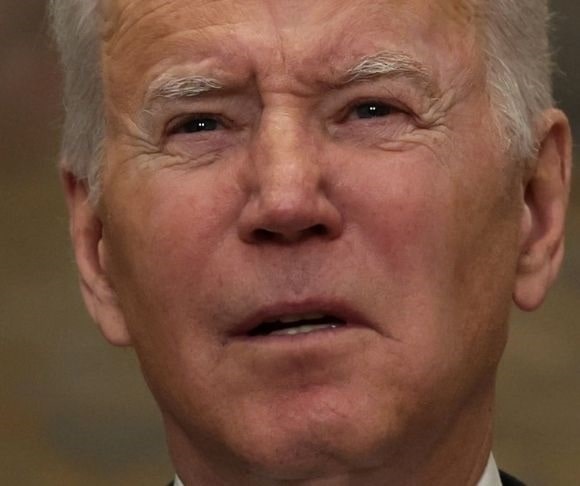

Is President Joe Biden responsible for today’s 40-year-high inflation? While it is politically expedient for opponents to lay the blame on the White House, there are many factors contributing to this inflationary environment, such as the Federal Reserve printing one-third of all U.S. dollars ever created in the nation’s history, the global supply chain crisis, and output failing to meet demand. But the president is not entirely absolved of responsibility for sky-high prices, particularly on the energy front as crude oil and natural gas soar to incredible levels unseen in many years. And this is creating pain in Americans’ pocketbooks throughout the entire country.

Americans Paying More For Green

The U.S. government is spending trillions of dollars it does not have to realize Biden’s vision of a green economy. His dream ostensibly consists of electric vehicles filling highways during the morning and afternoon rush-hour commutes, windmills erected on every open space, and solar panels installed on every rooftop. This is part of the broader goal of a net-zero world, something that serious people and influential organizations have conceded is impossible to achieve.

In order to pay for the trillions of dollars in new spending, the United States will need to complete a few tasks. The first is that the White House will need to sell new bonds, which will then be purchased by the central bank, effectively monetizing these debts and deficits. The second is higher taxes to fill government coffers. The third is to borrow money from foreign governments and investors. All of these are inflationary in some form, either through currency debasement or greater price inflation.

A West Texas Intermediate (WTI) crude oil barrel is around $90, while natural gas is about $4.50 per million British thermal units (Btu). As a result of these immense gains, gasoline prices are up 37% this year to a national average of $3.58, and electricity and utilities have surged 10.7% and 23.9%, respectively. Overall, the president’s energy policies added $1,000 to typical household costs last year, a new report from the Heartland Institute estimated earlier this month.

The administration promised that relief was coming, although the latest Bureau of Labor Statistics (BLS) report does not signal this. Biden has released 50 million barrels of oil from the Strategic Petroleum Reserves (SPRs) that barely made a dent in global crude prices. He has begged the Organization of the Petroleum Exporting Countries (OPEC) to turn on the taps, but the cartel is sticking to its more modest plans. The White House is now negotiating with Iran on a nuclear agreement that would likely see Tehran inject millions of barrels of oil into international energy markets. Press Secretary Jen Psaki also reiterated the president’s position that Washington is “looking at every legal and regulatory authority we have available to ensure consumers are protected.”

Biden has exhausted his options, except one that would offer relief: encouraging U.S. oil and gas firms to start drilling, exploring, and producing Texas tea. Energy analysts have stated that historically these companies would be ramping up output to take advantage of these prices. However, the regulatory uncertainty is preventing the industry from expanding capacity, prompting many Wall Street firms to pencil in $100 oil.

During the final 2020 presidential debate with then-President Donald Trump, Biden confirmed that he “would transition from the oil industry,” adding that “it is a big statement.” So far, he is keeping his word by canceling pipelines and promising reforms. It has not been all bad news, however. Despite promising to ban drilling auctions on federal land, his administration approved more than 3,000 new permits last year, 37% more than Trump. That said, the objective to shift to green energy has led to unintended consequences, even among Republican leaders who have embraced renewables. When snowfall happens in Texas, where about one-quarter of power is produced by green energy, the state shuts down. Europe, where the bloc has abandoned fossil fuels in favor of wind and solar, is depending on foreign energy to keep its lights on.

Blame Biden?

In the end, four-decade-high is not entirely Biden’s fault, but he is a contributing factor. Even Treasury Secretary Janet Yellen conceded that his spending sprees are partly to blame. Indeed, “partly” may be an understatement. When a government is spending trillions more than it is taking in, on top of the trillions already on the books, there is going to be an inflationary impact. With every Democratic and Republican administration – past and future – failing to take the budget seriously, dollar debasement and higher prices are likely to be the new norm in this post-pandemic world.

~ Read more from Andrew Moran.