“It Must End Badly” – Munger Says Market Resembles Dot Com Bubble, Calls SPACs “Shit”

Warren Buffett’s “No. 2” spoke during the annual meeting of the Daily Journal Corporation, the Los Angeles newspaper-publishing company chaired by Munger. The 97-year-old Charlie Munger is best known for his work as Vice Chairman of Berkshire Hathaway, where he has served as Buffett’s right hand man for decades. And like Buffett, Munger has a soft spot for newspapers and legacy media companies, and thus took time out of his (busy?) week to answer questions from Daily Journal shareholders in a meeting broadcast live online (watch recording below).

While there were only 410 shareholders of record of Daily Journal’s common stock as of Dec. 15, according to the firm’s annual report, Munger attracts a sizable and engaged audience each year, including non-shareholders, to listen to his aphorisms and wisecracks (many of which are not exactly politically correct) about business, investing, and life… which unfortunately have become somewhat confused due to Munger’s age.

Those who tuned in on Wednesday hoped to hear Munger answer questions on one critical topic: the state of contemporary markets, and whether or not all the craziness in equities, crypto, commodities etc constitutes an asset bubble.

Among the myriad topics covered in Mungers marathon, 2-hour presentation, the 97-year-old reflected on the crazy price moves in companies like GameStop, and said the prevailing attitude in the US equity market as a “horse-racing mentality toward stocks.”

“It’s really stupid to have a culture” encouraging such gambling in stocks, Munger said, calling the frenzied buying of stocks “a very dangerous way to invest.”

Unleashing his notorious tidal wave of criticism, Munger also gave Robinhood and new brokers a solid beating. He chided them for the way they make money, calling it “dirty,” and said it’s just luring in novice investors who want to gamble. Civilization would be better off without them, he added. And he left with a stark warning: Commission-free trading isn’t free (something which we had been saying since 2018).

Naturally, Munger also railed against Bitcoin (and gold), saying Berkshire wouldn’t follow Tesla into the cryptocurrency, and that it’s too volatile to be a true medium of exchange for the world. Munger paraphrased Oscar Wilde’s quotation about fox hunting to describe bitcoin, calling it “the pursuit of the uneatable by the unspeakable.”

In response to a question on which is crazier, Bitcoin at $50,000 or Tesla’s fully diluted enterprise value on $1 trillion, Munger said “I don’t know which is worse.”

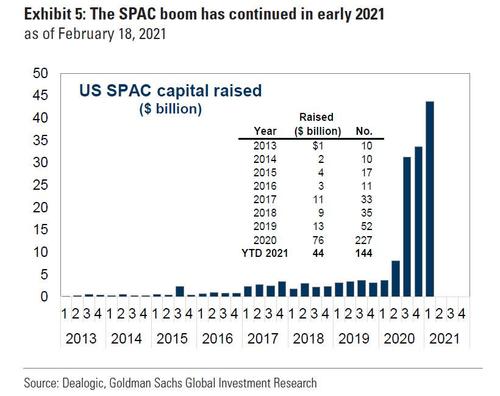

He also touched on another contemporary market fad: the advent of SPACs, which have exploded in recent months in the clearest reflection yet of the market’s bubble euphoria. So far in 2021, 144 SPACs have gone public — averaging roughly five per trading day — raising a total of $44 billion. Just seven weeks into the year, this represents more than half the totals in 2020, which itself witnessed a 5x increase in SPAC activity relative to 2019

Taking a shot at the SPAC scramble that is being stoked by both frenzied buyers and rabid bankers, Munger lamented that “the investment banking profession will sell shit as long as shit can be sold.”

As to how all this stock speculation might end, Munger declared that it would end badly, although it’s still unclear when. He said it’s best to stay out of the fray, which is what he’s doing: “Yes, I think it must end badly, but I don’t know when.”

As Bloomberg summarized, overall it was ” quite the event” with Munger still as sharp as ever though, and once he got on a roll, he opined on everything from the Reddit stock boom to China, and he even touched on personal questions like how to live a fulfilling life.

Watch the complete video of Munger’s marathon Q&A below:

Tyler Durden

Wed, 02/24/2021 – 15:29

“It Must End Badly” – Munger Says Market Resembles Dot Com Bubble, Calls SPACs “Shit”

Warren Buffett’s “No. 2” spoke during the annual meeting of the Daily Journal Corporation, the Los Angeles newspaper-publishing company chaired by Munger. The 97-year-old Charlie Munger is best known for his work as Vice Chairman of Berkshire Hathaway, where he has served as Buffett’s right hand man for decades. And like Buffett, Munger has a soft spot for newspapers and legacy media companies, and thus took time out of his (busy?) week to answer questions from Daily Journal shareholders in a meeting broadcast live online (watch recording below).

While there were only 410 shareholders of record of Daily Journal’s common stock as of Dec. 15, according to the firm’s annual report, Munger attracts a sizable and engaged audience each year, including non-shareholders, to listen to his aphorisms and wisecracks (many of which are not exactly politically correct) about business, investing, and life… which unfortunately have become somewhat confused due to Munger’s age.

Those who tuned in on Wednesday hoped to hear Munger answer questions on one critical topic: the state of contemporary markets, and whether or not all the craziness in equities, crypto, commodities etc constitutes an asset bubble.

Among the myriad topics covered in Mungers marathon, 2-hour presentation, the 97-year-old reflected on the crazy price moves in companies like GameStop, and said the prevailing attitude in the US equity market as a “horse-racing mentality toward stocks.”

“It’s really stupid to have a culture” encouraging such gambling in stocks, Munger said, calling the frenzied buying of stocks “a very dangerous way to invest.”

Unleashing his notorious tidal wave of criticism, Munger also gave Robinhood and new brokers a solid beating. He chided them for the way they make money, calling it “dirty,” and said it’s just luring in novice investors who want to gamble. Civilization would be better off without them, he added. And he left with a stark warning: Commission-free trading isn’t free (something which we had been saying since 2018).

Naturally, Munger also railed against Bitcoin (and gold), saying Berkshire wouldn’t follow Tesla into the cryptocurrency, and that it’s too volatile to be a true medium of exchange for the world. Munger paraphrased Oscar Wilde’s quotation about fox hunting to describe bitcoin, calling it “the pursuit of the uneatable by the unspeakable.”

In response to a question on which is crazier, Bitcoin at $50,000 or Tesla’s fully diluted enterprise value on $1 trillion, Munger said “I don’t know which is worse.”

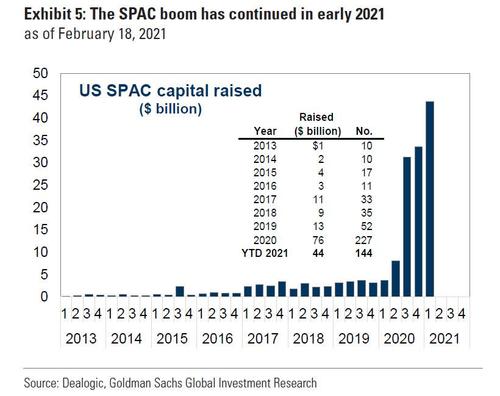

He also touched on another contemporary market fad: the advent of SPACs, which have exploded in recent months in the clearest reflection yet of the market’s bubble euphoria. So far in 2021, 144 SPACs have gone public — averaging roughly five per trading day — raising a total of $44 billion. Just seven weeks into the year, this represents more than half the totals in 2020, which itself witnessed a 5x increase in SPAC activity relative to 2019

Taking a shot at the SPAC scramble that is being stoked by both frenzied buyers and rabid bankers, Munger lamented that “the investment banking profession will sell shit as long as shit can be sold.”

As to how all this stock speculation might end, Munger declared that it would end badly, although it’s still unclear when. He said it’s best to stay out of the fray, which is what he’s doing: “Yes, I think it must end badly, but I don’t know when.”

As Bloomberg summarized, overall it was ” quite the event” with Munger still as sharp as ever though, and once he got on a roll, he opined on everything from the Reddit stock boom to China, and he even touched on personal questions like how to live a fulfilling life.

Watch the complete video of Munger’s marathon Q&A below:

Tyler Durden

Wed, 02/24/2021 – 15:29

Read More