Millennials Are “Mad As Hell”

Authored by David Robertson via RealInvestmentAdvice.com,

The Occupy Wall Street movement that emerged in the financial crisis of 2008 was interesting because a general sense of discontent seemed to merge. Also interesting was the lack of consensus as to the causes of dissatisfaction. More recently, the trading mania surrounding Robinhood and Gamestop reflected many of the same dynamics. A broad sense of anger was channeled variously against Wall Street, “suits,” boomers, short-sellers, and a sundry list of other participants deemed to be bad actors.

One thing is clear: Just like in the 1976 movie, “Network,” a lot of people are “mad as hell.” That anger is a symptom of a bigger problem, however. Digging into its root causes reveals insights about society and how it can reshape and defuse anger and become more productive.

Roots Of Anger

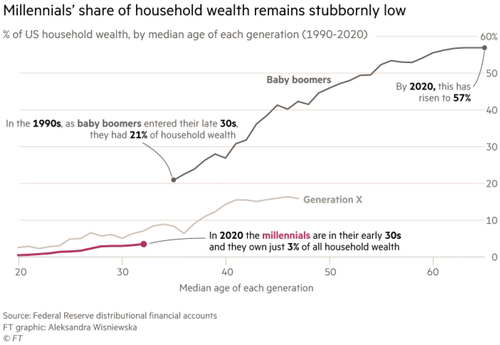

It is not hard to understand some of the sources of anger. Perhaps one of the most revealing single indicators is the variance in wealth distribution over time. In the 1990s, when Baby Boomers were in their late 30s, just slightly older than Millennials’ age in 2020, they owned seven times the share of household wealth (21% vs. 3%). The opportunities for income and wealth accumulation were massively more significant for Baby Boomers than for Millennials.

Missing The Target

As a result, it isn’t too surprising to observe a fair amount of discontent directed at the Baby Boom generation, and it is clear from a number of the Reddit/wallstreetbets threads that this is happening. Further, any reader of The Fourth Turning by William Strauss and Neil Howe can come away with plenty of material for younger generations to incriminate the Baby Boom generation.

For example, Baby Boomers in the US grew up in an environment of enormous economic growth in one of the world’s wealthiest countries. Yet, those prodigious benefits seemed not to be enough; massive debts got used to boost consumption even further. From a historical perspective (and to younger generations), Baby Boomers’ generation appears rapacious in its consumption, like locusts stripping the country bare.

A Generalization

Of course, such a view is a generalization that belies the existence of countless individual Baby Boomers who act and behave in ways that are utterly antithetical to that characterization. It is not hard to find smart and talented individuals and are generous with their time, financial support, knowledge, and experience. As a result, it is hard to consider the entire generation of Baby Boomers an appropriate target of opprobrium.

There are other targets. For instance, short-sellers have received a great deal of anger following the Gamestop and Robinhood episode. Such too appears unjustified. For one, there are at least two sides to every story, and it is essential to hear both to get closer to the truth. Besides, given the upward bias of stocks, short-sellers must work even harder to make a living. Some of the most accomplished (and humble and generous) investors are short-sellers.

As a result, the targeting of outrage against groups such as Baby Boomers or short sellers is at best misguided. At worst, such efforts are both malicious and counterproductive. It only makes things worse by directing outrage in a general direction, including people sympathetic to the cause.

A Bad Game

Where should anger be directed then? Ben Hunt guides us to a better understanding by completely flipping the perspective. It is not a whodunit where the perpetrator needs catching. Instead, the problem is the economic, political, and financial system has become a destructive “game” for most participants. In other words, the odds stacked against us are such that there is little chance of success over time, regardless of performance.

To see this, we need to reconsider our assumptions and mental models. In his piece, “Hunger Games,” Hunt explains how things have changed in the markets:

“You have been told that you can be a PARTICIPANT in the game of markets, that you can storm the playing field of companies, that you can take matters into your own hands and rescue a promising company under unfair attack.”

In a world of entirely free markets, strong property protection, effective regulation, effective enforcement, and a level playing field, this might be true, as the Robinhood episode revealed. However, many of these assumptions are no longer valid:

“We all saw that the thing that determines whether or not our stock market bets pay off is … other bets. We all saw that there is no ‘game of companies’ taking place independently of our bets. We all saw that our bets, in and of themselves, can win the ‘game’, with absolutely zero input from the ‘team’ that is supposedly out on the ‘field’.”

Such is a very different concept of markets than what most of us have operated on. It boils down to two straightforward tenets:

“Everyone knows that everyone knows that 1) The bets ARE the market. 2) Market makers OWN the market.”

Implications

The implications of this are huge. Success in investing in this context is not about researching and applying analytical skills and hanging in when it gets tough. Nope.

Being an investor today is more like being a gladiator. You might win some fights, even in glorious fashion, but the odds currently stacked against your long-term survival. You are mainly just an actor in a game designed to serve the ends of a select few.

“Both of these stories are narratives for our very own Hunger Game, a spectacle that chews up the participants in the arena while delivering enormous profits to the networks (media, financial and political) that put them on.”

The notion of participants getting chewed up in a contest that deliver enormous profits to others does seem to capture much of the environment – and therefore explains much of the anger if it feels like it’s not a fair game that’s because it isn’t.

Another Theory

Interestingly, Noam Chomsky’s presentation, Requiem for the American Dream, dovetails nicely with Hunt’s characterization of the higher-level structure of the social, political, and financial environment. According to Chomsky, the concentration of wealth and power is more than just an unpleasant outcome; instead, it is a distinct objective of the super-rich.

As he explains, the 1960s was an era of much greater wealth equality and was the backdrop for a substantial expansion of civil liberties. Increasingly too, young people were protesting against the government, against corporate leadership, against AUTHORITY, and it scared people in charge.

Principles

As Chomsky tells it, “The 10 Principles Of Concentration Of Wealth & Power” (the subtitle of the presentation) were something of playbook devised by the super-rich to stem the tide of egalitarianism and to reverse it. While this hypothesis certainly rings with conspiratorial tones, the “principles” sure explain many things.

One set of principles prescribes reshaping the economy through financialization and offshoring. Together, these two efforts serve to increase the role of asset owners in the economy at the expense of reducing laborers’ role. Both have succeeded spectacularly.

Another principle is, “Marginalize the population.” Such gets accomplished by maintaining the veneer of democracy while at the same time eroding its power to be representative. Chomsky describes how most people do not have a voice that counts:

“In one study, together with another fine political scientist, Benjamin Page, [Martin] Gilens took about 1,700 policy decisions, and compared them with public attitudes and business interests. What they show, I think convincingly, is that policy is uncorrelated with public attitudes, and closely correlated with corporate interests. Elsewhere he showed that about 70 percent of the population has no influence on policy—they might as well be in some other country. And as you go up the income and wealth level, the impact on public policy is greater—the rich essentially get what they want.”

Hypothesis

Based on these principles, the hypothesis seems to fit pretty well, but principle #5, “Attack solidarity,” really stands out as having explanatory power. The idea that the potential of an extensive group of people to collaborate toward a common goal is a terrifying prospect for a small minority of super-rich people with different interests. The energy of the masses, however, also represents a force that can turn on itself:

“SOLIDARITY IS quite dangerous. From the point of view of the masters, you’re only supposed to care about yourself, not about other people. This is quite different from the people they claim are their heroes, like Adam Smith, who based his whole approach to the economy on the principle that sympathy is a fundamental human trait—but that has to be driven out of people’s heads. You’ve got to be for yourself and follow the vile maxim—“don’t care about others”—which is okay for the rich and powerful, but devastating for everyone else.”

Wow, that puts a lot of things in a different context! Namely, when people fall prey to the maxim “don’t care about others,” they inadvertently advance the super-rich’s goals by disrupting the solidarity of everyone else. More specifically, when someone puts huge bets on Gamestop to stick it to the short sellers and rages about the boomers, they aren’t soldiers bravely fighting for a better system. They are pawns getting played.

Requiem

Such may get mistaken for a passing phase or a transient cultural phenomenon, but it seems like there is something far more substantive here. Chomsky hints at it with his introduction:

“DURING THE Great Depression, which I’m old enough to remember, it was bad—much worse objectively than today. But there was a sense that we’ll get out of this somehow, an expectation that things were going to get better, ‘maybe we don’t have jobs today, but they’ll be coming back tomorrow, and we can work together to create a brighter future’.”

Such highlights the problem. In the Great Depression, things were terrible, but there was a belief that things would get better. There was hope. Today, most people are far better off in terms of health and wealth, but the idea is that things are getting worse. The hope has faded.

For the first time in the country’s history, a generation has lost hope of things getting better. They have lost the American Dream. In a culture that highly values growth and competition, the fate of having less is an especially tough pill to swallow. It’s enough to make people angry.

Actions

What can we do? Diagnosed as a conflict between the super-rich and everyone else, improving the situation will not be a battle to be won by a handful of brave “soldiers.” That effort will require broader participation and more collaboration. As a result, an excellent place to start is to stop attacking each other.

Beyond that, Hunt provides several high-level prescriptions. He recommends pressing for lower leverage in financial institutions at the policy level. He recommends focusing on real-world companies and cash flows at the investment level. At a personal level, he recommends “calling a thing by its proper name.” Collectively, he promotes efforts designed to “diminish Wall Street’s influence over our democracy.” Such is a useful framework from which to make plans.

Conclusion

The bad news is many people are “mad as hell, and they aren’t going to take it anymore.” It is also unfortunate that much of the anger gets channeled in a way that, at best, isn’t helpful, and at worst, is counterproductive. We don’t need to descend into a Hunger Game competition, but it is possible.

The good news is that anger is a form of energy. Further, anger represents a level of energy sufficient to effect change. Perhaps the knowledge that most other people are not part of the problem can harness that energy. Maybe that energy could get used to collaborating to tear down a system that doesn’t work very well for most people and build a new one that does. Perhaps.

Tyler Durden

Fri, 02/12/2021 – 07:37

Millennials Are “Mad As Hell”

Authored by David Robertson via RealInvestmentAdvice.com,

The Occupy Wall Street movement that emerged in the financial crisis of 2008 was interesting because a general sense of discontent seemed to merge. Also interesting was the lack of consensus as to the causes of dissatisfaction. More recently, the trading mania surrounding Robinhood and Gamestop reflected many of the same dynamics. A broad sense of anger was channeled variously against Wall Street, “suits,” boomers, short-sellers, and a sundry list of other participants deemed to be bad actors.

One thing is clear: Just like in the 1976 movie, “Network,” a lot of people are “mad as hell.” That anger is a symptom of a bigger problem, however. Digging into its root causes reveals insights about society and how it can reshape and defuse anger and become more productive.

Roots Of Anger

It is not hard to understand some of the sources of anger. Perhaps one of the most revealing single indicators is the variance in wealth distribution over time. In the 1990s, when Baby Boomers were in their late 30s, just slightly older than Millennials’ age in 2020, they owned seven times the share of household wealth (21% vs. 3%). The opportunities for income and wealth accumulation were massively more significant for Baby Boomers than for Millennials.

Missing The Target

As a result, it isn’t too surprising to observe a fair amount of discontent directed at the Baby Boom generation, and it is clear from a number of the Reddit/wallstreetbets threads that this is happening. Further, any reader of The Fourth Turning by William Strauss and Neil Howe can come away with plenty of material for younger generations to incriminate the Baby Boom generation.

For example, Baby Boomers in the US grew up in an environment of enormous economic growth in one of the world’s wealthiest countries. Yet, those prodigious benefits seemed not to be enough; massive debts got used to boost consumption even further. From a historical perspective (and to younger generations), Baby Boomers’ generation appears rapacious in its consumption, like locusts stripping the country bare.

A Generalization

Of course, such a view is a generalization that belies the existence of countless individual Baby Boomers who act and behave in ways that are utterly antithetical to that characterization. It is not hard to find smart and talented individuals and are generous with their time, financial support, knowledge, and experience. As a result, it is hard to consider the entire generation of Baby Boomers an appropriate target of opprobrium.

There are other targets. For instance, short-sellers have received a great deal of anger following the Gamestop and Robinhood episode. Such too appears unjustified. For one, there are at least two sides to every story, and it is essential to hear both to get closer to the truth. Besides, given the upward bias of stocks, short-sellers must work even harder to make a living. Some of the most accomplished (and humble and generous) investors are short-sellers.

As a result, the targeting of outrage against groups such as Baby Boomers or short sellers is at best misguided. At worst, such efforts are both malicious and counterproductive. It only makes things worse by directing outrage in a general direction, including people sympathetic to the cause.

A Bad Game

Where should anger be directed then? Ben Hunt guides us to a better understanding by completely flipping the perspective. It is not a whodunit where the perpetrator needs catching. Instead, the problem is the economic, political, and financial system has become a destructive “game” for most participants. In other words, the odds stacked against us are such that there is little chance of success over time, regardless of performance.

To see this, we need to reconsider our assumptions and mental models. In his piece, “Hunger Games,” Hunt explains how things have changed in the markets:

“You have been told that you can be a PARTICIPANT in the game of markets, that you can storm the playing field of companies, that you can take matters into your own hands and rescue a promising company under unfair attack.”

In a world of entirely free markets, strong property protection, effective regulation, effective enforcement, and a level playing field, this might be true, as the Robinhood episode revealed. However, many of these assumptions are no longer valid:

“We all saw that the thing that determines whether or not our stock market bets pay off is … other bets. We all saw that there is no ‘game of companies’ taking place independently of our bets. We all saw that our bets, in and of themselves, can win the ‘game’, with absolutely zero input from the ‘team’ that is supposedly out on the ‘field’.”

Such is a very different concept of markets than what most of us have operated on. It boils down to two straightforward tenets:

“Everyone knows that everyone knows that 1) The bets ARE the market. 2) Market makers OWN the market.”

Implications

The implications of this are huge. Success in investing in this context is not about researching and applying analytical skills and hanging in when it gets tough. Nope.

Being an investor today is more like being a gladiator. You might win some fights, even in glorious fashion, but the odds currently stacked against your long-term survival. You are mainly just an actor in a game designed to serve the ends of a select few.

“Both of these stories are narratives for our very own Hunger Game, a spectacle that chews up the participants in the arena while delivering enormous profits to the networks (media, financial and political) that put them on.”

The notion of participants getting chewed up in a contest that deliver enormous profits to others does seem to capture much of the environment – and therefore explains much of the anger if it feels like it’s not a fair game that’s because it isn’t.

Another Theory

Interestingly, Noam Chomsky’s presentation, Requiem for the American Dream, dovetails nicely with Hunt’s characterization of the higher-level structure of the social, political, and financial environment. According to Chomsky, the concentration of wealth and power is more than just an unpleasant outcome; instead, it is a distinct objective of the super-rich.

As he explains, the 1960s was an era of much greater wealth equality and was the backdrop for a substantial expansion of civil liberties. Increasingly too, young people were protesting against the government, against corporate leadership, against AUTHORITY, and it scared people in charge.

Principles

As Chomsky tells it, “The 10 Principles Of Concentration Of Wealth & Power” (the subtitle of the presentation) were something of playbook devised by the super-rich to stem the tide of egalitarianism and to reverse it. While this hypothesis certainly rings with conspiratorial tones, the “principles” sure explain many things.

One set of principles prescribes reshaping the economy through financialization and offshoring. Together, these two efforts serve to increase the role of asset owners in the economy at the expense of reducing laborers’ role. Both have succeeded spectacularly.

Another principle is, “Marginalize the population.” Such gets accomplished by maintaining the veneer of democracy while at the same time eroding its power to be representative. Chomsky describes how most people do not have a voice that counts:

“In one study, together with another fine political scientist, Benjamin Page, [Martin] Gilens took about 1,700 policy decisions, and compared them with public attitudes and business interests. What they show, I think convincingly, is that policy is uncorrelated with public attitudes, and closely correlated with corporate interests. Elsewhere he showed that about 70 percent of the population has no influence on policy—they might as well be in some other country. And as you go up the income and wealth level, the impact on public policy is greater—the rich essentially get what they want.”

Hypothesis

Based on these principles, the hypothesis seems to fit pretty well, but principle #5, “Attack solidarity,” really stands out as having explanatory power. The idea that the potential of an extensive group of people to collaborate toward a common goal is a terrifying prospect for a small minority of super-rich people with different interests. The energy of the masses, however, also represents a force that can turn on itself:

“SOLIDARITY IS quite dangerous. From the point of view of the masters, you’re only supposed to care about yourself, not about other people. This is quite different from the people they claim are their heroes, like Adam Smith, who based his whole approach to the economy on the principle that sympathy is a fundamental human trait—but that has to be driven out of people’s heads. You’ve got to be for yourself and follow the vile maxim—“don’t care about others”—which is okay for the rich and powerful, but devastating for everyone else.”

Wow, that puts a lot of things in a different context! Namely, when people fall prey to the maxim “don’t care about others,” they inadvertently advance the super-rich’s goals by disrupting the solidarity of everyone else. More specifically, when someone puts huge bets on Gamestop to stick it to the short sellers and rages about the boomers, they aren’t soldiers bravely fighting for a better system. They are pawns getting played.

Requiem

Such may get mistaken for a passing phase or a transient cultural phenomenon, but it seems like there is something far more substantive here. Chomsky hints at it with his introduction:

“DURING THE Great Depression, which I’m old enough to remember, it was bad—much worse objectively than today. But there was a sense that we’ll get out of this somehow, an expectation that things were going to get better, ‘maybe we don’t have jobs today, but they’ll be coming back tomorrow, and we can work together to create a brighter future’.”

Such highlights the problem. In the Great Depression, things were terrible, but there was a belief that things would get better. There was hope. Today, most people are far better off in terms of health and wealth, but the idea is that things are getting worse. The hope has faded.

For the first time in the country’s history, a generation has lost hope of things getting better. They have lost the American Dream. In a culture that highly values growth and competition, the fate of having less is an especially tough pill to swallow. It’s enough to make people angry.

Actions

What can we do? Diagnosed as a conflict between the super-rich and everyone else, improving the situation will not be a battle to be won by a handful of brave “soldiers.” That effort will require broader participation and more collaboration. As a result, an excellent place to start is to stop attacking each other.

Beyond that, Hunt provides several high-level prescriptions. He recommends pressing for lower leverage in financial institutions at the policy level. He recommends focusing on real-world companies and cash flows at the investment level. At a personal level, he recommends “calling a thing by its proper name.” Collectively, he promotes efforts designed to “diminish Wall Street’s influence over our democracy.” Such is a useful framework from which to make plans.

Conclusion

The bad news is many people are “mad as hell, and they aren’t going to take it anymore.” It is also unfortunate that much of the anger gets channeled in a way that, at best, isn’t helpful, and at worst, is counterproductive. We don’t need to descend into a Hunger Game competition, but it is possible.

The good news is that anger is a form of energy. Further, anger represents a level of energy sufficient to effect change. Perhaps the knowledge that most other people are not part of the problem can harness that energy. Maybe that energy could get used to collaborating to tear down a system that doesn’t work very well for most people and build a new one that does. Perhaps.

Tyler Durden

Fri, 02/12/2021 – 07:37

Read More