In his latest note, SocGen’s Albert Edwards made an ominous – if obvious – comparison: “as energy prices surge with a backdrop of central bank tightening it’s starting to feel a bit like July 2008” referring to that moment of “unparalleled central bank madness as the ECB raised rates just as oil prices hit $150 and the recession arrived.” Then, looking at the dire impact that higher yields would have on the economy and markets which are still convinced the inflation (and in the case of European energy, hyperinflation) is transitory, he warned that not only has stagflation arrived, but that investors should “think hard about the likelihood that higher energy prices and bond yields will trigger a ‘wholly unexpected’ recession. For that is where the biggest risk might lie for investors.”

For once, Albert’s doomsday grumblings may be behind the curve, because according to former BOE central banker during the 2008 financial crisis and current Dartmouth College professor, David Blanchflower, and Alex Bryson of University College London, despite rising employment and wages, the US is already in a recession according to the recent plunge in consumer expectations. In a paper published on Thursday titled “The Economics of Walking About and Predicting US Downturns“, the establishment economist duo concluded that consumer expectations indexes from the Conference Board and University of Michigan tend to predict American downturns 18 months in advance.

“The economic situation in 2021 is exceptional, however, since unprecedented direct government intervention in the labor market through furlough-type arrangements has enabled employment rates to recover quickly from the huge downturn in 2020,” wrote Blanchflower and Bryson quoted by Bloomberg. “However, downward movements in consumer expectations in the last six months suggest the economy in the United States is entering recession now, even though employment and wage growth figures suggest otherwise.”

Can we predict recessions with expectations from social surveys? It seems so. See @D_Blanchflower presentation on our work at GLO yesterday: https://t.co/zHN5eWGNDj @UCLSocRes

— Alex Bryson (@AlexanderBryson) October 7, 2021

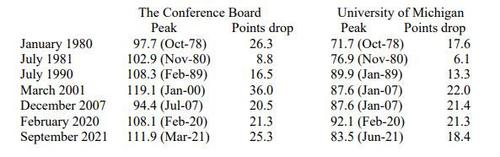

According to the authors, “all the recessions since the 1980s have been predicted by at least 10 and sometimes many more point drops in expectations indices.” Additionally, a single monthly rise of at least 0.3 percentage points in unemployment and two consecutive months of employment rate declines are also notable leading indicators.

The economists concludes that “this is a bold call of course, and not consistent with consensus and only time will tell if we are right.” However, they add “equivalent falls in these data in 2007 were an early indicator of recession, missed at the time by policymakers and economists. There is a possibility of course, that these data are giving a false steer. However, missing the declines in these variables in 2007, as most policymakers and economists did, proved fatal. It is our hope such mistakes will not be repeated this time around. They missed it last time, hopefully they won’t miss it this time. These qualitative data trends need to be taken seriously.”

As we noted at the end of September, the Conference Board’s gauge of current conditions fell to 143.4, a five-month low, while the group’s expectations index dropped to 86.60 the lowest since November.

Potentially offsetting this plunge, the University of Michigan’s gained. However, as we also noted, while one is private-entity sourced the other is government sponsored. Figure out which one is which from the chart below.