Since the last US troops pulled out from Bagram Air Base and the international Airport in Kabul (where 13 Marines and nearly 200 Afghans were killed by a rising insurgent group called ISIS-K, China has taken the lead in providing economic aid to the Afghan people, becoming the first nation in the world to pledge humanitarian assistance to the struggling Islamic Emirate of Afghanistan – as the Taliban are now calling it.

China’s foreign ministry has joined the Taliban in their demands that the US central bank and its allies in western Europe release reserve assets that legally belong to Afghanistan. But all those assets have been “frozen” by the US Treasury, which has imposed financial sanctions on the Taliban, allowing the US to effectively confiscate the money (though it will likely remain frozen for some time since the US can’t legally spend it).

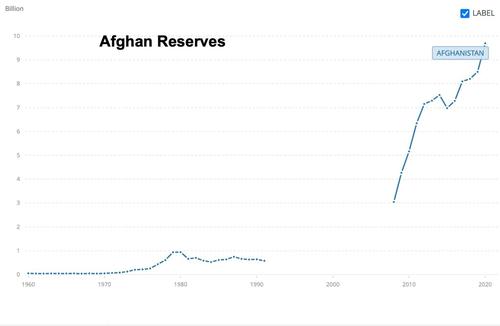

According to the World Bank, the Afghans have roughly $10 billion of foreign reserves outside the country, mostly in the US and Europe.

And while the US has so far ignored Beijing’s demands that the Fed release Afghanistan’s reserves so that the money could be used to feed the country’s starving and war-weary people, Reuters on Friday noted that the Taliban government has shifted to taken a different line with Europe. Right now, Afghanistan is a drought-stricken, war-torn wasteland where the people are facing the prospect of mass starvation if they don’t seek greener pastures elsewhere.

And where might those greener pastures be? We’ve already seen this play out once before with the Syrian migrant crisis: just like the Syrians, if they fear starvation, persecution or unceasing poverty at home, legions of Afghans are going to seek refugee status in Europe, unleashing the second major migrant crisis within a decade.

The US often uses the Taliban’s history of “human rights abuses” (not like the US has committed plenty of atrocities from Latin America to Vietnam over the years) including restrictions of educating women and requiring them to cover their faces in public and only travel with male relatives, as its primary reason for not engaging with the new EIA government (nevermind the fact that the US lost a 20-year guerilla war to the Taliban).

But as China is demanding, and as the Afghan government’s spokespeople have repeated over again (with some confirmation from foreign press on the ground) the Taliban of today have “liberalized” when compared with the Taliban of 1996-2000.

the ‘new-and-improved’ Taliban (under the guidance of their nominally Communist benefactors) have insisted that their new government will “respect human rights” and a woman’s right to education.

But instead of directing their latest demands at the US, the Taliban are now threatening the Europeans with a very simple fact: if the west withholds the money – which in fact belongs to the Afghan people – it will trigger an inevitable humanitarian crisis that will quickly explode since the aide currently being provided to the war-torn country simply isn’t enough.

Once this happens, Afghans will start fleeing to Europe by road, by boat and by any other means, setting off another migrant crisis just as Europe is finally moving past the last one. The political ramifications could be huge: the French grapple with the rise of a new right-wing populist, and many unelected bureaucrats in Brussels fear another resurgence by the anti-migrant anti-globalist right that might succeed this time in overthrowing the globalist world order.

Shah Mehrabi, a board member of the Afghan Central Bank, perhaps put it best: if the money isn’t released to the IEA, the west will face a “double-whammy” of disaster as they struggle to care for the migrants leaving Afghanistan, while new terrorist insurgent groups like ISIS-K seize the opportunity to try and wrest more power at home while launching attacks from abroad. Ultimately, their radical agenda will make the Taliban look like the Teletubbies.

Over in Europe, one top central bank official called on European countries including Germany to release their share of the reserves to avoid an economic collapse that could trigger mass migration towards Europe.

“The situation is desperate and the amount of cash is dwindling,” Shah Mehrabi, a board member of the Afghan Central Bank, told Reuters. “There is enough right now…to keep Afghanistan going until the end of the year.

“Europe is going to be affected most severely, if Afghanistan does not get access to this money,” said Mehrabi.

“You will have a double whammy of not being able to find bread and not being able to afford it. People will be desperate. They are going to go to Europe,” he said.

Afghan tax collection has amounted to just $4.4MM per day. But unlike the US, it looks like the Europeans, who are already facing down the prospect of surging energy prices this winter, might be willing to hand over some, if not all, of the Afghan reserves to try and avert another crisis that could lead to more political fracture in the EU.

Mehrabi said that Afghanistan needed $150 million each month to “prevent imminent crisis”, keeping the local currency and prices stable, adding that any transfer could be monitored by an auditor.

“If reserves remain frozen, Afghan importers will not be able to pay for their shipments, banks will start to collapse, food will be become scarce, grocery stores will be empty,” Mehrabi said.

He said that about $431 million of central bank reserves were held with German lender Commerzbank, as well as a further roughly $94 million with Germany’s central bank, the Bundesbank.

The Bank for International Settlements, an umbrella group for global central banks in Switzerland, holds a further approximately $660 million. All three declined to comment.

Now, the West has some really tough decisions to make. There aren’t a whole lot of good options that will help the Taliban while preventing the West from looking weak. But as for this second point, well, that ship has probably already sailed.

Read More