Morgan Stanley: This Is The Biggest Paradigm Shift In Global Macro In The Past Three Years

By Chetan Ahya, Morgan Stanley’s Chief Economist and Global Head of Economics

The Paradigm Shift

At a recent group dinner, I was asked to identify the most significant development in global macro I had witnessed during my three-year stint in New York. I expect that many people would point to the pandemic and the structural changes it has brought to the ways we work and live. But I think the bigger story is how the pandemic has triggered a paradigm shift in how corporate profits and wages will be distributed within national income. As this mega-trend reverses in the US, the tide will turn in favor of higher inflation and economic cycles will run hotter but shorter, in my view.

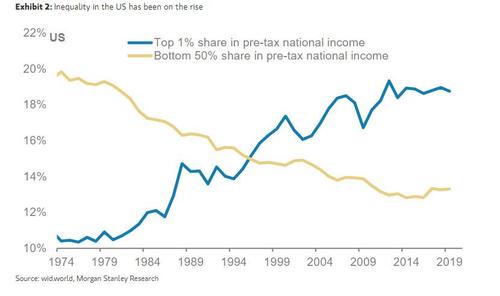

For context, the share of corporate profits in GDP has been on a rising path for the past 40 years, while the wage share has been declining until recently. At the same time, income inequality has increased sharply and intergenerational mobility has declined. While these trends are global in nature, the US has undoubtedly been at the forefront.

As time wore on, these trends became increasingly unsustainable. Calls for action grew louder and a collective voice began to make its way into policy-making circles. When the burden of the COVID-19 recession fell most heavily on lower-income households, policy-makers were galvanised into action.

How are policy-makers addressing these issues, and what are the implications?

At a macro level, they are explicitly aiming for a high-pressure economy. Drawing on the experience of the past cycle, they believe that such an economy will create broad-based and inclusive economic growth, which will help to reduce the impact of the recession on lower-income households and address the long-standing problem of income inequality.

The conduct of fiscal policy has shifted from austerity to activism. The fiscal response to this recession is already the largest since the Second World War, and policy-makers are working on additional fiscal packages. The Federal Reserve has recast both sides of its dual mandate, essentially creating room for unemployment rates to move lower in order to ensure that gains in the labor market can be shared more broadly among low-income groups.

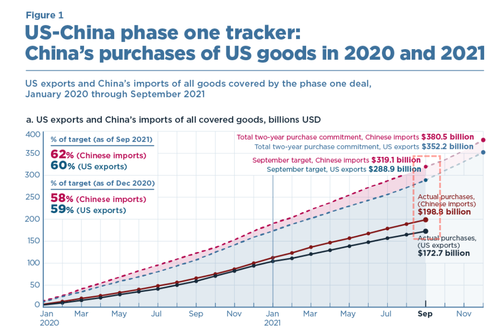

At a micro level, policy-makers are intervening to temper the adverse effects of market forces. The efforts under way to raise minimum wages are a case in point. But there will also be increasing scrutiny of the tech, trade and titans trio – the key factors that have held down the wage share of GDP. The previous US administration had already taken a new tack on trade policy, and all indications are that it will not be reversed under the current administration.

At the same time, policy-makers are homing in on corporate titans and their actions. These companies tend to have high industry concentration and have blunted labor’s bargaining power. Moreover, they typically have a low labor share of value-added, and their proliferation has also contributed to the general decline in the wage share of GDP.

All in, as policy-makers act to address income inequality and ensure an inclusive growth environment, the wage share of GDP will start to reverse its 40-year decline.

The reversal of this mega-trend could have far-reaching implications for the macro landscape. We highlight two in particular.

First, the tide is turning in favor of higher inflation. We have been vocal about the return of inflation since May 2020. Our base case is that US core PCE inflation will rise above 2%Y (stripping out the base effects) from April 2022. We also see a real risk that inflation could overshoot 2.5%Y on a sustained basis.

Second, economic cycles could run hotter but shorter. A high-pressure economy would mean a faster return to full employment. But tightening policies at a later stage in the recovery runs the risk that shifts in policy stances could become more disruptive, truncating economic cycles.

The initial burst of decisive policy action has set the US on a new course. Going forward, how pervasive and persistent these actions turn out to be will determine how far the US economy travels in this new direction. While the reversal of mega-trends could potentially be disruptive, this course correction will set the stage for a more balanced and sustainable economic trajectory over the longer term.

Tyler Durden

Sun, 06/13/2021 – 19:00

Morgan Stanley: This Is The Biggest Paradigm Shift In Global Macro In The Past Three Years

By Chetan Ahya, Morgan Stanley’s Chief Economist and Global Head of Economics

The Paradigm Shift

At a recent group dinner, I was asked to identify the most significant development in global macro I had witnessed during my three-year stint in New York. I expect that many people would point to the pandemic and the structural changes it has brought to the ways we work and live. But I think the bigger story is how the pandemic has triggered a paradigm shift in how corporate profits and wages will be distributed within national income. As this mega-trend reverses in the US, the tide will turn in favor of higher inflation and economic cycles will run hotter but shorter, in my view.

For context, the share of corporate profits in GDP has been on a rising path for the past 40 years, while the wage share has been declining until recently. At the same time, income inequality has increased sharply and intergenerational mobility has declined. While these trends are global in nature, the US has undoubtedly been at the forefront.

As time wore on, these trends became increasingly unsustainable. Calls for action grew louder and a collective voice began to make its way into policy-making circles. When the burden of the COVID-19 recession fell most heavily on lower-income households, policy-makers were galvanised into action.

How are policy-makers addressing these issues, and what are the implications?

At a macro level, they are explicitly aiming for a high-pressure economy. Drawing on the experience of the past cycle, they believe that such an economy will create broad-based and inclusive economic growth, which will help to reduce the impact of the recession on lower-income households and address the long-standing problem of income inequality.

The conduct of fiscal policy has shifted from austerity to activism. The fiscal response to this recession is already the largest since the Second World War, and policy-makers are working on additional fiscal packages. The Federal Reserve has recast both sides of its dual mandate, essentially creating room for unemployment rates to move lower in order to ensure that gains in the labor market can be shared more broadly among low-income groups.

At a micro level, policy-makers are intervening to temper the adverse effects of market forces. The efforts under way to raise minimum wages are a case in point. But there will also be increasing scrutiny of the tech, trade and titans trio – the key factors that have held down the wage share of GDP. The previous US administration had already taken a new tack on trade policy, and all indications are that it will not be reversed under the current administration.

At the same time, policy-makers are homing in on corporate titans and their actions. These companies tend to have high industry concentration and have blunted labor’s bargaining power. Moreover, they typically have a low labor share of value-added, and their proliferation has also contributed to the general decline in the wage share of GDP.

All in, as policy-makers act to address income inequality and ensure an inclusive growth environment, the wage share of GDP will start to reverse its 40-year decline.

The reversal of this mega-trend could have far-reaching implications for the macro landscape. We highlight two in particular.

First, the tide is turning in favor of higher inflation. We have been vocal about the return of inflation since May 2020. Our base case is that US core PCE inflation will rise above 2%Y (stripping out the base effects) from April 2022. We also see a real risk that inflation could overshoot 2.5%Y on a sustained basis.

Second, economic cycles could run hotter but shorter. A high-pressure economy would mean a faster return to full employment. But tightening policies at a later stage in the recovery runs the risk that shifts in policy stances could become more disruptive, truncating economic cycles.

The initial burst of decisive policy action has set the US on a new course. Going forward, how pervasive and persistent these actions turn out to be will determine how far the US economy travels in this new direction. While the reversal of mega-trends could potentially be disruptive, this course correction will set the stage for a more balanced and sustainable economic trajectory over the longer term.

Tyler Durden

Sun, 06/13/2021 – 19:00

Read More