The fallout will be epic – it is the greatest risk nobody’s talking about.

The gradual decline of Japan

I’ve been following the gradual decline of Japan’s economy for over ten years; Way back in March of 2010 I published an article titled, “Japan: the Harbinger of (bad) things to come,” opening with the sentence, “Large and gathering imbalances brewing in the Japanese economy threaten to generate a tsunami-like fallout that could soak most of the global economy.” The Bank of Japan (BOJ) cut interest rates to zero in 1999 and started quantitative easing in 2001, using its monetary printing presses to buy up corporate bonds, REITs, stocks and Japanese Government Bonds (JGBs).

Over the ensuing 12 years and several rounds of ever greater QE, the imbalances have only worsened and in February last year, the BOJ was forced to go full Mario Draghi, all-that-it-takes, committing to buy unlimited amounts of JGB’s. At the same time however, the BOJ capped the interest rates on 10-year JGBs at 0.25% to avoid inflating the domestic borrowing costs.

Yen will burn to a crisp!

The sudden collapse

By the end of 2022 we may also have reached the inflection point between Hemingway’s gradually and suddenly. In December alone, the BOJ escalated its JGB purchases to keep the yield on JGB’s capped at 0.25%: it spent 17 trillion yen (equivalent to about 3% of Japan’s GDP). In spite of that, on December 20 we saw the BOJ’s first battlefield retreat when it unexpectedly raised the maximum rate of 10-year JGBs from 0.25% to 0.50%. In spite of that, the BOJ had to continue spending huge sums to defend the new rate: on 12 and 13 January, it spent another 10 trillion yen (2% of GDP) wetting a new daily record. By now, the Bank of Japan owns about 55% of all Japanese Government Bonds.

The risk is this…

Yesterday morning (Wednesday, 19 January 2023), as it concluded its 2-day meeting, the BOJ Policy Board announced that it would hold the 10-year JGB yields firm at 0.50%. But the unravelling is far from over. As Jim Grant said in his recent interview, “Japan is perhaps the most important risk in the world, not least because it is among the least discussed risks… The risk is this: Every business day, the Bank of Japan is spending tens of billions of dollars worth of yen to enforce governor Kuroda’s yield curve interest rates suppression program. To put this into perspective: in the UK, when the little crisis over liability driven pension investing in late September happened, the Bank of England spent around $5 billion. The BOJ does that before breakfast.”

Grant is also right about the fact that Japan is among the least discussed risks today. By the way, if you wish to keep abreast of the developments in Japan, I recommend Richard Katz’s excellent Substack, “Japan Economy Watch.”

What happens next?

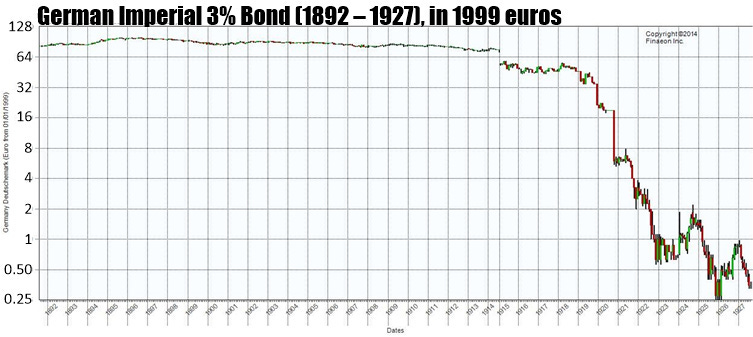

There’s no predicting how this situation will unfold. Corroborating Ernest Hemingway, Jim Grant also points out that bond market cycles tend to be very long and that trends reverse only very gradually. However, when governments and central banks resort to the printing presses to monetize debt, and we have seen many such cases through history, the typical outcomes include the collapse of the currency, rise in interest rates, and very probably a sharp rise in equity values. One such example, and a possible indication of what we might see in Japan, was Germany at the beginning of the last century:

Here again, we can see the gradual phase of the decline from about 1896 turn into the suddenly phase in the beginning of 1918. By the end of 1922, German government bonds had become nearly worthless.

Stocks go vertical…

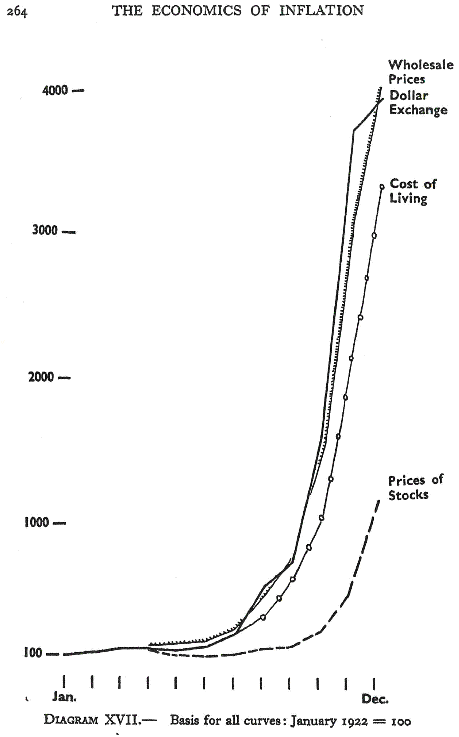

What typically happens as bonds and the currency collapse, equities tend to go vertical as we saw in many cases, including Venezuela, Zimbabwe, Argentina, Israel and also the Weimar Republic:

This is perhaps because investors see holding any asset preferable to holding cash, so they plough ever penny they can spare into stocks.

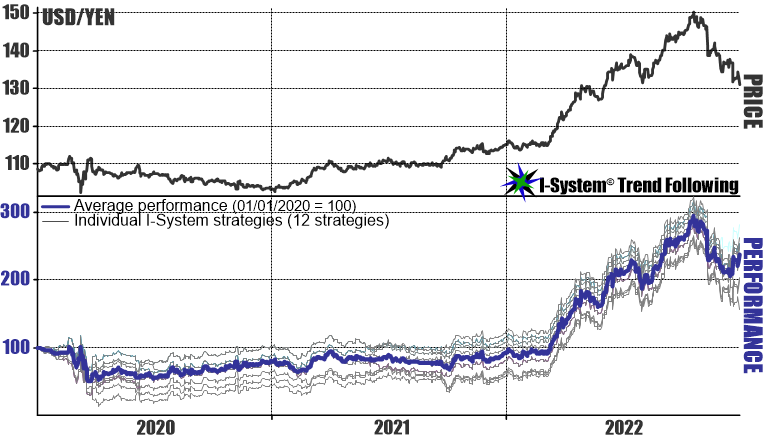

Even if the timing and magnitude of these events can’t be predicted, such large-scale price events invariably unfold as trends. The most reliable way to navigate trends is with trend following strategies. For example, last year we’ve already seen the beginnings of the collapse of the yen. Here’s how the 12 trend following strategies included in our Major Markets TrendCompass report performed:

The top of the chart shows the price of US dollar in yen, which suddenly vaulted through most of 2022. And in spite of the yen’s strong recovery in the last quarter of 2022, I expect that this story has only started its suddenly phase of collapse. Over the coming months and years, we’ll likely see further pressure on the yen and JGBs. The Nikkei will likely break into a significant uptrend fairly soon.

It’s not just Japan…

With time, the same developments will almost certainly engulf Great Britain and the Eurozone. Ultimately, even the United States will not be able to avoid the collapse; that outcome is baked into the economic equation from the get go under the monetary system based on fractional reserve lending with a fiat currency.