JPMorgan Predicts That The Biggest Short Squeeze Yet Begins Next Month

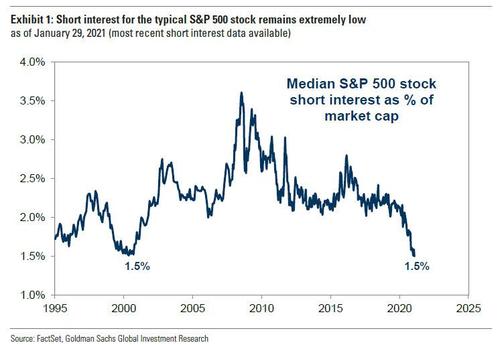

While markets, regulators and even Maxine Waters have been obsessing over the various rolling short squeezes orchestrated by Reddit and Robinhood raiders (with or without the help of hedge funds who ended up being the biggest beneficiaries of the Gamestop surge) which first targeted the most shorted mid-cap names, before moving to biotechs, pot stocks and eventually pennystocks, the reality is that such squeezes are tiny in the grand scheme of things for two reasons: with stocks trading at record highs, overall short interest across equities is at all time lows…

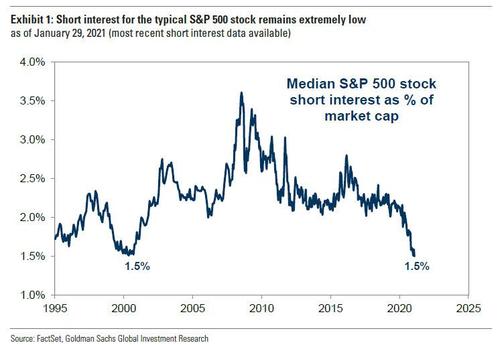

… so one needs to do highly targeted campaigns looking only for illiquid small and mid-cap names which have a very high short interest to float ratio, and second the real systematic shorts are to be found not in stocks but futures and specifically commodities; after all the original widow-maker trader refers not to Gamestop but to nat gas, where as we showed yesterday moves tend to be fast, furious and especially brutal (just ask Amaranth’s Brian Hunter). In fact, anyone who was short any midcontinent nat gas overnight is now out of business.

We bring all this up because while equity squeezes – while dramatic and exciting – tend to go as quickly as they come, the real squeezes in commodities tend to last for a long, long time especially if they are accompanied by a shift in sentiment.

Well, according to JPMorgan’s Marko Kolanovic, such a squeeze may soon be coming to commodities in general and oil in particular.

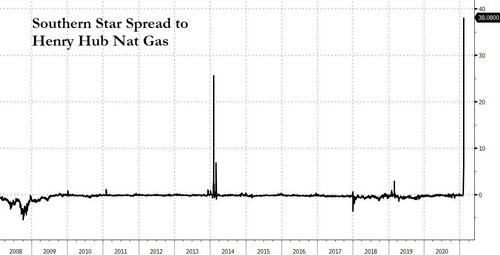

Recall that on Wednesday, JPM’s famous quant, Marko Kolanovic argued that “”the new commodity upswing, and in particular Oil up cycle, has started“

… a very contrarian thesis to the prevailing conventional wisdom that oil – which is clearly overbought after soaring more than 50% since November – may soon resume its slide if and when more covid-related shutdowns return, and one which was predicted on a series of fundamental factors which he laid out below. And after all, just 10 months ago WTI was trading at a negative $43 per barrel, an experience that has scarred a generation of oil bulls for life.

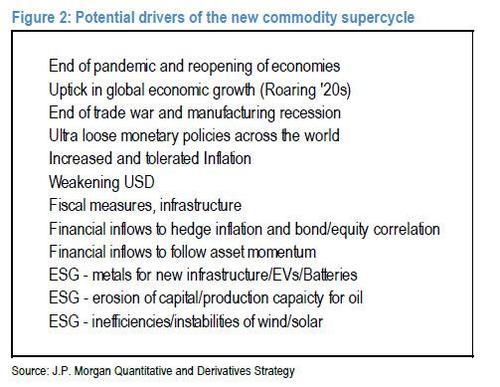

To be sure, Kolanovic listed a variety of fundamental drivers behind his highly contrarian call, among which…

… of which he noted postpandemic recovery (‘roaring 20s’), ultra-loose monetary and fiscal policies, weak USD, stronger inflation, and unintended consequences of environmental policies and their friction with physical constraints related to energy consumption and production.” as the key ones.

He may or may not be right – after all commodities (and macro) is hardly Kolanovic’s specialty. But what grabbed our attention, and what Kolanovic truly excels at, was his views on the upcoming dramatic shift in technicals and flows in the commodity sector.

Specifically, while the fundamental factors may well support a “sypercycle” thesis, any true commodity surge would require a buying catalyst spark. And according to Kolanovic this will come in the form of quant, momentum and other systematic investors being forced to start covering – initially slowly and then faster and faster – what is a historic short across the energy sector. The timing of this squeeze? One month from today.

Here’s why:

In a market where – occasional reddit-inspired microcap short squeeze aside – algos and CTAs have established themselves as the dominant price-setters, it is hardly a surprise that Kolanovic – whose specialty after all is precisely derivative and futures flows – focuses on their influence as the driver behind a commodity supercycle. Indeed, he writes that after “CTAs played significant role in the 2014 oil price downturn” more recently, “CTA funds have been adding Energy exposure. The reason is that 12-month momentum turned positive on Oil, and going forward signals will remain solidly positive.” However, this is in the context of a huge systematic net short overhang in the energy sector. In other words, energy – in all forms be it oil or energy stocks – remains the most hated sector across all investors.

And since vol-control funds are some of the dumbest money around and their actions can be anticipated well in advance, JPM notes that “a further decline in volatility will likely result in larger and more stable cross-asset quant allocations. A larger momentum impact may affect Energy equities, which is the only sector that still has a strongly negative momentum signal and is hence heavily shorted in the context of factor investing.” Indeed, until recently, oil was the only asset that was still below its covid pandemic highs. But, not any more with Brent having finally risen above its pre-pandemic highs.

That – and this is the punchline of Kolanovic’s thesis – will “change in mid-March, when the momentum signal for energy equities turns positive” which is also a gentle hint from the JPM quant to all the redditors out there: if you want to spark a truly historic short squeeze, one which forces systematic shorts to not only cover but to go long, do it where it hurts and buy some energy stocks.

Kolanovic was kind enough to even give you the timing: you have about a month to do so because JPM’s model momentum factor “will need to rebalance in March by closing ~20% of its allocation to Energy equity shorts, and adding ~2% to energy longs, for a ~22% net buying in Energy.”

What is the quantitative significance of these flows?

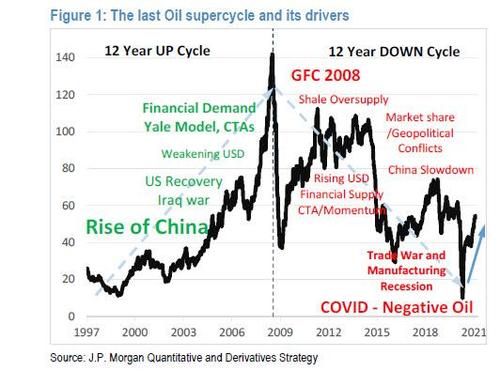

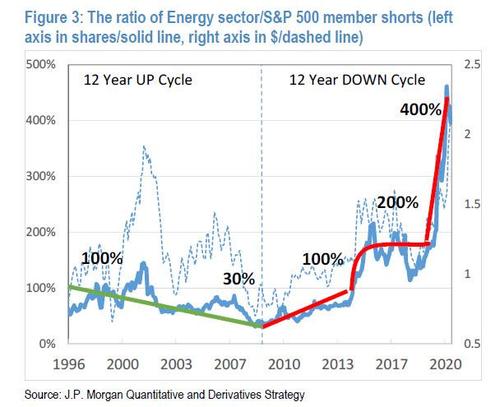

Well, the Croatian quant calculates that if one roughly assumes that there is about ~$1Tr in equity long-short quant funds and that half of these funds are not sector neutralized, “the flows could be quite significant, roughly $20-$30bn.” It could be far, far more. As shown in the chart below, the ratio of energy shares shorted vs all other S&P 500 shares shorted, closely followed the commodity supercycle. And, remarkably, the most recent number of shares shorted for energy was 4 times the S&P 500 average.

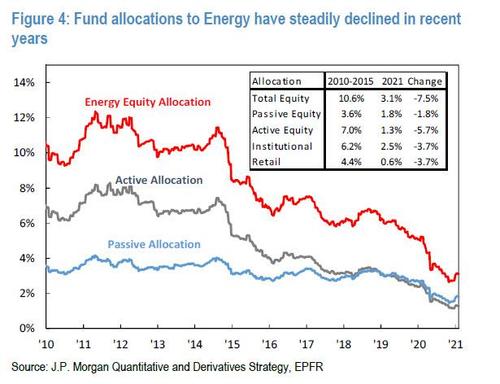

In other words, one doesn’t even need to squeeze the shorts: come March – absent some major new crisis – as a result of broader market technicals the existing systematic shorts will quietly start closing them on their own and go long, in the process injecting tens of billions of new capital. And then, once retail, passive and institutional accounts – all of whom have a record low allocation to energy…

… jump on board once the momentum gets going, there’s no telling how high oil could go although judging by this week’s surge in crude which is clearly frontrunning the “supercycle” the thesis laid out by Kolanovic, the answer is “very.”

Tyler Durden

Fri, 02/12/2021 – 13:20

JPMorgan Predicts That The Biggest Short Squeeze Yet Begins Next Month

While markets, regulators and even Maxine Waters have been obsessing over the various rolling short squeezes orchestrated by Reddit and Robinhood raiders (with or without the help of hedge funds who ended up being the biggest beneficiaries of the Gamestop surge) which first targeted the most shorted mid-cap names, before moving to biotechs, pot stocks and eventually pennystocks, the reality is that such squeezes are tiny in the grand scheme of things for two reasons: with stocks trading at record highs, overall short interest across equities is at all time lows…

… so one needs to do highly targeted campaigns looking only for illiquid small and mid-cap names which have a very high short interest to float ratio, and second the real systematic shorts are to be found not in stocks but futures and specifically commodities; after all the original widow-maker trader refers not to Gamestop but to nat gas, where as we showed yesterday moves tend to be fast, furious and especially brutal (just ask Amaranth’s Brian Hunter). In fact, anyone who was short any midcontinent nat gas overnight is now out of business.

We bring all this up because while equity squeezes – while dramatic and exciting – tend to go as quickly as they come, the real squeezes in commodities tend to last for a long, long time especially if they are accompanied by a shift in sentiment.

Well, according to JPMorgan’s Marko Kolanovic, such a squeeze may soon be coming to commodities in general and oil in particular.

Recall that on Wednesday, JPM’s famous quant, Marko Kolanovic argued that “”the new commodity upswing, and in particular Oil up cycle, has started”

… a very contrarian thesis to the prevailing conventional wisdom that oil – which is clearly overbought after soaring more than 50% since November – may soon resume its slide if and when more covid-related shutdowns return, and one which was predicted on a series of fundamental factors which he laid out below. And after all, just 10 months ago WTI was trading at a negative $43 per barrel, an experience that has scarred a generation of oil bulls for life.

To be sure, Kolanovic listed a variety of fundamental drivers behind his highly contrarian call, among which…

… of which he noted postpandemic recovery (‘roaring 20s’), ultra-loose monetary and fiscal policies, weak USD, stronger inflation, and unintended consequences of environmental policies and their friction with physical constraints related to energy consumption and production.” as the key ones.

He may or may not be right – after all commodities (and macro) is hardly Kolanovic’s specialty. But what grabbed our attention, and what Kolanovic truly excels at, was his views on the upcoming dramatic shift in technicals and flows in the commodity sector.

Specifically, while the fundamental factors may well support a “sypercycle” thesis, any true commodity surge would require a buying catalyst spark. And according to Kolanovic this will come in the form of quant, momentum and other systematic investors being forced to start covering – initially slowly and then faster and faster – what is a historic short across the energy sector. The timing of this squeeze? One month from today.

Here’s why:

In a market where – occasional reddit-inspired microcap short squeeze aside – algos and CTAs have established themselves as the dominant price-setters, it is hardly a surprise that Kolanovic – whose specialty after all is precisely derivative and futures flows – focuses on their influence as the driver behind a commodity supercycle. Indeed, he writes that after “CTAs played significant role in the 2014 oil price downturn” more recently, “CTA funds have been adding Energy exposure. The reason is that 12-month momentum turned positive on Oil, and going forward signals will remain solidly positive.” However, this is in the context of a huge systematic net short overhang in the energy sector. In other words, energy – in all forms be it oil or energy stocks – remains the most hated sector across all investors.

And since vol-control funds are some of the dumbest money around and their actions can be anticipated well in advance, JPM notes that “a further decline in volatility will likely result in larger and more stable cross-asset quant allocations. A larger momentum impact may affect Energy equities, which is the only sector that still has a strongly negative momentum signal and is hence heavily shorted in the context of factor investing.” Indeed, until recently, oil was the only asset that was still below its covid pandemic highs. But, not any more with Brent having finally risen above its pre-pandemic highs.

That – and this is the punchline of Kolanovic’s thesis – will “change in mid-March, when the momentum signal for energy equities turns positive” which is also a gentle hint from the JPM quant to all the redditors out there: if you want to spark a truly historic short squeeze, one which forces systematic shorts to not only cover but to go long, do it where it hurts and buy some energy stocks.

Kolanovic was kind enough to even give you the timing: you have about a month to do so because JPM’s model momentum factor “will need to rebalance in March by closing ~20% of its allocation to Energy equity shorts, and adding ~2% to energy longs, for a ~22% net buying in Energy.”

What is the quantitative significance of these flows?

Well, the Croatian quant calculates that if one roughly assumes that there is about ~$1Tr in equity long-short quant funds and that half of these funds are not sector neutralized, “the flows could be quite significant, roughly $20-$30bn.” It could be far, far more. As shown in the chart below, the ratio of energy shares shorted vs all other S&P 500 shares shorted, closely followed the commodity supercycle. And, remarkably, the most recent number of shares shorted for energy was 4 times the S&P 500 average.

In other words, one doesn’t even need to squeeze the shorts: come March – absent some major new crisis – as a result of broader market technicals the existing systematic shorts will quietly start closing them on their own and go long, in the process injecting tens of billions of new capital. And then, once retail, passive and institutional accounts – all of whom have a record low allocation to energy…

… jump on board once the momentum gets going, there’s no telling how high oil could go although judging by this week’s surge in crude which is clearly frontrunning the “supercycle” the thesis laid out by Kolanovic, the answer is “very.”

Tyler Durden

Fri, 02/12/2021 – 13:20

Read More