The “cargo cult” represents an important concept and seems especially so of late. Early observations of such behavior emerged in island cultures exposed to European explorers. Ships unlike anything previously dreamed of arrived full of strange people with wondrous trade goods for exchange. Metals, mirrors, muskets, you name it. The desire for these advanced goods was strong and so the locals traded for them with gusto. Then, at some point, the newcomers left.

The locals wanted more trade and to attempt to foster it, many adopted rituals whereby they would create what essentially amounted to effigies of ships and float them on the sea in hope that this would make the trade goods come once more.

Astonishingly, examples of such practices remain, even today.

In essence, this practice is a category error of mistaking the surface marker or seeming of a thing for the thing itself and before anyone gets too supercilious and starts laughing up their sleeves about “those poor ignorant savages and their imaginary landing strips to which no planes will ever come.”

Let me first caution that this is not only one of the most human of phenomena, but also one of the most prolific. It’s absolutely fricking everywhere and being an “educated modern person” is zero defense against it and may well increase one’s overall vulnerability especially given, as I will begin to explore below, the inevitable effect it has on issues like higher education. It’s a model of the world worth considering.

Cargo cult thinking has become endemic in the ideas of so-called “modern” government and mistaking the signifier of a thing for the thing itself is a very dangerous and expensive proposition when you can distort markets by throwing trillions of dollars at them. At least the Bislama torch brigade is not using up a whole lot of resources or causing lasting or even lifelong harm through its misapprehension and malpractice, because let me tell you mis amigos, we here in the US most certainly are.

Cargo cat sez “Buy a house!”

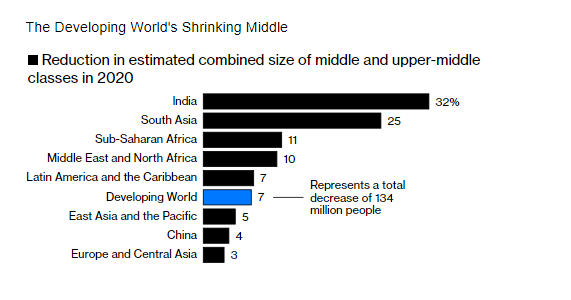

Consider the 2008 financial crisis, a crisis caused by the mandating (and federal guaranteeing) of loans to the extremely uncreditworthy as though they were prime credits. Pretty much anyone can tell you that that never ends well. It’s not exactly subtle but it was altogether ignored because there was a cargo cult outbreak underway.

The cult was this: middle class people own homes. Therefore, if we enable these lower-class people to own homes, they will be elevated to become middle class. “Home ownership is the path to a middle-class life” was the mantra of the day. But, as many (including me) warned at the time and as events clearly showed: this is obviously, painfully, catastrophically wrong.

The home does not make you middle class. It’s something you can successfully acquire and pay for once you have met a set of other criteria like stability, income, etc. that have made you middle class. The home is predominantly an effect, not a cause.

If you do not have the income or the stability and general creditworthiness, suddenly having a home and a huge pile of debt associated with it does not elevate you, it chokes you. At some point, you cannot pay. It can drive you into bankruptcy, wreck your life, your finances, and set you back decades in terms of the quest for financial independence and stability. You mistook a marker of a certain sort of person for meaning that you would be that sort of person if you possessed the marker, and that sort of mistake can cost dear. Obvious instances abound.

There is no surer way to fail to become a rich person than aping the expenditures of rich people at a time when you cannot afford to. Buying a Ferrari with a $400k car loan is not the path to prosperity. Neither is eating at places you can’t afford or taking posh vacations. These may make you look like a rich person to an uninformed observer, but they are, in actuality, poverty traps, markers mistaken for meaning.

It’s easier to see if we add a little absurdity:

- Adults drive cars, so if we give a car to a 4-year-old, they will be an adult

- People in sequined suits walk on high wires; therefore if I dress in spangles I, too, may perform death-defying stunts and not fall to my untimely end.

These are clearly examples that fail to pass the “seems plausible” test and few would make such a mistake and so these do not represent large dangers but what of the ones we do fall for?

- Tour de France riders ride this bike so if I get one, I’ll ride like a pro! (Visit northern California and tell me this one is not as widely practiced as it is denied.)

But these can get desperately serious well beyond the realm of a $15,000 bike, $5 legs.

What about “if I <for reasons of your intrinsic/intersectional qualities> give you a job for which you are not qualified, you’ll rise to the occasion and thrive as opposed to get buried and look inadequate?”

Or what about the even subtler issue of “seeing a person of <this type> in a role of <whatever we’re pushing> provides a good example and normalizes the sort of intersectional integration and equity we’re seeking to promote” as opposed to “affirmative action demeans the legitimate achievements of whole groups by rendering any in high position suspect for nepotism/preferencing over merit?”

Or what about the absolute doozie of “If you get a college degree it’s the path to career and earnings success?” Because that one is starting to hurt A LOT of people, bend the economy out of shape, destroy the original function of higher learning, and turn universities into factories of radicalization and persecution fantasy stripped of rigor – setting up many of those who go there for failure and debt.

Doubt me? Let’s look.

I have donned my ceremonial hat and brandished my ornate document; why does money not fall from the sky?

It’s been an article of faith for decades that those with college degrees outearn those without. And it clearly shows up in the data. The correlation is unmistakable. But, and this is a massive but, that does not mean what many suspect. It does not mean that “college creates earnings and opportunity.” For many, it starts to seem to mean the opposite: college is a lost opportunity and vast expenditure and debt accumulation that will never pay for itself. And a lot of this comes down to bad expectations and a form of “Lake Wobegon fallacy” of statistical illiteracy.

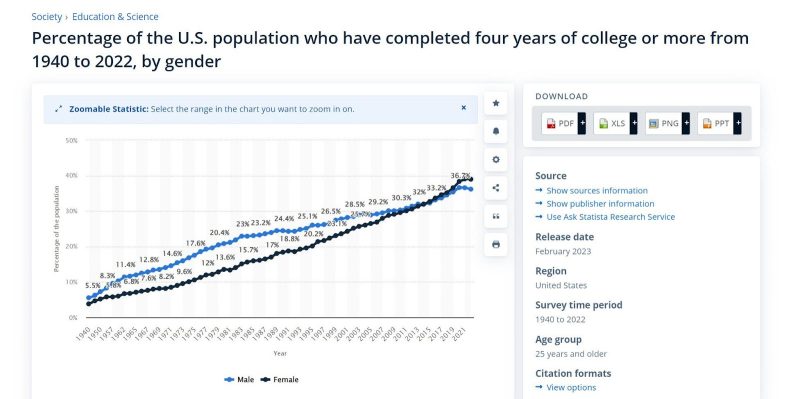

The percentage of Americans getting college degrees has exploded from around 4 percent in 1940 to 37% percent now and this actually understates the issue as this is just the number who successfully complete a 4-year degree. Over 70 percent of recent high school grads enroll in college which means that around 45 percent of 16-24 year olds are enrolled in college and more than half were at some point. What was once 1 in 20 is now 1 in 2. And that’s a VERY different thing and this is where the cargo cult emerges:

An institution for the top five percentile of a society is a very different place than an institution for the whole top half. It must be structured differently, work differently, place different demands, and perhaps most of all: its output and the outcomes of those who attended are going to be different. College is not magic. It does not make people more motivated or smarter. It may select for these traits, but it does not make those who attend “higher percentile” in terms of innate ability or expected outcome.

Past a point, college may be inflicting harm and I would argue that based on the promises and expectations, it is creating a mathematical impossibility.

It seems like every kid who enrolls in college is expecting to be in the top 10-20 percent of earners. This is sort of “the deal” that folks are buying into. But if 50 percent of society is enrolling, it’s obviously impossible. The real world is not Lake Wobegon. We cannot all be above average.

Half of society cannot be a top 10 percent earner and that’s the sort of outcome being mistaken for the marker of “went to college” – a thing that used to all but unerringly signify “top decile” but that does so no longer. Somewhere on the order of 3/4 of them are going to wind up being disappointed. They have to be. It’s just math. (Perhaps this is why high schools and universities seem so increasingly loath to teach it?)

So, “Get a college degree, be a top decile earner” is clearly a cargo cult for many, probably for most who start down that path. It’s a ritual that fails on results. And this gets MUCH worse because the very fact of so many having been inducted into the cult has made cult membership vastly more expensive and therefore considerably less attractive.

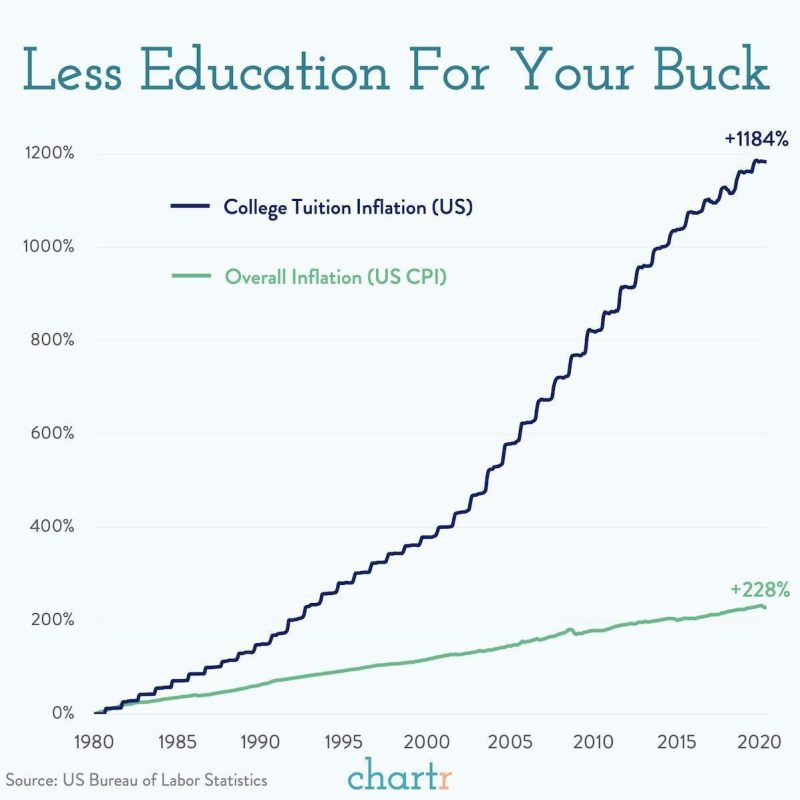

The price of college tuition has gone mad as all the natives clamor for the magic of the trade to come. The variance is astonishing. I got what for the time was a VERY expensive education. I did four years at a prestigious boarding school and four more at a top university. It cost over $100k, but this was still within reach of my middle class parents who had scrimped and saved over the course of my life to be able to make that happen for me.

Today, that would barely buy you a year. My education from then would cost closer to $700k at current prices for the same schools. And that is a VERY different proposition.

If you’re going to lay out that kind of cheddar, you better be pretty sure of the value you’re getting and the value that was actually added by the education. This is especially true in a day and age when truck driver salaries are starting at $100k and plumbers and electricians are making mints because the skilled trades in the US are an empty bench of understaffing trying to serve exploding demand.

So just who is served by this sort of expenditure? Only the very top earners are going to comfortably be able justify a cash-on-cash return to that sort of outlay.

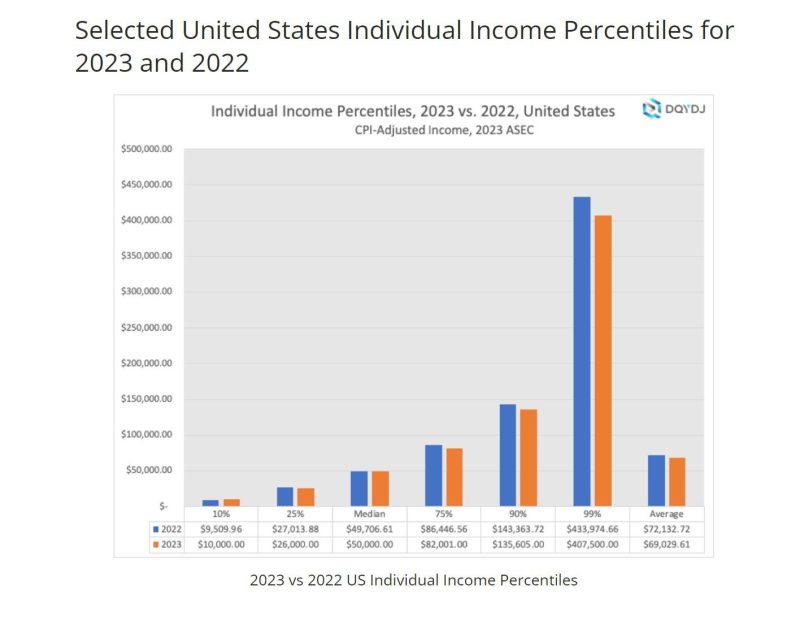

2023 median US individual income is $50k. (The 2022 data is imputed in real terms using CPI.) The 75th percentile is $82k. You’d probably take home $62k of that. How are you going to pay off $700k in debt from that (or even just the $400k from a top university)? You aren’t. Obviously, $400k in university debt is a death sentence for nearly all earners.

Even the 90th percentile, the top 10 percent of all earners, is making $135k and probably taking home ~$100k. It would take 20 percent of that every year just to keep up with 5 percent interest on a $400k loan. You could not even make a dent in the principal. See the problem? Yeah. Cult membership is expensive and obviously, fewer than 1 in 4 people enrolling in college are going to hit the top 10 percent (and certainly not at first; that group is mostly older people later in careers with more experience, seniority, etc.)

Now, clearly, $400k is a lot of debt and more than most will undertake, but that’s what the top schools cost. Forty-five million borrowers have student loan debt today, which is how federal lending has exploded from around $400 billion in 2005 to nearly $1.8 trillion today. It’s been compounding at a staggering 9 percent a year.The average per borrower is around $39k with a median much lower ($20-25k) which implies that is a few folks with big loans dragging up the average, probably the ones who went to top schools.

This is still a big deal.

- A $25k loan at 5 percent interest paid off in 10 years is a $330 monthly payment, $3,960 a year

- A $39k loan at 5 percent interest paid off in 10 years is a $515 monthly payment, $6,180 a year.

- At $100k, $1,321/mo gets you $15,852/yr. $400k? Yeah, you’re paying $63k a year.

You fund a whole Ivy education with debt, you are going to seriously struggle to pay it back. The 90th percentile? No chance of paying this. The 99th percentile (where take home is probably $250k) will still be allocating 1/4 of take home pay to debt, and pretty much no one is 99th percentile for the first 10 years out of school. So the question of “Was this worth the money?” starts to look pretty iffy for full freight Ivy education.

And we have not yet addressed the issue of “Are the top earners top earners based on where they went to school or were they going to wind up there anyhow and happened to go to top schools along the way because they’re the sort of people who consistently wind up at the top of whatever endeavor they undertake?”

It’s a bigger question than many realize. I see it all the time professionally. Early on in career, yeah; it’s all the kids from schools like mine in jobs like mine. But as you get up to the top? Nope. It’s all over the place. Outside of government, you’re as likely to see a CEO from State as Yale.

But this top tier from top schools is a bit of an outlier; let’s move back to the middle:

Fact: hitting the 75th percentile of income in their first 10 years of work is an unrealistic expectation for most who enroll in college.

Recall it is half of society enrolling and that they are competing for percentile slots with older, more experienced, more established workers. But even if they manage it from day one, $6,180 a year (based on average loan) is 10 percent of their after-tax income (~$62k) over a 10-year span. In reality it’s likely to be more like 15%-20 percent because pay will be lower.

Wage increases will help, but they need to be 5 percent a year just to keep up with interest and being in the top quarter of all earners working when you’re being comped to people in their 40’s and 50’s in prime professional earnings years is a tall ask for most 20-somethings, even the very smart and capable ones.

So, 10-20 percent of take home pay is a big number, the kind of number that stops you from being able to do the other things (like save or buy a home) that lift you into the middle and upper classes, generate stability, and start setting you up for life. So even when you win this bet, you’re still losing ground.

This is a VERY expensive cult to join, one so expensive and whose payback is sufficiently poor that very few private underwriters would lend against it (92-95 percent of student loans are government) and that, just like the housing bubble, is being driven by a government that lends without regard to ability to repay to people who fail to understand the proposition and are mistaking the marker of a thing for the thing itself. It’s homeownership all over again except that not even BK discharges most kinds of student debt. It’s become such an obvious trap that even the feckless federales want to just write it off.

Why is there a bubble? Because that’s what indiscriminate cash flows do. More people and more money are chasing a relatively inelastic number of college spots (this is especially so at top schools whose enrollment has not risen) until the market is well and truly broken; punching $1.4 trillion of borrowed money into a market over 18 years will do that. This problem likely would not even exist if the federal lenders had not created it.

Just as homes did in 2007, college prices mostly represent a bad investment that cannot be sustained.

And now, as then, it becomes a question of when, not if, this is all going to go bad.

And now, as then, those sucked into debt accumulation by these false promises and misrepresentations of markers as substance are going to pay the price and have their futures cut out from under them because lending-fueled cargo cults end in tragedy.

It’s basically a perfect heuristic: whatever class of people the feds are indiscriminately lending piles of money to right now are going to get porked 15 years down the road. It’s as regular as sunrise.

They were promised trade goods, wealth, and high position but 50 percent can never be in the top 10 percent and so the promises will go unkept. The fact is that they could not have been kept. It’s just math. This purported path to elevation was a sham, another government-enabled category error producing not the pavement of prosperity but a perpetual path to penury.

And so the bell will toll and they’ll stand with their “hermeneutics of aggrievement in diversity narratives” degrees and utter the magical job phrases of “Venti-double whip no foam, for Kyle? You want a scone with that?” as they wait in vain for planes that will never land.

Your plumber owns his home and a boat.

Your electrician has a vacation house and a Ford Raptor.

Their job security is outstanding.

They did it without risk or huge capital outlay.

It’s time to re-assess the “need” for half of America to go to college as a vital path to the middle class.

For some, sure, it’s a great plan, always was.

But for many, this is not a sail; it’s an anchor.

It’s just cargo cult baggage.

Republished from the author’s Substack

By