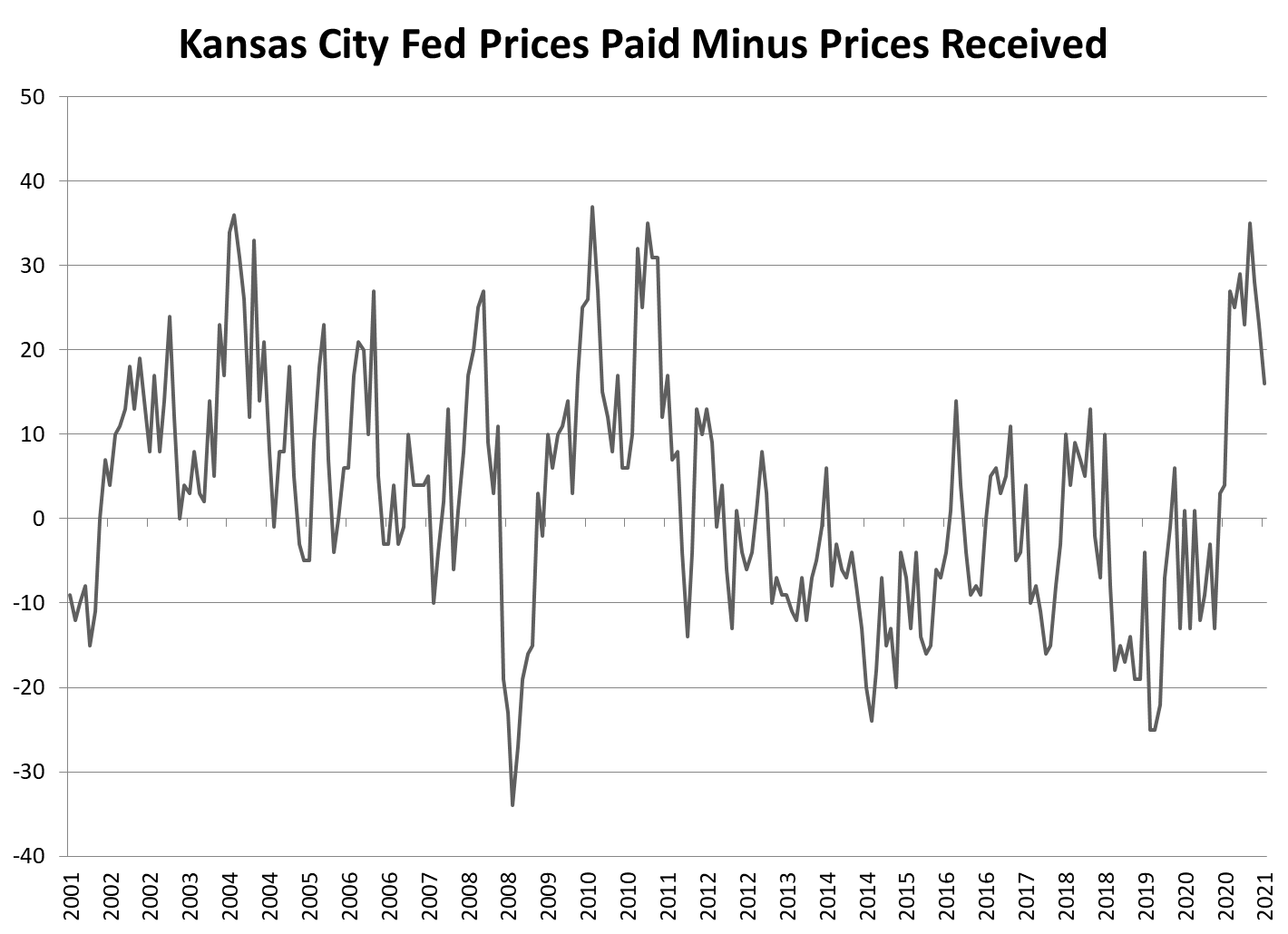

The chart of the day shows the price squeeze on manufacturers in the Kansas City Federal Reserve district (the percentage of survey respondents reporting higher prices paid for raw materials minus the percentage reporting higher prices for finished goods).

We looked at a similar survey published earlier this week by the Federal Reserve Bank of Philadelphia. The Kansas data released Thursday morning tell the same story: Businesses can’t raise prices fast enough to maintain profit margins in the face of rising input costs.

If investors hadn’t been paying attention before, this warning about depressed profits margins from Unilever chairman Alan Jope Thursday morning woke them up: “We are facing very material cost increases. Our first reflex is to look for savings in our own business to offset these costs, but these are of a magnitude that will require us to continue to take some price increases.” The company’s shares dropped by 6%.

With nominal wages rising at 3% a year, according to the Atlanta Fed’s well-respected wage tracker, inflation in excess of 5% implies a hit to consumer spending, as well.

We observed July 20 that private-sector gauges of apartment rents show a big jump over the past year (7% according to Zillow, and almost 10% from last December according to Apartmentlist.com).

With apartment vacancies close to the all-time low of 6%, supply is constrained, so the likelihood is that rental inflation will roar ahead. A lot of households will cut back on purchases of consumer goods whose prices are rising.

Big tech, whose costs amount to the price of programmers, has been less damaged by these trends than the economically-sensitive Russell 2000 index of small-capitalization stocks, now down 7% from its February peak. But expect more signs of economic weakness and eroding profit margins during the coming weeks.

The post Inflation’s profits-squeeze turns into stagflation appeared first on Asia Times.