The inevitable consequence of the current Global Debt Bubble will be the Bankruptcy of the financial system and many of its participants.

The one Swiss and three US banks that just went under is just a foretaste of what is to come.

As the US and European banking systems come under pressure, The Everything Collapse will cause a collapse in financial markets of a magnitude that has never before been seen in history. Since the global financial system is a mesh which reaches every financial player in the world, from sovereigns to private individuals, no-one will be able to escape the The Everything Collapse.

So how will the The Everything Collapse or Bankruptcy start. Well, it has already started but the world hasn’t noticed it yet. Four collapsed banks have already been shaken off by investors as a light headache which was cured by a few hundred billion dollars of central bank aspirin.

As Hemingway said, you go bankrupt first Gradually and then Suddenly. But no one should be deceived by the gradual phase of bankruptcy or collapse we are in currently. We have just had the final warning. This gradual phase might last a few months or longer but it is the last chance investors have to put their house in order. If you wait until the sudden phase, the panic will paralyse you as you wait for a recovery which will not happen. Instead, the horrid losses will just get worse.

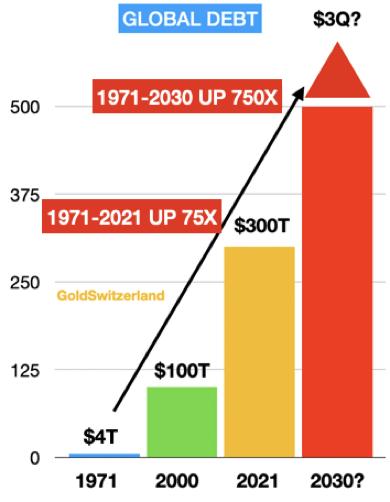

So what will actually collapse? Well that’s obvious! The Everything Collapse is primarily a debt crisis. Global debt has trebled in this century and if we include derivatives (a major part of which will become debt), we are looking at up to $3 quadrillion. This is 20X global GDP and obviously of a magnitude that will cause major harm to the world.

US & EUROPEAN BANKS’ RISKY BALANCE SHEETS

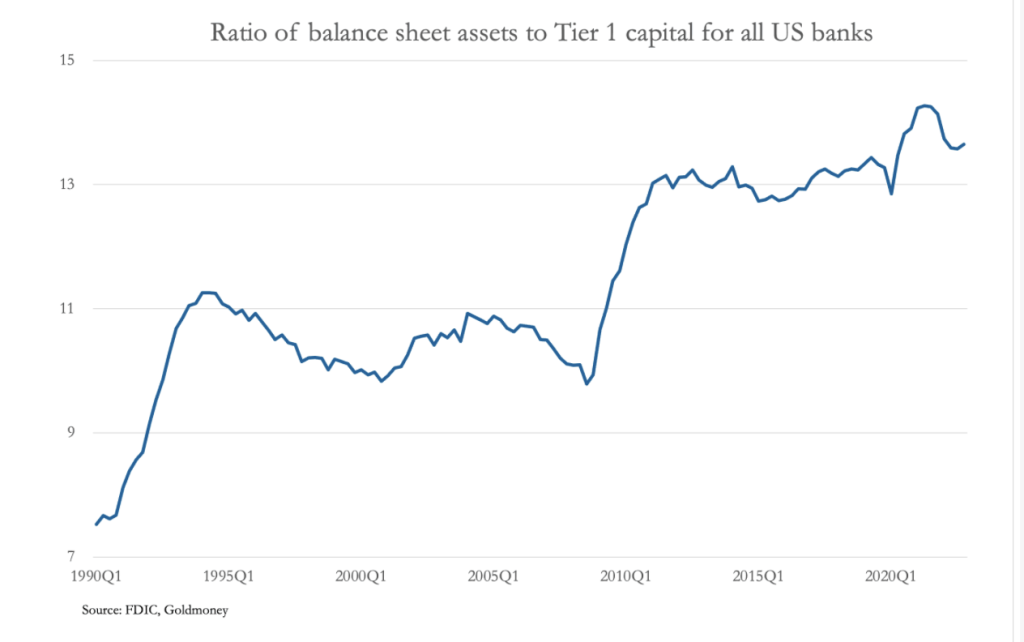

As interest rates rise both in the US and EU, outstanding credit is contracting. In the US, the balance sheets for all banks to Tier 1 capital is at a 30 year high. (See chart). This is a precarious level which puts the US banking system in a very fragile position. US banks must now shrink their balance sheets substantially by demanding loan repayments.

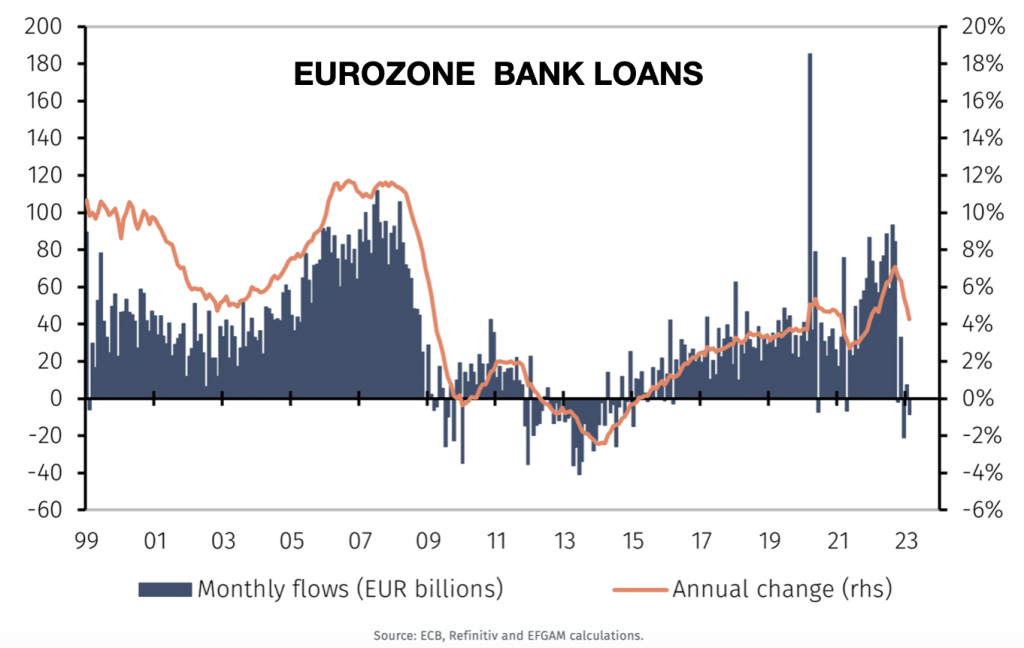

The situation in Europe is just as dire. Eurozone banks have tightened company credit the most since 2011 and expect to continue to do so.

CONSEQUENCES OF HIGH RATES AND CREDIT CONTRACTION

The high interest rates combined with a forced credit contraction will not only put pressure on the borrowers but also on the US and EU banking systems. As bank defaults accelerate, the carousel of central bank money printing will resume at an ever increasing pace.

Coming back to what will collapse, it is obvious that it will be primarily bank debt. So not only will credit be expensive but it will also be scarce. This will lead to major defaults by borrowers and solvency pressures for the banks.

Central bankers are opportunists who can never tell the truth. Their main purpose is to control the financial system in their and their banker friends’ favour. They are not stupid and most certainly understand the consequences of their constant manipulation of markets and their manufacturing of fake money. Their actions are totally in line with what Mayer Amschel Rothschild, a German banker stated in the late 1700s: “Let me issue and control a nation’s money and I care not who writes the laws.”

As I just mentioned, the other side of contracting bank balance sheets will be the banks’ infinite liquidity requirements.

So the next stage of the The Everything Collapse will be a constant pressure on Western banks’ liquidity and solvency. And the consequence of that is obvious – UNLIMITED MONEY PRINTING of a magnitude never seen before in history.

Remember that central banks have no REAL money and therefore extremely weak balance sheets. If they were a commercial bank, they would have been bankrupt long ago. But they have a very friendly partner in crime who is forced to collude in order to provide the only solution they know.

CONSEQUENCES OF THE EVERYTHING COLLAPSE

For us normal mortals, when ends don’t meet we need to either increase income or reduce expenses. But that is a formula that governments seldom practice and certainly not in the last 50+ years. They only know one solution which is to create more debt in order to solve their debt problem. That obviously sounds absurd but it is the only way a government can buy votes and stay in power.

Again, the consequences at the very end of a credit cycle will clearly be cataclysmic.

What will rapidly follow is:

- CURRENCY DEBASEMENT LEADING TO COLLAPSE

- HIGH INFLATION LEADING TO HYPERINFLATION

- FOOD AND ENERGY SHORTAGES

- DEBT DEFAULTS LEADING TO DEBT COLLAPSE

- IMPLOSION OF BUBBLE ASSETS (stocks, bonds, property) in real terms – Gold

- FAILURE OF FINANCIAL SYSTEM

- POLITICAL & SOCIAL TURMOIL – CIVIL UNREST

- GEOPOLITICAL PROBLEMS

- THE FALL OF THE WEST AND RISE OF THE EAST AND SOUTH

So how long will this take. Obviously no one knows.

But what we do know is that the risk is greater than at any time in history and this on a global scale. Every corner of the world will suffer with Europe, North America and Japan particularly exposed.

So initially it will happen Gradually but at some point the Suddenly phase will come whether that is in a few months time or in a few years.

Like with any impending risk, the key is obviously to protect against the risk today. I have stressed so many times that it is imperative to buy the insurance before the fire starts since it obviously will not be available after the event.

BANKRUPT – BANCA ROTTA

The word Bankruptcy originates from the Italian Banca Rotta or broken bench. Bankers in the 16th century Italy would conduct their business from a bench or table. When they could no longer fulfil their obligations, their bench was smashed to signify that they were out of business. Although the word rotten is said to derive from old Norse, it is not unlikely that the origin is the same as rotta. A broken or rotten bank/bench.

And this is the state of the world financial system today. The global banking system is not just broken, it is rotten to the core or in other words BANKRUPT.

In the last few weeks, we have witnessed three US and one Swiss bank collapse within a matter of days. The US banks, Silvergate, Silicon Valley Bank and Signature Bank all imploded within a matter of hours or days. They were all involved in the tech and crypto industry.

Their management had ZERO understanding of risk management, investing in long term bonds at the low of interest rates which then had to be liquidated at a massive loss.

A basic AI (Artificial Intelligence) computer programme would have managed these banks much better as long as they had not been programmed with greed as a primary requirement.

I wrote about the Credit Suisse collapse a few weeks ago: THIS IS IT! – THE FINANCIAL SYSTEM IS TERMINALLY BROKEN and warned our readers about it already 2 years ago – ARCHEGOS & CREDIT SUISSE – THE TIP OF THE ICEBERG

So Switzerland’s second bank, an insolvent Credit Suisse was absorbed by the No 1 Swiss bank – UBS.

The question is now if this merger is the blind leading the blind or 1+1 making a 1/2.

UBS was created by the merger of two Swiss banks in 1998. Since then it has had its fair share of scandals and losses. In 2008 for example, UBS lost CHF20 billion and has lost a few billions since then on fines and trading losses. Then there was the attack on undeclared US accounts (which every Swiss bank had) which put major pressure on the bank.

The problem is now that the new UBS/CS is 200% of Swiss GDP. Add to that the Swiss National Bank (SNB) is also bigger than Swiss GDP. And the SNB lost CHF122 billion in 2022 on currency and investment positions.

As I have stressed in previous articles, the Swiss banking system is not really worse than any banking system but its adventures confirm my view that no one should hold any major assets in any bank in any country. As I have stressed above, the Western financial system is rotten and not suitable for holding investors’ assets.

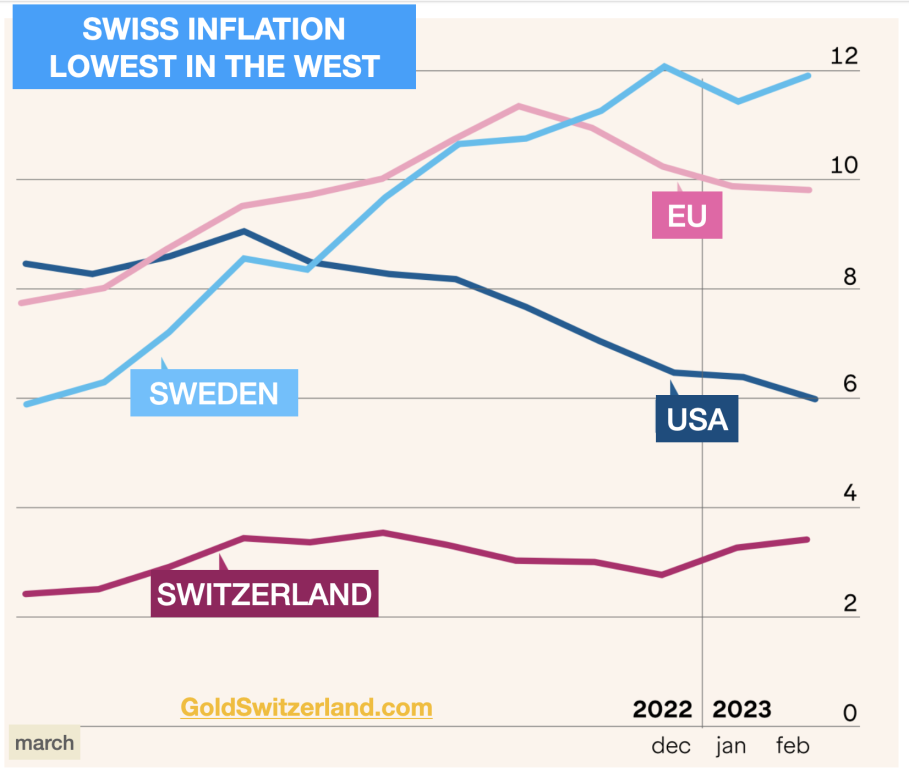

Regardless of the Swiss banking system, the Swiss economy is the strongest in the Western world and probably the whole world. Debt to GDP is under 40%, the budget deficit is very small and inflation is the lowest in the Western world. And the political system with direct democracy, is the best in the world.

Remember that the whole financial system is totally interconnected and once one major bank falls, the dominos will start falling throughout the whole system.

Yes, central banks will initially print unlimited amounts of money. But once the derivatives start to collapse, the money printing will be meaningless as the money at that point will be worthless.

GOLD IS ETERNAL MONEY

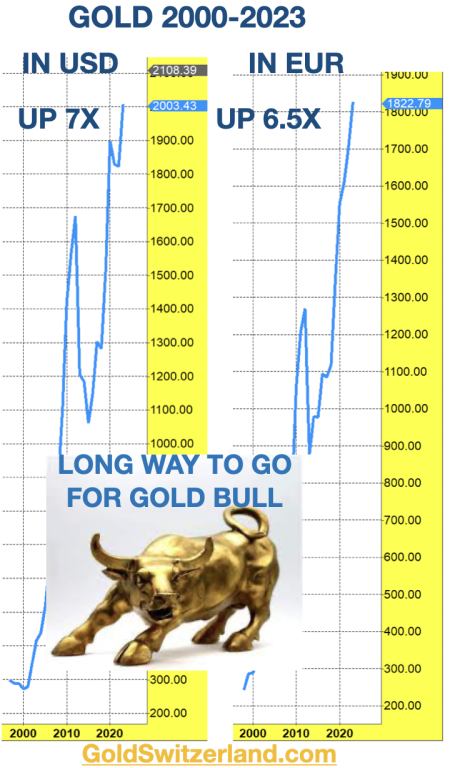

We have invested in physical gold held outside the banking system for our clients and ourselves for over 20 years.

During that time gold has gone up at least 7- 8X in most currencies and 100s to 1000s of times in weak currencies such as in Venezuela, Argentina, Zimbabwe, Turkey etc.

In spite of gold having appreciated by 700-800% in Western countries in this century, less than 0.5% of global financial assets are invested in gold.

Banks, investment advisors and fund managers don’t understand gold. Also, they can of course neither justify their role nor their existence if they bought just one asset around 20-22 years ago and just sat on it. Their raison d’être is to churn commission by trading frequently and speak to their clients in investment gobbledegook that makes them sound competent. But in reality 99% of investment professionals underperform the market so they are a redundant.

I would call this group of so-called experts not just incompetent but also negligent.

As all fiat money has gone to ZERO throughout history, without fail, any individual or investment manager who holds funds in cash is guaranteed to see the value evaporate over time. Remember that fiat money is down at least 97- 99% in all currencies since 1971 measured in real money – GOLD.

Remember also that Central Bankers are gold’s best friend. Throughout history they have always destroyed the value of money and thus supportive for gold. And today when the biggest money printing in history is about to start, holding physical gold outside the banking system is a SINE QUA NON (absolutely essential).

As physical gold will outperform virtually all major investments, in real terms, over the coming years, it is critical to own if you want to avoid a total destruction of your wealth.

Please remember to hold it in physical form in a safe jurisdiction and outside a fractured financial system.