JPMorgan: Investors Have Been Asking Questions About The Potential For Hyperinflation

The following excerpts from today’s JPMorgan Market Intelligence report (Afternoon Briefing) from JPM’s Andrew Tyler:

EQUITY AND MACRO NARRATIVE: The CPI print today may assuage some of the building anxiety regarding inflation. While the reflation trade is approaching consensus long, investors across all asset classes have been asking questions about the probability/risk of inflation occurring this year as well as the potential for hyperinflation. Hyperinflation seems unlikely while the US labor market recovers.

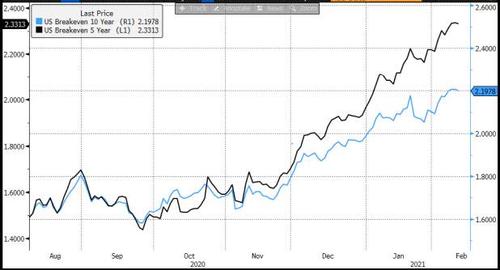

That said, it is possible to see some transitory spikes to inflation due to COVID-induced bottlenecks. The market’s expectations for inflation continue to trend higher, evidenced by US breakeven rates and 5Y5Y inflation swaps.

Insert photo of guy with wheelbarrow full of cash here.

Tyler Durden

Wed, 02/10/2021 – 21:05

JPMorgan: Investors Have Been Asking Questions About The Potential For Hyperinflation

The following excerpts from today’s JPMorgan Market Intelligence report (Afternoon Briefing) from JPM’s Andrew Tyler:

EQUITY AND MACRO NARRATIVE: The CPI print today may assuage some of the building anxiety regarding inflation. While the reflation trade is approaching consensus long, investors across all asset classes have been asking questions about the probability/risk of inflation occurring this year as well as the potential for hyperinflation. Hyperinflation seems unlikely while the US labor market recovers.

That said, it is possible to see some transitory spikes to inflation due to COVID-induced bottlenecks. The market’s expectations for inflation continue to trend higher, evidenced by US breakeven rates and 5Y5Y inflation swaps.

Insert photo of guy with wheelbarrow full of cash here.

Tyler Durden

Wed, 02/10/2021 – 21:05

Read More