Inflation Fears And Soaring Oil Inflows: What Happens Next

By Ryan Fitzmaurice of Rabobank

Summary

- Oil prices continue to be supported by a surge in capital inflows into broad-based commodity index products, in a stark reversal in trend from recent years

- Investors want to own commodities at the moment and are willing to overlook some of the weaker fundamental inputs to focus on the bigger picture at hand

- The one-year implied roll-yield has climbed to over 8% for both the ICE Brent contract and the Nymex WTIcontract, which is quite attractive in this extremelylow rate environment

Board-Based Support

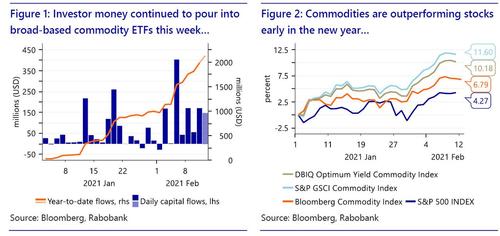

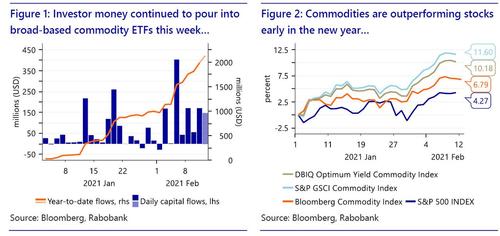

It was more of the same for oil prices this week as flows into commodity index products propelled Brent crude firmly above the psychological $60/bbl level despite a rather mixed fundamental backdrop. To that end, money continued to pour into broad-based commodity ETFs this week with more than +500mm USD of capital inflows reported through Thursday, bringing the year-to-date total above the 2BN USD mark. It is worth noting that these inflows are simply what is publicly available from the ETF space, but one can be sure that the real figure is multiples of this number given institutional investors and high net worth individuals are also increasing their commodity allocations via separately managed accounts which are not required to disclose such information. These flows are all benchmarked to a predetermined commodity index, so anywhere from 25% to 50% of the notional invested winds up in the oil futures market depending on the index and the oil sector’s weighting. As noted though, the fundamental picture remains mixed at best for oil markets which can be seen in the weakening gasoline crack spread this month.

So what exactly is driving this renewed interest in commodities if it’s not fundamentals? Well in our view, these large inflows speak to the fact that investors want to own commodities at the moment and are willing to overlook some of the weaker fundamental inputs to focus on the bigger picture at hand.

Looking at things from a macro lens, inflation fears are increasing rapidly and there is a historic amount of capital filtering through global financial markets due to all of the stimulus programs. Ironically, the widespread inflation fears that have emerged in recent weeks and months are even becoming self-fulfilling, in a way, given investors are buying commodities to hedge these inflation fears which in turn drives commodity prices higher, thereby creating inflationary pressures.

The “carry” trade

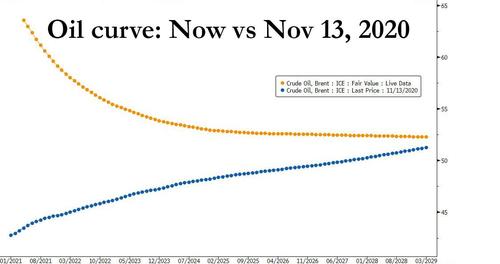

On top of the renewed interest in commodity index products as an inflation hedge, the oil markets have also caught the attention of “carry” traders recently given the strong “backwardation” that has developed along the crude oil forward curves this year.

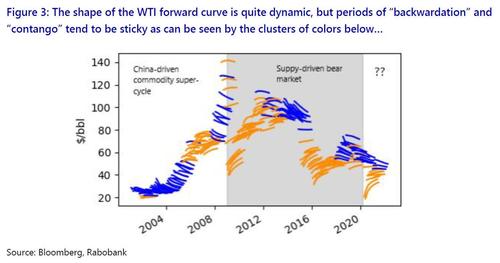

As many experienced traders and investors know, roll-yield is a significant driver of commodity futures returns in the medium and long-term and, as such, roll-yield is a key input for many investment strategies. In fact, we wrote about the powerful impact roll-yield has on commodity futures returns in a primer we published last year and which can be found here. As we discussed in that note, roll-yield in commodity futures is an implicit yield unlike the explicit yield that interest rate products offer. It is also dynamic in nature with no real way to effectively lock in roll-yield on a forward basis, however, the shape of the curve tends to be rather sticky as can be seen by the clusters of “backwardation” and “contango” exhibited in Figure 3 throughout the past twenty years.

For reference, Figure 3 depicts the evolution of the WTI forward curve on a monthly basis with periods of “backwardation” shown in blue while “contango” is shown in orange. For our purposes, we are comparing the first contract maturity with the contract for the same month in the following year to determine the state of the curve. As it currently stands though, the one-year implied annual roll-yield has climbed to over 8% for both the ICE Brent contract and the Nymex WTI contract, which is quite attractive in absolute terms and even more so in relative terms, considering the 1yr US Treasury is yielding next to nothing. In addition to outright “carry” investments, there are a number of long/short systematic strategies that go “long” commodities that have positive yield and “short” commodities that do not. The dramatic shift in the oil forward curves in recent months has resulted in those strategies shifting from “short” to “long”. Roll-yield even plays a part in many of the new-age commodity indices where instead of placing a “long” position near the front of the curve, there are popular indices that seek to maximize roll-yield by going “long” the contract with the best implied roll-yield, generally within the next 13 months for liquidity purposes. So not only is roll-yield a factor for returns and determining directional money flows but also where on the forward curve those flows wind up which can be equally important.

Looking Forward

Looking forward, we expect to see more in the way of broad-based commodity flows this year giving the very supportive macro backdrop. Large asset allocators have been “underweight” commodities for some time now given the poor performance of the asset class this past decade. As such, we see that trend reversing and with that we are likely in the early stages of the industry shifting to an “overweight” commodity position. These investments dollars should continue to support oil prices on the margin but could ultimately weigh on the curve due to roll pressures.

Tyler Durden

Mon, 02/15/2021 – 18:50

Inflation Fears And Soaring Oil Inflows: What Happens Next

By Ryan Fitzmaurice of Rabobank

Summary

Oil prices continue to be supported by a surge in capital inflows into broad-based commodity index products, in a stark reversal in trend from recent years

Investors want to own commodities at the moment and are willing to overlook some of the weaker fundamental inputs to focus on the bigger picture at hand

The one-year implied roll-yield has climbed to over 8% for both the ICE Brent contract and the Nymex WTIcontract, which is quite attractive in this extremelylow rate environment

Board-Based Support

It was more of the same for oil prices this week as flows into commodity index products propelled Brent crude firmly above the psychological $60/bbl level despite a rather mixed fundamental backdrop. To that end, money continued to pour into broad-based commodity ETFs this week with more than +500mm USD of capital inflows reported through Thursday, bringing the year-to-date total above the 2BN USD mark. It is worth noting that these inflows are simply what is publicly available from the ETF space, but one can be sure that the real figure is multiples of this number given institutional investors and high net worth individuals are also increasing their commodity allocations via separately managed accounts which are not required to disclose such information. These flows are all benchmarked to a predetermined commodity index, so anywhere from 25% to 50% of the notional invested winds up in the oil futures market depending on the index and the oil sector’s weighting. As noted though, the fundamental picture remains mixed at best for oil markets which can be seen in the weakening gasoline crack spread this month.

So what exactly is driving this renewed interest in commodities if it’s not fundamentals? Well in our view, these large inflows speak to the fact that investors want to own commodities at the moment and are willing to overlook some of the weaker fundamental inputs to focus on the bigger picture at hand.

Looking at things from a macro lens, inflation fears are increasing rapidly and there is a historic amount of capital filtering through global financial markets due to all of the stimulus programs. Ironically, the widespread inflation fears that have emerged in recent weeks and months are even becoming self-fulfilling, in a way, given investors are buying commodities to hedge these inflation fears which in turn drives commodity prices higher, thereby creating inflationary pressures.

The “carry” trade

On top of the renewed interest in commodity index products as an inflation hedge, the oil markets have also caught the attention of “carry” traders recently given the strong “backwardation” that has developed along the crude oil forward curves this year.

As many experienced traders and investors know, roll-yield is a significant driver of commodity futures returns in the medium and long-term and, as such, roll-yield is a key input for many investment strategies. In fact, we wrote about the powerful impact roll-yield has on commodity futures returns in a primer we published last year and which can be found here. As we discussed in that note, roll-yield in commodity futures is an implicit yield unlike the explicit yield that interest rate products offer. It is also dynamic in nature with no real way to effectively lock in roll-yield on a forward basis, however, the shape of the curve tends to be rather sticky as can be seen by the clusters of “backwardation” and “contango” exhibited in Figure 3 throughout the past twenty years.

For reference, Figure 3 depicts the evolution of the WTI forward curve on a monthly basis with periods of “backwardation” shown in blue while “contango” is shown in orange. For our purposes, we are comparing the first contract maturity with the contract for the same month in the following year to determine the state of the curve. As it currently stands though, the one-year implied annual roll-yield has climbed to over 8% for both the ICE Brent contract and the Nymex WTI contract, which is quite attractive in absolute terms and even more so in relative terms, considering the 1yr US Treasury is yielding next to nothing. In addition to outright “carry” investments, there are a number of long/short systematic strategies that go “long” commodities that have positive yield and “short” commodities that do not. The dramatic shift in the oil forward curves in recent months has resulted in those strategies shifting from “short” to “long”. Roll-yield even plays a part in many of the new-age commodity indices where instead of placing a “long” position near the front of the curve, there are popular indices that seek to maximize roll-yield by going “long” the contract with the best implied roll-yield, generally within the next 13 months for liquidity purposes. So not only is roll-yield a factor for returns and determining directional money flows but also where on the forward curve those flows wind up which can be equally important.

Looking Forward

Looking forward, we expect to see more in the way of broad-based commodity flows this year giving the very supportive macro backdrop. Large asset allocators have been “underweight” commodities for some time now given the poor performance of the asset class this past decade. As such, we see that trend reversing and with that we are likely in the early stages of the industry shifting to an “overweight” commodity position. These investments dollars should continue to support oil prices on the margin but could ultimately weigh on the curve due to roll pressures.

Tyler Durden

Mon, 02/15/2021 – 18:50

Read More