“…It’s Not Money…” – Desperate ECB Downplays Cryptos As Market Cap Soars Above $2 Trillion

How do you know that cryptocurrencies are disrupting the status quo and offering ‘we, the global people’ an alternative to establishment fiat control?

Simple – when the global central planning elites continue to jawbone how terrible, awful, dangerous (etc…) cryptocurrencies are and will be.

On the heels of US Fed’s Powell “it’s a speculative asset” comments, and US Treasury Secretary Janet Yellen’s lies about “illicit finance” and “extreme inefficiency”, and ECB President Christine Lagarde’s warnings about crypto enabling “reprehensible behavior”; Isabel Schnabel, Member of the Executive Board of the ECB described Bitcoin as a speculative asset that doesn’t meet the definition of money.

As Decrypt reports, in an interview with Der Spiegel, which is also available at the ECB’s website, Schnabel said that “in our view, it is wrong to describe Bitcoin as a currency, because it does not fulfill the basic properties of money.”

She argued that Bitcoin is a “speculative asset without any recognizable fundamental value,” which is no stranger to wild price fluctuations.

When questioned whether the fact that a lot of people trust Bitcoin could harm fiat currencies like the Euro, Schnabel said she is more concerned that “trust in cryptocurrencies might rapidly evaporate.”

She argued that since Bitcoin “is a very fragile system,” this could result in disruption in financial markets.

And here is the kicker – put down sharp objects and remove any liquid from your mouth before reading on…

“The euro is backed by the ECB, which is highly trusted. And it is legal tender,” she said.

“Nobody can refuse to accept euro. Bitcoin is a different matter.”

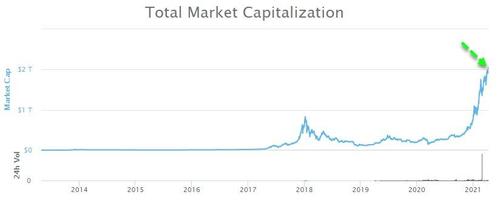

Wethinks she doth protest too much… and so does the market that just surged above $2 trillion market cap…

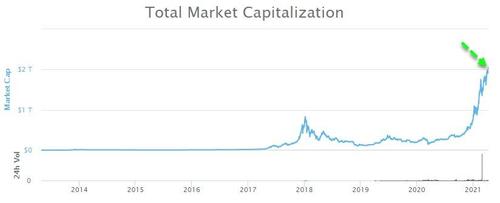

Putting cryptocurrencies above Microsoft ($1.93 trillion) and just below Apple ($2.23 trillion) and Bitcoin alone at $1.13 trillion (just below that of the entire silver market)…

The gains overnight were dominated by Ethereum spiking to a new record high just shy of $2200 ($2197)…

Source: Bloomberg

And Bitcoin surged back above $61,000 (just shy of its record highs at $61,742)…

Source: Bloomberg

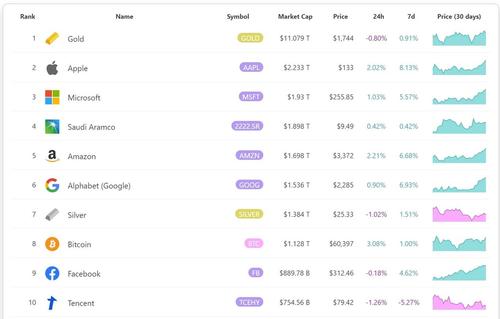

The relative outperformance of altcoins over bitcoin have reduced the leading crypto’s dominance to 56% – its smallest since June 2019…

As John Rubino previously noted, the above comments from the establishment are not random.

It’s a coordinated laying of the groundwork for a move against cryptos by most major governments, which in turn is a prelude to the introduction of digital national currencies and eventually a digital global currency run by the IMF or some other monetary consortium.

Ask bitcoin fans about this risk and many will laugh at the idea of pathetic governments trying to stop the unstoppable. This sounds a bit overoptimistic to non-revolutionary ears, of course. And it probably is. But revolutions, especially in tech, frequently succeed. Electricity replaced whale oil, digital cameras replaced film, online retailers replace book stores and so on. The blockchain might do the same thing to banks, both central and commercial.

But governments aren’t camera makers or whalers. This revolution is happening on a much bigger stage, with far more dangerous players. So the outcome isn’t guaranteed, and anyone who says otherwise is just talking their financial or philosophical book.

Finally, for those worried about the building rhetoric from the ’empire’ against crypto, zycrypto reports that “Crypto Mom” SEC Commissioner Hester Peirce has recently spoken out against the U.S government, as conversations centered around the possibility of the government implementing a ban heightens.

Speaking on the ‘MarketWatch Investing in Cryptocurrency event series‘,

“I think we were past that point very early on because you’d have to shut down the internet. I don’t see how you [the U.S government] could ban it. You could certainly make the effort and say it is not allowed here, but people would still be able to do [use] it. So I think that it would be a foolish thing for the government to try to do that.”

But then again, it wouldn’t be the first foolish thing government’s ever done.

Tyler Durden

Sat, 04/10/2021 – 11:35

“…It’s Not Money…” – Desperate ECB Downplays Cryptos As Market Cap Soars Above $2 Trillion

How do you know that cryptocurrencies are disrupting the status quo and offering ‘we, the global people’ an alternative to establishment fiat control?

Simple – when the global central planning elites continue to jawbone how terrible, awful, dangerous (etc…) cryptocurrencies are and will be.

On the heels of US Fed’s Powell “it’s a speculative asset” comments, and US Treasury Secretary Janet Yellen’s lies about “illicit finance” and “extreme inefficiency”, and ECB President Christine Lagarde’s warnings about crypto enabling “reprehensible behavior”; Isabel Schnabel, Member of the Executive Board of the ECB described Bitcoin as a speculative asset that doesn’t meet the definition of money.

As Decrypt reports, in an interview with Der Spiegel, which is also available at the ECB’s website, Schnabel said that “in our view, it is wrong to describe Bitcoin as a currency, because it does not fulfill the basic properties of money.”

She argued that Bitcoin is a “speculative asset without any recognizable fundamental value,” which is no stranger to wild price fluctuations.

When questioned whether the fact that a lot of people trust Bitcoin could harm fiat currencies like the Euro, Schnabel said she is more concerned that “trust in cryptocurrencies might rapidly evaporate.”

She argued that since Bitcoin “is a very fragile system,” this could result in disruption in financial markets.

And here is the kicker – put down sharp objects and remove any liquid from your mouth before reading on…

“The euro is backed by the ECB, which is highly trusted. And it is legal tender,” she said.

“Nobody can refuse to accept euro. Bitcoin is a different matter.”

Wethinks she doth protest too much… and so does the market that just surged above $2 trillion market cap…

Source

Putting cryptocurrencies above Microsoft ($1.93 trillion) and just below Apple ($2.23 trillion) and Bitcoin alone at $1.13 trillion (just below that of the entire silver market)…

Source

The gains overnight were dominated by Ethereum spiking to a new record high just shy of $2200 ($2197)…

Source: Bloomberg

And Bitcoin surged back above $61,000 (just shy of its record highs at $61,742)…

Source: Bloomberg

The relative outperformance of altcoins over bitcoin have reduced the leading crypto’s dominance to 56% – its smallest since June 2019…

Source

As John Rubino previously noted, the above comments from the establishment are not random.

It’s a coordinated laying of the groundwork for a move against cryptos by most major governments, which in turn is a prelude to the introduction of digital national currencies and eventually a digital global currency run by the IMF or some other monetary consortium.

Ask bitcoin fans about this risk and many will laugh at the idea of pathetic governments trying to stop the unstoppable. This sounds a bit overoptimistic to non-revolutionary ears, of course. And it probably is. But revolutions, especially in tech, frequently succeed. Electricity replaced whale oil, digital cameras replaced film, online retailers replace book stores and so on. The blockchain might do the same thing to banks, both central and commercial.

But governments aren’t camera makers or whalers. This revolution is happening on a much bigger stage, with far more dangerous players. So the outcome isn’t guaranteed, and anyone who says otherwise is just talking their financial or philosophical book.

Finally, for those worried about the building rhetoric from the ’empire’ against crypto, zycrypto reports that “Crypto Mom” SEC Commissioner Hester Peirce has recently spoken out against the U.S government, as conversations centered around the possibility of the government implementing a ban heightens.

Speaking on the ‘MarketWatch Investing in Cryptocurrency event series‘,

“I think we were past that point very early on because you’d have to shut down the internet. I don’t see how you [the U.S government] could ban it. You could certainly make the effort and say it is not allowed here, but people would still be able to do [use] it. So I think that it would be a foolish thing for the government to try to do that.”

But then again, it wouldn’t be the first foolish thing government’s ever done.

Tyler Durden

Sat, 04/10/2021 – 11:35

Read More