It Always Ends The Same Way: Crisis, Crash, Collapse

Authored by Charles Hugh Smith via OfTwoMinds blog,

Risk has not been extinguished, it is expanding geometrically beneath the false stability of a monstrously manipulated market.

One of the most under-appreciated investment insights is courtesy of Mike Tyson: “Everybody has a plan until they get punched in the mouth.” At this moment in history, the plan of most market participants is to place their full faith and trust in the status quo’s ability to keep asset prices lofting ever higher, essentially forever.

In other words, the vast majority of punters are convinced they will never suffer the indignity of getting punched in the mouth by a market crash. What makes this confidence so interesting is massively distorted markets always end the same way: crisis, crash and collapse.

The core dynamic here is distorted markets provide false feedback and misleading information which then lead to participants making catastrophically misguided decisions. Investment decisions made on poor information will also be poor, leading participants to end up poor, to their very great surprise.

The surprise comes from the falsity of the feedback, as those who are distorting markets want punters to believe “the market” is functioning transparently. If you’re manipulating the market, the last thing you want is for the unwary marks to discover that the market is generating false signals and misleading information on risk, as knowing the market is being distorted would alert them to the extraordinary risks intrinsic to heavily distorted markets.

The risks arise from the disconnect between the precariousness of the manipulated market and the extreme confidence punters have in its stability and predictability. The predictability comes not from transparent feedback and market signals but from the manipulation. This stability is entirely fabricated and therefore it lacks the dynamic stability of truly open markets.

Markets that are being distorted/manipulated to achieve a goal that is impossible in truly open markets–for example, markets that only loft higher with near-zero volatility–lull participants into a dangerous perception that because markets are so stable, risk has dissipated.

In actuality, risk is skyrocketing beneath the surface of the artificial stability because the market has been stripped of the mechanisms of dynamic stability. This artificial stability derived from sustained manipulation has the superficial appearance of low-risk markets, i.e., low levels of volatility, but this lack of volatility derives not from transparency but from behind-the-scenes suppression of volatility.

Another source of risk in distorted markets is the illusion of liquidity: in low-volume markets of suppressed volatility, participants are encouraged to believe that they can buy and sell whatever securities they want in whatever volumes they want without disturbing market pricing and liquidity. In other words, participants are led to believe that the market will always have a bid due to the near-infinite depth of liquidity: no matter how many billions of dollars of securities you want to sell, there will always be a bid for your shares.

In actual fact, the bid is paper-thin and it vanishes altogether once selling rises above very low levels. Heavily manipulated markets are exquisitely sensitive to selling because the entire point is to limit any urge to sell while encouraging the greed to increase gains by buying more.

The illusions of low risk, essentially guaranteed gains for those who increase their positions and near-infinite liquidity generate overwhelming incentives to borrow more and leverage it to the hilt to maximize gains. The blissfully delusional punter feels the decision to borrow the maximum available and leverage it to the maximum is entirely rational due to the “obvious” absence of risk, the “obvious” guaranteed gains offered by markets lofting ever higher like clockwork and the “obvious” abundance of liquidity, assuring the punter they can always sell their entire position at today’s prices and lock in profits at any time.

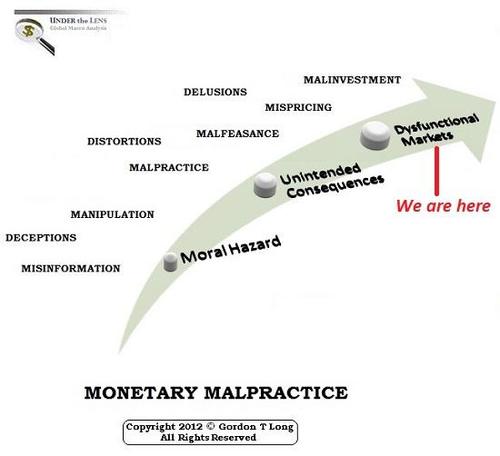

On top of all these grossly misleading distortions, punters have been encouraged to believe in the ultimate distortion: the Federal Reserve will never let markets decline again, ever. This is the perfection of moral hazard: risk has been disconnected from consequence.

In this perfection of moral hazard, punters consider it entirely rational to increase extremely risky speculative bets because the Federal Reserve will never let markets decline. Given the abundant evidence behind this assumption, it would be irrational not to ramp up crazy-risky speculative bets to the maximum because losses are now impossible thanks to the Fed’s implicit promise to never let markets drop.

This is why distorted, manipulated markets always end the same way: first, in an unexpected emergence of risk, which was presumed to be banished; second, a market crash as the paper-thin bid disappears and prices flash-crash to levels that wipe out all those forced to sell by margin calls, and then the collapse of faith in the manipulators (the Fed), collapse of the collateral supporting trillions of dollars in highly leveraged debt and then the collapse of the entire delusion-based financial system.

Gordon Long and I illuminate the many layers of distortion, manipulation and moral hazard in our new video presentation, It Always Ends The Same Way (34:33). Amidst the ruins generated by well-meaning manipulation and distortion, the “well meaning” part will leave an extremely long-lasting bitter taste in all those who failed to differentiate between the false signals and distorted information of manipulated markets and the trustworthy transparency of signals arising in truly open markets.

In summary: risk has not been extinguished, it is expanding geometrically beneath the false stability of a monstrously manipulated market. As I often note here, risk cannot be extinguished, it can only be transferred. By distorting markets to create an illusion of low-risk stability, the Federal Reserve has transferred this fatal supernova of risk to the entire financial system.

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

* * *

My recent books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World (Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

Tyler Durden

Thu, 06/24/2021 – 16:19

It Always Ends The Same Way: Crisis, Crash, Collapse

Authored by Charles Hugh Smith via OfTwoMinds blog,

Risk has not been extinguished, it is expanding geometrically beneath the false stability of a monstrously manipulated market.

One of the most under-appreciated investment insights is courtesy of Mike Tyson: “Everybody has a plan until they get punched in the mouth.” At this moment in history, the plan of most market participants is to place their full faith and trust in the status quo’s ability to keep asset prices lofting ever higher, essentially forever.

In other words, the vast majority of punters are convinced they will never suffer the indignity of getting punched in the mouth by a market crash. What makes this confidence so interesting is massively distorted markets always end the same way: crisis, crash and collapse.

The core dynamic here is distorted markets provide false feedback and misleading information which then lead to participants making catastrophically misguided decisions. Investment decisions made on poor information will also be poor, leading participants to end up poor, to their very great surprise.

The surprise comes from the falsity of the feedback, as those who are distorting markets want punters to believe “the market” is functioning transparently. If you’re manipulating the market, the last thing you want is for the unwary marks to discover that the market is generating false signals and misleading information on risk, as knowing the market is being distorted would alert them to the extraordinary risks intrinsic to heavily distorted markets.

The risks arise from the disconnect between the precariousness of the manipulated market and the extreme confidence punters have in its stability and predictability. The predictability comes not from transparent feedback and market signals but from the manipulation. This stability is entirely fabricated and therefore it lacks the dynamic stability of truly open markets.

Markets that are being distorted/manipulated to achieve a goal that is impossible in truly open markets–for example, markets that only loft higher with near-zero volatility–lull participants into a dangerous perception that because markets are so stable, risk has dissipated.

In actuality, risk is skyrocketing beneath the surface of the artificial stability because the market has been stripped of the mechanisms of dynamic stability. This artificial stability derived from sustained manipulation has the superficial appearance of low-risk markets, i.e., low levels of volatility, but this lack of volatility derives not from transparency but from behind-the-scenes suppression of volatility.

Another source of risk in distorted markets is the illusion of liquidity: in low-volume markets of suppressed volatility, participants are encouraged to believe that they can buy and sell whatever securities they want in whatever volumes they want without disturbing market pricing and liquidity. In other words, participants are led to believe that the market will always have a bid due to the near-infinite depth of liquidity: no matter how many billions of dollars of securities you want to sell, there will always be a bid for your shares.

In actual fact, the bid is paper-thin and it vanishes altogether once selling rises above very low levels. Heavily manipulated markets are exquisitely sensitive to selling because the entire point is to limit any urge to sell while encouraging the greed to increase gains by buying more.

The illusions of low risk, essentially guaranteed gains for those who increase their positions and near-infinite liquidity generate overwhelming incentives to borrow more and leverage it to the hilt to maximize gains. The blissfully delusional punter feels the decision to borrow the maximum available and leverage it to the maximum is entirely rational due to the “obvious” absence of risk, the “obvious” guaranteed gains offered by markets lofting ever higher like clockwork and the “obvious” abundance of liquidity, assuring the punter they can always sell their entire position at today’s prices and lock in profits at any time.

On top of all these grossly misleading distortions, punters have been encouraged to believe in the ultimate distortion: the Federal Reserve will never let markets decline again, ever. This is the perfection of moral hazard: risk has been disconnected from consequence.

In this perfection of moral hazard, punters consider it entirely rational to increase extremely risky speculative bets because the Federal Reserve will never let markets decline. Given the abundant evidence behind this assumption, it would be irrational not to ramp up crazy-risky speculative bets to the maximum because losses are now impossible thanks to the Fed’s implicit promise to never let markets drop.

This is why distorted, manipulated markets always end the same way: first, in an unexpected emergence of risk, which was presumed to be banished; second, a market crash as the paper-thin bid disappears and prices flash-crash to levels that wipe out all those forced to sell by margin calls, and then the collapse of faith in the manipulators (the Fed), collapse of the collateral supporting trillions of dollars in highly leveraged debt and then the collapse of the entire delusion-based financial system.

Gordon Long and I illuminate the many layers of distortion, manipulation and moral hazard in our new video presentation, It Always Ends The Same Way (34:33). Amidst the ruins generated by well-meaning manipulation and distortion, the “well meaning” part will leave an extremely long-lasting bitter taste in all those who failed to differentiate between the false signals and distorted information of manipulated markets and the trustworthy transparency of signals arising in truly open markets.

In summary: risk has not been extinguished, it is expanding geometrically beneath the false stability of a monstrously manipulated market. As I often note here, risk cannot be extinguished, it can only be transferred. By distorting markets to create an illusion of low-risk stability, the Federal Reserve has transferred this fatal supernova of risk to the entire financial system.

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

* * *

My recent books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World (Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

Tyler Durden

Thu, 06/24/2021 – 16:19

Read More