Say what you will about Germans, they have a distinct hate-hate relationship with hyperinflation, having been one of the very few “developed” nations to experience it in the not too distant past courtesy of Rudy von Havenstein’s application of “Modern Money Theory” to the Weimar Republic back in 1921 with less than stellar results. Well, Germany may soon enjoy double (and triple) digit price gains quite soon.

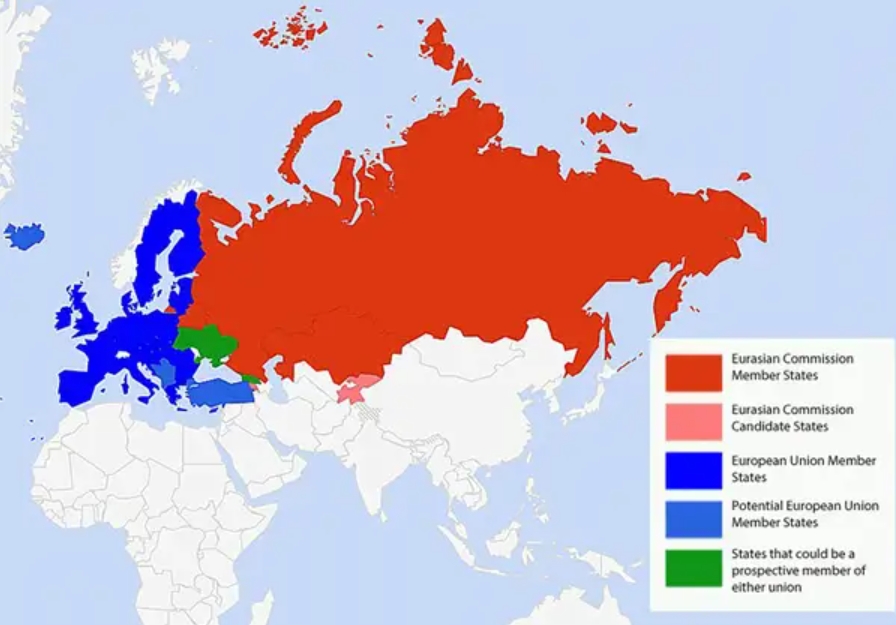

When asked by Frankfurter Allgemeine Zeitung about the possibility of double-digit inflation rates, Volker Wieland, a member of the German government’s council of economic advisers said that “it can’t be ruled out, especially if Russia stops oil and gas deliveries or if there’s a total import embargo, then I think inflation rates in this magnitude would be conceivable.”

Now if only Germany hadn’t allowed its energy policy to be determined by a petulant, publicity obsessed Swedish teenager, and if the country actually had some strategic views on how to maintain at least some energy independence, none of this would have happened (as we warned last summer in “Will ESG Trigger Energy Hyperinflation“). Unfortunately that wasn’t the case.

ECB sarcasm aside – which is not easy as one can never be sarcastic enough about the world’s most clueless ‘buy only’ hedge fund central bank – the reason why the topic of double-digit German inflation emerged is because earlier today analysts were shocked (again) when German headline inflation printed 7.6%yoy in March, sharply above consensus expectations of 6.8%, and up from 5.5% in December.

Here are some more details courtesy of Goldman:

- 1. German headline inflation was 7.6% yoy in March, sharply above consensus expectations, and up from 5.5%yoy in December. The press release highlights the rise in energy prices following the outbreak of the war in Ukraine and supply chain bottlenecks as driving forces behind the high March print. According to the release, an equivalently high inflation rate was last recorded in the autumn of 1981 in Germany.

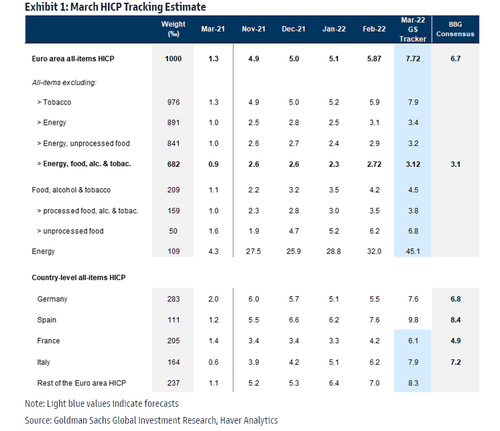

- 2. With the German and Spanish releases in hand, we update our tracking estimate of Friday’s flash March Euro area HICP inflation (Exhibit 1). We upgrade our headline inflation forecast to 7.72%yoy, from 7.56%yoy previously, signalling sizable upside risk to consensus expectations. We leave our core inflation tracking estimate unchanged at 3.12%yoy. With a few more days of energy price data, we also increase our Italian headline HICP inflation forecast to 7.9%yoy (from 7.4%yoy previously) and lower our French headline inflation forecast to 6.1%yoy (from 6.3%yoy previously).

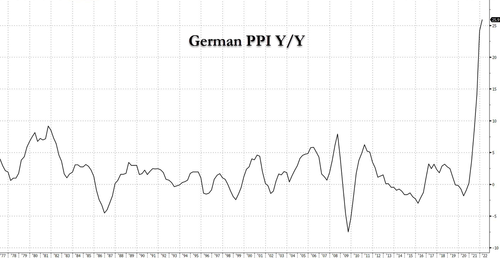

Finally, for those who think that double digit inflation is in the bag but triple digit is clearly hyperexageration, here is what German PPI looks like: in February it hit 25.9%… and that was before the Russian invasion really pushed commodity prices into overdrive.

So how long before German prices double over the past year (i.e., 100%+) and how long after that before they are passed on to consumers? And to think that at least Germans were smart enough to recognize those clueless politicians who would sell them down the river for just a few minutes in the global virtue signaling limelight with the likes of John Kerry, even if the outcome was the second coming of Weimar hyperinflation…