Exposing The Robinhood Scam: Here’s How Much Citadel Paid To Robinhood To Buy Your Orders

Frankly, we’ve had it with the constant stream of lies from Robinhood and neverending bullshit from the company’s CEO, Vlad Tenev.

With Tenev scheduled to testify on Thursday, alongside the CEOs of Citadel, Melvin Capital and Reddit, the apriori mea culpas have started to emerge – if a little too late – the former HFT trader spoke late on Friday on the All-In Podcast hosted by Chamath Palihapitiya, who had strongly criticized Robinhood over the trading restrictions, and Jason Calacanis, a Robinhood investor, and said that “no doubt we could have communicated this a little bit better to customers.”

What he is referring to, of course, is Robinhood’s outrageous decision to restrict the buying of 13 heavily shorted stocks on Jan 28 that had been driven to record highs, including GameStop, whose shares had surged more than 1,600%.

Tenev said the restrictions were necessary due to a large increase in collateral/deposit requirements by the DTCC, but that was not spelled out in automated emails sent to Robinhood customers early on Jan. 28.

And then he decided to pull the oldest trick and deflect attention from his own mistakes by blaming “conspiracy theories.”

“As soon as those emails went out, the conspiracy theories started coming, so my phone was blowing up with, ‘how could you do this, how could you be on the side of the hedge funds,’” he said.

What Tenev did not say, or explain, is why his company – which is merely a client-facing front of Citadel, which buys the bulk of Robinhood’s orderflow to use it perfectly legally in any way it sees fit – was so massively undercapitalized that the DTCC required several billion more in collateral to protect Robinhood’s own investors against the company’s predatory ways of seeking to capitalize on the gamification of investing making it nothing more (or less) than a trivial pursuit to millions of GenZ and millennial investors, a point which Michael Burry made so vividly.

The #mainstreetrevolution is a myth. Zero commissions and gamified apps were designed to feed flows to the two most influential WS trading houses. A few HFs got hurt, but if retail is moving toward more trading and away from fundamentals, WS owns that game. #Stonks by design. https://t.co/Y4raF0jiM3

— Cassandra (@michaeljburry) February 9, 2021

Incidentally we know why Tenev did not mention it: it’s because Robinhood’s back office is a shambles of a shoestring operation, one which never anticipated either such a surge in trading not a multi-billion collateral requirement; had Robinhood been a true brokerage instead of pretending to be one, and run merely to open as many retail accounts as it could in the shortest amount of time, thus generating the most profit in the quickest amount of time to allow its sponsors a quick and profitable exit, it would actually have been on top of this.

It’s also why Tenev’s ridiculous pleas for immediate settlement instead of the usual T+2 arrangement, which has not been an issue for any other brokers, is nothing but a strawman argument which he hopes to present in Congress.

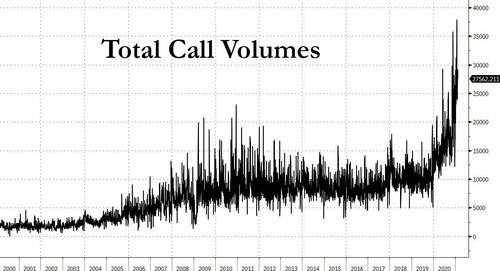

Which brings us to a totally separate topic, and one which Teven will one way or another have to address: the fact that Robinhood is a de facto subsidiary of Robinhood, whose entire business model is to sell retail orders to a handful of HFT market makers first and foremost… Citadel. In doing so the only ones who benefited from the surge in retail trading are Robinhood itself, by pocketing millions more from selling orderflow to Citadel, Virtu, Two Sigma, Wolverine and other HFT frontrunning “market-making” venues, as well as Citadel which made billions by having an advance look at the biggest surge in retail stock and option orders flow in history, and being able to trade ahead of and around it.

And no, it’s not a conspiracy theory Vladimir – it is the stone cold truth, as Jeffrey Gundlach suggested last week when he said “Robin Hood (sic) should be forced to change its name to Hood Robbin’. I grow so weary of lies through nomenclature, which are ubiquitous these days” adding “To be clear, the name change would reflect Robinhood robbing the little guy, nothing else.”

To be clear, the name change would reflect Robinhood robbing the little guy, nothing else.

— Jeffrey Gundlach (@TruthGundlach) February 10, 2021

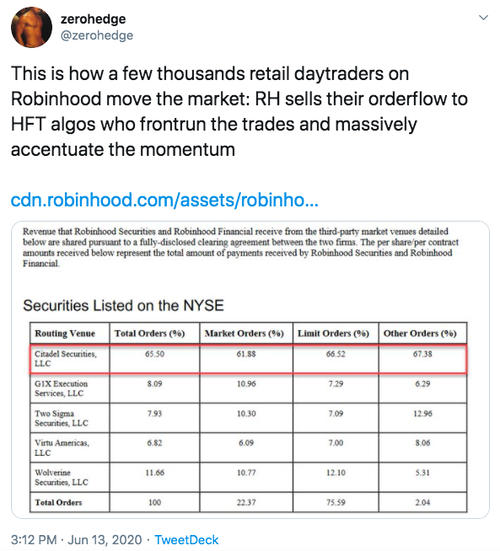

As an aside, how dare we allege that Citadel was buying orderflow to frontrun it? After all, that very allegation…

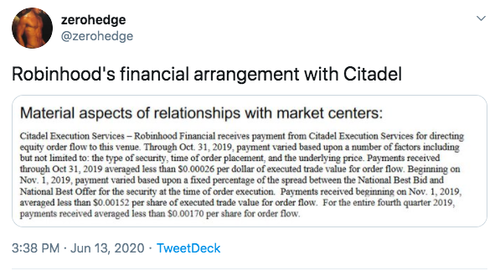

… coupled with the reminder that Robinhood engages exclusively in a practice called payment-for-orderflow (or PFOF)…

… which is what allowed Robinhood to provide “free” trading in the first place, that nearly destroyed us when last June Citadel’s lawyer army threatened to sue us into the ground for suggesting precisely that?

Some key phrases of note from the above text:

- “‘Frontrunning’ is an industry term of art that refers to an illegal form of trading.”

- “Citadel Securites does not engage in such conduct [i.e., frontrunning] and there was no factual basis whatsoever for ZeroHedge to publish such an incendiary, false, and reckless allegation to its 742,000 Twitter followers” [it’s 771,000 now].

- “ZeroHedge’s statement obviously disparages the lawfulness and integrity of Citadel Securities’ business pratices.”

- “Quite obviously, this most recent iteration of this same harmful allegation was not made in jest.”

- “We demand that ZeroHedge immediately retract this tweet by deleting it from ZeroHedge’s Twitter page… A refusal to promptly take down these remedial steps will be seen as further evidence of actual malice and will only increase the already substantial legal risk faced by you and ZeroHedge.”

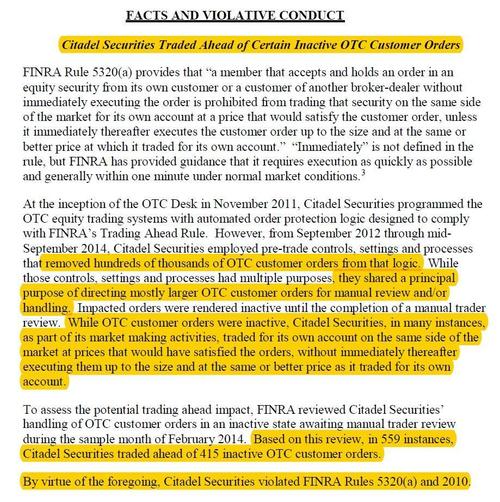

Well, we now officially know all about Citadel’s modus operandi because just a few days after we received that letter, none other than financial regulator FINRA, revealed that Citadel Securities was censured and fined for engaging in – drumroll – “trading ahead of customer orders” as Letter of Acceptance No. 2014041859401 revealed:

Now we admit that our financial jargon is a bit rusty these days, but “trading ahead of customer orders” sounds awfully similar to another far more popular “term of art“, one which we know very well: frontrunning!

Jargon aside, some of the other highlighted words we are very familiar with, such as “hundreds of thousands”… and “559 instances” in which Citadel traded ahead of customer orders.

And while we may be getting a little ahead of ourselves here, it was Citadel’s own lawyers that informed us on more than one occasion that:

“frontrunning” is an unethical and illegal trading practice.”

So, what are we to make of this? Could it be that Citadel was engaging in at least 559 instance of what its lawyer called “unethical and illegal trading practice.” Surely not: after all the lawyers would surely know very well how ridiculous and laughable their letter and threats would look if it ever emerged that Citadel was indeed frontrunning its customers.

But wait, it gets even funnier.

Back in April 2004, long before Citadel became the dominant market maker – and buyer – of retail orderflow controlling a whopping 27% of total US equity volume market share in 2020 according to Bloomberg and a staggering 46% of retail orderflow, it was Citadel’s own General Counsel, Adam Cooper, who urged the SEC to ban payment for orderflow because it “distorts order routing decisions, is anti-competitive, and creates an obvious and substantial conflict of interest between broker-dealers and their customers.“

As Cooper also revealed…

“broker-dealers accepting payment for order flow have a strong incentive to route orders based on the amount of order flow payments, which benefit these broker-dealers, rather than on the basis of execution quality, which benefits their customers. Furthermore, the parties making such payments (either voluntarily or through an exchange-mandated program) are forced to find other ways to recoup the amounts of such payments, whether through wider spreads or a reduction in other benefits that otherwise could, and should, be provided to customers.”

And the punchline:

Payment for order flow is a practice that on its face is at odds with a broker-dealer’s obligations to its customers. A broker-dealer has a fiduciary obligation to obtain the best execution reasonably available for its customers’ orders under prevailing market conditions. We do not believe that a broker-dealer that accepts payment for order flow and does not pass such payments on to its customers (either directly or through reduced execution fees or commissions) can consistently fulfill its best execution obligations.

Which leads us to the one time Citadel was actually telling the truth:

Because payment for order flow creates fundamental conflicts of interest that cannot be cured by disclosure, the Commission should ban payment for order flow altogether. It is crucial that this ban include not only exchange-sponsored programs, but also payment for order flow arrangements entered into privately between order flow providers and market centers.

Little did Citadel know that just 15 years later it would be the single biggest beneficiary of paying for orderflow, a practice which has allowed Citadel founder to amass a trophy collection of some of the most expensive real estate in the world.

We also know all this is true because we were also among the first to expose Robinhood as a client-facing front for Citadel back in 2018, when we wrote “Robinhood Is Said To Get 40% Revenue From HFT Firms Like Citadel” in which we wrote:

“Stealing from millennials to give to the rich. Robinhood app sells user customer data to make a quick buck from the high-frequency trading (HFT) firms on Wall Street,” that is what we wrote last month, in one of the first articles that expressed concern over the popular Robinhood investing app for millennials, which has shady ties to HFT firms and undermines its image of an anti-Wall Street ethos.

The conclusion was a searing prediction of what would happen a little over two years later:

A few anonymous venture capitalists told Bloomberg that Robinhood has already begun to see the consequences of their cozy relationship with Wall Street firms, which has degraded the company’s image.

With six million clients, most of whom are millennials — seeking an anti-Wall Street investing culture, could soon find out, that, they too, have been conned by Robinhood founders into thinking the app offers free investing. The lesson at play: nothing in life is free, even if it is from Silicon Valley.

That said, we were not the first to expose Robinhood’s ways. That honor falls to our friend Joe Saluzzi and Sal Arnuk, who for over a decade have led the crusade against high frequency trading, and who in November 2014 wrote “Beware of Those Offering Free Retail Trades.”

We are always suspicious when somebody offers us something for free. Usually, the one offering the free service has other ways of making money. For example, Google offers lots of free services like Gmail, Google Maps or Youtube. While the services are free, Google is still making money by targeting ads and selling data. The latest free thing which is creating quite a buzz (the hot term for this is “disrupting”) is free retail trading by a company called Robinhood.

What is Robinhood? According to an article in the Irish Times yesterday:

“Founded by Stanford mathematics graduate Vlad Tenev and Baiju Bhatt last year, Robinhood is a stock brokerage that charges no commission.”

Robinhood is offering free stock trades and no-cost real time market data. How do they do it? According to the company:

– They don’t have brick and mortar companies and don’t spend millions on Superbowl ads.

– Technology has allowed them to eliminate much of the human intervention and paper confirms.

And how do they make money? According to their website:

“Robinhood has two key revenue streams; charging interest for margin trading, and collecting interest on cash balances.”

Call us crazy but relying on generating revenue from margin interest and collecting interest on cash balances (where the account minimum is $0) sounds a bit risky and overly ambitious in a market which has been saddled with zero percent interest rates for the past 5 years. That’s why we think Robinhood must have another way of making money. Could it be that the founders, Vlad and Baiju, are planning on taking advantage of the rebates and payment for order flow that are embedded in the equity market? But how could two guys who graduated from Stanford in 2008 know that much about the market structure of the US equity market? From their website:

“After graduating from Stanford, roommates Vladimir Tenev and Baiju Bhatt moved to New York, where they built high-frequency trading platforms for some of the largest financial institutions in the world. They began to realize that electronic trading firms pay effectively nothing to place trades in the market yet charge investors up to $10 for each trade — and thus the idea for Robinhood was born. They soon ventured back to California to begin solving the problem of democratizing access to the markets.”

Seems like Vlad and Baiju know a lot more about US equity trading than we thought. Heck, they may even know that when a retail limit order is sent to the DirectEdge stock exchange, that order could qualify for a special rebate if it is attributed and displayed as a retail order. Here is how DirectEdge describe their retail attribution program :

“With this improvement, Members sending Retail Orders may elect to display those orders on the EdgeBook Attributed data feed with the generic retail identifier “RTAL” rather than their Market Participant ID (MPID). Including a standard retail identifier gives retail brokers greater flexibility and choice to participate in the attribution program that has helped improve execution rates for retail orders.”

Talk about leading the lambs to the slaughter. Retail orders that are being attributed are basically flashing bright lights telling the world that they are retail.

We’re not sure if Robinhood is planning on selling their order flow but it is certainly something that their customers should be asking them once they do start trading. While their website does not say anything about payment for order flow, in a CNBC interview from earlier this year, Vlad Tenev did say the company would be accepting payment for order flow:

“So, Robinhood has many revenue streams on Day One. Those include margin lending, payment for order flow, interest on cash balances. We’ll have those on Day One,” Tenev said on CNBC’s “Halftime Report”.

Right now, Robinhood is still busy attracting some high profile investors which include Snoop Dog, actor Jared Leto, the venture capital fund Andreessen Horowitz and Google Ventures (Robinhood raised $13 million in their latest financing round).

Two points here: Vlad Tenev’s entire background is HFT – he knew from day one that he could create a “free brokerage” if only he were to quietly sell all the orderflow to a generous sponsor, say Citadel. It’s also why we find laughable his recent tweet asking, obviously rhetorically, “What exactly is high-frequency trading? And is it evil?”

What exactly is high-frequency trading? And is it evil?

— VLAD (@vladtenev) February 9, 2021

Tenev then went on into a rambling, nonsensical defense of HFT and why it is not evil, concluding that “high-frequency trading is just what you get when you apply technology to trading and getting data moving faster between trading centers will enhance trading for us all”…

In short, high-frequency trading is just what you get when you apply technology to trading and getting data moving faster between trading centers will enhance trading for us all. https://t.co/9S17EZdYEc (11/11)

— VLAD (@vladtenev) February 10, 2021

… what he did not say is that HFT is just a perfectly legal and widely accepted way of frontrunning retail orderflow (usually by the order of a few milliseconds, explaining the presence of lasers at the New York Stock Exchange in Mahwah), and then selling it to the highest bidder, something he knew almost a decade ago when he launched Robinhood. We almost wonder if he did so in some low-lit Chicago backroom while sitting across from Citadel’s Ken Griffin (this would be the other Citadel, not the one from 2004 which found payment for orderflow loathsome and deserving to be banned, but a Citadel which now considered PFOF a source of almost unprecedented riches and profit).

The second point we would like to address from the Themis Trading 2014 post is that while back then it was unclear if RH sold their orderflow, we now know that not only is Robinhood selling your orders to other internalizers, but that sale represents the biggest source of RH revenue by orders of magnitude. And thanks to the company’s just filed latest Disclosure Form 606 we know just how much Robinhood made from selling your orderflow to Ken Griffin.

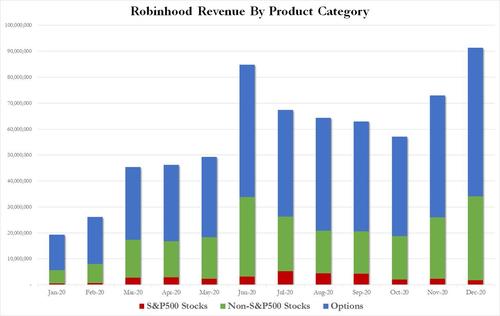

The chart below shows Robinhood’s monthly revenues for the full year 2020, broken down in the three key categories: i) S&P500 stocks, ii) Non-S&P500 stocks and iii) Options. And while Robinhood made a not-too-shabby $247 million in 2020 from just selling access to your retail stock orders to such non-directed orderflow venue as Citadel, Vitru, Wolverine, Two Sigma, G1X, Morgan Stanley and others, it is the sale of option orderflow that has emerged as Robinhood’s golden goose, having generated an impressive $440 million in revenue in 2020.

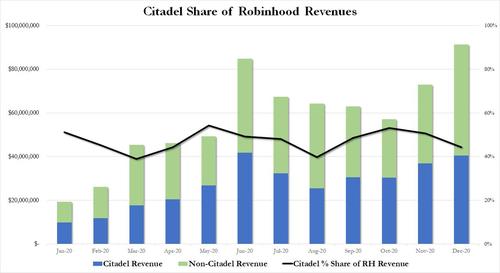

Which then brings us to the punchline: Robinhood is kind enough to break down not only revenue by product (going down to such granular detail as market orders and limit orders), starting several years ago the company also started disclosing who its biggest clients were. And here it will come as no surprise that in 2020, Citadel accounted for more than half of all Citadel revenues, or $362.5 million, exactly 53% of the company’s total revenues of $687.1 million.

Would it therefore be farfetched to say that Robinhood is nothing more than a client-facing subsidiary of Citadel, one which pretends to offer free trades to tens of millions of young, naive traders, but in reality merely allows Citadel to trade ahead and/or against this orderflow for which it paid over $300 million.

Probably not, but we won’t have a definitive answer until we find out just how much profit Citadel made from buying all this critical data, which gives it an early glimpse into not only each discrete individual trade but also a sense of which way the retail horde is moving, critical and extremely valuable data which until last August was public and available to all (with a slight delay) courtesy of Robintrack, and which last August was inexplicably halted.

We are confident that this week’s Congressional hearings will quickly get to the bottom of this critical question of just how profitable this orderflow – which it paid Robinhood $362 million to procure – is for Citadel, because anything less will confirm that this latest hearing is nothing but a kangaroo court meant to appease retail investors that someone in Washington is doing something… when in reality everyone knows that what Citadel wants, Citadel gets and there is no sign that Citadel will ever tire of making billions out of the same orderflow for which it paid pennies on the dollar to Robinhood.

Tyler Durden

Sun, 02/14/2021 – 18:17

Exposing The Robinhood Scam: Here’s How Much Citadel Paid To Robinhood To Buy Your Orders

Frankly, we’ve had it with the constant stream of lies from Robinhood and neverending bullshit from the company’s CEO, Vlad Tenev.

With Tenev scheduled to testify on Thursday, alongside the CEOs of Citadel, Melvin Capital and Reddit, the apriori mea culpas have started to emerge – if a little too late – the former HFT trader spoke late on Friday on the All-In Podcast hosted by Chamath Palihapitiya, who had strongly criticized Robinhood over the trading restrictions, and Jason Calacanis, a Robinhood investor, and said that “no doubt we could have communicated this a little bit better to customers.”

What he is referring to, of course, is Robinhood’s outrageous decision to restrict the buying of 13 heavily shorted stocks on Jan 28 that had been driven to record highs, including GameStop, whose shares had surged more than 1,600%.

Tenev said the restrictions were necessary due to a large increase in collateral/deposit requirements by the DTCC, but that was not spelled out in automated emails sent to Robinhood customers early on Jan. 28.

Robinhood CEO Vlad Tenev

And then he decided to pull the oldest trick and deflect attention from his own mistakes by blaming “conspiracy theories.”

“As soon as those emails went out, the conspiracy theories started coming, so my phone was blowing up with, ‘how could you do this, how could you be on the side of the hedge funds,’” he said.

What Tenev did not say, or explain, is why his company – which is merely a client-facing front of Citadel, which buys the bulk of Robinhood’s orderflow to use it perfectly legally in any way it sees fit – was so massively undercapitalized that the DTCC required several billion more in collateral to protect Robinhood’s own investors against the company’s predatory ways of seeking to capitalize on the gamification of investing making it nothing more (or less) than a trivial pursuit to millions of GenZ and millennial investors, a point which Michael Burry made so vividly.

The #mainstreetrevolution is a myth. Zero commissions and gamified apps were designed to feed flows to the two most influential WS trading houses. A few HFs got hurt, but if retail is moving toward more trading and away from fundamentals, WS owns that game. #Stonks by design. https://t.co/Y4raF0jiM3

— Cassandra (@michaeljburry) February 9, 2021

Incidentally we know why Tenev did not mention it: it’s because Robinhood’s back office is a shambles of a shoestring operation, one which never anticipated either such a surge in trading not a multi-billion collateral requirement; had Robinhood been a true brokerage instead of pretending to be one, and run merely to open as many retail accounts as it could in the shortest amount of time, thus generating the most profit in the quickest amount of time to allow its sponsors a quick and profitable exit, it would actually have been on top of this.

It’s also why Tenev’s ridiculous pleas for immediate settlement instead of the usual T+2 arrangement, which has not been an issue for any other brokers, is nothing but a strawman argument which he hopes to present in Congress.

Which brings us to a totally separate topic, and one which Teven will one way or another have to address: the fact that Robinhood is a de facto subsidiary of Robinhood, whose entire business model is to sell retail orders to a handful of HFT market makers first and foremost… Citadel. In doing so the only ones who benefited from the surge in retail trading are Robinhood itself, by pocketing millions more from selling orderflow to Citadel, Virtu, Two Sigma, Wolverine and other HFT frontrunning “market-making” venues, as well as Citadel which made billions by having an advance look at the biggest surge in retail stock and option orders flow in history, and being able to trade ahead of and around it.

And no, it’s not a conspiracy theory Vladimir – it is the stone cold truth, as Jeffrey Gundlach suggested last week when he said “Robin Hood (sic) should be forced to change its name to Hood Robbin’. I grow so weary of lies through nomenclature, which are ubiquitous these days” adding “To be clear, the name change would reflect Robinhood robbing the little guy, nothing else.”

To be clear, the name change would reflect Robinhood robbing the little guy, nothing else.

— Jeffrey Gundlach (@TruthGundlach) February 10, 2021

As an aside, how dare we allege that Citadel was buying orderflow to frontrun it? After all, that very allegation…

… coupled with the reminder that Robinhood engages exclusively in a practice called payment-for-orderflow (or PFOF)…

… which is what allowed Robinhood to provide “free” trading in the first place, that nearly destroyed us when last June Citadel’s lawyer army threatened to sue us into the ground for suggesting precisely that?

Some key phrases of note from the above text:

“‘Frontrunning’ is an industry term of art that refers to an illegal form of trading.”

“Citadel Securites does not engage in such conduct [i.e., frontrunning] and there was no factual basis whatsoever for ZeroHedge to publish such an incendiary, false, and reckless allegation to its 742,000 Twitter followers” [it’s 771,000 now].

“ZeroHedge’s statement obviously disparages the lawfulness and integrity of Citadel Securities’ business pratices.”

“Quite obviously, this most recent iteration of this same harmful allegation was not made in jest.”

“We demand that ZeroHedge immediately retract this tweet by deleting it from ZeroHedge’s Twitter page… A refusal to promptly take down these remedial steps will be seen as further evidence of actual malice and will only increase the already substantial legal risk faced by you and ZeroHedge.”

Well, we now officially know all about Citadel’s modus operandi because just a few days after we received that letter, none other than financial regulator FINRA, revealed that Citadel Securities was censured and fined for engaging in – drumroll – “trading ahead of customer orders” as Letter of Acceptance No. 2014041859401 revealed:

Now we admit that our financial jargon is a bit rusty these days, but “trading ahead of customer orders” sounds awfully similar to another far more popular “term of art”, one which we know very well: frontrunning!

Jargon aside, some of the other highlighted words we are very familiar with, such as “hundreds of thousands”… and “559 instances” in which Citadel traded ahead of customer orders.

And while we may be getting a little ahead of ourselves here, it was Citadel’s own lawyers that informed us on more than one occasion that:

“frontrunning” is an unethical and illegal trading practice.”

So, what are we to make of this? Could it be that Citadel was engaging in at least 559 instance of what its lawyer called “unethical and illegal trading practice.” Surely not: after all the lawyers would surely know very well how ridiculous and laughable their letter and threats would look if it ever emerged that Citadel was indeed frontrunning its customers.

But wait, it gets even funnier.

Back in April 2004, long before Citadel became the dominant market maker – and buyer – of retail orderflow controlling a whopping 27% of total US equity volume market share in 2020 according to Bloomberg and a staggering 46% of retail orderflow, it was Citadel’s own General Counsel, Adam Cooper, who urged the SEC to ban payment for orderflow because it “distorts order routing decisions, is anti-competitive, and creates an obvious and substantial conflict of interest between broker-dealers and their customers.”

As Cooper also revealed…

“broker-dealers accepting payment for order flow have a strong incentive to route orders based on the amount of order flow payments, which benefit these broker-dealers, rather than on the basis of execution quality, which benefits their customers. Furthermore, the parties making such payments (either voluntarily or through an exchange-mandated program) are forced to find other ways to recoup the amounts of such payments, whether through wider spreads or a reduction in other benefits that otherwise could, and should, be provided to customers.”

And the punchline:

Payment for order flow is a practice that on its face is at odds with a broker-dealer’s obligations to its customers. A broker-dealer has a fiduciary obligation to obtain the best execution reasonably available for its customers’ orders under prevailing market conditions. We do not believe that a broker-dealer that accepts payment for order flow and does not pass such payments on to its customers (either directly or through reduced execution fees or commissions) can consistently fulfill its best execution obligations.

Which leads us to the one time Citadel was actually telling the truth:

Because payment for order flow creates fundamental conflicts of interest that cannot be cured by disclosure, the Commission should ban payment for order flow altogether. It is crucial that this ban include not only exchange-sponsored programs, but also payment for order flow arrangements entered into privately between order flow providers and market centers.

Little did Citadel know that just 15 years later it would be the single biggest beneficiary of paying for orderflow, a practice which has allowed Citadel founder to amass a trophy collection of some of the most expensive real estate in the world.

We also know all this is true because we were also among the first to expose Robinhood as a client-facing front for Citadel back in 2018, when we wrote “Robinhood Is Said To Get 40% Revenue From HFT Firms Like Citadel” in which we wrote:

“Stealing from millennials to give to the rich. Robinhood app sells user customer data to make a quick buck from the high-frequency trading (HFT) firms on Wall Street,” that is what we wrote last month, in one of the first articles that expressed concern over the popular Robinhood investing app for millennials, which has shady ties to HFT firms and undermines its image of an anti-Wall Street ethos.

The conclusion was a searing prediction of what would happen a little over two years later:

A few anonymous venture capitalists told Bloomberg that Robinhood has already begun to see the consequences of their cozy relationship with Wall Street firms, which has degraded the company’s image.

With six million clients, most of whom are millennials — seeking an anti-Wall Street investing culture, could soon find out, that, they too, have been conned by Robinhood founders into thinking the app offers free investing. The lesson at play: nothing in life is free, even if it is from Silicon Valley.

That said, we were not the first to expose Robinhood’s ways. That honor falls to our friend Joe Saluzzi and Sal Arnuk, who for over a decade have led the crusade against high frequency trading, and who in November 2014 wrote “Beware of Those Offering Free Retail Trades.”

We are always suspicious when somebody offers us something for free. Usually, the one offering the free service has other ways of making money. For example, Google offers lots of free services like Gmail, Google Maps or Youtube. While the services are free, Google is still making money by targeting ads and selling data. The latest free thing which is creating quite a buzz (the hot term for this is “disrupting”) is free retail trading by a company called Robinhood.

What is Robinhood? According to an article in the Irish Times yesterday:

“Founded by Stanford mathematics graduate Vlad Tenev and Baiju Bhatt last year, Robinhood is a stock brokerage that charges no commission.”

Robinhood is offering free stock trades and no-cost real time market data. How do they do it? According to the company:

– They don’t have brick and mortar companies and don’t spend millions on Superbowl ads.

– Technology has allowed them to eliminate much of the human intervention and paper confirms.

And how do they make money? According to their website:

“Robinhood has two key revenue streams; charging interest for margin trading, and collecting interest on cash balances.”

Call us crazy but relying on generating revenue from margin interest and collecting interest on cash balances (where the account minimum is $0) sounds a bit risky and overly ambitious in a market which has been saddled with zero percent interest rates for the past 5 years. That’s why we think Robinhood must have another way of making money. Could it be that the founders, Vlad and Baiju, are planning on taking advantage of the rebates and payment for order flow that are embedded in the equity market? But how could two guys who graduated from Stanford in 2008 know that much about the market structure of the US equity market? From their website:

“After graduating from Stanford, roommates Vladimir Tenev and Baiju Bhatt moved to New York, where they built high-frequency trading platforms for some of the largest financial institutions in the world. They began to realize that electronic trading firms pay effectively nothing to place trades in the market yet charge investors up to $10 for each trade — and thus the idea for Robinhood was born. They soon ventured back to California to begin solving the problem of democratizing access to the markets.”

Seems like Vlad and Baiju know a lot more about US equity trading than we thought. Heck, they may even know that when a retail limit order is sent to the DirectEdge stock exchange, that order could qualify for a special rebate if it is attributed and displayed as a retail order. Here is how DirectEdge describe their retail attribution program :

“With this improvement, Members sending Retail Orders may elect to display those orders on the EdgeBook Attributed data feed with the generic retail identifier “RTAL” rather than their Market Participant ID (MPID). Including a standard retail identifier gives retail brokers greater flexibility and choice to participate in the attribution program that has helped improve execution rates for retail orders.”

Talk about leading the lambs to the slaughter. Retail orders that are being attributed are basically flashing bright lights telling the world that they are retail.

We’re not sure if Robinhood is planning on selling their order flow but it is certainly something that their customers should be asking them once they do start trading. While their website does not say anything about payment for order flow, in a CNBC interview from earlier this year, Vlad Tenev did say the company would be accepting payment for order flow:

“So, Robinhood has many revenue streams on Day One. Those include margin lending, payment for order flow, interest on cash balances. We’ll have those on Day One,” Tenev said on CNBC’s “Halftime Report”.

Right now, Robinhood is still busy attracting some high profile investors which include Snoop Dog, actor Jared Leto, the venture capital fund Andreessen Horowitz and Google Ventures (Robinhood raised $13 million in their latest financing round).

Two points here: Vlad Tenev’s entire background is HFT – he knew from day one that he could create a “free brokerage” if only he were to quietly sell all the orderflow to a generous sponsor, say Citadel. It’s also why we find laughable his recent tweet asking, obviously rhetorically, “What exactly is high-frequency trading? And is it evil?”

What exactly is high-frequency trading? And is it evil?

— VLAD (@vladtenev) February 9, 2021

Tenev then went on into a rambling, nonsensical defense of HFT and why it is not evil, concluding that “high-frequency trading is just what you get when you apply technology to trading and getting data moving faster between trading centers will enhance trading for us all”…

In short, high-frequency trading is just what you get when you apply technology to trading and getting data moving faster between trading centers will enhance trading for us all. https://t.co/9S17EZdYEc (11/11)

— VLAD (@vladtenev) February 10, 2021

… what he did not say is that HFT is just a perfectly legal and widely accepted way of frontrunning retail orderflow (usually by the order of a few milliseconds, explaining the presence of lasers at the New York Stock Exchange in Mahwah), and then selling it to the highest bidder, something he knew almost a decade ago when he launched Robinhood. We almost wonder if he did so in some low-lit Chicago backroom while sitting across from Citadel’s Ken Griffin (this would be the other Citadel, not the one from 2004 which found payment for orderflow loathsome and deserving to be banned, but a Citadel which now considered PFOF a source of almost unprecedented riches and profit).

The second point we would like to address from the Themis Trading 2014 post is that while back then it was unclear if RH sold their orderflow, we now know that not only is Robinhood selling your orders to other internalizers, but that sale represents the biggest source of RH revenue by orders of magnitude. And thanks to the company’s just filed latest Disclosure Form 606 we know just how much Robinhood made from selling your orderflow to Ken Griffin.

The chart below shows Robinhood’s monthly revenues for the full year 2020, broken down in the three key categories: i) S&P500 stocks, ii) Non-S&P500 stocks and iii) Options. And while Robinhood made a not-too-shabby $247 million in 2020 from just selling access to your retail stock orders to such non-directed orderflow venue as Citadel, Vitru, Wolverine, Two Sigma, G1X, Morgan Stanley and others, it is the sale of option orderflow that has emerged as Robinhood’s golden goose, having generated an impressive $440 million in revenue in 2020.

Which then brings us to the punchline: Robinhood is kind enough to break down not only revenue by product (going down to such granular detail as market orders and limit orders), starting several years ago the company also started disclosing who its biggest clients were. And here it will come as no surprise that in 2020, Citadel accounted for more than half of all Citadel revenues, or $362.5 million, exactly 53% of the company’s total revenues of $687.1 million.

Would it therefore be farfetched to say that Robinhood is nothing more than a client-facing subsidiary of Citadel, one which pretends to offer free trades to tens of millions of young, naive traders, but in reality merely allows Citadel to trade ahead and/or against this orderflow for which it paid over $300 million.

Probably not, but we won’t have a definitive answer until we find out just how much profit Citadel made from buying all this critical data, which gives it an early glimpse into not only each discrete individual trade but also a sense of which way the retail horde is moving, critical and extremely valuable data which until last August was public and available to all (with a slight delay) courtesy of Robintrack, and which last August was inexplicably halted.

We are confident that this week’s Congressional hearings will quickly get to the bottom of this critical question of just how profitable this orderflow – which it paid Robinhood $362 million to procure – is for Citadel, because anything less will confirm that this latest hearing is nothing but a kangaroo court meant to appease retail investors that someone in Washington is doing something… when in reality everyone knows that what Citadel wants, Citadel gets and there is no sign that Citadel will ever tire of making billions out of the same orderflow for which it paid pennies on the dollar to Robinhood.

Tyler Durden

Sun, 02/14/2021 – 18:17

Read More