developer’s annual report. It targets a further cut of 150 billion yuan this year.

As Bloomberg notes, the unusual move by the four Hong Kong mortgage lenders to act in unison underscores how dramatically perceptions of Evergrande have deteriorated in recent weeks. And it’s not just the company’s stock that is getting hammered: the company’s 2025 dollar note sank by about 6 cents on Wednesday to 49 cents on the dollar, an all time low, and suggesting investors are bracing for a potential default absent a Beijing bailout of course.

An uncontrolled default by Evergrande – one where Beijing does not step in – would likely catastrophic repercussions for China’s financial system, eroding confidence in other highly leveraged property companies, shadow lenders and potentially even some banks, which is why Beijing will never allow it. Still, the status quo is unlikely to persist – officials from China’s top financial regulator told Evergrande founder Hui Ka Yan at the end of June that he should solve his company’s debt problems as quickly as possible, emphasizing the need to avoid major economic shocks.

Read More