“Inflation Is Always A Political Choice”

As Jim Reid leaves the Deutsche Bank credit desk for the next few weeks (“I’ll be taking holiday and sending the kids to Easter holiday camp and playing golf every day as courses in the UK open on Monday for the first time in 3 months”), his last Friday “chart of the day” covers an especially sensitive topic: inflation.

As Reid writes, “there is clearly a lot of talk about inflation at the moment and a lot of talk about whether the Fed and ECB (amongst others) will meet their respective targets” However, for Reid personally, and a statement we wholeheartedly agree with, “inflation is largely a political choice in the fiat currency world that we’ve been in since 1971” and he explains why:

When you have full control over how much money you can print and spend, rather than the money supply be fixed to Gold, you can always create inflation if the inclination is there regardless of demographics, digitalisation, globalisation or weak growth.”

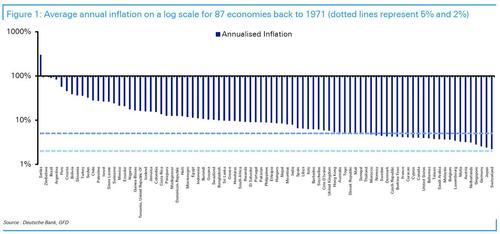

Appropriately, today’s CoTD shows average inflation for all the 87 economies that DB has data on going back to 1971 when the US (and with it the vast majority of rest of the world) cut ties to gold. What is remarkable, is that no economy has managed to keep average annual inflation below 2% since, with Switzerland (2.1%), Japan (2.3%), and Germany (2.5%) the closest. Only 28 out of 87 managed to keep inflation below 5% over the full period. The US is at 3.8%.

So, as Reid concludes, “inflation is a choice in a fiat money world. The question is whether politicians will choose it or not, advertently or inadvertently.”

To this we will just add that politicians and central bankers have already chosen, but they hope to be able to get away with soaring inflation – the kind that crushes the value of long-term debt – for as long as possible while lying to the population that soaring prices are only a conspiracy theory spread by evil Russian KGB spies.

It’s only after the facade of the deflationary lie falls away – leading to a speech such as this one from Jimmy Carter from October 1978…

… in which the former president called inflation “our most serious domestic problem”, that all hell breaks loose and the resulting panic prompts politicians to try to put the hyperinflation genie back into the bottle.

Good luck with that – back in the early 1980s, only Volcker’s hiking of rates to 20% made this possible. A similar hike now would lead to social collapse and/or war as the value of stocks – which have become the only defacto benchmark by which the status quo measures its success – would collapse by 80% or more, wiping out a majority of the world’s “net worth” and sparking unprecedented social upheaval. And that simply can never be allowed.

Which is why the government is already doing everything in its power to institutionalize universal basic income, “reparations” to blacks and other minorities, and generally boost incomes in what it very well knows will be a time of soaring prices. And the only thing it can do is boost incomes for as long as it can before the tsunami of soaring prices washes everything away.

Tyler Durden

Tue, 03/30/2021 – 05:45

“Inflation Is Always A Political Choice”

As Jim Reid leaves the Deutsche Bank credit desk for the next few weeks (“I’ll be taking holiday and sending the kids to Easter holiday camp and playing golf every day as courses in the UK open on Monday for the first time in 3 months”), his last Friday “chart of the day” covers an especially sensitive topic: inflation.

As Reid writes, “there is clearly a lot of talk about inflation at the moment and a lot of talk about whether the Fed and ECB (amongst others) will meet their respective targets” However, for Reid personally, and a statement we wholeheartedly agree with, “inflation is largely a political choice in the fiat currency world that we’ve been in since 1971″ and he explains why:

When you have full control over how much money you can print and spend, rather than the money supply be fixed to Gold, you can always create inflation if the inclination is there regardless of demographics, digitalisation, globalisation or weak growth.”

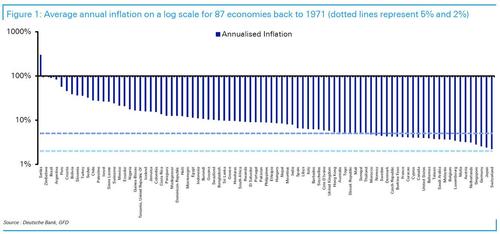

Appropriately, today’s CoTD shows average inflation for all the 87 economies that DB has data on going back to 1971 when the US (and with it the vast majority of rest of the world) cut ties to gold. What is remarkable, is that no economy has managed to keep average annual inflation below 2% since, with Switzerland (2.1%), Japan (2.3%), and Germany (2.5%) the closest. Only 28 out of 87 managed to keep inflation below 5% over the full period. The US is at 3.8%.

So, as Reid concludes, “inflation is a choice in a fiat money world. The question is whether politicians will choose it or not, advertently or inadvertently.”

To this we will just add that politicians and central bankers have already chosen, but they hope to be able to get away with soaring inflation – the kind that crushes the value of long-term debt – for as long as possible while lying to the population that soaring prices are only a conspiracy theory spread by evil Russian KGB spies.

It’s only after the facade of the deflationary lie falls away – leading to a speech such as this one from Jimmy Carter from October 1978…

… in which the former president called inflation “our most serious domestic problem”, that all hell breaks loose and the resulting panic prompts politicians to try to put the hyperinflation genie back into the bottle.

Good luck with that – back in the early 1980s, only Volcker’s hiking of rates to 20% made this possible. A similar hike now would lead to social collapse and/or war as the value of stocks – which have become the only defacto benchmark by which the status quo measures its success – would collapse by 80% or more, wiping out a majority of the world’s “net worth” and sparking unprecedented social upheaval. And that simply can never be allowed.

Which is why the government is already doing everything in its power to institutionalize universal basic income, “reparations” to blacks and other minorities, and generally boost incomes in what it very well knows will be a time of soaring prices. And the only thing it can do is boost incomes for as long as it can before the tsunami of soaring prices washes everything away.

Tyler Durden

Tue, 03/30/2021 – 05:45

Read More