- Ukraine is part of a far bigger geopolitical picture. Russia and China want US hegemonic influence in the Eurasian continent marginalised. Following defeats for US foreign policy in Syria and Afghanistan and following Brexit, Putin is driving a wedge between America and the non-Anglo-Saxon EU.

- Due to global monetary expansion, rising energy prices are benefiting Russia, which can afford to squeeze Germany and other EU states dependent on Russian natural gas. The squeeze will only stop when America backs off.

- Being keenly aware that its dominant role in NATO is under threat, America has been trying to escalate the Ukraine crisis to suck Russia into an untenable occupation. Putin won’t fall for it.

- The danger for us all is not a boots-on-the-ground war — that’s likely to only involve the pre-emptive attacks on military installations Putin initiated last night — but a financial war for which Russia is fully prepared.

- Both sides probably do not know how fragile the Eurozone banking system is, with both the ECB and its national central bank shareholders already having liabilities greater than their assets. In other words, rising interest rates have broken the euro system and an economic and financial catastrophe on its eastern flank will probably trigger its collapse.

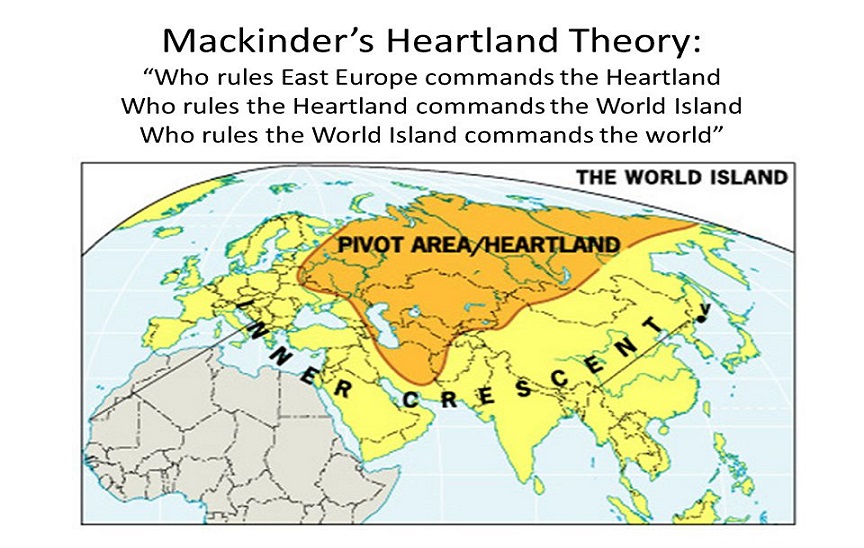

The bigger picture is Mackinder’s World Island

The developing tension over Ukraine is part of a bigger picture — a struggle between America and the two Eurasian hegemons, Russia and China. The prize is ultimate control over Mackinder’s World Island.

Halford Mackinder is acknowledged as the founder of geopolitics: the study of factors such as geography, geology, economics, demography, politics, and foreign policy and their interaction. His original paper was entitled “The Geographical Pivot of History”, presented at the Royal Geographical Society in 1905 in which he first formulated his Heartland Theory, which extended geopolitical analysis to encompass the entire globe.

In this and a subsequent paper (Democratic Ideals and Reality: A study in the Politics of Reconstruction, 1919) he built on his Heartland Theory, and from which his famous quote has been passed down to us: “Who rules East Europe commands the World Island [Eurasia]; Who rules the World Island rules the World”. Stalin was said to have been interested in this theory, and while it is not generally admitted, the leaders and administrations of Russia, China and America are almost certainly aware of Mackinder’s theory and its implications.

We cannot know if the Russian and Chinese leaders and administrations are avid Mackinder fans, but their partnership in the Shanghai Cooperation Organisation is consistent with his World Island Theory. Since commencing as a post-Soviet, post-Mao security agreement between Russia and China founded in 2001 to suppress Islamic fundamentalism, the SCO has evolved into a political and economic intergovernmental organisation, which with its members, observer states, and dialog partners accounts for over 3.5 billion people, half the world’s population.

The symbiotic relationship between resource rich Russia and the industrial Chinese ties the whole SCO together. China’s development of the Asian land mass holds the promise of dramatic improvements in everyone’s living conditions. And consistent with the World Island Theory, Chinese money now dominates the whole of sub-Saharan Africa, the Middle East and South-East Asian nations, particularly those controlled and influenced by the Chinese diaspora. China’s influence also spreads to South America through organisations such as BRICS (B is for Brazil) and Chile for copper and other metals.

While the Sino-Russian partnership dominates the World Island economically, America has only gradually been expelled from Asian affairs. Its post 9/11 campaigns in the Middle East destabilised that region, creating fuel for America’s enemies and appalling refugee calamities for her European allies to this day. Her withdrawal from resource-rich Afghanistan was merely the last domino to fall. She retains political influence in Western Europe and South-East Asia only, though her military and intelligence presence is still widespread.

Today, America’s actions are those of a hegemon whose time is passing. By the UK opting for Brexit, American influence over the European Union through its security and political partnership with the UK has been diminished. Its grip on European affairs through NATO is being undermined by both Turkey’s determination to shift its interests into the Turkic regions of Central Asia, and the EU’s determination to establish its own defence arrangements. The irrelevance of NATO for the future defence of Western Europe is now becoming apparent to the Russians, and it must be hard for them to resist speeding its decline.

The cold war in the Pacific is all about containing China. While Taiwan’s future and China’s attempts to establish naval bases in the South China Seas hog the headlines, China’s trade influence in the region continues to increase. After President Trump withdrew America from the planned Trans-Pacific Partnership, the TTP was replaced by the Comprehensive and Progressive Agreement for Trans-Pacific Partnership which came into force in December 2018, whose eleven signatories have combined economies representing 13.4% of world GDP. This makes it one of the largest free trade areas by GDP and includes Australia and New Zealand. Even the UK has formally applied to join (it qualifies as a Pacific nation through its dependencies in the region), so that three of the US security “five eyes” members will be part of the CPTPP.

China also applied to join the CPTPP last September. For now, China’s membership of the CPTPP is in doubt. US allies in the partnership, including Japan, are insisting on various obstructive provisions. But in that well-worn hackneyed metaphor, China is the elephant in the room, and it is hard to see the CPTPP holding out against her membership for ever. For now, China can chip away at it by separate free trade agreements with selected CPTPP members, with whom it is already in bilateral trade.

Whatever America’s desire to retain political and military control over the Pacific may be, the economics of trade will eventually diminish that influence. And while sabres are being rattled over Taiwan and Pacific atolls, Russia is putting pressure on Europe to put an end to American dominated defence arrangements at the other end of the World Island.

Observers of the greatest of the great games would be right to look at current developments over Ukraine in the context of Mackinder’s heartland theory. Understand that, and you have a grasp of Putin’s reasoning. Driving American influence out of the Eurasian continent has been his objective ever since America reneged on her agreement not to advance NATO any closer to Russia following the ending of the old USSR.

Ukraine is caught in the middle

Both Russia and the Anglo-Saxons are ramping up the rhetoric over Ukraine. Until recently, Ukraine itself had seen little evidence of any truth in Western propaganda, asking for it to be toned down because all this war talk is increasing its likelihood and ruining the economy. Meanwhile the EU mainstream just wants peace and natural gas.

Concern is being expressed in some quarters that all this talk of war might become self-fulfilling — like the first World War. In this case, it is generally agreed by military strategists that Putin would be mad to take over Ukraine. He certainly has the fire power, and Ukraine is cast like a Belgium on the Steppes, with two ethnic groups and whose main purpose seems to be to allow foreign occupation and passage for foreign troops. But holding on to Ukraine against the peoples’ will, when there is an immensely long border over which dissidents can be provided with arms and anti-Russian propaganda is another matter.

Russian occupation is likely to be limited to defending Donbas and Luhansk now that Russia has formally recognised their right to self-determination. Without firing a shot, the Russian military has moved the border a hundred miles into formally Ukrainian territory. But that is where an occupying invasion is likely to stop and is not to be confused with the pre-emptive strikes against military bases and airfields today.

These moves are there to apply increasing pressure for a diplomatic settlement. So, what is it that Putin wants? Basically, he wants America to get out of Eastern Europe. And following Brexit, as America’s poodle he sees no reason why Britain should be there either. And having his thumb over various gas pipes into Europe, he is squeezing Germany and the other EU NATO members into his way of thinking.

Ukraine comes in the wake of America’s disastrous evacuation of Afghanistan, which followed the failure of her attempt to remove Syria’s Assad. It is rumoured that US intelligence services organised the failed coup in Kazakhstan, which was quickly subdued by Russian troops. So, from Putin’s point of view, American policy with respect to the Eurasian land mass has failed, he has America on the run, and he will want to capitalise on its retreat.

Meanwhile America, which has ruled western Europe through NATO following WW2, finds it hard to come to terms with its setbacks and needs to get back on the front foot. Presumably, by ramping up fears of a Russian invasion, the Biden administration hoped that either Putin would back down or be tricked into attacking Ukraine. If he had backed down, that would be a diplomatic victory and allow America to rebuild its presence in Kiev. If Putin invades and occupies Ukraine, America can help make life extremely difficult for an occupying force. Either way, it would mark the end of American policy failures on the Eurasian continent. Britain, as always, merely toes the American line.

But Putin is no fool. He is destroying Ukraine’s economy. He has his thumb on Nord Stream 1 and 2. And Germany has too many commercial and financial interests in both Russia and Eastern Europe for this not to hurt. Germany also hosts the main railhead for China’s silk road. If Germany kowtows to America, will America then put pressure on her to cut ties with China?

This is the geopolitical reality Germany and all mainland Europeans must now face. The new German Chancellor must decide: does he back America, sacrifice Germany’s economic potential and see energy costs soar, or does he recognise the economic realities of the Russia—China partnership and the enormous opportunities it provides for the long run?

Russia, America, and Germany are the principal actors whose decisions will decide the outcome of the Ukrainian situation. An escalation into a non-nuclear conflict and Russian occupation of Ukraine will only suit the Americans, confirming that their presence is the guarantee of national security.

Ukraine has become a virtual battleground.

Ukraine’s geographical position, between the liberated central European states and Russia ensured that it would become central to the continuing rivalry between Russia and America. Since the fall of the Soviet Union, Ukraine has been determined to forge its path independent of Russia as a sovereign nation. But its starting point was difficult, with its eastern provinces predominantly Russian, while the western regions were more central European.

The Orange and Maidan Revolutions in 2004 and 2014 respectively were proxy struggles between America and Russia. While America allegedly chucked billions into its Ukrainian interests, in 2014 Russia responded by taking over Crimea and fomented rebellions in Luhansk and Donetsk. By capturing Crimea and fostering two breakaway provinces, Putin had won this territorial battle in an ongoing war.

Other than these eastern provinces, most Ukrainians have desperately tried to avoid their country becoming a Russian colony. They wanted to apply for EU membership, which was rejected by Russian-backed President Yanukovych in 2013, leading to the Maidan Revolution and Yanukovych fleeing the country to Russia. Ukraine has also sought the protection of NATO, which has provoked Putin to put a stop to American influences marching eastwards.

While Ukraine never left the headlines, the US moved its focus to Syria later in 2014.The eventual failure to oust Assad, who drew on Russian help, was followed by Afghanistan. Ukraine is now back in the headlines, this time at the behest of Russia. Putin is now proactively leading this conflict instead of quietly letting America make all the mistakes and rolling with the punches, representing a major change in Russian strategy. It implies that Putin perceives America to be off balance, and he sees it as the time for a winning move.

Putin has prepared his defences carefully. US politicians called for Russia to be cut out of SWIFT after the Crimean invasion. Since then, Russia has developed Mir, a payment system for electronic fund transfers, and a SWIFT equivalent known as SPFS — System for transfer of Financial Messages, with agreements linking SPFS to other payment systems in China, India, Iran, and member nations of the Eurasian Economic Union. The Central Bank of Russia has strengthened the commercial banking network. And it has also reduced its dollar exposure as much as possible by investing in gold and euros instead, which means less reserves are held as deposits in the US banking system and invested in US bonds.

From these actions, Putin has signalled that he is aware that the danger to Russia is more likely to be a financial war, rather than a physical one. As President Biden said, to have American troops on the ground fighting the Russians is a world war and will not happen. In that sense the Ukraine, over which Russia retains an energy stranglehold, is a virtual battleground for a proxy war.

Financial considerations

In examining the strengths and weakness of the principal parties, we must first confirm who they are: Russia, America, and the EU. And in the EU, principally it is Germany, but all member states will be affected.

As argued above, Russia’s real objective is to get America out of Europe, and Putin’s strategy is to drive a wedge between America and the EU, and in particular its industrial powerhouse, Germany. Plans to split America from Europe go back to Putin’s earlier days, with the construction of Nord Stream to bypass Ukraine with which Russia’s Gazprom was in dispute. Delivering 55bn billion cubic meters of natural gas annually, the first Nord Stream was completed in 2012. A second pipeline. Nord Stream 2, which is ready to go online, doubles this capacity.

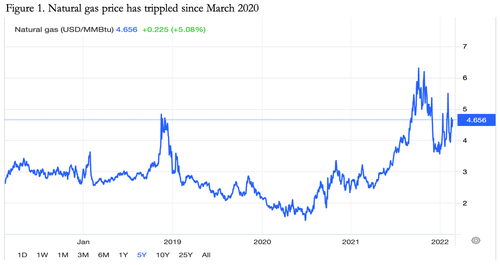

American pressure on Germany to delay the operation of Nord Stream 2 follows the dollar’s debasement from March 2020 in particular, when the Fed reduced interest rates to zero and instituted QE of $120bn every month. The effect has been to undermine the dollar’s purchasing power for nearly all commodities, including energy. Consequently, a combination of dollar debasement, winter demand and the absence of extra supply from Russia has created an energy crisis not just for Germany, but all EU members.

Germany is particularly hard hit, with its producer prices index up 25% year-on-year at the end of January. Germany cannot go along with an escalation of financial sanctions against Russia at a time when its industry is struggling with other rising production costs. Not only is her trade with Russia substantial, but she has banking and financial interests in Central Europe, Eastern Europe, and Russia, which could be destabilised by American-led attempts to restrict payments.

Despite Chancellor Scholz’s initial support for EU sanctions Germany is likely to be indecisive, torn between competing demands from a collapsing economy and pressure from NATO. By withholding regulatory permission for Nord Stream 2 he has demonstrated that instead of regarding his electors’ interests as paramount, he has given in to NATO pressure. This weakness on Olaf Scholz’s part is consistent with the indecisive socialism of his Social Democratic Party and Germany’s continuing guilt trip following two world wars.

Recognising the importance of Germany and its likely indecision, President Macron of France seized the political opportunity to mediate between Russia and the EU, which suits the Russian cause. Macron simply provided another channel for Putin’s message about NATO: get the US out of Europe and the EU should be responsible for its own defence. And given Macron’s ambitions for France in Europe he is likely to see it as an opportunity to enable France to take the lead in the EU’s future defence arrangements after the Ukraine situation has blown over. That will be down the road, but for now the EU is standing firm behind US and UK sanction proposals.

Sanctions rarely work. They merely encourage the sanctioned to dig deeper into their own intellectual and entrepreneurial resources and work hard to find ways round them. Russia will merely sell its gas elsewhere: at these high prices harm is minimal, and they can afford to restrict supplies through Ukraine, the Yamal-Europe and Turk-stream pipeline supplies. It might be sensible for Russia to allow flows through Nord Stream 1 to continue for now, holding its restriction as a backup threat. European gas prices will likely rise even further, providing a price windfall for Russia. The tweet below, from former Russian President Medvedev implies European gas prices will double from here.

The apparent lack of understanding of economic and financial consequences for the EU by the EU leadership is a wild card danger. The economic and financial exposure of Germany to its eastern neighbours has already been mentioned, but other EU members are similarly exposed. Furthermore, the reckless inflationary policies of the ECB have undermined the financial health of the entire euro system to the point where even on the current rise in bond yields, the ECB and all the national central banks (with only three minor exceptions) have liabilities greater than their assets. The whole eurozone is a mountain of financial disasters balanced on an apex over which it is set to topple.

We cannot say for sure that Ukraine will be the last straw for the euro system, but we can point to political ignorance of this instability. Any dissenting central banker (and there could be some, particularly at the Bundesbank) has no influence at the political level. We must assume that none of the major political players in this tragedy are aware of the financial and economic crisis in Europe waiting to be triggered. And if the Russians have made a mistake, it will be in their accumulation of euro reserves, which will turn out to be worthless when the euro system collapses.

Financial sanctions against individual oligarchs have probably already been anticipated and avoiding action been taken by them: oligarchs are not dumb. Sanctions against Russian banks will have also been anticipated and will probably inflict less damage on them than on their counterparties in the EU banking system, particularly if SWIFT comes under pressure to suspend Russian banking access.

Not only Ukraine, but the whole of the EU, for which Russia supplies over 40% of its natural gas, is being squeezed. We can be reasonably sure that the Russian government has war-gamed this situation in advance.

Inflation, gold, and unintended consequences

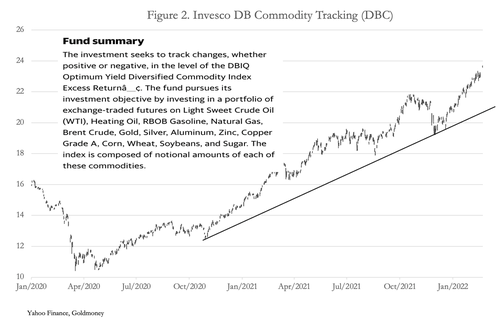

The situation today is very different from that of 2014 at the time of the Maidan revolution, with the world massively increasing government debt and currency in circulation since then. At the time of the Crimean take-over, commodity prices were declining from their peak in 2011, and following Crimea, they fell sharply with negative consequences for the Russian economy. The expansion of world currencies is now driving commodity and energy prices higher due to their purchasing power is declining.

Figure 2 shows how a basket of commodities has increased in price since the Fed reduced its funds rate to the zero bound and instituted QE at $120bn per month. In those 22 months commodity prices have risen by 127% by this measure.

When all commodity prices rise at the same time it is due to currency debasement, which is what has happened here. Within the broader commodity context, energy price increases have been particularly acute, with Russia being a major beneficiary, leading to a substantial surplus on its balance of trade.

It has been a long-term ambition of the Sino-Russian partnership not just to expel America from the World Island but to reduce dependency on dollars as well. While trade between Russia and China is increasingly settled in their own currencies, so long as the dollar has credibility for settling international transactions it will still dominate trade for the other nations in the Eurasian landmass.

The fiat alternative for Russia has been the euro, which partly explains why Russia has accumulated them in her foreign currency reserves. But since 2014, the stability of the euro system has deteriorated to the point where the currency is no longer a credible alternative to the US dollar. We cannot be sure if this is understood in the Kremlin. But there has always been a Plan B, which is the accumulation of physical gold.

There is evidence that official reserves in China and Russia understate the true position. Following the enactment of regulations in 1983 whereby the Peoples Bank was appointed sole responsibility for the acquisition of China’s gold and silver reserves, I have estimated that the State accumulated as much as 20,000 tonnes of gold before permitting the public to own gold, for which purpose the Shanghai Gold Exchange was established in 2002. Since then, the SGE has delivered a further 20,000 tonnes from its vaults into public hands, though some of this will have been returned as scrap.

The Chinese state has retained the exclusive right to mine and refine gold, even importing doré from abroad. China is now the largest gold mine producer in the world by far, continuing to add over tonnes annually to total above ground stocks (last year’s dip to 350 tonnes was due to covid), which are all ringfenced in China. These policies, as well as anecdotal evidence suggests that my earlier estimate of state-owned gold of 20,000 tonnes was realistic.

Russia has been relatively late in adding to her gold reserves, having officially accumulated 2,298 tonnes. But being only second to China as a gold mine producer at 330 tonnes, it is likely that following earlier financial sanctions that Russia has accumulated undeclared gold reserves as well. Additionally, we can see that all the SCO members and their associates have increased their declared gold reserves by 75% since 2014. Plan B therefore appears to be to back fiat roubles and renminbi with gold in the event of a Western fiat currency meltdown.

The West has no such plan. America’s fifty-one-year denial of and attempted demotion of gold as the ultimate money appears to have left it short: otherwise it could have returned Germany’s gold on demand instead of trying to spin it out over a number of years. Furthermore, Western central banks routinely lease and swap their gold, leading to double counting of reserves and lack of clarity over ownership. We can be sure that neither Russia nor China indulge in these practices.

The consequence of these disparities is to weaponize gold’s monetary status, turning it into a nuclear weapon in a financial war. If, say, during NATO-led attempts to destabilise the rouble Russia was to declare another 6,000 tonnes to match America’s unaudited figure and for China to revise its reserves to stabilise the renminbi, it would probably result in a run against the dollar. It would be a sure-fire way for the Asian hegemons to destroy US economic and military power.

Therefore, ultimately, the US and its five-eyes allies cannot win a financial war. When China and Russia planned their financial defences, this golden umbrella made sense, and the security services in America would have been aware of it, if not the full implications. But things have changed, particularly the debasement of all major currencies, including the renminbi. China has an old-fashioned cyclical property crisis on her hands and can only think to print her way out of trouble. Together with the Fed, the ECB, and the Bank of Japan, the Peoples Bank has expanded its balance sheet recklessly, and all together they have increased from $5 trillion equivalent in 2007 to over $31 trillion today, with their rate of expansion being particularly high from March 2020.

The consequences for their currencies’ purchasing power are becoming obvious now, turbocharging Russia’s strategy with respect to European energy supply. What few politicians appear to be aware of, and we should include Putin in this, is the fragile state of the major central banks. Having loaded their balance sheets up with fixed-interest government debt, falling market values for these bonds are eliminating central banks’ margin of assets over liabilities. While the Fed, the Bank of Japan and the Bank of England can turn to their governments for recapitalisation, embarrassing though that may be, the ECB has no such recourse.

The ECB’s shareholders are the national central banks in the euro system. And they in turn, except for Ireland’s, Malta’s, and Slovenia’s central banks, all have liabilities easily exceeding their assets. The euro system is already insolvent, and Russian action on energy supplies could tip the whole currency system over the edge.

Given the Russian Central Bank’s reserve holding of euros, we can call that an unintended consequence.