Authored by Mark Jeftovic via BombThrower.com,

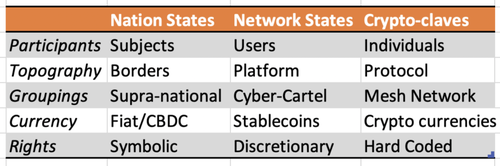

A phrase which has been coming up more often lately on the podcast circuit is the ‘Network State’ and the idea that our current default governance structure, the nation state, is in the process of being obsoleted by them. In many ways network states will be more oppressive than nation states. But what is also occurring are variations of the network state, enclaves built on decentralized crypto-currencies and principles of individual autonomy. I think of this phenomenon as an emerging league of crypto-sovereignties or “crypto-claves”.

The idea of a network state isn’t an entirely new concept. There is the Manuel Castells trilogy which kicked off with ‘The Rise of Network Society’ in 1996. A few decades earlier with 1970’s ‘Future Shock’ by Alvin Toffler realized that the accelerating rate of change brought about by the microprocessor was sending society into something post-industrial. He expanded on that later in Third Wave which came out in 1980. By the time he got to Power Shift in 1990, the arc he had traced in three books, across three decades started refining his insights that the information economy would become the great leveller. Knowledge would be the ultimate democratizer, individuals would be able to attain wealth and power previously reserved for monarchs or nation states. The defining struggle of the future, as Toffler saw it, wouldn’t be between political factions or rival nations but between the information cognoscenti and those left behind in the remnants of industrial society.

But the work which picked up the threads of these undercurrents and I think most presciently anticipated transformational shift we’re experiencing today was Lord Rees-Mogg and James Dale Davidson’s ‘The Sovereign Individual‘ from 1997. I first read this book shortly after it came out and have re-read it several times since. I have it on audiobook and sometimes listen to it on long drives. We used to talk about this a lot back in the AxisOfEasy Salon days.

What Sovereign Individual did, which makes it a near holy tome among the Bitcoin and crypto currency space, was anticipate the rise of non-state digital money. It realized that when it happened it would be a complete game-changer. Digital money was going to ‘take away the punch bowl’ from nation state governments and it would force them to compete for fealty.

“Inflation has the same effect as a tax on all who hold the currency… inflation as a revenue option will be largely foreclosed by the emergence of cybermoney. New technologies will allow the holders of of wealth to bypass the national monopolies that have issued and regulated money in the modern period.”

We still don’t know who Satoshi Nakamoto was, and probably never will. But I can guarantee you this: Satoshi read The Sovereign Individual.

What all of these works converged on was how the megatrends set in motion by the microchip, computers and networks would reshape industrial society. But what really changed the game not only industrial society but the governance structure that managed it was that emergence of decentralization, cryptography and non-state money.

What I think Rees-Mogg and Davidson captured so well in Sovereign Individual was the recognition of where the levers of power were throughout recorded history, and how when technology moved those fulcrums, it reordered society itself. Dark Ages… Feudalism… The Church…. The Nation State, all arising and giving way to the next as agriculture, gunpowder, literacy, double-entry accounting created the power shifts of their day.

As society moved through various stages of development, the prevailing form of hierarchy and authority evolved. There is a lesser known book by the Canadian W R Clement called Quantum Jump: A survival guide for the new Renaissance who ascribed this to increasing levels of abstraction. Each shift, every level-up in mental abstraction created a corresponding reordering in the fundamental architecture of society – from the Middle Age’s agrarian feudalism through to the industrial age’s monolith, assembly lines and cubicles, and then the microchip leading to computer networks.

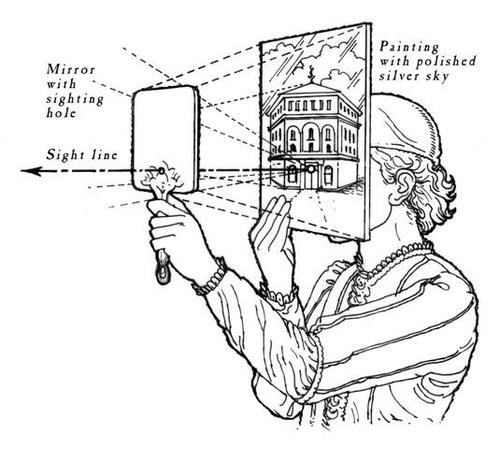

In the Age of the Enlightenment the heightened abstraction was the discovery of perspective (“God’s Space”) and the intellectual leaps that accompanied it, such as increased literacy and double-entry accounting. The abstraction component unfolding now is about cryptography and it’s about decentralization.

Brunelleschi and the re-discovery of Linear Perspective circa 1400’s

It’s this increasing abstraction element that helps us understand why this shift to a post-industrial age will not simply be digitized industrialism.

What we have been calling “globalism” is an industrialist fantasy premised on a linear extrapolation of assembly line society into post-national super-states, with top down governance by a technocratic elite (although applied locally through “subsidiarity”). In other words, it’s industrialist society gone digital.

But the digital age comes with an architecture of its own. Nation states don’t magically morph into network states after their leaders convene in Davos and come out of it with a framework and a catch phrase.

Nation States get Supplanted by Network States

If the near constant lurching from crisis to crisis over the last decade or more shows, nation states have become ill equipped to deal with the complexities of a networked world. The global crisis induced by the pandemic exposed policy-makers and the experts who inform them to be more tone deaf and beholden to institutional groupthink than rational, competent and innovative in their responses.

Taking the obsolete nation state model into the digital age via simple linear extensions is not what we mean by “network states”, although that isn’t preventing world leaders (and the industrial era super-rich who pull their strings) from trying.

Disruption, almost as a rule, originates from outside the wheelhouse of whatever is being disrupted. So too will network states disrupt the nation state from outside of the Westphalian context.

Right now the front-runners for becoming the first recognized network states are Big Tech platforms like Facebook and Google. In Eric Schmidt and Jared Cohen’s The New Digital Age, they more or less nominate themselves:

“We believe that that modern technology platforms such as Google, Facebook, Amazon and Apple, are even more powerful than most people realize, and in our future world will be profoundly altered by their adoption and successfulness in societies everywhere”.

Once a platform like Facebook successfully launches their own digital currency, then a typical user’s Facebook account will become more central to their day-to-day existence than their state issued passport (especially in the coming era of increasing travel restrictions on the plebeians).

These emergent network states will not simply brush aside nation states and replace them. In many aspects they will overlap and in some cases fuse, like if Facebook’s coming Diem stablecoin becomes a de facto FedCoin.

The power structures of the nation states won’t go gently into the dustbin of history. They will go down swinging, over a transitional era that may span decades or longer, similar to the centuries long tensions between monarchs and the Papacy that shaped the transition from the Middle Ages into the Renaissance

Left: King Henry II submitting to Pope’s Legate, 1563

Right: The First Zuck, grilled by US Senate committee 2018

Nor will these Network States, built almost entirely upon the fruits of surveillance capitalism, be a beacon of personal freedom and individual autonomy in the coming age. In this sense (the repression of the individual), Network States will be a linear extrapolation and amplification of current nation state trends.

For a long time when I used to talk about how industrialist ideas like The Great Reset and Fourth Industrial Revolution would be transitory and ultimately give way to something else, I had lingering doubts in my mind. I worried that maybe I’d be wrong about all that and we really were headed into a system of Fully Automated Top Down Collectivism. A technologically driven dystopian dark age from which only a complete system collapse would make it possible to emerge.

However, it was in writing this month’s Crypto Capitalist Letter that I finally realized that I hadn’t fully appreciated something very important about what I knew intellectually:

It was that no amount of trying to force a linear extrapolation of the outgoing systems were going to work because the advent of decentralized cryptography and non-state money had already changed the architecture of power and the incentive structures around wealth preservation.

Until even recently I was still thinking about this in probabilities, as something that appeared almost certain to happen, but not necessarily a lock. What I realized when I was writing the following, was that it’s now already occurred. For one thing, in my coverage of the US Infrastructure Bill and the months long battle to amend the crypto currency clause which was tucked-in to it, I wrote:

the bill passed and the tax reporting clause on crypto was included without any of the amendments the crypto community was looking for (it was blocked by a single congressman, who is in his final term and was holding out for a $50B military pork allocation to his state, and he didn’t get it).

But all that said, everybody with proximity to it understands that the provision as written is overly broad and unworkable, but the larger picture is this: This bill took the idea that “The US government will eventually ban crypto” off of the table.

It’s over. The US will never ban crypto, it’s officially part of the system now.

Further, in my monthly coverage of the development of Central Bank Digital Currencies (CBDC’s or ‘EvilCoin’), and this is the part where it really kicked in for me, I wrote:

“established policy makers are operating on the premise of a linear extension from their previous experience. Central Bank Digital Currencies are the purest expression of this assumption. Take central bank issued fiat currency, digitize it, add the ability to overlay ideological policy imperatives onto money (like social credit), and then everything just continues on as before.

But the underlying architecture of the global power structure is phase shifting into something else entirely and the reason why is because decentralized, non-state, cryptographically secured money is already here. The smart money realizes that this is a superior form of money to preserve wealth and autonomy. Everything else is secondary.”

Existing pools of capital are simply not going to select CBDCs to safeguard their wealth because CBDCs will be explicitly constructed to preclude capital formation: expiry dates on cash, negative interest rates, and policy overrides on how you can spend it? Versus unrestricted capital mobility, ultra-sound monetary policy and crypto-graphically secured self-custody?

Nobody in a position to would choose the former and there’s enough wealth in the world to drive the latter that it made me realize the genie well and truly is out of the bottle.

Crypto-claves become the bastions of individual freedom

The emergence of what comes next, something I differentiate from network states by calling them “crypto-claves” isn’t something that will probably happen, it is happening. The monetary architecture that would drive something like that is already here and the proof is in it being the fastest growing monetary asset in world history.

Where network states won’t be decentralized or very participatory (mostly subject to “take it or leave it” EULAs), and may grow to more closely resemble China-style social credit systems, crypto-claves will be decentralized, participatory enclaves of self-sovereignty.

Crypto-claves are a type of network state that is decentralized and holds participant sovereignty paramount (I say ‘participant’ instead of ‘individual’ because the participants may be a person, or perhaps they may be a smart contract or other autonomous agent).

The defining difference between network states and crypto-claves is the platforms vs protocols distinction we’ve been making for some time.

A platform is a black box, top down walled garden. The rules may be spelled out in enormous EULAs that nobody ever reads but everybody is forced to accept before entering the space. The rules are applied capriciously and it’s clear to all participants that some are more equal than others and certain ideological mindsets are preferred and rewarded.

Facebook and Twitter are platforms. Email and DNS are protocols. Anybody can stand up an email server and as long as they conform to the protocol laid out in places like RFC 2822, be able to send and receive email. Savvy marketers have been saying for years that in this era of cancel culture and deplatform attacks, the single most important communications channels with one’s community is email.

While many are quick to point out that DNS is an inverted tree hierarchy under the purview of ICANN, the internet root is observed purely via consensus and convention. There are no technical barriers from anybody adding their own extensions onto the root or using a different one, other than somehow gaining market adaption.

As an aside: before Bitcoin came along I was habitually declaring that a true P2P DNS was impossible. Then came the blockchain and I was proved wrong (it is worth observing that I’m considered a DNS expert, so what we saw happen there was an expert in the field was proven dead wrong by non-credentialed outsiders. There’s that disruption again, incessantly intruding from the outside).

While it’s still in the early innings, with experiments like Namecoin, Handshake and Ethereum Name Service, it’s just a matter of time before the ICANN sponsored legacy root is seriously challenged or disrupted by a blockchain based root layer that extends the capabilities of DNS. But I digress.

Platform-based network states will, in some ways simply be linear extrapolations of nation states, implemented in the digital realm.

But in crypto-claves that are truly decentralized, protocol based systems, the rules will always be open source code that can be downloaded by anybody. They will apply across the board to all participants because they are baked into the protocol itself. That doesn’t mean equal outcomes abound or that participants can’t erect layer 2 filters and mechanisms that incentivize some actions over others. Just that the rules are clear, every participant’s rights under the protocol are inalienable because they are crypto-graphically guaranteed and that the rules are applied uniformly and require consensus to change.

Finally, and perhaps most importantly, participation in decentralized protocol systems will be voluntary. Crypto sovereignties will be able to be exited or forked. If the recent past is any guideline, platforms tend to coalesce into quasi-monopolies much like their nation state antecedents, while protocol based claves will likely form more of a mesh network effect. Charles Hugh Smith once likened it to a modern age Hanseatic League of Crypto States.

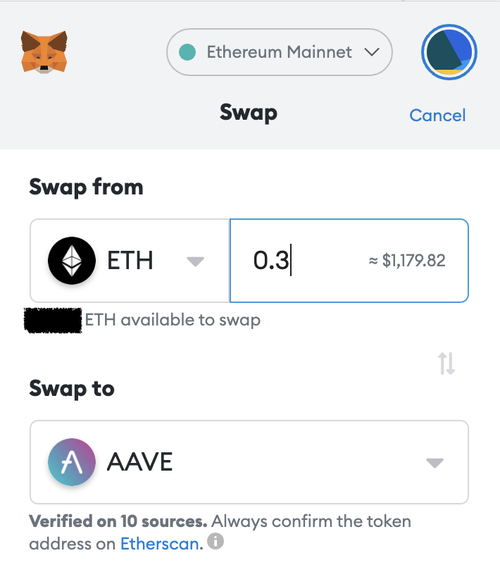

This is already happening with the emergence of Decentralized Autonomous Organizations (DAOs). Almost every single Decentralized Exchange (DEX) is a DAO and run by owners of that DAO’s governance token. And these are not just piddling little experiments. Aave has a $3 billion dollar treasury. That’s more cash than most publicly traded companies.

Would you like to be a direct participant in the allocation of that treasury? Simply swap some of your ETH into AAVE and bingo! You’re a citizen of the DAO.

More importantly, if some DAO I’m a member of decides to enact some policy I’m not entirely on board with, I can simply swap out.

Where tech platforms like Google and Facebook insist and enforce true identity verification, crypto-claves will incentivize and cultivate pseudonymity. Participants in the latter will have membership in (citizenship?) in multiple DAOs, and guilds that suit their purposes at multiple times and from multiple places.

Similar to how network states will not supplant nation states entirely, crypto claves will gather a momentum of their own and elbow out their own space amongst the network states.

The future will be a chaotic interplay between these three organizing principles, a creative tension between overlapping nation states, breakaway states, local fiefdoms, network states and crypto sovereignties.

21st Century governance structure quick-reference

Because basic human rights are hard coded into decentralized, open source crypto-graphically secured protocols, they will gather increasing gravitas over time. Once people figure out (as many have over the last two years) that when their inalienable rights, such as the ones recognized by the UN Charter of Human Rights or the US Constitution, are subject to interpretation and suspension by a thin layer of overlords and technocrats, the incentive structure will impel them toward systems and structures that mathematically guarantees those rights.