Inflation: Making The Complex, Simple – Part 1

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

The quarterback signals for the Y receiver in the trips formation to shift left toward the right tackle. At the same time, the running back moves to the quarterback’s right. The slot Z receiver runs a fake jet sweep and doubles back. The left tackle and guard are ready to pull to the right, and the center will counter to the left. A safety creeps toward the line and the Sam yells to the strong-side linebacker to shadow the tight end.

The quarterback drops back and throws a pass up the middle for a 20 yard gain. What looks like a simple football play on television, is a complex choreography of 22 football players, coaches, and numerous strategies.

Humans constantly digest massive amounts of data. To make sense of our surroundings, we summarize data into simple packages. This survival skill is necessary, but it often results in a failure to appreciate life’s complexity.

Like a passing play, the price of a Big Mac may appear to be a simple number. However, the market forces determining its price are complex and often misunderstood. In fact, the most vital force has nothing to do with McDonald’s or its customers. It’s all about the supply and demand for money.

Upon reading this article, and its conclusion in a week, you will understand what drives inflation. Whether we are approaching an inflationary or deflationary environment, being a step ahead of the markets thinking is critical to investment success.

Part Two of this article will continue on the same themes as this article. The best-returning trades are those occurring when the market is proven wrong and offsides. In Part Three, we will share some market-based inflation measures to understand the market’s inflation view.

Who Remembers the ’70s?

Ask any investment professional what it was like to manage money in an inflationary environment, and you are likely to get a blank stare. The reason is an investment professional that worked through a period of high inflation in the U.S. is at least 65 years old. As such, experience managing wealth in such a volatile environment is hard to come by. The lack of real inflation era experience may increase price volatility if such an environment emerges. Accordingly, a trying investment environment will be even more challenging to navigate.

While we think the odds of sustained inflation are small, we must be prepared nonetheless. If inflation proves temporary and fades within months, assets being shunned today like long-term bonds and possibly gold offer sizeable returns. If we are wrong, investments that benefit from inflation like miners and energy companies should do well. Regardless, we are on guard for either scenario.

Preparation, first and foremost, involves understanding the drivers of inflation.

The Price of a Big Mac

The price of a McDonalds Big Mac is always expressed in relation to a currency. For instance, in the United States, the price is $4.25.

Like a football play, $4.25 is a simple summary of something more complex. To raise the complexity, we can fractionalize the price to 4.25/1. Whereas 4.25 represents the number of dollars required to purchase 1 Big Mac.

We can further expand on the numerator (dollars) and denominator (1 Big Mac) with the following formula: SD($)/SD(BM). The supply and demand for dollars over the supply and demand of Big Macs.

Now consider, regardless of the supply or demand for dollars and Big Macs, the denominator is always one. A dollar is always worth 1.00. Accordingly, the numerator (dollar price) changes to reflect fluctuations in the supply/demand functions of the dollar and/or the Big Mac.

What happens to the price of a Big Mac if the dollar is devalued by 50%? Despite the cheaper dollar, it is still worth $1. Therefore, only the numerator can change to reflect a price change. In this case, we would expect the price of a Big Mac to double.

In Aggregate

We could devote pages to the multitude of factors affecting the supply, demand, and pricing of a Big Mac. The exercise would explain why the Big Mac price rises or falls versus Burger King Whoppers and every other good and service available. Such analysis is critical to McDonalds, but often overemphasized from a macroeconomic perspective.

Economists cite increasing oil prices as a driver for inflation and stronger retail sales from time to time. They assume consumers will still buy everything they were consuming, yet pay an extra $20 at the pump each week. In reality, consumers often substitute goods and services based on their budgets and needs. Economists often fail to consider the extra $20 spent at the gas pump is $20 not spent elsewhere.

The price of oil may rise, but the price of oranges may fall as consumers spend less on oranges to compensate. What matters most from a macroeconomic perspective is the aggregate price change for oil, oranges, Big Macs, and every other good and service.

To correctly anticipate inflation, we must look beyond the supply and demand for goods and services. The truth lies in the supply and the demand for money. Unfortunately, the supply of money gets the headlines, while its demand is an afterthought.

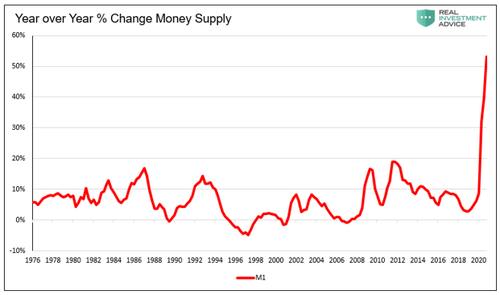

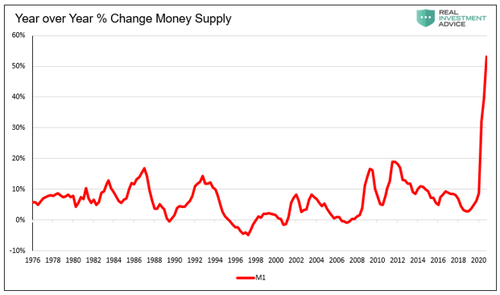

The chart below shows the forthcoming evidence of inflation used by most inflationists.

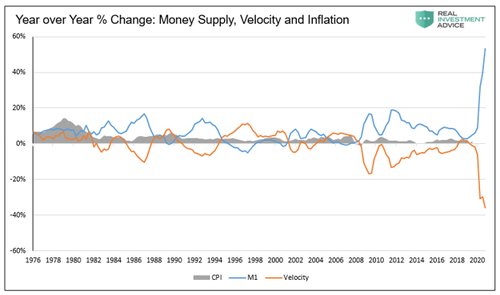

The following graph captures monetary velocity for an appropriate view of inflation.

Inflation is a function of money supply but equally critical, the demand for money (velocity). For more on why we must consider both, please read our article, The Fed’s Inconvenient Truth: Inflation is M.I.A.

To Be Continued…

Tyler Durden

Thu, 04/08/2021 – 14:34

Inflation: Making The Complex, Simple – Part 1

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

The quarterback signals for the Y receiver in the trips formation to shift left toward the right tackle. At the same time, the running back moves to the quarterback’s right. The slot Z receiver runs a fake jet sweep and doubles back. The left tackle and guard are ready to pull to the right, and the center will counter to the left. A safety creeps toward the line and the Sam yells to the strong-side linebacker to shadow the tight end.

The quarterback drops back and throws a pass up the middle for a 20 yard gain. What looks like a simple football play on television, is a complex choreography of 22 football players, coaches, and numerous strategies.

Humans constantly digest massive amounts of data. To make sense of our surroundings, we summarize data into simple packages. This survival skill is necessary, but it often results in a failure to appreciate life’s complexity.

Like a passing play, the price of a Big Mac may appear to be a simple number. However, the market forces determining its price are complex and often misunderstood. In fact, the most vital force has nothing to do with McDonald’s or its customers. It’s all about the supply and demand for money.

Upon reading this article, and its conclusion in a week, you will understand what drives inflation. Whether we are approaching an inflationary or deflationary environment, being a step ahead of the markets thinking is critical to investment success.

Part Two of this article will continue on the same themes as this article. The best-returning trades are those occurring when the market is proven wrong and offsides. In Part Three, we will share some market-based inflation measures to understand the market’s inflation view.

Who Remembers the ’70s?

Ask any investment professional what it was like to manage money in an inflationary environment, and you are likely to get a blank stare. The reason is an investment professional that worked through a period of high inflation in the U.S. is at least 65 years old. As such, experience managing wealth in such a volatile environment is hard to come by. The lack of real inflation era experience may increase price volatility if such an environment emerges. Accordingly, a trying investment environment will be even more challenging to navigate.

While we think the odds of sustained inflation are small, we must be prepared nonetheless. If inflation proves temporary and fades within months, assets being shunned today like long-term bonds and possibly gold offer sizeable returns. If we are wrong, investments that benefit from inflation like miners and energy companies should do well. Regardless, we are on guard for either scenario.

Preparation, first and foremost, involves understanding the drivers of inflation.

The Price of a Big Mac

The price of a McDonalds Big Mac is always expressed in relation to a currency. For instance, in the United States, the price is $4.25.

Like a football play, $4.25 is a simple summary of something more complex. To raise the complexity, we can fractionalize the price to 4.25/1. Whereas 4.25 represents the number of dollars required to purchase 1 Big Mac.

We can further expand on the numerator (dollars) and denominator (1 Big Mac) with the following formula: SD($)/SD(BM). The supply and demand for dollars over the supply and demand of Big Macs.

Now consider, regardless of the supply or demand for dollars and Big Macs, the denominator is always one. A dollar is always worth 1.00. Accordingly, the numerator (dollar price) changes to reflect fluctuations in the supply/demand functions of the dollar and/or the Big Mac.

What happens to the price of a Big Mac if the dollar is devalued by 50%? Despite the cheaper dollar, it is still worth $1. Therefore, only the numerator can change to reflect a price change. In this case, we would expect the price of a Big Mac to double.

In Aggregate

We could devote pages to the multitude of factors affecting the supply, demand, and pricing of a Big Mac. The exercise would explain why the Big Mac price rises or falls versus Burger King Whoppers and every other good and service available. Such analysis is critical to McDonalds, but often overemphasized from a macroeconomic perspective.

Economists cite increasing oil prices as a driver for inflation and stronger retail sales from time to time. They assume consumers will still buy everything they were consuming, yet pay an extra $20 at the pump each week. In reality, consumers often substitute goods and services based on their budgets and needs. Economists often fail to consider the extra $20 spent at the gas pump is $20 not spent elsewhere.

The price of oil may rise, but the price of oranges may fall as consumers spend less on oranges to compensate. What matters most from a macroeconomic perspective is the aggregate price change for oil, oranges, Big Macs, and every other good and service.

To correctly anticipate inflation, we must look beyond the supply and demand for goods and services. The truth lies in the supply and the demand for money. Unfortunately, the supply of money gets the headlines, while its demand is an afterthought.

The chart below shows the forthcoming evidence of inflation used by most inflationists.

The following graph captures monetary velocity for an appropriate view of inflation.

Inflation is a function of money supply but equally critical, the demand for money (velocity). For more on why we must consider both, please read our article, The Fed’s Inconvenient Truth: Inflation is M.I.A.

To Be Continued…

Tyler Durden

Thu, 04/08/2021 – 14:34

Read More