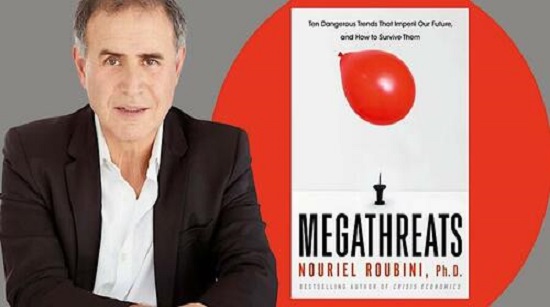

There is already a world war underway, which could lead to the total ruin of Western nations, leading economist Nouriel Roubini has said. According to the renowned economist, “everything will split in two”. Economist Nouriel Roubini, who’s been dubbed ‘Dr. Doom’ for his gloomy-yet-correct prediction of the 2008 market meltdown, is making headlines again during a series of interviews promoting his new book “Megathreats”.

A new world war is practically underway, “certainly in the Ukraine and cyberspace,” economist Nouriel Roubini explained.

Last week, the New York University professor was interviewed by Der Spiegel and listed some of the world’s most acute problems.

Recalling a recent event hosted by the International Monetary Fund, he referred to historian Niall Ferguson who “said in a speech there that we would be lucky if we got an economic crisis like in the 1970s — and not a war like in the 1940s.”

When speaking about major global threats, Roubini mentioned the ongoing conflict between Russia and Ukraine, adding that Iran and Israel are “on a collision course” as well.

“I read that the Biden administration expects China to attack Taiwan sooner rather than later,” the economist said, summarizing that “World War III has already effectively begun.”

The rivalry between Washington and Beijing is driving tension to a large degree, Roubini noted, adding that the US has banned the export of certain semiconductors to China and is pressuring European nations into cutting trade ties with the country on national security grounds. He believes that a breakup of the globalized world is looming.

“Trade, finance, technology, internet: Everything will split in two,” he predicted.

It was not clear if non-allied nations would pick the US side in the confrontation, he said. “I asked the president of an African country why he gets 5G technology from China and not from the West. He told me, we are a small country, so someone will spy on us anyway. Then, I might as well take the Chinese technology, it’s cheaper,” the economist revealed to Der Spiegel.

The professor is concerned that the political systems in the US and Europe may not be able to deal with the problems, leading to a rise of right-wing governments.

Nouriel Roubini came to prominence for predicting the financial crisis of 2008-09 and was dubbed ‘Doctor Doom’ by Wall Street, RT reports

When asked if we’re “there again” in reference to the 2008 great financial crisis, Roubini replied: “Yes, we’re here again.”

“But in addition to the economic, monetary, and financial risks – and there are new ones – now we’re going towards stagflation like we’ve never seen since the 1970s.”

Private and public debt levels globally have exploded from 200 percent of GDP in 2000 to around 350 percent of GDP today, he said, blaming ultra-loose central bank policies that made borrowing cheap and encouraged households, businesses, and countries to take on ever greater debt loads even though many were barely solvent.

But now, facing persistently high inflation, central banks led by the Fed have embarked on aggressive rate hiking cycles, with Roubini predicting that highly indebted and operationally fragile “zombie” institutions are going to go bankrupt.

Read the Der Spiegel interview below:

DER SPIEGEL: Professor Roubini, you don’t like your nickname “Dr. Doom.” Instead you would like to be called “Dr. Realist.” But in your new book, you describe “ten megathreats” that endanger our future. It doesn’t get much gloomier than that.

Roubini: The threats I write about are real – no one would deny that. I grew up in Italy in the 1960s and 1970s. Back then, I never worried about a war between great powers or a nuclear winter, as we had détente between the Soviet Union and the West. I never heard the words climate change or global pandemic. And no one worried about robots taking over most jobs. We had freer trade and globalization, we lived in stable democracies, even if they were not perfect. Debt was very low, the population wasn’t over-aged, there were no unfunded liabilities from the pension and health care systems. That’s the world I grew up in. And now I have to worry about all these things – and so does everyone else.

DER SPIEGEL: But do they? Or do you feel like a voice crying in the wilderness?

Roubini: I was in Washington at the IMF meeting. The economic historian Niall Ferguson said in a speech there that we would be lucky if we got an economic crisis like in the 1970s – and not a war like in the 1940s. National security advisers were worried about NATO getting involved in the war between Russia and Ukraine and Iran and Israel being on a collision course. And just this morning, I read that the Biden administration expects China to attack Taiwan sooner rather than later. Honestly, World War III has already effectively begun, certainly in Ukraine and cyberspace.

DER SPIEGEL: Politicians seem overwhelmed by the simultaneity of many major crises. What priorities should they set?

Roubini: Of course, they must take care of Russia and Ukraine before they take care of Iran and Israel or China. But policymakers should also think about inflation and recessions, i.e. stagflation. The eurozone is already in a recession, and I think it will be long and ugly. The United Kingdom is even worse. The pandemic seems contained, but new COVID variants could emerge soon. And climate change is a slow-motion disaster that is accelerating. For each of the 10 threats I describe in my book, I can give you 10 examples that are happening as we speak today, not in the distant future. Do you want one on climate change?

DER SPIEGEL: If you must.

Roubini: This summer, there have been droughts all over the world, including in the United States. Near Las Vegas, the drought is so bad that bodies of mobsters from the 1950s have surfaced in the dried-up lakes. In California, farmers are now selling their water rights because it’s more profitable than growing anything. And in Florida, you can’t get insurance for houses on the coast anymore. Half of Americans will have to eventually move to the Midwest or Canada. That’s science, not speculation.

DER SPIEGEL: Another threat you describe is that the U.S. could pressure Europe to limit its business relations with China in order to not endanger the U.S. military presence on the continent. How far are we from that scenario?

Roubini: It is already happening. The U.S. has just passed new regulations banning the export of semiconductors to Chinese companies for AI or quantum computing or military use. Europeans would like to continue doing business with the U.S. and China, but it won’t be possible because of national security issues. Trade, finance, technology, internet: Everything will split in two.

DER SPIEGEL: In Germany, there is a dispute right now about whether parts of the Port of Hamburg should be sold to the Chinese state-owned company Cosco. What would your advice be?

Roubini: You have to think about what the purpose of such a deal is. Germany has already made a big mistake by relying on energy from Russia. China, of course, is not going to take over German ports militarily, as it could in Asia and Africa. But the only economic argument for this kind of agreement would be that we could strike back once European factories are seized in China. Otherwise, it’s not a very smart idea.

DER SPIEGEL: You warn that Russia and China are trying to build an alternative to the dollar and the SWIFT system. But the two countries have failed so far.

Roubini: It’s not just about payment systems. China is going around the world selling subsidized 5G technologies that can be used for spying. I asked the president of an African country why he gets 5G technology from China and not from the West. He told me, we are a small country, so someone will spy on us anyway. Then, I might as well take the Chinese technology, it’s cheaper. China is growing its economic, financial and trading power in many parts of the world.

DER SPIEGEL: But will the Chinese renminbi really replace the dollar in the long run?

Roubini: It will take time, but the Chinese are good at thinking long term. They have suggested to the Saudis that they price and charge for the oil they sell them in renminbi. And they have more sophisticated payment systems than anyone else in the world. Alipay and WeChat pay are used by a billion Chinese every day for billions of transactions. In Paris, you can already shop at Louis Vuitton with WeChat pay.

DER SPIEGEL: In the 1970s, we also had an energy crisis, high inflation and stagnant growth, so-called stagflation. Are we experiencing something similar now?

Roubini: It is worse today. Back then, we didn’t have as much public and private debt as we do today. If central banks raise interest rates now to fight inflation, it will lead to the bankruptcy of many »zombie« companies, shadow banks and government institutions. Besides, the oil crisis was caused by a few geopolitical shocks then, there are more today. And just imagine the impact of a Chinese attack on Taiwan, which produces 50 percent of all semiconductors in the world, and 80 percent of the high-end ones. That would be a global shock. We depend more on semiconductors today than on oil.

DER SPIEGEL: You are very critical of central bankers and their lax monetary policy. Is there any central bank that gets it right these days?

Roubini: They are damned either way. Either they fight inflation with high policy rates and cause a hard landing for the real economy and the financial markets. Or they wimp out and blink, don’t raise rates and inflation keeps rising. I think the Fed and the ECB will blink – as the Bank of England has already done.

DER SPIEGEL: On the other hand, high inflation rates can also be helpful because they simply inflate the debt away.

Roubini: Yes, but they also make new debt more expensive. Because when inflation rises, lenders charge higher interest rates. One example: If inflation goes from 2 to 6 percent, then U.S. government bond rates will have to go from 4 to 8 percent to keep bringing the same yield; and private borrowing costs for mortgages and business loans will be even higher. This makes it much more expensive for many companies, because they have to offer much higher interest rates than government bonds, which are considered safe. We have so much debt right now that something like this could lead to a total economic, financial and monetary collapse. And we’re not even talking about hyperinflation like in the Weimar Republic, just single digit inflation.